for these free STRATMOR

online publications

Last week, I stayed at a Marriott hotel in the West End of Washington, D.C., one of the nicer neighborhoods in the city. And since hotel stays in this area tend to run $500 to $600 per night, my expectations for a great customer experience were also a bit higher. When I checked in, the desk attendant said, “We’d like to invite you to enjoy breakfast with us tomorrow in this area (he pointed) from 6:00 a.m. to 10:00 a.m.” I liked the offer, and I even liked the welcoming way it was phrased. You might even say I was delighted. So, the next morning, I ventured down to the breakfast area, grabbed a few of the displayed items, and started out the door, only to be stopped by an employee requesting my room number. Apparently, there’s a $20 charge to “enjoy breakfast” with them. My delight quickly vanished.

I share this story to impress a simple point: Context is everything. I was delighted at the prospect of a free continental breakfast but surprised and then annoyed with a $20 one. Same food, but one context exceeded my expectations, while the other felt like a betrayal caused by poor communication. This concept applies equally in the world of mortgage lending. Borrowers expect a certain level of service, and we must exceed that level if we hope to get word-of-mouth referrals. Our question this month: What does it take to exceed expectations and delight borrowers in 2024?

One of the most common conversations I have with loan officers goes something like this:

Me: Would you say your borrowers like you?

LO: Yes, they LOVE me. I get high ratings and testimonials from almost all of them.

Me: What kinds of things do they say?

LO: They say I’m great, always available, that I answer all their questions, and that they trust me.

Me: Wow, those are some nice things to hear. Now tell me, if you took all your closed loans from the past six months and counted all the referrals you’ve gotten from those borrowers, what would that number be?

LO: Not as many as I’d like.

Me: Why do you think that is?

LO: I don’t know. They loved me. It’s probably just the market.

Me: Or maybe, just maybe, they didn’t receive an unexpectedly good experience?

It’s a dog-eat-dog world out there in mortgage lending right now. The average loan officer is taking just four applications per month, down significantly from 12 at the 2021 peak. Rate cuts that many expected early in the year have yet to materialize. The market supply of existing homes for sale is still tight and new construction can’t move fast enough. And without the anticipated refinance bump, loan officers must continue to contend with a 90% purchase mix. On top of all that, the recent National Association of REALTORS (NAR) decision risks upsetting the referral market in ways we don’t yet fully understand. It has never been more crucial for loan officers to do everything in their power to drive word-of-mouth referrals from their customers—to be sure they are delighted and thus motivated to spread the word. For many, it will be of existential importance.

The key to delighting borrowers, and therefore to generating word-of-mouth referrals, is to operate in the world of the unexpected.

Earlier this week, my wife and I celebrated our seven-year anniversary at a nice steakhouse. The steaks were in the $85 range, so I expected it to be good … and it was. In fact, if someone asked me for a recommendation for a steakhouse in my area, I’d give this one a thumbs up. But they’d have to ask first. I would not tell anyone unprompted about what an amazing experience I had. The restaurant did nothing special, nothing unexpected. The steak was tasty, the server was knowledgeable and timely, but they’d better be for $85 a steak.

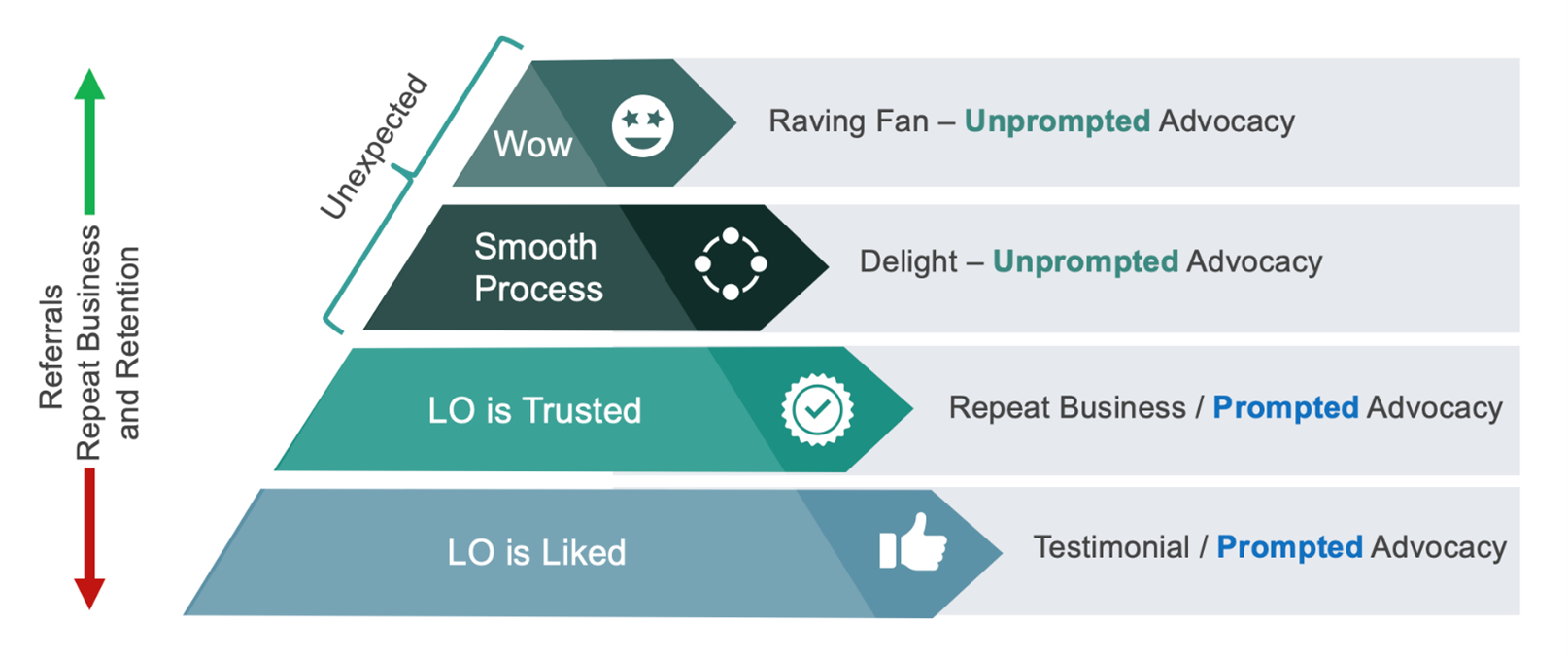

The same phenomenon happens within the mortgage journey. Borrowers expect to like their loan officer. They expect to trust them, too. After all, they’re giving them a bunch of personal and financial data, including their social security number and blood type. (Ok, they don’t actually ask for blood type, but it might feel like it!) Liking and trusting your loan officer, however, will at best earn you prompted advocacy — the kind where someone has to ask for a recommendation. And yet, I often speak with executive lending leaders who base their entire confidence in their CX execution on the idea that people like and trust their LOs.

To move from prompted to unprompted advocacy, we must move into the world of the unexpected. In the thousands of borrower testimonials I’ve read over the years, I look for ones that make explicit advocacy statements like, “I’ve already referred my sister.” There are two themes that I see in such testimonials:

Both of those are delightful because they’re unexpected. The “Wow” experiences make sense, but what about the smooth process? Borrowers tend to go into the loan journey expecting a bit of pain and struggle. It’s no fun having to round up and submit a bunch of financial documents, having to feel vulnerable while said documents are being evaluated and feeling unsure of the outcome.

The expectation is that there will be some confusion, some anxiousness, some frustration. And it’s a fair expectation. According to STRATMOR data, more than 50% of surveyed borrowers who complete a loan transaction cite one or more problems, with a resulting 75-point drop in Net Promoter Score (NPS), which measures their likelihood to recommend. That’s the difference between a raving fan and someone who will say bad things about you. To bring someone through that gauntlet unscathed is remarkable in their eyes.

STRATMOR tracks seven make-or-break aspects of the process that we call The Seven Commandments. If you shepherd your borrower through the process without exposing them to those seven things, NPS is an astounding 97. If you’ve ever heard people sing the praises of companies like Chewy, Starbucks, and Apple, these people are like them, but are even more intense in their fandom. They are the ones going around telling everyone of a company’s greatness — unprompted.

Here are three ideas you can implement today for operating in the world of the unexpected:

If you’d like to discuss STRATMOR’s MortgageCX program in more detail, find time on my calendar to set up a free consultation.

MortgageCX is now integrated with Encompass®!

To find more Monthly Customer Experience Tips, click here.

Start receiving monthly Customer Experience Tips