Looking back over my mortgage banking career, I wish I had kept a diary. I lived and worked through the savings and loan failures and oil patch crisis of the eighties, refinance booms in 1993 and 1998 created by record low rates (at that time), 9/11 and the recession in the early 2000s, the subprime and Alt A boom from 2004-2006 and of course the Great Recession and Mortgage Meltdown of 2007-2008. Remember Implodometer.com?

Now fast forward to 2020. What a strange year it has been — we have a pandemic and world-wide recession, yet a mortgage market that is expected to set records for origination volume and profitability. One thing we know for sure — things change fast in our business.

In our ongoing workshop sessions focused on Operations, Consumer Direct Lending, the Customer Experience and Capital Markets, STRATMOR has a unique window into how mortgage executives are feeling and what they are thinking about when it comes to changes in our industry. In this article, we will share what we have learned from our recent workshops and consider how history might record this tumultuous year.

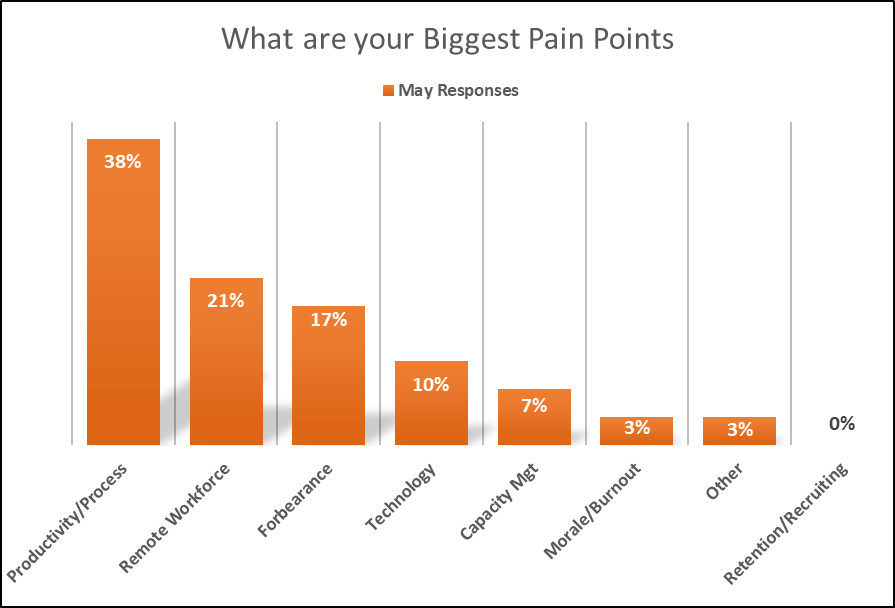

In our May 2020 Operations Workshop, we asked executives to share their biggest pain points at that time. These points fell into the broad categories shown below.

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.Not unexpectedly, productivity and process-related issues were at the top of the list. After all, COOs are tasked with managing the mortgage “factory” and efficiency, productivity, and the metrics by which they are measured are normally top of mind. But, two pandemic-related issues were next in line. In early May, we were relatively fresh off the shelter-in-place (SIP) rules established at the state and local level, so managing a remote workforce was of great concern at that time. Also, the CARES Act rules allowing temporary forbearance of mortgage payments and the ancillary issues created by these rules were a major concern. After that, operations executives cited technology, capacity management and employee morale/burnout as key issues in May.

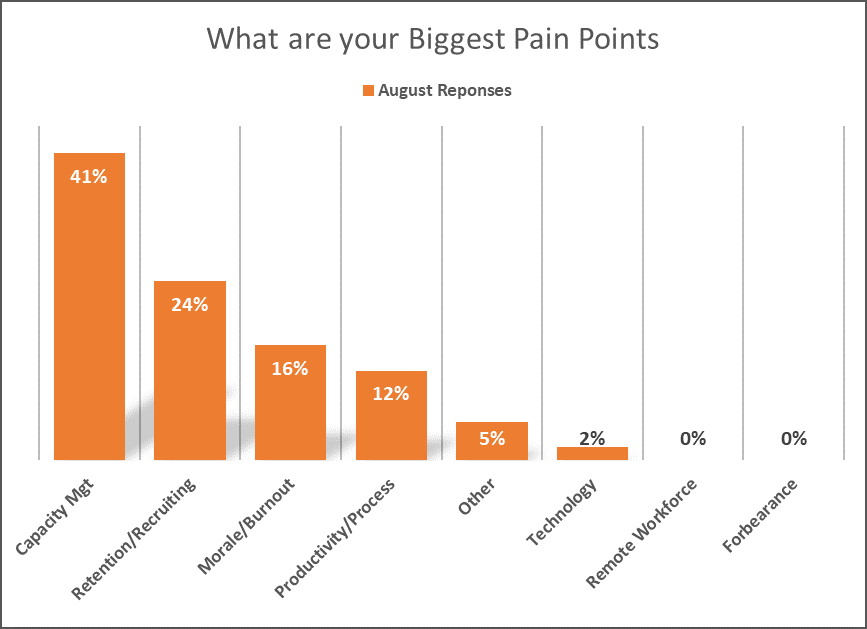

When we asked our August 2020 Operations Workshop attendees the very same question: “What are your top issues and pain points?” the top of mind issues had already changed.

Chart 2

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.Far and away the biggest issue in August was capacity management. According to Black Knight, a record $1.1 trillion (that’s trillion with a “t”) was originated in the second quarter, 70 percent of which were refinance transactions. Operations executives were consumed by the challenge of processing, underwriting and closing this massive amount of loan volume — they could think of little else and this trend has continued unabated into September.

By August, most lenders had successfully navigated the changes required to set up and maintain a remote workforce. Also, the angst around how forbearance rules might impact investor guidelines, rep and warranty risk, and uncertainty around servicing advances and ongoing cash flows had all but disappeared. Instead, operations executives were consumed by issues such as how to retain key employees (underwriters specifically) and recruit the additional staff needed to handle the crush of volume. One executive noted, “Staff are being lured away with massive bonuses and they are being promised no overtime,” which we all know is a promise that, in this environment, will be difficult to keep. Virtually all executives noted that their operations teams were being heavily recruited, with one executive remarking, “We are getting picked off.”

Given the environment, various grow-your-own strategies were discussed at the August workshop. Some executives shared strategies to replace attrition by training existing staff while others talked about mentoring programs and bringing in recent college graduates to teach them processing from the ground up. Recruiting inexperienced staff and training them can be an uphill battle in our industry, but in today’s environment, STRATMOR encourages lenders to embrace this strategy as part of a comprehensive staff development program.

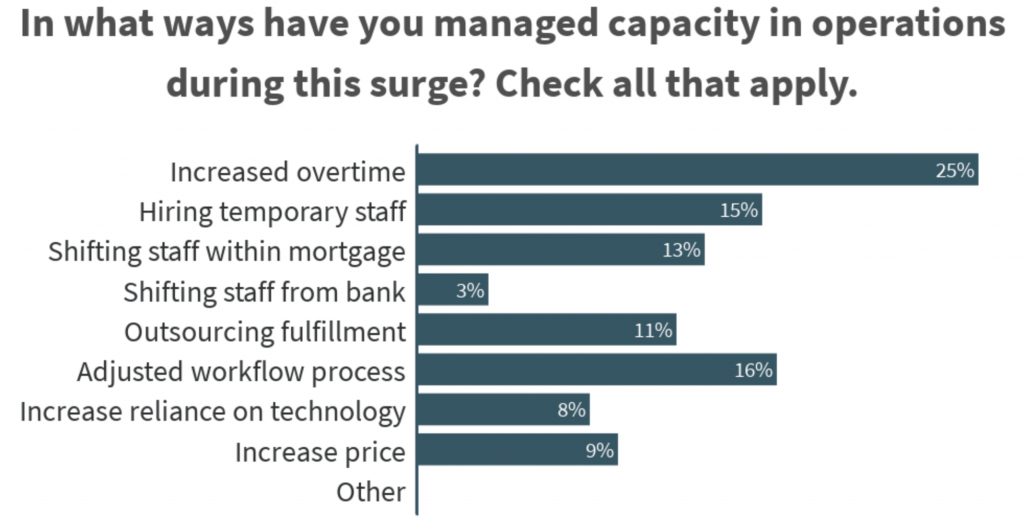

The third biggest pain point cited in August was the challenge of employee burnout and declining morale. When handling increased volume, the easiest and most effective short-term lever to pull is to increase staff overtime. We asked operations executives about the ways they have managed capacity, and this is what they told us:

Chart 3

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.While adjusting workflow process, hiring temps and shifting staff were cited as ways to manage capacity, overtime is and continues to be the most expedient and common technique. But excessive overtime is never an acceptable long-term solution, and the levels being worked in today’s environment come with collateral damage in the form of decreased morale, burnout and fatigue. According to one executive, “It has been a long road of overtime by the team this year — burnout is a big concern.” Another workshop attendee remarked, “Staff are burned out and tired, and therefore, they are more receptive to outside offers.”

When asked what they were doing to help mitigate burnout, operations executives offered many creative ideas including the following:

Besides overtime, the other primary technique used in managing capacity is to stretch out refinance lock periods and cycle times. Based on feedback we received in our workshops, application-to-close cycle times for refinance transactions increased from 45-50 days in February to 60-75 days in August. While stretching out refinance cycle times certainly helps mitigate the pressure on operations, taken to an extreme, it negatively impacts borrower satisfaction. This is borne out by data from the MortgageSAT Borrower Satisfaction Survey program. Our data indicates that Net Promoter Score (NPS) on refinance loans falls sharply – from 88 to 70 – when turn times surpass 45 days. Even more damage is done when turn times exceed 60 days, with NPS dropping to 60. “Borrowers who have been promised a sizable monthly savings start planning in their head how they will spend the extra money,” says MortgageSAT Director Mike Seminari. “So, a delayed closing – which often forces them to make another payment on the old loan – can feel like you’re actually taking money away from them. And that’s not a recipe for delight.”

In a period of record volumes, tremendous capacity constraints, recruiting and retention challenges and burnout/morale issues, where does technology fit in? Regarding technology, an executive recently told me, “It is hard to think long term when your house is burning down!” Others have said: “How can we fix the train when it is moving 100 miles an hour?”

In May, 10 percent of the respondents mentioned technology as a pain point. But in August, with the significant increase in production volume, only two percent of the operations executives cited technology as a pain point. When pressed, these executives fully acknowledge the importance of ongoing improvements in technology — it is clearly one of the keys to improving productivity and chipping away at cost. But for now, many executives don’t feel that they have the luxury of using up vital resources and management’s time and attention to continue full speed ahead with technology projects. In many cases. lenders are hitting the pause button on their technology improvement projects despite the long-term importance. In other words, technology is not exactly top of mind for many operations executives in the current environment.

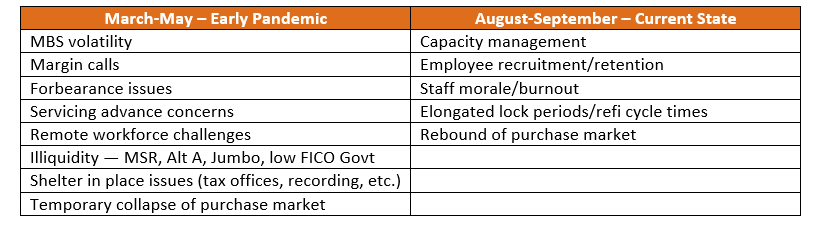

The following table summarizes the headline issues for the industry in the March-May timeframe as well as in the current August-September timeframe.

Chart 4

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.Early in the pandemic, the mortgage industry clearly faced great uncertainty. It was a scary time for the industry, and for the country, for that matter. But now, there is far less uncertainty, just the daunting challenge of how the industry is going to handle the volume, which all would agree is a great problem to have.

As we look ahead to the next few years, what can we expect to see in our industry? It is easy to predict certain trends, but what we don’t know are the exact timeframes in which these trends will occur. I feel comfortable that our industry will experience the following trends at some point:

What we can’t predict are major, unexpected events. The pandemic threw us for a loop in 2020 — and there is no doubt that there will be other future events that will dramatically impact our industry, both favorably and unfavorably.

So how will history record today’s events? What will we think when we look back on 2020 years from now? I believe the adage “necessity is the mother of invention” applies here. So far this year, we have been challenged and stretched way beyond our comfort zone, and as a result, we grew as an industry despite the short-term pain. For example, we:

As we ponder the events of 2020, a fascinating story is being written. But even as the crazy events of 2020 play out, I am looking forward to tomorrow’s challenges. Some we will expect (e.g. digital transformation, margin pressures, capacity management) and there will be other challenges that will cause us to use that “u-word” (unprecedented!) once again. To me, that is what makes our industry so exciting, challenging and rewarding.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.