The main intersection near my house is being torn up and replaced. What were previously three lanes in each direction are now down to a single lane each way, creating significant traffic delays — and a good deal of frustration.

Despite my irritation, I know this intersection badly needs repairs. It has potholes that threaten to swallow my small sedan, and when it rains, the flooded roads cause the traffic lights to go out, creating chaos and accidents. The plan to replace the pavement, improve drainage and update the traffic signals will be worth it.

Like the streets near my home, the intersection of mortgage and wealth management may need some help as well.

Recently, a wealth manager at a major Wall Street firm told me the squealing brakes story of a near-accident when the topic of mortgages came up: He had just expended tremendous effort to prevent one of his clients of many years from moving all her accounts — nearly $20 million — to another firm, all because of a subpar mortgage experience.

The wealth manager had referred the client to a lender he trusted to take superior care of one of his best clients and they didn’t. As a result, the lender lost not only the high-value mortgage, but also any future referrals from the wealth management team.

The mortgage process issues cited by this client will be familiar to every lender: she was asked to provide the same documentation multiple times, the lender incorrectly calculated the LTV, and there were delays in the closing, among other problems.

Wealth managers and private bankers advise high-net-worth (HNW) individuals who very often want to borrow against their residential real estate.

For lenders, there is an upside to working with them. Lenders can make the same amount of money — or more — with fewer deals because the loan sizes are larger, loan officers (LOs) will likely receive a steady stream of qualified borrowers, and the fulfillment team will see very clean credit with good liquidity. Underwriting is not always traditional. Some institutions will do global cash flows with in-house underwriting on commercial relationships, so getting a deal through is often highly customized.

Savvy lenders who have the chops to work with an HNW borrower referred by a wealth manager or private banker understand that the mortgage is one piece of a larger, and more lucrative, relationship. Treating the client very well with the intent to foster a great relationship with the client’s wealth manager can pay off handsomely.

In this article we will focus on the HNW client segment — individuals in the $1M to $25M range. This covers the top 10 percent of Americans, or approximately 21,951,000 people as of 2020 according to Credit Suisse’s 2021 Global Wealth Report.

Private banking and wealth management are sometimes used interchangeably, but there are key differences between the two. While wealth management advisors may have a lower dollar threshold to meet for their services, both private bankers and wealth managers cater to HNW individuals. The threshold to meet the criteria differs by institution, but the minimum is typically $1,000,000 or more in either net worth or liquid assets. Some firms offer more specialized services for the ultra-high-net-worth (UHNW) where the threshold typically starts at $25 million to $30 million in investable assets.

Private banking offers precisely what the name implies: high-touch banking services. At larger institutions, private banking consists of dedicated teams that provide clients with personalized management of their financial assets. Some private banks may also include financial advisors, as well as trust or estate settlement services, as part of their private banking support. UHNW clients may also receive family office services, philanthropic guidance, specialty asset management and lending, or even supplementary tax advising.

Some private bankers do not have an LO working in-house or affiliated with their firm. Independent, non-banking family offices typically do not offer in-house banking or lending services of any kind as they are focused more on financial planning with a holistic view of the client’s balance sheet. A concierge financial advisor with a Certified Financial Planner (CFP) certification, sometimes a Certified Public Accountant (CPA), or even an attorney will run an independent family office. If borrowing money is needed to offset other tax implications and the interest paid can be offset by market gains, this is when an LO may be contacted for assistance.

Wealth management firms, by contrast, are more broadly focused on managing a client’s portfolio to obtain investment return goals within the risk tolerance of the client. Working with the client to create a personalized investment strategy and ongoing monitoring of the client’s investment positions is part of the offering. Some wealth management firms may also be part of a bank and therefore have banking and lending services available, including LOs. Those who are not part of a bank, or who do not have in-house LOs, have to rely on a solid and trusted external lender to whom they can refer such a valuable client.

According to the online publication finmasters, 40 percent of the average American millionaire’s investments consist of real estate, and many have a mortgage on that asset. Additionally, 43 percent of these millionaires own only a single property.

Being more affluent doesn’t change whether a mortgage is needed. Many do not want to use their liquid assets, especially for a primary residence. I was recently speaking with the head of a wealth management team at a major Wall Street firm who said that roughly 90 percent of the clients in his portfolio have a mortgage.

So where is the opportunity for mortgage lenders? There are some common types of products the HNW client prefers and, perhaps a bit surprisingly, they’re not usually for investment properties. Most mortgages for HNW borrowers are for primary or secondary residences. Increasingly, they are buying second homes either for their adult children just starting out and sometimes for themselves in cities where their children are attending college.

Some of the more typical characteristics of mortgages for HNW borrowers are:

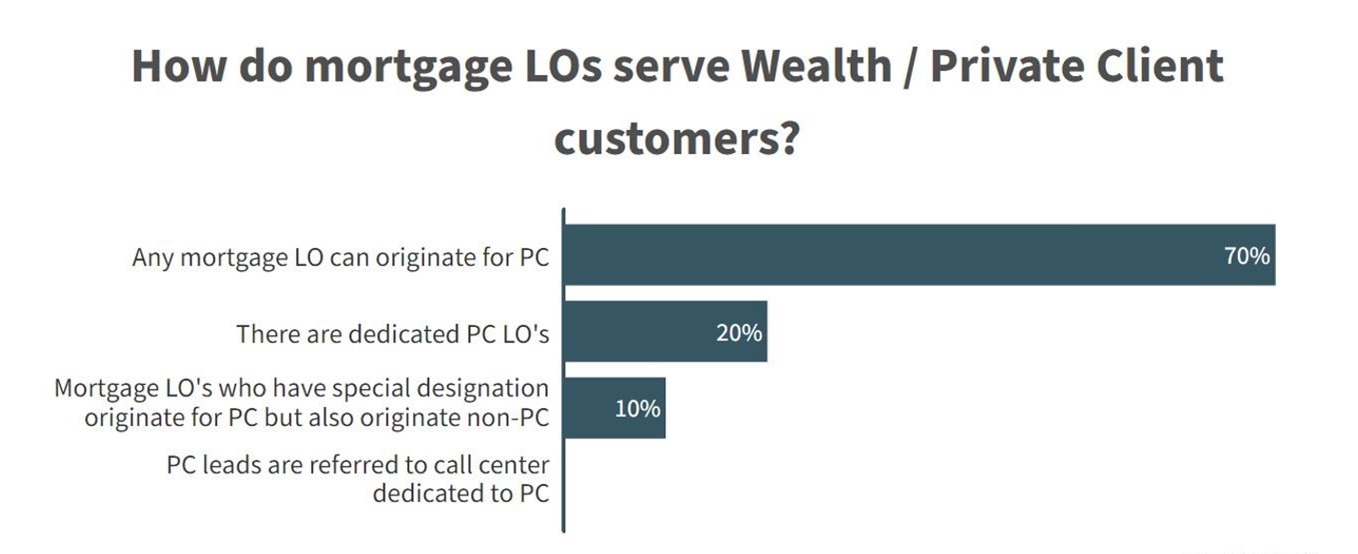

Liquidity is a driving factor for the HNW client, and strict lending requirements often advance the desire to utilize a mortgage instead of a line of credit. I know an individual who has taken out interest-only loans on his primary residence consistently for the last 15 years because he can make more in the market and it’s a strategic tax advantage. He uses an LO assigned to his private banker, however, that is not the dominant model. Chart 1 from STRATMOR’s recent Private Wealth Workshop shows 70 percent of the participants allow non-dedicated LOs to originate for their clients.

Chart 1

Source: © 2023 STRATMOR Group, Private Wealth Workshop.

Source: © 2023 STRATMOR Group, Private Wealth Workshop. A frequent obstacle to the mortgage/wealth management intersection is that advisors who have an in-house lending option do not want to refer mortgages to their existing firms. Many would rather direct clients to a mortgage broker or other external contact. Unfortunately, I’ve heard it said by wealth advisors that there is no upside and lots of downside to referring a client to an LO.

There are several reasons for the bad press:

Ensuring that the mortgage experience is as smooth as possible and seamless to the HNW client is paramount. One wealth manager at a major financial and advisory institution noted he loses “more goodwill in the mortgage process than any other … not even market fluctuations cause as much client backlash.” Journey mapping and leveraging voice of the advisor feedback are some good ways to start to identify weak spots in the client experience. More on this later.

Knowing and trusting an LO with their client is a huge leap of faith for a wealth advisor. Building that trust takes time, but perhaps not as much as you might think. Two or three deals in a row that go well should start to cement that trust. However, be warned: Any road bumps during those initial three deals will reset that clock, should you get a second chance at all.

Bumps sometimes can be avoided with appropriate and timely communication with the advisory team or with the client, depending on the circumstance. Coordinating communication with the advisor to drive a great client experience will only help solidify an LO and lender partnership with a wealth manager or private banker. While critical for any successful relationship, in the mortgage/wealth management partnership timely and concise communication with the referring wealth advisor and client (as directed) is crucial to help build confidence in the LO and lender and establish both as trusted partners.

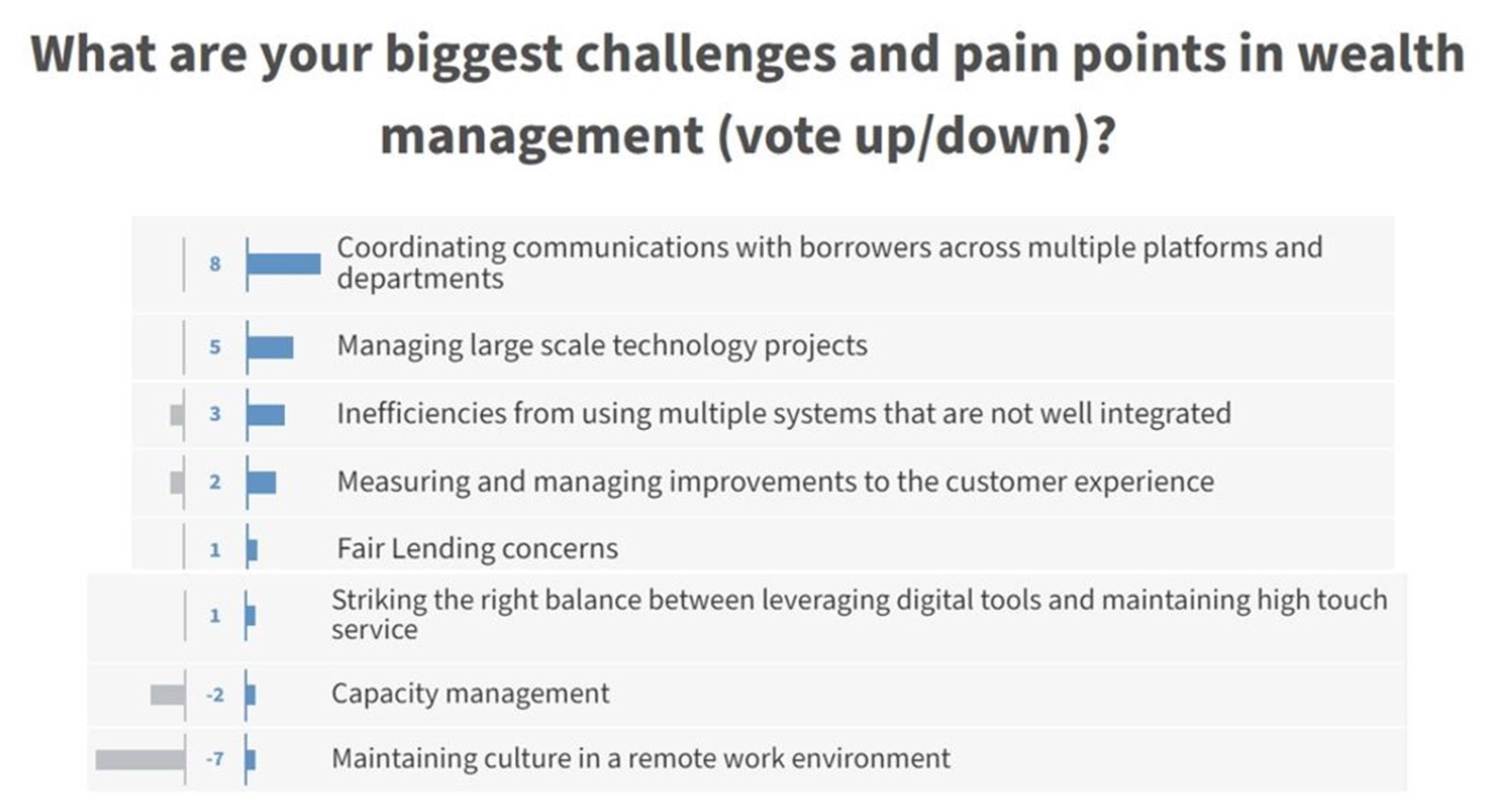

As noted in Chart 2, according to a participant survey from STRATMOR’s most recent Private Wealth Workshop, the top challenges/pain points with mortgage lending are related to communication.

Chart 2

Source: © 2023 STRATMOR Group, Private Wealth Workshop.

Source: © 2023 STRATMOR Group, Private Wealth Workshop. Note the use of the term “client” throughout this article. It is intentional. Customers are, by nature, transactional; however, clients are relationship-based. Wealth managers and private bankers do not have customers, they have clients. Embracing this mindset and terminology distinction is an important first step to becoming an effective partner.

When seeking a wealth management/private banking relationship, lenders and LOs should be aware of what a wealth management or private banking advisor expects:

At larger financial institutions, a dedicated in-house LO is often assigned to cover two or three private banking or wealth management teams. The LO only works with the assigned teams and is considered an extension of the advisory team. As such, they are often included in broader team or client meetings. It can be tough to land this role, but it guarantees a steady stream of lucrative business.

As a lender, you may be certain you can build the trust needed, but how do you attract the wealth manager or private banker? Offering differentiated products, like ones that allow for a cash purchase to be followed up with a standard refinance within 60 days of closing, can help. So can offering superior service, since a mortgage is a commodity that can be purchased anywhere.

The value proposition of a wealth management/private banking service requires white glove service, and it starts with how the LO communicates with the wealth advisor. It continues through processing and underwriting, where quick access to and communication with the head of underwriting is often necessary.

Managing expectations with transparent, two-way communication is the key to success. This includes understanding from the wealth advisor the goal of the loan, who will be contacting the client at various touchpoints and any escalation protocols. It is risky for the wealth management team to have a client go through the mortgage process only to be denied a loan. For this reason, some advisors may want to run through with the underwriter in advance to save the client the headache of a decline, and subsequently adjust a client’s financial plan instead.

A good mantra for the LO working with a HNW client is, “How do I make my client’s life easier without them even knowing it?” That is the differentiation that is expected. Maintaining good pipeline management, excellent communication, and focusing on client experience make a difference.

The head of mortgage lending at a regional bank sums up working with HNW clients with this one piece of advice: “Don’t screw up.”

The client experience is paramount in the mortgage process and even more acute with wealth management clients. We often talk about “table stakes” for HNW clients. Even a hiccup is usually very bad news for the wealth advisory team, and worse news for the mortgage lender.

It is important to remember that wealth managers and private bankers don’t care that the processor needs to get the tax returns. They want the entire mortgage lending team to understand that this is an important client and there is more riding on this mortgage than just a mortgage.

The white-glove treatment expected by HNW clients extends to the partnership with the advisor, since they are also the LO’s client. What might bring in high customer satisfaction scores for an average borrower will be barely passable (if at all) in this client segment. To meet these very high expectations, remember to keep the wealth advisor informed, especially in the event an issue impacts their client. Communicate per the wealth advisor’s direction, and don’t ask the client for the same document more than once.

Banks and wealth management firms place tremendous value on their relationships with HNW clients. Don’t let a bad mortgage experience sour that relationship, as it may have huge repercussions on the investment and commercial lending side of the house.

Senior partner Jim Cameron who leads STRATMOR’s Private Wealth Workshop suggests lenders interested in developing wealth management and private banking relationships examine their current processes. To optimize the mortgage process for the HNW customer base, Cameron recommends the following steps:

Speaking of paths, the repairs to the intersection near my house are coming along and looking great! The city says they should be complete in the next 30 days, just in time for the rainy season, and — coincidentally — almost as long as it takes to close on a mortgage.

Likewise, the future is always bright for lenders that learn how to better serve HNW borrowers and keep the intersection of wealth management and mortgages flowing smoothly.

It may seem like it takes a lot of extra work, cost and stress, but the benefits are well worth it. Jennifer Smith

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.