This spring, STRATMOR conducted five workshops for more than 200 industry executives — just as the COVID-19 pandemic roiled the mortgage industry with extreme volatility, uncertainty and unforeseen risks.

The workshop discussions were highly interactive and productive, and as one would expect, the impact of the pandemic was a hot topic. Many ideas and best practices were discussed to address the incredible depth, breadth and pace of change in the mortgage industry. And yet what became clear to me is what has not changed — the three immutable laws of economics:

In this article, I summarize these three laws in the context of mortgage industry events since the U.S. began to experience the impact of the pandemic in March 2020.

My father first introduced me to the concept of supply and demand, and we used to talk about it often as a simple way of explaining market events. Of course, these conversations were subsequently reinforced in high school and college economics classes. Investopedia summarizes the law as follows:

The law of demand states that, if all other factors remain equal, the higher the price of a good, the less people will demand that good. In other words, the higher the price, the lower the quantity demanded. The amount of a good that buyers purchase at a higher price is less because as the price of a good goes up, so does the opportunity cost of buying that good. As a result, people will naturally avoid buying a product that will force them to forgo the consumption of something else they value more.

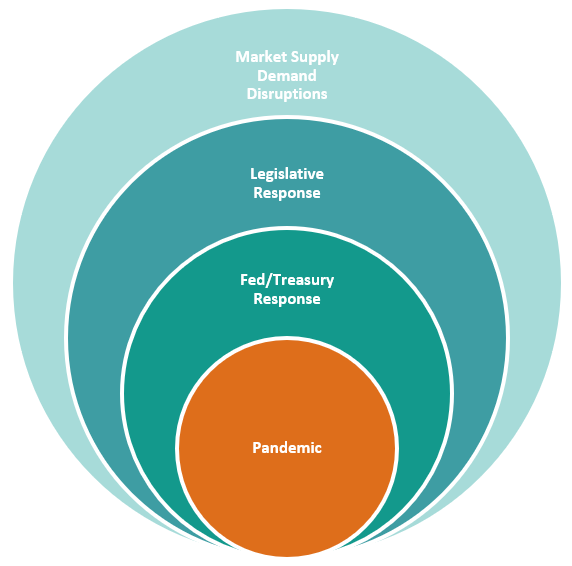

While the mortgage industry is, hopefully, on the down slope of the impacts of COVID-19, the pandemic has reinforced the law of supply and demand across many markets. The pandemic triggered a variety of legislative and policy responses which resulted in a wave of seemingly complex mortgage market actions and reactions. The following graphic reflects the sequence of events:

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.As those of us in the mortgage industry know, the Fed, Treasury and Congress reacted swiftly and aggressively to this crisis.

The key policy and legislative actions included the following:

While the depth and speed of the policy and legislative responses were unprecedented, they also caused never-before-seen market reactions resulting in wild disruptions in supply/demand dynamics in a variety of mortgage-related markets.

The following nine tables summarize major events and the resulting market reactions through the lens of supply and demand.

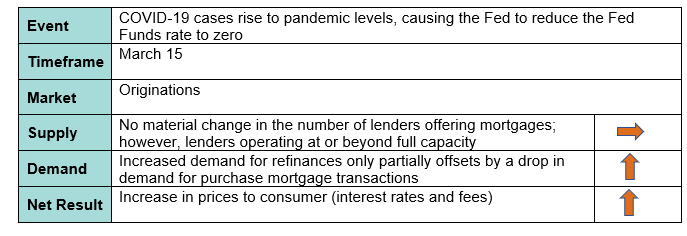

Table 1

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.This one is a classic mortgage banking response to a market cycle. Retailers simply increase prices when customers are lined up out the door.

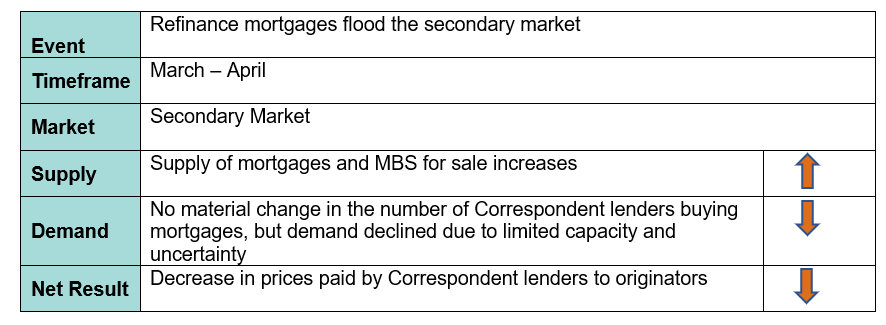

Table 2

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.With loans flooding the market and a relatively fixed number of investor outlets, Correspondent lenders had little or no excess capacity and therefore decreased the amounts they were willing to pay for loans. Capacity was further constrained by disruptions in offshore fulfillment sites (e.g. India) due to shelter in place restrictions.

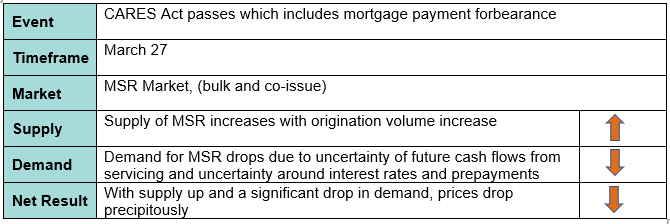

Table 3

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.The disruption in supply/demand dynamics in the MSR market was severe. And the bulk market closed and co-issue market prices in some cases dropped to zero (and for some products, into the negative).

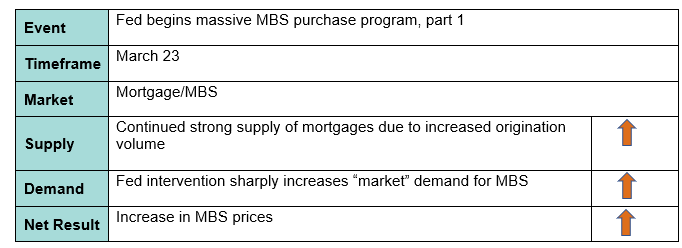

Table 4

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.While supplies of MBS remained strong, massive purchases by the Fed drove prices up and yields down, creating historically high levels of volatility in MBS prices as the Fed wielded a blunt instrument to try to find the right level of MBS purchases to stabilize the markets. See my synopsis of the Law of Unintended Consequences below.

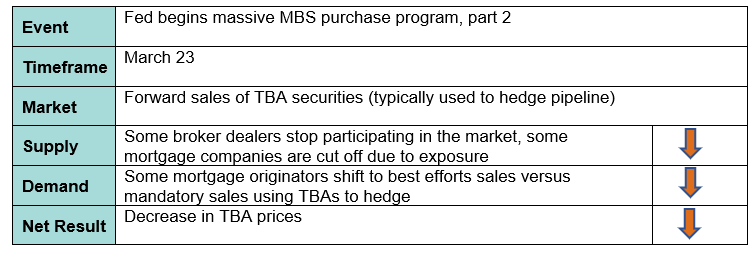

Table 5

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.The large and sudden drop in TBA prices caused a rash of pipeline hedge margin calls and a liquidity crisis for many non-banks. Under normal circumstances, assuming that lenders can meet margin calls on the hedge, they can look forward to large back end gains on the ultimate sale of the hedged assets. However, due to the oversupply of mortgages and weak demand brought on by market uncertainty, the expected backend gains on the loan assets were not fully realized, thereby creating a “heads you win, tails I lose” scenario. This scenario played out as many mortgage originators, flush with volume but lacking direct access to the agencies, saw their gain on sale evaporate. Several lenders in our workshops reported this experience, noting they were still faced with incurring all the production expenses — including paying their loan officers for the higher volume — and were losing money with each closed loan.

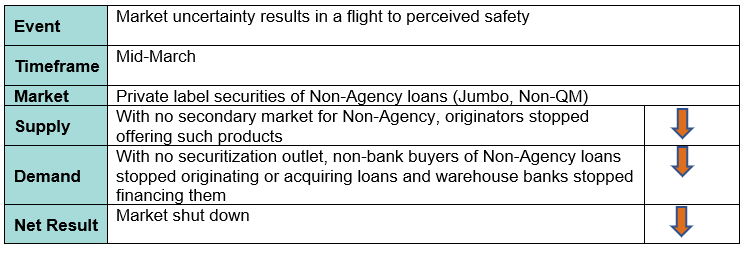

Table 6

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.This one is straightforward — the Non-Agency market effectively shut down for all except bank portfolio lenders.

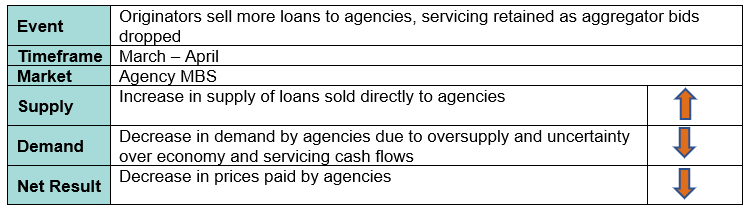

Table 7

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.This was a no-brainer for lenders approved with the agencies, at least in the short run. Since the aggregators were not “paying up,” lenders continued to sell most of their loans to the agencies, servicing retained.

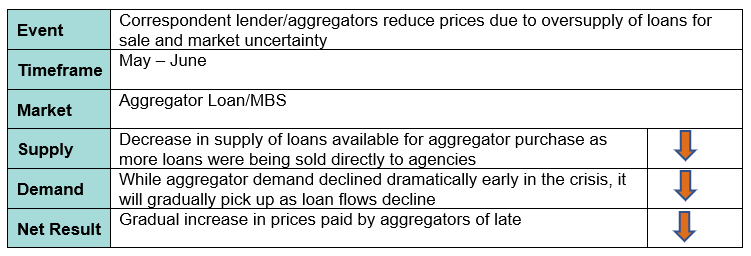

Table 8

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.In our current market, there is an evolving supply/demand equation in the aggregator space. Correspondent lenders have lost market share to the agencies as approved lenders have opted to sell the bulk of their loans servicing retained to the agencies. In response to this, Correspondent lenders will gradually have to increase prices to regain market share. STRATMOR is already seeing this begin to happen.

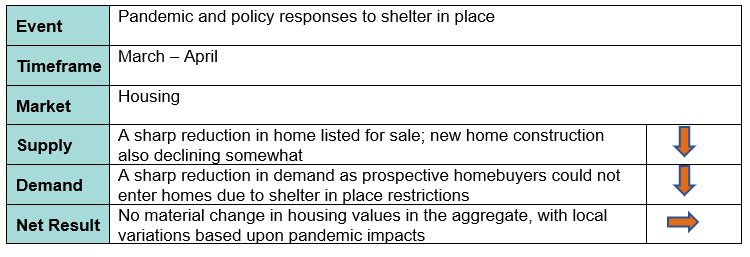

Table 9

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.Since both the supply of homes for sale and the demand for housing dropped in tandem, there has been no material change in housing prices. In fact, recent trends have reflected increased demand for housing and ongoing supply constraints, creating some upward pressure on prices.

Looking back over the past few months, the pandemic and resulting policy and legislative responses created a complex set of market reactions with potential longer-term impacts. But for me, the mortgage market disruptions weren’t so complex when viewed through the lens of the immutable law of supply and demand. Just like my father told me all those years ago.

In simple terms, the best way I can describe this law is that when policy makers take actions to intervene in a complex situation, it tends to create unintended consequences. Giving policy makers the benefit of the doubt, they likely have good intentions and use what they believe to be the best available information prior to taking action. That does not mean that the net result of the policy is negative, although it can be.

The law of unintended consequences played out in a variety of ways the past few months in the mortgage industry. Here are a few examples:

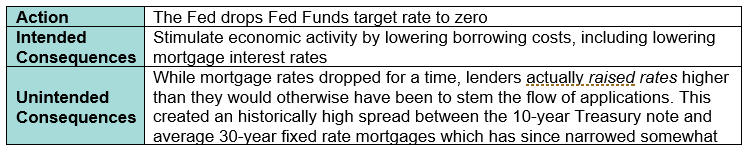

Table 10

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.On balance, as lenders have adjusted capacity and rates over time, a large number of borrowers have been able to obtain lower interest rates on their purchase or refinance transactions, thus providing a boost to household net cash flow and ultimately stimulating additional consumer spending as the market opens up.

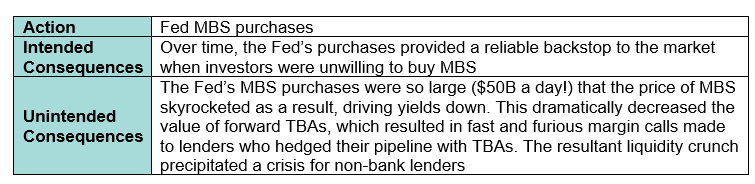

Table 11

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.While margin calls were an existential problem for many non-banks, on balance, the Fed’s purchase of MBS was necessary to provide stability to the market once they determined the “sweet spot” of daily MBS purchases and were able to gradually taper down. But it was a wild ride until then.

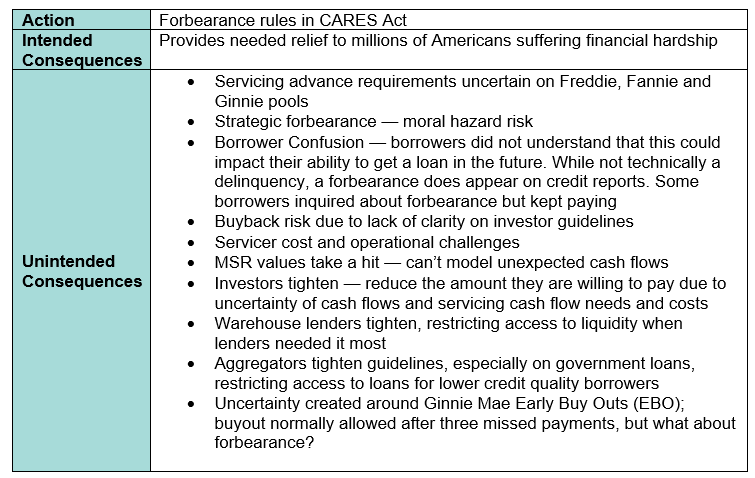

Table 12

Source: © Copyright STRATMOR Group, 2020.

Source: © Copyright STRATMOR Group, 2020.While there are many unintended consequences for the mortgage industry, the forbearance guidelines provided much needed relief to millions of Americans. Will the forbearance rules ultimately have a net positive impact on the economy? Time will tell.

During this time, policy makers made tough decisions with good intentions and the best available data. However, unintended consequences were inevitable due to the unprecedented nature of the decisions and the complexity and magnitude of the economic problems they were trying to solve. It is the classic definition of The Law of Unintended Consequences. While the mortgage industry continues to experience real pain and hardship from the unintended consequences, it remains to be seen whether the net result of the policy decisions was positive.

Anyone who has been in business for any period of time has heard the phrase “cash is king.” Cash is the lifeblood of any organization — without cash the organization will die (or be put on life support in the form of a structured reorganization such as Chapter 11 bankruptcy).

A few years ago, I met with Dave Zitting, former CEO of Primary Residential Mortgage and now CEO of Avenue, LLC, a technology company. In our conversation, Dave shared the following philosophy that he has used when managing a mortgage bank through challenging markets: “Volume is vanity, margins are sanity and cash is king.” I like this quote and use it frequently as we advise our mortgage banking clients.

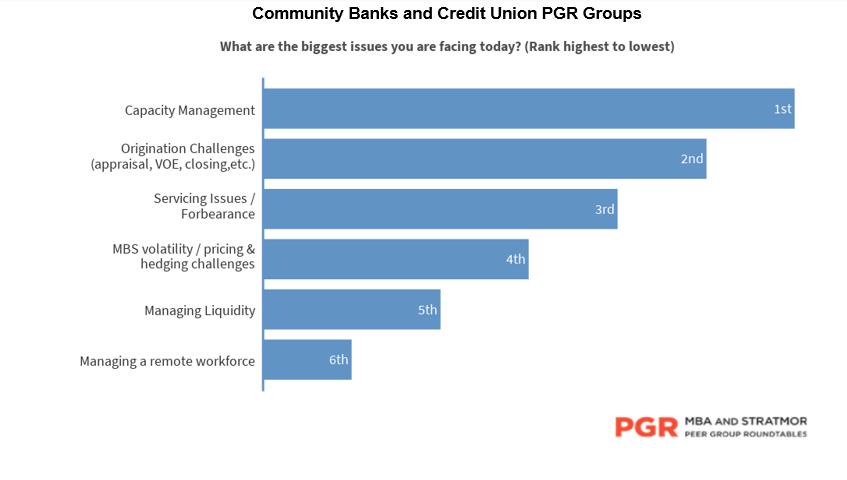

Of course, the law of “cash is king” is more applicable to non-banks than banks. This point was driven home in recent PGR: MBA and STRATMOR Peer Group Roundtable program meetings this spring. STRATMOR has collaborated with the MBA on the PGR program since 1998, and the program currently has 100 participating companies divided into seven separate and distinct peer groups based on operating model (bank vs. non-bank) and loan origination volumes. For each meeting (normally face-to-face but virtual this spring), the MBA and STRATMOR polled the various groups on their top issues or pain points in the COVID-19 environment. The table below summarizes the results for one of the Community Bank and Credit Union PGR groups.

For banks, liquidity was ranked fifth out of six issues and pain points. The banks focus was on managing capacity and the challenges of originating and servicing loans.

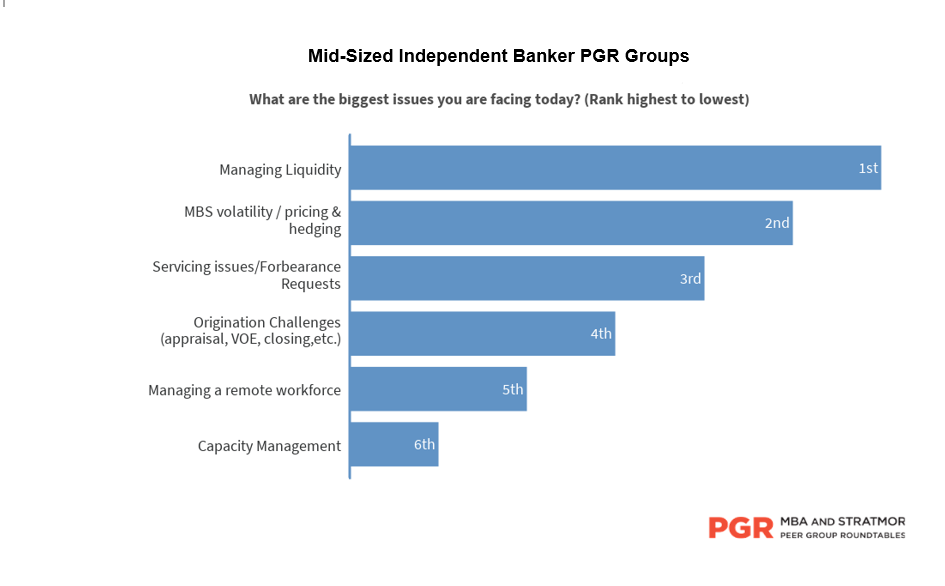

The next table shows the top issues and pain points for one of the Mid-Sized Independent mortgage banker PGR groups.

Not surprisingly, managing liquidity was ranked number one. The non-bank lenders were also keenly focused on dealing with pricing and hedging issues during a time of extreme volatility of MBS prices. Interestingly, capacity management was ranked last while it was ranked first for banks. To me, this underscores the point that for non-banks, when liquidity is under pressure, it becomes by far the most important priority.

As one would expect, when non-banks have cash flow and liquidity issues, it is “all hands on deck” time and most short run decisions are laser-focused on optimizing cash flow and limiting the risk of events that would negatively impact cash such as margins calls or loan repurchases.

In our workshop discussions, executives shared that they managed cash flow and liquidity by selling loans directly to agencies, selling more loans on a best-efforts basis, raising margins as the market allows.

Selling Directly to the Agencies via the Cash Window

It is well-documented that lenders with agency approvals began selling to agencies as much as possible when market volatility kicked into gear in March. First, there was a clear need to get loans sold and funded quickly to clear loans off warehouse lines that were nearing full capacity. With pipelines at all-time highs, the marching orders were clear — get the loans funded quickly to make room for the origination of more loans. Without warehouse line availability, loans cannot be funded, which is the ultimate cash flow doomsday scenario for non-bank lenders. While agency execution may or may not have been the best execution for lenders, the need for speed and warehouse line availability became paramount.

Selling loans more quickly also cuts back on risk that loans will go into forbearance after the loan is closed but before it is sold to an investor. It also reduces the risk (or the window within which investor guidelines and overlays may change) after the loan is closed but before it is sold. Ultimately, the goal is to reduce repurchase risk on the back end as buybacks have significant negative implications on cash flow.

In addition, since aggregators were not ascribing any value to servicing (and negative value in some cases), selling servicing retained to agencies did not create a negative cash flow impact on the margin and effectively allowed lenders to retain servicing for “free.” An actual/actual remittance structure avoids the risk of servicer advances on delinquent or forborne loans for P&I, a longer term but critical cash flow consideration.

With the uncertainty and market volatility brought on by the pandemic, agency became the technique of choice to manage liquidity for agency approved lenders.

Raise Prices to Borrowers

As mortgage bankers operate their businesses, they need to cover costs, earn a reasonable profit and earn a reasonable return on the capital deployed given the risks of the business. Given the fact that investors reduced the amount they were willing to pay for loans on the secondary market, the only other primary source of revenue for lenders were the amounts collected from borrowers in the form of interest rates or fees. Fortunately for lenders, current market conditions are enabling them to charge higher rates and fees, as lenders currently have little or no excess capacity. Mortgage interest rates are higher than they normally would be by historical standards, and this is evidenced by the historically high spread between the 10-year Treasury and average 30-year fixed mortgage rates. The higher-than-normal mortgage note rates increase back-end gain on sale revenue which, in today’s market, more than offsets the reduction in prices paid by investors.

Sell More Best Efforts

Amidst the extreme market volatility we saw in mid-to-late March, many lenders reverted to selling their loans on a best-efforts basis even when mandatory execution could have yielded a higher sales price. Lenders wanted to mitigate the risk of large unexpected margin calls which might reduce cash to dangerously low levels. Effectively, lenders switched to best efforts sales to lay off hedging risks on their investors. Of course, this further reduced investor prices but at least lenders avoided large unexpected cash outlays for margin calls. At that time, many lenders believed that it was better to have suboptimal execution for a period of time then to have margin calls put the company into a cash crisis at a minimum or, at worst, become insolvent.

Selling directly to the agencies, raising prices to consumers where possible and selling more loans on a best-efforts basis were the primary ways non-bank lenders managed cash during the COVID-19 environment this spring. These cash flow driven decisions reinforced the notion that the law of “cash is king” is alive and well in the mortgage industry.

The Good News — Markets Have Settled Down

As of this writing, it appears that the mortgage markets — especially the TBA market — have settled down. The number of borrowers asking for and entering forbearance appears to be leveling off based on the latest data from the MBA and Black Knight. Concerns over liquidity for non-bank lenders have alleviated somewhat as Ginnie Mae announced on April 10 that they are providing a facility for servicers to finance P&I advances. Furthermore, Fannie Mae and Freddie Mac announced on April 21 that servicers will only be responsible for advancing P&I for the first four months a borrower is in forbearance. Also, with rates at record lows, non-bank servicers have a large amount of P&I flowing in each month due to payoffs, and they can use that cash in the short run to cover advances on forborne loans.

As the TBA market appears to be stabilizing, the Fed has gradually reduced its purchases of MBS, as average daily purchases have dropped from a high of approximately $35B a day the week of March 23 to current levels of less than $10B a day. There are signs of life in Non-Agency and Non-QM as lenders start to re-enter the market. And finally, with rates at all-time lows, refinance transactions at very strong levels and purchase mortgage transactions slowly rebounding, mortgage originator profits are very strong right now, bolstering liquidity and capital levels.

When the pandemic erupted in March 2020, it created a massive chain reaction of aggressive policy responses, major disruptions in supply and demand dynamics in mortgage markets and a host of unintended consequences. The good news is that, on balance, for the mortgage industry, the self-correcting nature of supply and demand has appeared to serve our industry well. The unintended consequences, while severe, are not life threatening to most lenders and servicers with the possible exception of non-bank servicers with a high percentage of loans in forbearance (e.g. Ginnie specialists). And, cash is still king. In the end, in the face of disruption, the constants of market economics remain unchanged. Jim Cameron

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.