Psychologists estimate that the average person makes as many as 35,000 decisions per day. Many decisions we make subconsciously, and out of habit; other decisions are serious enough to change the course of our lives.

In the mortgage industry’s current environment of rising rates, shrinking volumes and tight-enough-to-choke margins, lenders are faced with making tough decisions in their efforts to “right the ship.” It isn’t pretty. Right now, Job One is to survive.

What’s a lender to do?

At the highest level, there are three logical options:

STRATMOR meets with lenders throughout the year, in person and in workshops, where we help them think through the choices they have before them — and the impacts those decisions will have on their companies.

As you might expect, CEOs are treading carefully as they consider their options and wrestle with these issues with internal and external stakeholders. Those who lack a framework for having these critical discussions will find it difficult to make an informed decision.

In this article, we will outline the factors that CEOs and shareholders should consider in making the decision on which option to choose.

Doing well in a difficult market is always a challenge, but of the three options available to mortgage leaders, staying in the fight is the one most will choose. Many of the conversations we’ve been having with executives have been focused on strategies and tactics to “right the ship.”

“We all know the market realities,” says STRATMOR Senior Partner Jim Cameron. “The headlines are filled with news of the challenges facing lenders. Some will feel equal to the challenge and others will not. But before considering strategic options, a clear-eyed assessment of the current state of both the primary shareholders and the company is critical.”

The first of these internal realities is the age of the primary shareholders and what stage of life they find themselves in at this moment. “An owner in their late 50s who has achieved a fair amount of success may consider this a good time to sell the business, especially after two huge profit years,” says Cameron. “If the expected proceeds of selling the business seem too low, they may exercise their option to shut the business down.”

It will also depend upon the financial position of the owners, he says. Those who have not diversified financially may opt to exit the business as they near retirement so they can take the sales proceeds and invest in a variety of investments that match future cash flow needs and risk tolerance. Alternatively, those with other investments may find it easier to stay in the business, as they don’t have all their financial eggs in the mortgage company basket.

The current state of the business must also be considered. For example, a lender who has achieved fantastic success by offering streamlined refinance loans over the past few years may find the cost of retooling for the purchase money market to be a major impediment and choose not to remain in the fight.

“Even if the business is ready to compete for new home buyers, the future cash flows resulting from the current operating model is another part of the equation,” says Cameron. “Ultimately, the assets in the business may be worth more on the market today, making a sale a reasonable option.”

Once the decision to remain in the business has been made, the work can begin. According to Cameron, winning this fight will require management to achieve two objectives in short order: (1) stop the bleeding, and (2) maximize current revenue.

In both cases, management will have to take an objective view of their business as it stands today. What can the business originate over the next 12 months and what are all the costs involved in doing so? For many lenders this is a gut-wrenching process, and they would benefit from some external, objective counsel.

When lenders look at the costs associated with to origination, the most significant of these is always personnel. Lenders who want to succeed through this downturn will have to staff their businesses optimally. For most, that means trimming staff — believing that every job can be saved in the current market is not realistic. In our recent lender workshops, 86% of attendees told us they are currently reducing staff via direct reductions or attrition.

But getting staff exactly right requires the lender to know how much the business is expected to originate and the productivity of its people by role. Only then can a lender create a credible production forecast and then adjust associated staffing and expenses accordingly.

At the same time the lender is rightsizing staff, management will also be reducing overhead costs to fit the new “normal” in production. Creating target metrics that are credible and supported by industry benchmark data is an important first step. Again, those benchmarks should be taken from pre-COVID data. STRATMOR has a deep and rich dataset of benchmarks through its collaboration with the Mortgage Bankers Association in the PGR: MBA and STRATMOR Peer Group Roundtables program.

Organizational redesign may be the outcome of staffing adjustments, and lenders should look for opportunities to cross train existing staff and put performance evaluation metrics in place. Monitoring performance progress vs. goals with scorecards can help identify individuals who need additional training to improve productivity — or who may not be suited to a position in the mortgage industry.

There are many tools available to help lenders do this work, including reviewing existing contracts, vendor performance standards, shifting fixed costs to variable costs and setting the company’s new breakeven point.

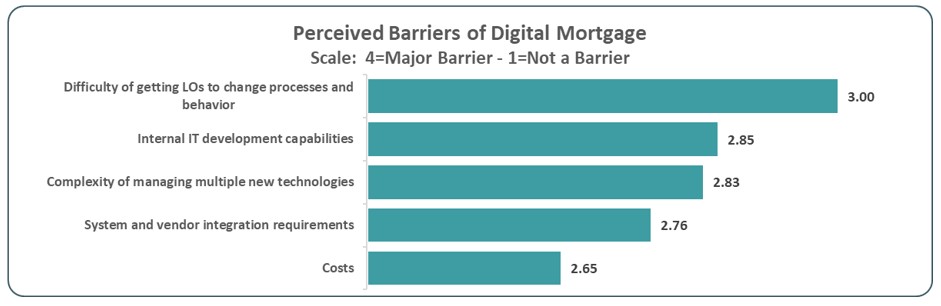

Also essential is a review of the company’s technology, marketing and business productivity tools spend. In many cases, lenders will find that technologies acquired through previous investments are not being fully adopted, which can also increase costs. Chart 1 below from the 2021 Technology Insight® Study shows the barriers to digital adoption.

Chart 1

Source: © 2021 STRATMOR Group. Technology Insight® Study.

Source: © 2021 STRATMOR Group. Technology Insight® Study. Efforts should be made to increase adoption, and consideration should be given to abandoning ineffective technology and/or exploring other tech options.

Perhaps most important is developing a strategy, roadmap and timeline to execute the needed changes. Rarely will lenders have staff available to effectively manage this project and will call on outside advisors. Lenders, if you need assistance with developing a strategy, roadmap and timeline for your business changes, reach out to STRATMOR. Our executive advisory team has years of experience through all market cycles and can help you put together or revise your plan in light of current market conditions.

Cutting costs alone will not be enough to succeed in this competitive market. Leaders will also need to pursue options for revenue enhancement. There are a number of strategies lenders can employ to help shore up top line revenue in a downturn.

Leading lenders know that the way to grow in a down market is to take market share from competitors. In our business, that often comes down to effective recruiting of top people, specifically purchase-focused loan officers. Lenders who handle recruiting poorly will fail to attract the best people with purchase business muscle memory to manage in these tough times.

Recruiting well often comes down to the story the institution offers to professional salespeople. Differentiation is challenging, but it can be done. What lenders cannot afford to do in this market is compensate talent to the same degree they have in the past. Margins are just too tight.

As Cameron pointed out in a recent article, “To Pay or Not to Pay: The Question of Signing Bonuses,” signing bonuses are under careful consideration by lenders today, as are retention bonuses. This means the lender’s recruiting story, as well as its retention story, can’t be all about compensation. It also must be about the support the lender will offer its professional sales team as well as its stability and track record.

On the front end, loan officers with better technologies will be more successful at bringing new business into the enterprise. Tools to consider:

“The good news is that all these tools exist, and presumably, many of your best MLOs have them actively in play already,” says STRATMOR Senior Advisor Sue Woodard. “Gain traction quickly by utilizing your best performers to help you understand what is working, and to champion full adoption with the rest of your origination sales force.”

The ability to mine past customer and prospect databases and leverage big data to connect with more prospective customers, if done right, is worth the investment.

Whether it’s marketing, social media advertising or CRM, better tools will make recruiting and retention easier and improve overall company sales.

Solid secondary marketing execution starts with pricing discipline. Do you understand the target margins you want or need to achieve by product? For example, tiering of pricing by loan size, geography and LLPA type with the appropriate documentation of the business rationale for the approach, can enhance overall gain on sale. Having a disciplined approach to monitoring true competitor daily market prices rather than via anecdotal loan officer information can also contribute to margin maximization.

“Fully adopting mandatory delivery and a comprehensive approach to best execution analysis, including both servicing retained and released options, can contribute to gain,” says STRATMOR Principal Tom Finnegan. “Do you track basis risk between the hedge instruments being used and the true sales execution value for loans being generated? Do you measure actual versus expected results based on your initial pricing margins, and are results less than expected due to lack of discipline over pricing exceptions, extensions and renegotiations? Solid policies and controls in these areas can materially improve overall gain on sale revenue.”

Finnegan suggests lenders work with their hedging advisors and investors, including the GSEs, to ensure maximization of the value of the types of loans being generated, such as low balance loans.

Some lenders will need to consider channel or branch consolidation or the retirement of certain lines of business in order to remain profitable. This will require a candid assessment of the future potential for profitable operations. Some large lenders have recently made such decisions, including LoanDepot shutting down its Wholesale channel and Celebrity Home Loans shutting down its Correspondent unit.

While developing the roadmap, strategy and timeline remain vitally important, it is also important that lenders continue to satisfy consumers through this process. As STRATMOR Customer Experience Director Mike Seminari points out, increasing the lender’s Net Promoter Score (NPS) in customer satisfaction can have a substantial impact on repeat and referral business, and the tools needed to collect, analyze and implement customer feedback may be less costly than you think.

“With solutions like STRATMOR’s MortgageCX, lenders can leverage deep customer insights and social proof tools — testimonial collection and sharing — wrapped into one program for about the same cost they might currently pay for one or the other,” says Seminari. “This is an opportunity for increased revenue and improved culture with little to no added expense.”

Many industry leaders will choose to throw themselves into the battle and continue to fight. For many others, it will make more sense to sell the company and move to other endeavors. We have seen a significant spike in our Mergers and Acquisition (M&A) advisory business during the past 12 months.

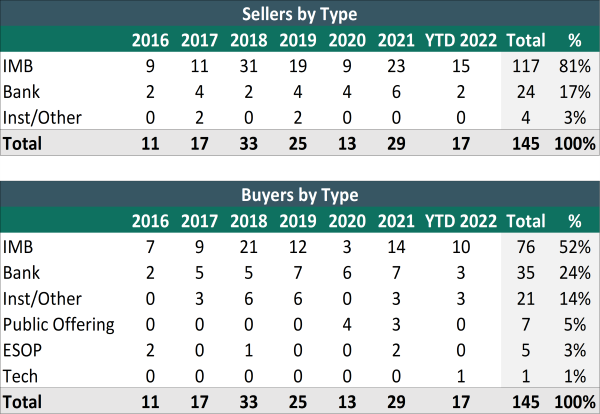

During the last “bust” period (2018 – 2019), STRATMOR data reveals that there were more than 50 M&A deals over the two-year period, but we are projecting that there could be more than 50 M&A deals in 2022 alone.

Of course, it’s generally true that anyone who begins the conversation with a STRATMOR consultant is considered an acquirer until proven a seller. And there is no shame in getting out of the business when it fits your overall strategy. In many other cases, owners who want to retire will be courting buyers.

As our Senior Partner Garth Graham has pointed out in other articles, many owners of residential lending companies are aging. Some aren’t interested in going through another business cycle. Others are trying to improve efficiencies, and if there is a cultural fit with another company why pay for two accounting departments, two capital markets departments, two sets of doc drawers and funders, etc.?

Chart 2 shows the buyers and sellers in M&A activity since 2016.

Chart 2

Source: © 2022 STRATMOR Group.

Source: © 2022 STRATMOR Group. Graham strongly encourages lenders who are thinking about selling their business to start the process early to figure out how to maximize value. “There may be things you can do to ‘stage’ the house, and that takes some level of planning,” says Graham. “Also, ensure confidentiality: don’t just start taking calls without thinking through disclosure risk. At STRATMOR, we typically engage with sellers in a confidential process to determine the best likely buyer and then coordinate a confidential process to have buyer and seller engage.”

Graham advises prospective sellers to focus on model match and culture. “Buyers and sellers need to have a level of compatibility to make the deal work. After all, you typically are going to work together after the sale, and the key is that it’s a good fit not just a good price,” he says.

“Earn outs can be very valuable if it is the right buyer with synergy,” Graham says. “If a buyer can make more money with the seller’s platform, then that extra earnings is part of a well-structured earn out. Often buyers focus only on upfront cash and don’t pay enough attention to the post closing earnings.”

Graham suggests that sellers be realistic and willing to compromise. “A ‘scorched earth’ negotiation will ultimately create issues, the classic example of winning a battle but losing a war. Do not disclose a potential or pending transaction prior to close date to anyone other than those that MUST know,” he said.

He also advises prospective sellers to evaluate the transaction impact from the perspective of sales, operations and corporate staff. Do pricing, product menu, benefit programs, lending opportunities, technology tools and resources stay the same or improve? This is what typically drives retention.

“Be disciplined with your objectives and evaluation. If you want a deal too badly, you may very well get it badly,” Graham said. “Celebrate the transaction with your employees but do not oversell it or apologize for it. A good deal often means better opportunities for the employees, and they need to know that.”

For most, the merger or acquisition conversation is really an examination of the numbers, followed closely by whether there is a like-culture model match. The mathematics that support most sales in our business are straightforward and we have a great deal of experience in helping owners uncover not only the numbers, but also in identifying potential matches in culture and synergy. Contact STRATMOR for help evaluating your options in buying or selling your mortgage business.

Shutting down should not be viewed as a failure. Experienced business leaders know that sometimes it makes the most sense to shutter a business to preserve capital, avoid the unintended consequences of holding on for too long, and to leverage their time, experience and resources elsewhere.

If an objective view into the business indicates that its operating model is no longer viable and the cost to right the ship is too high or the results uncertain, shutting down the business should be considered.

If the enterprise is losing money each month and a turnaround or sale is not likely in the near term, owners may opt for a wind-down instead to preserve their hard-earned equity, less the expected shutdown / liquidation costs. STRATMOR Principal David Hrobon has this advice for lenders considering shutting down:

Do not delay. “Waiting to make the decision to shut down is a difficult one, and the longer you wait, the greater the impact on everyone involved,” says Hrobon. This is not just a strategic decision it is also an emotional decision given its impact to your staff and your family. The responsibilities that you feel for others is normal and admirable. However, extending the decision ‘just a little longer,’ means you are burning through assets that could go toward softening the landing for those impacted. You have more options the sooner you make the decision — when you delay, some of the decisions are made for you.”

Work with a trusted advisor. “Your career success has probably been, in part, driven by some combination of optimism, salesmanship and passion,” says Hrobon. “Your DNA is in this business, and you are emotionally invested. As such, you should enlist a disinterested third-party, or trusted advisor, to help make this decision. This is a very different market than we’ve seen before and leaning on your own past approaches and experiences may not be the best strategy. It will help you to be able to talk with, to work with someone who knows the mortgage business and who understands that you want to do the right thing to support your staff and protect your hard-earned assets.”

Organize a small team to develop a plan and timetable. “It’s important to develop a go forward plan and then execute it with precision and exacting detail,” says Hrobon. “This keeps everyone focused, eliminates confusion about what’s going on and sets deadlines and expectations that help keep the business moving forward as operations wind down.”

Identify resources or solutions you can offer your employees, customers and vendors to minimize the impact to them. “Certain tasks take time to wind down and you may want to provide retention bonuses to key people,” suggests Hrobon. “Tenured employees that manage key processes are invaluable to the wind-down process, but do not assume any of them will stay without appropriate retention bonuses.”

Maintain confidentiality. “Be concise and honest with your communication and get the timing of messages right,” says Hrobon. “Communicating the decision to shut down the business is a difficult one and should never be heard by your staff or your customers second hand. Work with some combination of your Legal, Human Resources and Communications team to develop the messages and provide reassurance to your audiences that you will keep them informed.”

The market is in turmoil and mortgage executives are facing major strategic and tactical decisions. Lenders may decide to fight on, sell or shut down, but they certainly cannot stand still.

Regardless of which course management sets for the lending enterprise, now is the time to make that decision. STRATMOR has helped many institutions work through these issues and we look forward to supporting you.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.