Anyone who travels as much as some of us at STRATMOR do develops a healthy appreciation for airports — and not just the terminals or the frequent flyer lounges. What keeps air travel working at scale isn’t the aircraft or even the pilots. It’s air traffic control.

Thousands of planes take off and land every day, often in crowded airspace, under tight time constraints and constantly changing conditions. The system works not because every pilot is exceptional, but because there is a centralized layer coordinating traffic routing planes, sequencing landings, managing delays, and keeping everything moving safely and predictably. Without that coordination, even the best pilots would struggle. Volume would overwhelm judgment.

Mortgage lending today increasingly looks like a busy airport without sufficient air traffic control.

Leads arrive through multiple channels: calls, websites, emails, texts, and referrals. Borrowers expect immediate responses and clear direction. Loan officers juggle dozens of conversations at once while systems struggle to stay synchronized. Follow-up depends on availability. Status updates lag. Inconsistency and uncertainty creeps in, not because people are careless, but because the system relies too heavily on individual effort to manage volume.

This is where artificial intelligence is establishing a beachhead in mortgage lending.

AI is not replacing loan officers any more than air traffic control replaces pilots. Instead, it provides a foundation and point of coordination. It handles routine routing, standard responses, and predictable interactions so that human expertise can be applied where it adds the most value — complex scenarios, judgment calls, and relationship management.

Without air traffic control, airports grind to a halt. Without better coordination at the top of the funnel, mortgage lending experiences the same symptoms: delays, missed connections, frustrated customers, and rising operational strain. AI is emerging as the control layer lenders have been missing: not a silver bullet, but a necessary component of operating at scale in today’s environment.

As traffic volumes increase, airports don’t ask pilots to work harder — they invest in better coordination systems. Mortgage lending is reaching a similar inflection point, and the lenders pulling ahead are those investing early in the foundational control layer that artificial intelligence provides.

Several converging forces are pushing AI from optional to mandatory:

Borrowers no longer compare their mortgage experience to other lenders. They compare it to Amazon, their bank’s mobile app, and any digital experience that works well. Meeting those expectations with traditional staffing models and legacy processes is becoming increasingly difficult.

This shift is not about replacing people. It is about reallocating human effort away from repetitive, transactional work and toward activities that require human judgment, empathy, and expertise.

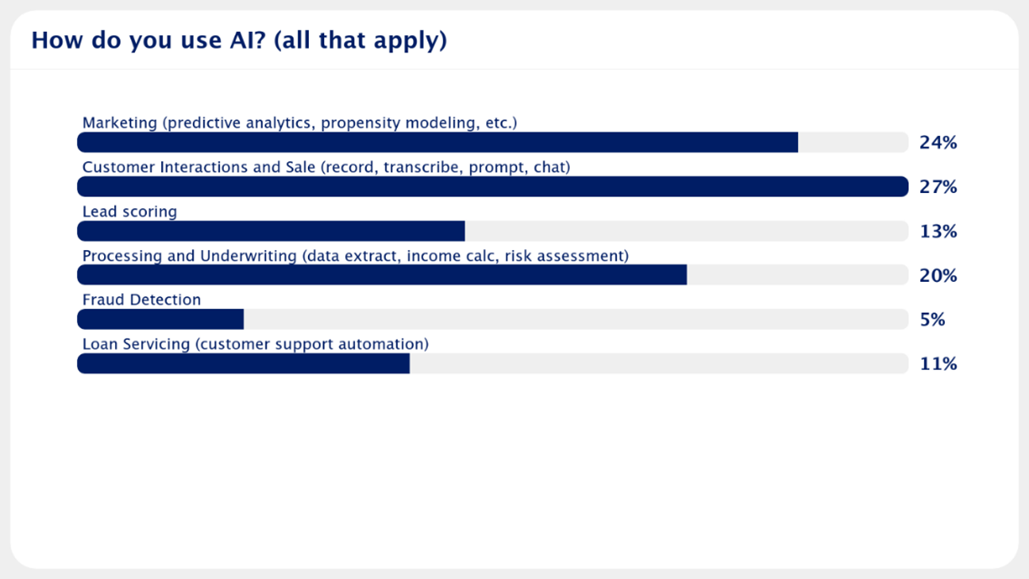

STRATMOR’s Technology Insight® Study (TIS), conducted annually since 2014, provides a clear window into how lenders are deploying, and struggling with, technology. In recent years, we expanded the study to track automation and AI adoption, and several consistent patterns are emerging.

First, lender interest in AI is high and growing. Second, execution remains uneven. Most lenders are still experimenting rather than operating with a clearly defined AI strategy. Third, early adoption is heavily concentrated at the top of the funnel — sales, marketing, and borrower interaction — where inefficiencies are most visible and the return on improvement is immediate.

Source: STRATMOR Consumer Direct Workshop, May 2025

Notably, lenders are not pursuing AI simply to cut costs. Productivity, consistency, and customer experience are the dominant drivers. That distinction matters, because it influences both how AI is deployed and how success is measured.

When we look at near-term, practical AI opportunities, sales and origination stand out clearly.

These functions share several characteristics that make them ideal for early AI adoption:

These are not new problems. What is new is the availability of AI tools capable of addressing them consistently and at scale.

This is where AI can make an immediate difference: not by replacing loan officers, but by making them more effective.

One of the most visible applications of AI today is the emergence of AI-powered agents that can interact directly with borrowers. These agents can answer common questions, collect missing application information, verify data, and route complex issues to human loan officers.

The implications are significant. Loan officers spend a substantial portion of their time responding to routine inquiries, tracking down information, and re-answering the same questions across multiple borrowers. AI agents can handle much of this work — 24/7, without variability — freeing loan officers to focus on relationship-building, problem-solving, and closing loans.

The projected productivity gains are not trivial. In some cases, lenders are estimating meaningful reductions in sales labor cost per funded loan, while simultaneously improving borrower responsiveness and consistency.

This is not about automation for its own sake. It is a deliberate redeployment of human effort to where it adds the most value.

STRATMOR’s work with lenders consistently highlights the same customer experience challenges in origination:

These issues frustrate borrowers and lenders alike. Importantly, they are rarely the result of poor intent or effort. They are process and consistency problems, not people problems.

AI is uniquely suited to address these friction points. It does not get tired. It does not forget to respond. It does not answer the same question differently depending on the day or the loan officer. When deployed correctly, it brings a level of consistency and responsiveness that is extremely difficult to achieve with traditional models.

Beyond borrower interaction, AI is also showing promise inside the application process itself. In demonstrations we have seen, AI can quickly transform technical, compliance-heavy content — such as loan quotes — into clearer, more consumer-friendly language in minutes rather than days.

This capability has several important implications:

It also highlights an important truth: AI does not fix broken processes. Instead, it quickly exposes them. Lenders who attempt to layer AI on top of poorly defined process/workflow often discover underlying issues that must be addressed first.

The competitive advantage with AI does not come from having the most tools. It comes from making disciplined choices.

Lenders that are succeeding with AI today tend to:

The risk of inaction is not theoretical. Lenders who fail to improve responsiveness, consistency, and productivity will find themselves at a growing disadvantage — particularly as borrowers become less tolerant of friction and delay.

For lenders looking to move beyond experimentation, STRATMOR recommends a pragmatic, structured approach:

This approach helps lenders avoid “tourist AI,” or tools that look impressive but fail to deliver sustained value, and instead focus on solutions that improve performance where it matters most.

AI will not replace the need for human relationships at the heart of mortgage lending. But lenders that apply AI thoughtfully and effectively will increasingly replace those that don’t.

In 2026, the question is no longer whether AI belongs in a lender’s strategy. It is where it should be applied first, how success will be measured, and how quickly execution can move from concept to impact. The arms race is underway, and the winners in this next phase will be determined not by size or spend, but by the discipline with which they align AI to business outcomes: speed, consistency productivity, and customer experience.

STRATMOR’s role is to help lenders cut through the hype, focus on what matters most, and apply AI in ways that drive measurable performance gains today, not someday.

STRATMOR works with lenders to identify high-impact use cases, align technology investments with business objectives, and incorporate AI into existing workflows in ways that deliver real results. For organizations ready to move beyond experimentation, now is the time to define priorities, align stakeholders, and build a clear execution path.

Want to learn more about how STRATMOR helps lenders implement smart AI strategies? Contact us today. Garth Graham Michael Grad

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.