Often, my articles start with data. Today, I start with a story.

Pretend you are at a cocktail party (a gathering that occurred pre-Covid where you sat within six feet of other non-masked individuals), and you strike up a conversation with someone you only recently met. And, for a second, pretend that you are NOT a mortgage banker, but rather a “normal” person.

During this conversation your new acquaintance says, “I am thinking of buying a new home.” How would you — the normal person — respond to that? Normal people would say “Wow, that’s so exciting! What type of house are you looking for?” Then you might discuss why the person is thinking of buying a home, and maybe talk about what they hope to achieve. There is always going to be a conversation about why someone buys a home because the purchase of a home is about much more than the financial transaction.

Now, let’s go back to reality and assume you are a mortgage banker with a call center. The person you met at the party is now calling around, trying to find a good mortgage rate on their purchase of a home. The call center LO picks up the phone, and as soon as the caller says he/she is interested in a purchase loan, the LO launches into a litany of questions about the transaction. “How much is your down payment? What type of loan do you want? How is your credit?” and then (if the call center agent is a real salesperson), they might ask, “Do you want to lock a rate?”

So, which of the conversations is more impactful to the person thinking about buying the home? The first one, where during the course of the conversation the two individuals bond over the shared excitement of buying a home, or the second one, where the call center agent reduces the entire interaction to a financial transaction with the soft touch of a mechanized robot?

Most would say that the first conversation is more enjoyable, and that the home buyer is going to feel much better talking about what is truly important to them — the home itself — than trying to work through the various mortgage terms to figure out what loan to get. The job of a good mortgage banker is to create that bridge, to create a way to engage with the consumer while meeting the needs of the mortgage company to originate the loan.

So, as a mortgage lender, what does this mean and why is this so important as we head into 2022?

The market is changing. It’s no longer a matter of expert prediction, but rather is clearly visible in the industry’s data.

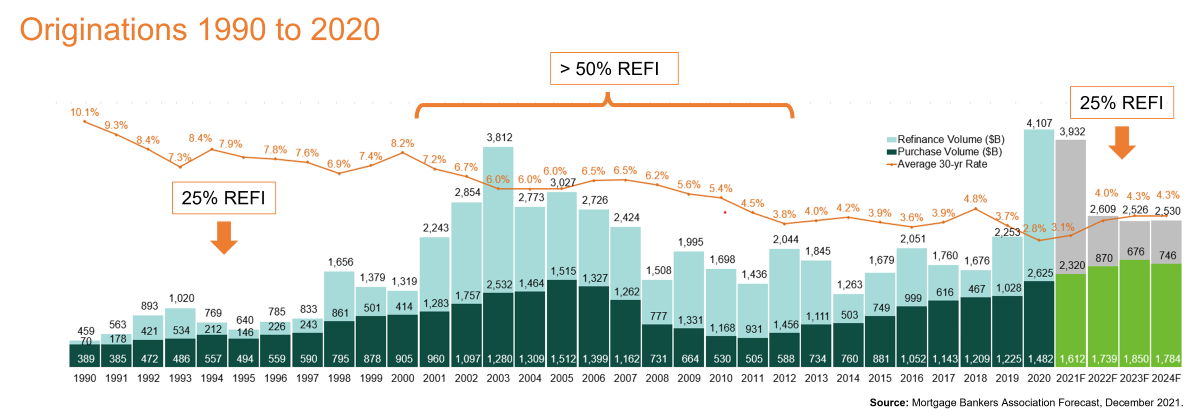

The Mortgage Bankers Association’s (MBA’s) most recent Mortgage Finance Forecast shows purchase money business accounting for only 29 percent of all originations in the first quarter of last year, rising to roughly half by the end of the year. For all of 2021, it looks like purchases will account for only 41 percent of all originations, but the forecast is for purchases to rise to 67 percent of all originations by the end of 2022.

Last year there was more refinance than purchase business and this year will be more purchase than refinance. This is a significant change in the business mix, especially for companies that have trained their staff and optimized their processes for refinance transactions.

This would be a serious challenge if every lender originated an average number of purchase and refinance mortgage loans. But that’s not the case. Some lenders have maintained a strong purchase pipeline, while others have feasted on the volume and the profits of refinance. It is the refi lenders who will be struggling with this change.

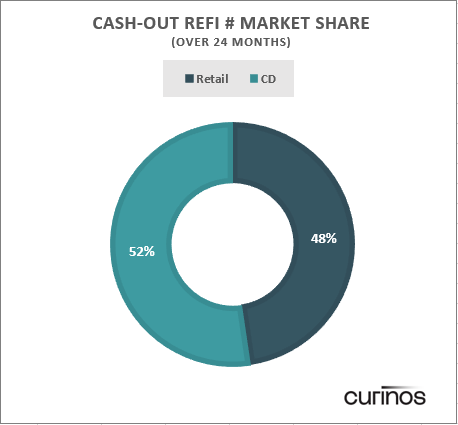

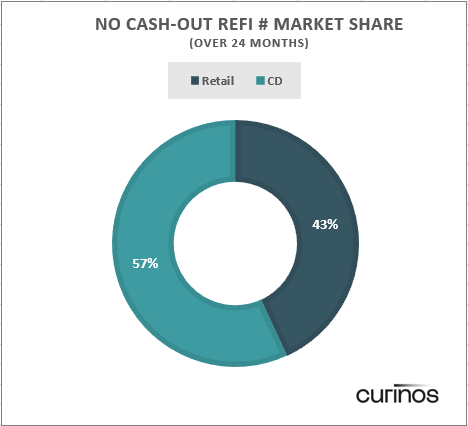

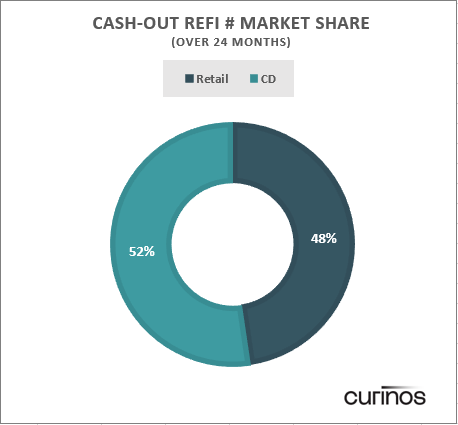

Consumer Direct (CD) loans are more likely to be refinance than purchase. Based on data provided by Curinos for 24 months, from October 2019 to October 2021, refinance units (both cash-out and no cash-out) in the CD channel exceeded Retail channel units as shown below.

During that same 24-month period, purchase units were only 15 percent so less than one-fifth of purchase loans were done through CD.

Source: Curinos, 2021.

Source: Curinos, 2021. For CD lenders to hold or grow their market share, they need to develop a strategy for attracting, nurturing, converting, and closing purchase business. CD lenders who think “I’ll just pivot and start purchase business” are in for a rude awakening — even when you acquire a purchase lead, it may take six to nine months to convert.

This is going to be a significant shift for CD lenders. Pivoting to purchase is not a matter of changing marketing messages and starting a pre-qual program. To make it work, CD lenders are going to have to understand the needs of purchase borrowers and craft marketing messages that will appeal to them, tweak their processes for purchase money loan originations and then train their LOs to close this business.

Success in the purchase money market will require CD lenders to understand the emotional drivers for all borrowers.

Unlike the refinance process where the borrower just wants a better rate on an existing loan, purchase money buyers are dealing with much more emotionally complex problems. Refinance borrowers can walk away easily if the terms don’t fit; purchase buyers can lose their dream home if all doesn’t go well. And, if their current home already has a buyer, a lost deal can leave them feeling like their family is out on the street. These borrowers need the loan officer to begin a dialogue with them and their agent to find their versions of success, and then have a process that will deliver it.

When the person who is buying a home contacts the lender, the originator must connect to the emotions of the borrower. As I discuss in my story at the beginning this article, I often challenge CD lenders to make the connection by considering how they would respond to someone at a cocktail party by saying something like, “That’s exciting. Why are you doing this?”

Once that emotional connection is made, the LO can get to the real reasons for the transaction, which could include:

Whatever the reason, this is what a lender’s marketing needs to focus on.

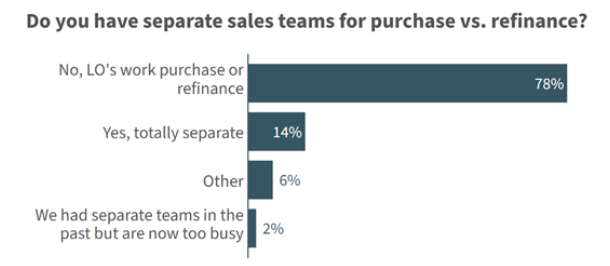

Unfortunately, most originators don’t know the right words to make this connection, and our workshop surveys show that 78 percent of CD lenders ask the same originators to work both purchase and refinance business instead of setting up a separate trained sales team. Only 14 percent have separate teams to meet the needs of these borrowers.

© STRATMOR Group, 2021.

© STRATMOR Group, 2021.That means these originators probably haven’t been trained to see the differences between borrower profiles. STRATMOR has created and deployed borrower journeys on behalf of lenders, and we find that typically there are only two types of refinance journeys but there are six types of journeys for purchases. In less than a minute, can you identify which of the six journeys or profiles you are working with? If not, you’re probably not selling purchases effectively. You should have a strategy for every purchase profile, and if you don’t, contact STRATMOR for help.

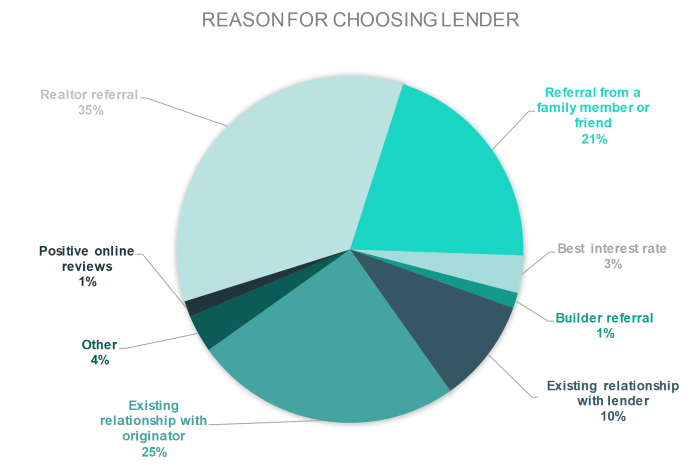

According to data from the MortgageSAT National Benchmark, a borrower satisfaction program of STRATMOR and CFI Group, over 90 percent of borrowers chose their lender due to a personal relationship with the loan officer or a personal recommendation from a friend, family member or real estate agent.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. This underlines the importance of personal and emotional connections in the purchase journey. That emotional connection is much easier to establish when the borrower is talking to an originator who understands and shares their life experience. It also makes diversity and inclusion efforts a critical part of building a strong purchase money mortgage business.

With the bulk of their business skewed to the refinance side, most CD lenders have optimized their process to originate refis. As we have discussed, this will not work for purchase money borrowers — check out my recent Insights article, “Prepare Now for the Storms Ahead: Build Your Purchase Business” for additional insights on preparing for the purchase market.

Some lenders may require new technologies, including faster prequalification tools and more extensive product and pricing engines. Communication between both the lender and the real estate agent must be simple, secure, and auditable, which could require a new Point of Sale technology or a mortgage-specific CRM.

It’s important to remember that today’s borrowers want both the convenience of digital tools and the security that comes from a personal touch. This will take more of the originator’s time than refi business, but with the right technology, some of these touches can be delivered via automated email, text, and pre-recorded videos.

Bottom line: in the beginning, the process will require more human interaction. With borrowers applying with multiple lenders, the lender who can make the connection will win the business. That makes investing the time to initiate interactions worthwhile.

Unfortunately, most CD lenders measure metrics such as talk time, with less being considered better for the business. While that makes sense on the refi side, it won’t work for purchase transactions. Even 10 minutes spent talking won’t be wasted when nurturing a purchase money borrower.

While chief lending officers are coming to the realization that a major retooling of their shops is about to become necessary, many originators are already there.

Loan officers were already feeling uneasy before the holidays, according to HousingWire. Big layoff announcements in shops like better.com, Interfirst and Freedom Mortgage had originators thinking about their futures in the industry. Many know they haven’t received the training to work effectively with purchase money borrowers and real estate agents and worry that it might cost them their jobs.

Originators will need to be taught how to emotionally connect with borrowers and agents, and it falls to the lender to provide the training. This will mean pulling the originators off the phones and training them. And then training them again. And again. STRATMOR’s experience shows that the average loan officer will need to be trained at least three times to be ready to manage purchase loans.

Part of that training must be teaching them to use technology to communicate with borrowers face-to-face over distance. When polled, lenders in our workshops said that only 25 percent of originators used video conferencing technology to speak with borrowers. Of those that didn’t, only half said they wanted to provide this technology.

This is a HUGE missed opportunity. On an emotional purchase, seeing the non-verbal communication in the originator’s face is critical for making the connection that will win the business.

How will the lender know if their originators are ready? The answer lies in the customer experience (CX) data. This information provides the scorecard if the lender is capturing and analyzing the data.

This is a complex topic and beyond the scope of this article, but the seven elements of an effective mortgage CX strategy must be tailored to the lender’s needs and the needs of the market it serves. Call us for a quick overview of our 360-degree CX Strategy Review.

A useful tool for understanding originator performance is the Net Promoter Score (NPS). NPS is based on a single question: “How likely are you to recommend us to a friend or colleague?” Because new loan borrowers put so much stock in recommendations they receive from friends and family, NPS has become a powerful tool for knowing how well our training is taking root.

Far and away the most powerful source of new purchase money business is the real estate agent. Unfortunately, many loan officers have not had to cultivate relationships with these important business referral partners and may not even know how to talk to them about their businesses.

It falls to the originator to make the case for the lender to the real estate agent. And it’s not just about saying the right things, it’s matching the emotion for that connection and then delivering on their version of success.

Too often a real estate agent will call with a borrower who needs a pre-qualification. The originator provides the information to the agent, hangs up the phone and moves on. That won’t be effective in the new market. The consumer will not be able to effectively make the originator’s case to the agent, even if they had the inclination to do so, which they do not.

Originators should call on agents and say to them, “This is so exciting! These borrowers are first-time homebuyers. How do you think it’s going on their side?” These are the originators that will close the deals. It’s not just about the details of the mortgage transaction.

The other problem that occurs when originators are not proactive is that when the borrower goes with another lender at the recommendation of the agent, the originator will consider it an affront and blame the agent for the lost business. It is not the agent’s fault that the originator wasn’t trained to call on the agent and that management didn’t track metrics to make sure they did so.

And it’s not about pressuring the agent to move the borrower to the close. Agents know the nurture path very well. They know the process takes time and they know how to keep it on track.

Instead, the originator should talk about what the agent really cares about. Find out if this is a back-to-back closing on a tight timeline. Find out what it’s going to take to make the agent feel comfortable that the deal will get done on schedule. That’s the way to earn repeat business from your referral partners. After all, both you and the real estate agent have the same goal: helping the home buyer get into their new home.

It may seem overwhelming when the complexity of the preparation process comes into focus, but it is possible to retool a Consumer Direct shop to be competitive in the new purchase money mortgage market. Lenders who start now, create a strong plan and adopt the right strategies will be the ones who maintain their strong market position relative to retail lenders in 2022. Garth Graham

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.