We all know it takes a village to create a mortgage. The list of entities a lender must interact with — and rely upon — is long: borrower, Realtor, loan officer, processor, underwriter, closer, settlement agent, appraiser, credit agency, MI company, servicer, investor, and guarantor, just to name a few. In today’s world each of these players (and others as needed) have their own technology, interfaces, and processes, all of which need to be pulled together to originate a loan. Data is collected, verified and transmitted; documents are requested, created, signed and stored; key milestones need to be reached; and the right elements must be pulled together at the right time to ensure the closing happens.

As an industry, we have layered complexity on complexity. And it is no surprise to anyone in the mortgage business that, to quote songwriter Bob Dylan, “The times they are a changin”. Financial services technology — Fintech — is part of that change.

Today’s mortgage technology may not be able to make the mortgage process less complex, but it can make it faster, less labor-intensive and more borrower-friendly. And, because there are so many possible technology combinations for each step to creating a mortgage, lenders can now reasonably consider creating their own “best-in-breed” platform rather than relying solely on their Loan Origination System (LOS) for this end-to-end experience.

In this article we’ll contrast and compare two technology options for lenders: the traditional vendor-centric approach and the blended, best-in-breed option.

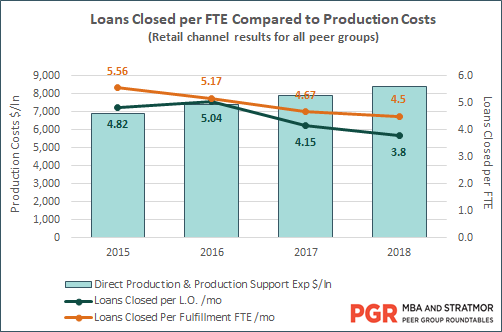

Regardless of the option you choose, it’s good to keep in mind that while technology has always been heralded as the solution to overcome the complexities of originating a loan, the cost to originate a loan continues to escalate, now averaging almost $9,000. Conversely, according to PGR: MBA and STRATMOR Peer Group Roundtable data shown in Chart 1, productivity — as measured by loans an underwriter is able to decision per day or number of total loans closed per day per employee — continues to decline. Year over year, productivity is down eight percent and fulfillment is down four percent. Loan officer and fulfillment productivity have each declined approximately 20 percent since 2015. That’s the equivalent of one loan per FTE per month. All this as technology costs continue to rise.

Source: PGR: MBA and STRATMOR Peer Group Roundtable Program, 2019.

Source: PGR: MBA and STRATMOR Peer Group Roundtable Program, 2019.

This is a scary trend for mortgage companies. Further, this data shows no apparent correlation between technology spending and productivity. Some lenders that have spent heavily on technology are doing well, some are not. Some lenders that have scrimped on technology are doing well, some are not. This suggests that how effectively a lender executes their chosen technology strategy (and its subsequent adoption) have a bigger impact on the overall success of their technology selection than the technology itself. In other words, effective strategy, execution and adoption are the real driving success factors.

Traditionally, the LOS has been the centralized system of record where data is collected and managed and where the mortgage team goes to conduct their work and move the process along. LOS vendors have touted their ability to organize the data and documents, articulate the workflow, manage the regulatory requirements of the transaction, and make workers more productive. The argument has been that when a lender purchases a platform from a single vendor, the complexities of integrating multiple technologies fades away and simplicity reduces the need for expensive IT teams. The cost per loan becomes secondary to the comfort the lender experiences when hearing the vendor say, “We’ve got you covered — our product is all you need to originate a loan.”

The vendor-centric approach has worked for many lenders over the years. The top LOS vendors have spent millions of dollars keeping up with changes in regulations and improvements in technology. Yet, many lenders do not see their core LOS as a key source of differentiation, choosing instead to define their place in the market with their team by focusing on process differentiation, the borrower experience, and gaining market share.

In the last several years, technology investors have helped create a number of software companies focused on the mortgage industry. In the current Fintech world, relatively narrow functions are executed by cutting-edge technology solutions. To start, a good CRM enables a lender to stay in touch with a potential borrower upstream of the application process and contracting for a home purchase. More and more, borrowers are seeking a true pre-approval upstream of purchasing a home. Staying in touch with such borrowers is a critical role of the CRM so that the pre-approval lender is top-of-mind when the borrower is ready to engage.

Then, when a customer is ready to engage, the tech solutions pivot to Point of Sale (POS). The number of POS vendors, each with an interesting proposition for how lenders can communicate with tech savvy-borrowers, is staggering. Fintech has delivered capabilities like product and pricing, Enterprise Content Management (also known as ECM — loan data and document management), income analysis, risk analysis, and identity verification, among others. Some of the solutions also include robust notification capabilities, including text and emails which can overlap with the CRM solutions. (Are you confused yet?) Each of these “point solutions” prides themselves on their ability to do the specific job better than a generalist LOS can, claiming that is the value they deliver is above and beyond the average way a loan is manufactured.

Almost every technology vendor in the mortgage space is touting their ability (or their planned ability — we often hear “it’s on the roadmap”) to interact with other systems through Application Program Interfaces — APIs. This is a fundamental technology that is not new to technologists. In fact, API has been a feature of other industries’ technology for decades but has come to prominence in the mortgage industry in just the last few years. The core premise of API technology is the ability of an application to communicate with another system or application through standard languages that are easy for the company’s IT team to create. By definition, an API needs to talk to another API: the conversation may be a simple transfer of information or it may be complex interactions resulting in rich two-way transactions. The marketing pitch is that a lender is no longer constrained by what a single vendor — most notably the LOS — has to offer because they can now use APIs to incorporate their best-in-breed capability into their platform.

Even the LOS vendors have hopped on this bandwagon. As more and more lenders see attractive features in the point solutions, LOS vendors have offered ways to integrate these capabilities into their systems by offering their own APIs and making them available to lenders and third-party vendors. This allows the LOS vendors to create integrations while maintaining some control of which vendors are selected for integration purposes. As many lenders know, LOS providers often negotiate click fees with vendors connecting to their LOS, hence, the desire to control the availability and subsequent use of these APIs.

To be sure, not all APIs are created equal, and there are claims of openness that have been exaggerated. Still, the general trend of our industry is to migrate toward a more technologically open world where best-in-breed systems from multiple providers can work together. One of the key vendors who has embraced this approach has been Optimal Blue, which can supply pricing to many CRM, POS and LOS systems based on APIs that they provide.

For example, one large national lender is promoting their ability to rapidly close loans and drive to the highest levels of customer service, based in part on an end-to-end platform which combines many components through a series of APIs. While there is a LOS in the background, its role has been diminished to that of central record keeping, with all the borrower-and loan officer-facing elements of the platform having been built by the lender or assembled from the offerings of a range of vendors.

As is often the case, the answer is: it depends. And upon what does it depend? What are the critical criteria that can lead to a sound decision? For any strategy chosen, what are the key elements needed to make it successful?

At STRATMOR, these are the questions we’re getting from lenders:

Like so many other things in our business, there is no single right answer for all mortgage lenders to this complex set of questions.

The advent of APIs and FinTech have given lenders, even ones of modest size, the opportunity to create end-to-end platforms in ways that were not practical even a handful of years ago for all but the most technologically advanced companies. Vendors are making their advanced, point solutions ready to be integrated into the fabric of a lender’s technology stack. It is in their best interest to do so; if they don’t, it is much harder to convince lenders that their solutions are useful.

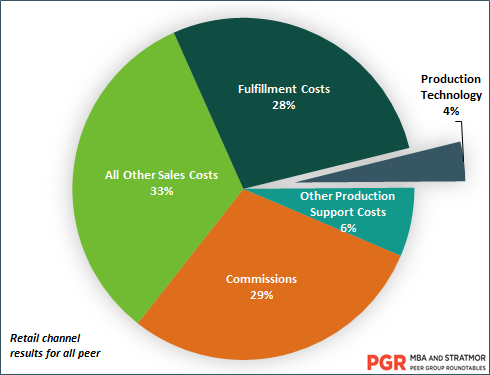

In response, LOS vendors are coming up with more comprehensive technology offerings. They are adding competitive capabilities like POS, document recognition, data extraction, and closing collaboration, just to name a few. To make the decision even more complicated, the cost equation is not very clear. Technology still represents a relatively small fraction of the total cost of loan origination, as little as four percent for some lenders, based on PGR: MBA and STRATMOR Group Roundtable data.

Source: PGR: MBA and STRATMOR Peer Group Roundtable Program, 2019.

Source: PGR: MBA and STRATMOR Peer Group Roundtable Program, 2019.The LOS vendors are trying to extract more revenue per loan from lenders, pointing to the positive value of the added features. Best-in-breed vendors are also asserting the value proposition of their capabilities.

It is not an easy choice for lenders. Some lenders who have made a choice: Quicken’s Rocket Mortgage has altered the face of Consumer Direct lending (then, as interest rates dropped, the swing back to purchase mortgages re-asserted the prominence of the retail loan officer). LoanDepot advertises the eight-day, ready-to-close mortgage and Fannie Mae is pushing their Day-One-Certainty product. First-time-home-buyer Millennials have expectations for speed and service set more by the likes of Amazon, Venmo, Zappos and Apple than they do by the traditional 45-days-to-close mortgage process.

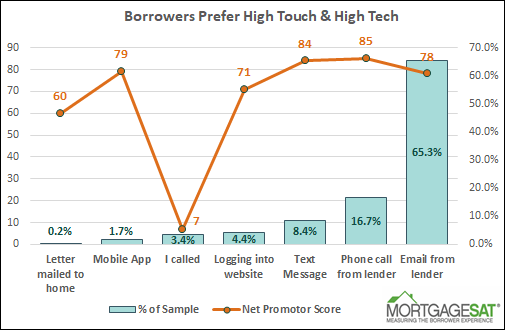

One thing we do know: STRATMOR’s MortgageSAT Borrower Satisfaction Survey data, collected from more than 100,000 borrowers each year, has statistically confirmed what most mortgage bankers instinctively already know — the majority of borrowers want both high touch and high tech.

Source:MortgageSAT Borrower Satisfaction Program, © 2019.

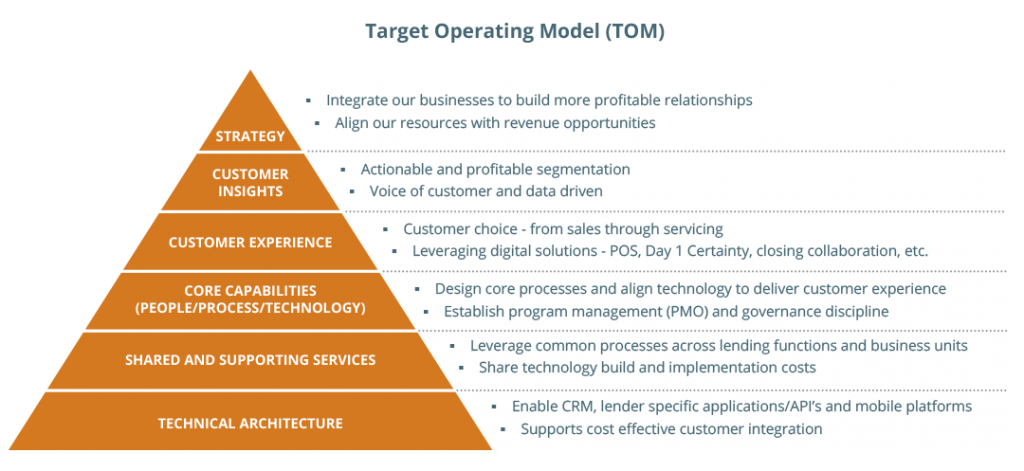

Source:MortgageSAT Borrower Satisfaction Program, © 2019.The starting point for any technology strategy is to articulate in the business strategy — the critical elements of success and the business activities that will differentiate you in this highly-competitive marketplace. For example, is attracting new leads more important than attracting new LOs who will bring their leads with them? Will you target first-time homebuyers as they are the fastest growing segment of borrowers, or can you meet your growth goals by more deeply mining more experienced buyers? There are a myriad of ways a lender may describe what they want to be their element of competitive advantage. STRATMOR recommends using a Target Operating Model (TOM) — the following illustration shows a customer-centric, growth focused strategy TOM framework.

Source: STRATMOR Group, © 2018.

Source: STRATMOR Group, © 2018.The next step is to recognize the portfolio nature of the problem. No lender operates off a single application; there will always be a collection of capabilities required. To begin the process of mapping critical technologies into critical business needs, lenders need to list the key components that will map into the business strategy. The final, crucial variable may be the hardest to define; it is the lender’s culture and willingness to take technology risks to achieve business goals. The line between being a lender who leverages technology and being a technology company that makes mortgage loans is a fine one, and even those two end points exist on a spectrum. A lender must recognize the point on that spectrum that best matches their company’s culture and leadership.

Armed with a list of key competitive needs and an understanding of the component nature of the end-to-end origination platform, an analysis about the best way to add technology to address those needs can begin. The recommended approach is to start from the top and work down while assessing high-level alternatives, replete with questions and complexities, to specific alternative plans where tangible costs and benefits can be articulated. Looking at the current technology architecture and its strengths and weaknesses is a place to begin, but not to dwell. A high-level scan of capabilities in the market will also lead to possibilities to pursue.

As the potential technology strategy paths emerge, it is a good time to look at the costs and risks of each potential strategy and to weed out the ones that do not fit the company’s willingness to take risks and its budget for technology. This analysis of capabilities should not be primarily about choosing the right set of vendors — it should be about setting the strategic direction that will inform the plan and the selection of vendors to fulfill that plan.

With a strategic direction set, a more specific and actionable roadmap can be developed. The roadmap needs to recognize the current state, the major steps and milestones required to get to the future state, the list of critical decisions, and the sequence in which those decisions must be made. Selecting the “anchor” vendors — the ones whose capabilities are the most critical and whose constraints may determine the selection of others — is an early activity in building the roadmap. Frequently, but not always, this will be the LOS, even if a best-in-breed approach is selected.

As the roadmap process get closer to a conclusion, a robust cost/benefit model will come into play. Iterative decisions to proceed to the next level of detail will help ensure the process does not take too long and fall into the trap of “analysis paralysis.” The final result must be a go/no go decision on a specific course of action. And then its implementation … a topic for another day.

The rapid changes in the technology landscape that supports mortgage origination have brought lenders the prospect of increased capabilities and the opportunity to better meet the needs of today’s tech savvy borrowers. Lenders’ choices have never been as varied, in terms of the business strategy the technology can enable, vendors they might choose, and the strategy they can employ to achieve their goals. Choices inevitably lead to complexity, and a well-designed and executed planning process will help lead to the best possible outcome. Weiss

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.