People who know me know that I travel a lot (or used to…). If it’s not going with my wife to see one of our favorite teams, it was to visit my daughter at school (until she had the audacity to graduate a few years ago!). I have a pocket full of other excuses for travel, but I rarely need to use them because business keeps me moving.

For the last year or so, travel has seemed better (ignoring the annoying mask issue). Faster, even. I book a flight, coast through security, hit my gate and board the plane. What’s changed? The number of people traveling — fewer people, lower volume.

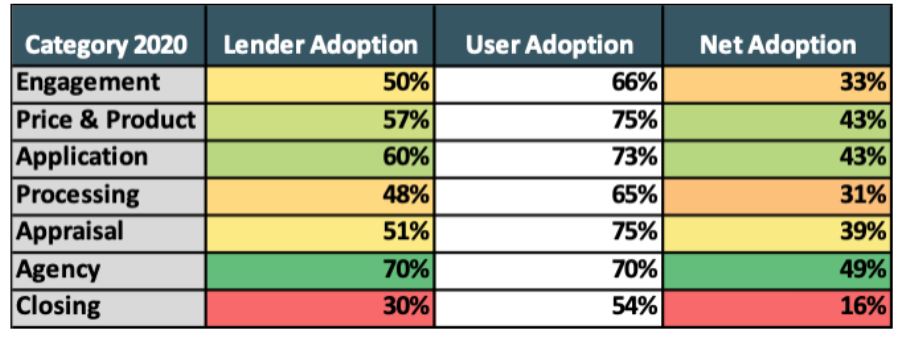

COVID had the opposite effect on the mortgage industry. Lenders ramped up with more people and pushed harder on technology, buying and installing at a maddening pace. But while lender adoption of tools has gone up, adoption by users has not kept pace. Lenders are rushing to deploy the tools, but only about half the eligible users (internal and consumer) are adopting the tools they are provided.

I thought about this as I was recently waiting for my plane. Not adopting the tools we have is like half the people who qualified for the TSA Pre-Check not taking advantage of the offer because they want to take off their shoes, put them on the conveyer belt and get their socks dirty walking through the security check. Or, it would be like me not using the online app to get my boarding pass because I want to take the extra time to stand in line to talk to the gate agent.

So, my message to lenders and vendors is that you can roll out new tools, but you have to drive adoption of those new tools to have the digital technology success you want.

The data we uncovered in the most recent STRATMOR Technology Insight® Study (TIS) shows this gap. In this article, I’ll unpack the details on digital adoption, and we’ll see where we stand on our digital journey.

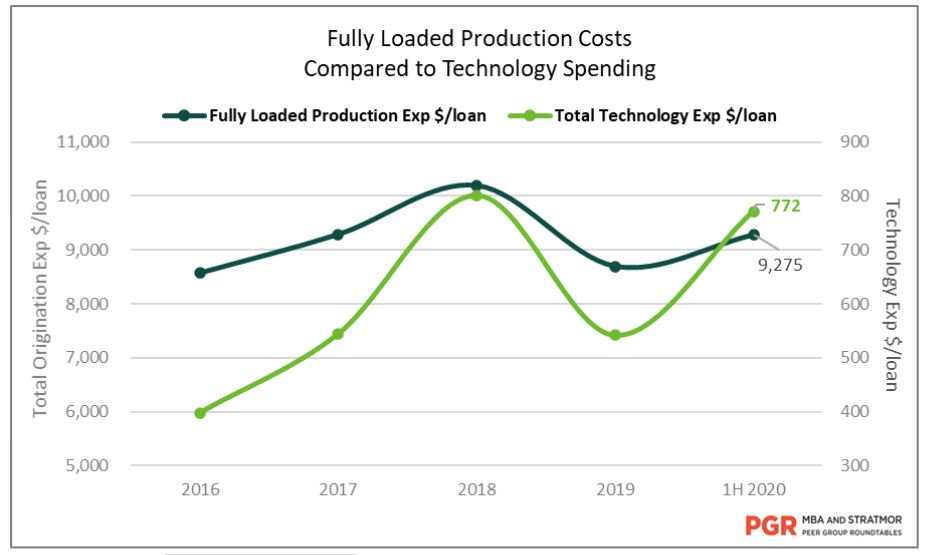

Technology investments are driving up costs, but are they driving up benefits? Technology investments are certainly going up, in fact Retail lenders spent almost $800 per loan on technology, up from less than $400 per loan in the past five years. However, the total cost of origination has not gone down.

Chart 1

Source: Expense data from the MBA and STRATMOR Peer Group Roundtables (PGR) program.

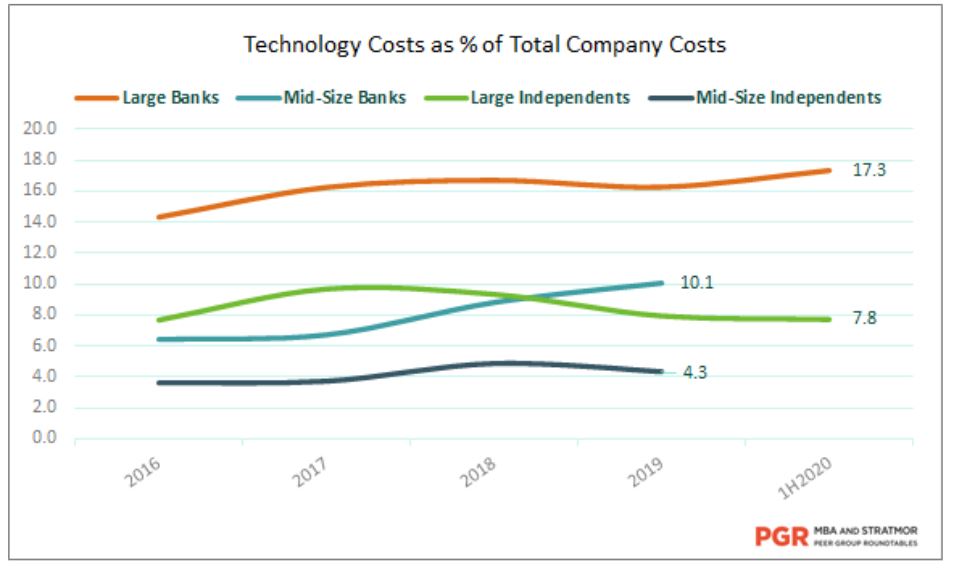

Source: Expense data from the MBA and STRATMOR Peer Group Roundtables (PGR) program.As you can see from the chart above, both numbers are up, with tech cost per unit doubling since 2016. However, we now have production costs that are higher than five years ago, despite the big bump up in volume in the past year. Yet, total tech costs remain a small percent of overall costs. Large banks have significantly increased their tech expenditures but are still at just above 17 percent of the total spend; while larger Independent Mortgage Bankers (IMBs) spend about 10 percent and midsize banks spend approximately eight percent of their budget on tech. Midsize IMBs put roughly five to ten percent of their spend to tech (about $4 million annually).

Chart 2

Source: Expense data from the MBA and STRATMOR Peer Group Roundtables (PGR) program.

Source: Expense data from the MBA and STRATMOR Peer Group Roundtables (PGR) program.There’s a lot of talk about how much money is being invested in digital mortgage technology, but is it making mortgage bankers more productive?

Our data shows that even with the increase in tech expense, productivity has not necessarily increased. Productivity went down steadily from 2015 to 2018, then started to increase, but that may be just as likely driven by higher unit volume and the increase in easy-to-process refinances as any major tech expense.

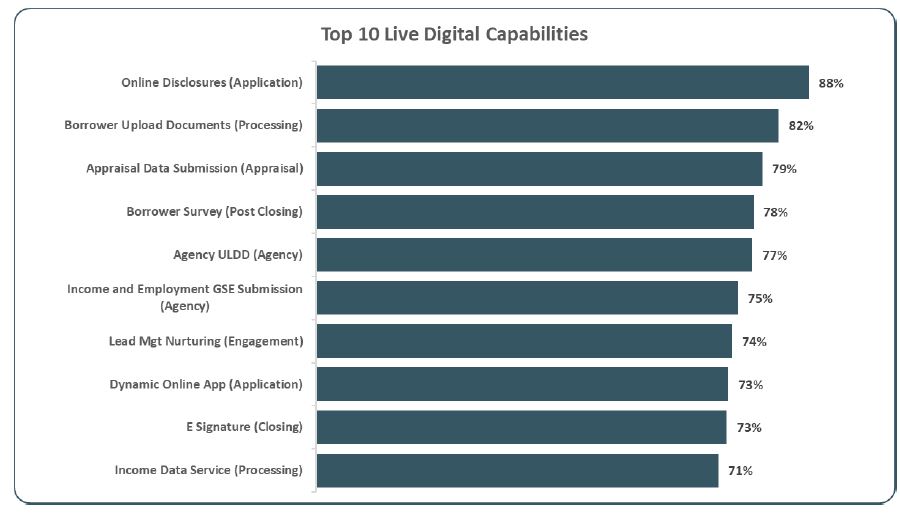

When we asked lenders in 2020 which digital capabilities they had already installed and made available for use by their teams, the numbers were impressive. The following chart shows the top 10 digital capabilities that lenders have already deployed include online disclosures, borrower uploading capabilities, appraisal data submission, eSignatures and eClosing.

Chart 3

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.

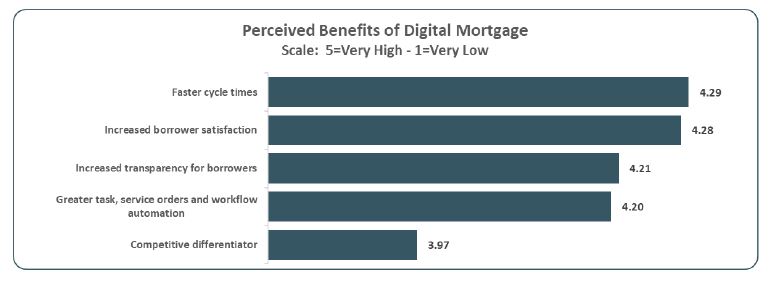

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.This makes good sense because lenders told us that the perceived benefits they hoped to gain by going digital included faster cycle times and increased borrower satisfaction. The technologies lenders have installed thus far are quite capable of delivering those results.

Chart 4

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.Bear with me here on the air travel analogy: Have you had to wait until group six to board, only to have someone roll their bag up by you and start a conversation in which you figure out they could have boarded in group one? They have a group one ticket (the tools) but didn’t use it. That’s us in mortgage: we have the tools, but many people who can use them aren’t. E-closing capabilities are a good example.

If COVID struck down the airline industry, it electrified the RON business. Suddenly, it became critically important for lenders to close mortgage loans without putting borrowers, closing agents or notaries in the same room together. This was exactly what the electronic notarization industry needed.

Overnight, the industry saw legislative action around the country enabling remote notarization. One would think that, in light of this, nothing would hold eClosings back. Remember from Chart 3 above that 73 percent of lenders told us that they had e-signing capabilities live in 2020 — and now.

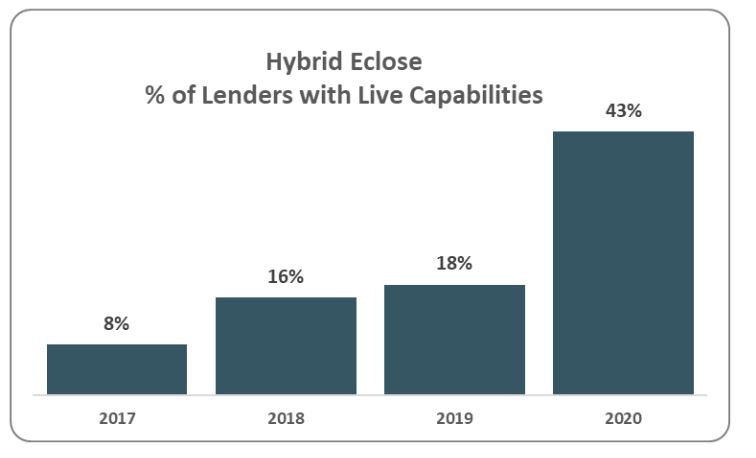

But eClosings didn’t get in the group one line. Instead, we saw hybrid eClosings experience the highest gains in the Technology Insight® Study, increasing by 25 percent. Arguably, the gains would have been even higher had COVID struck earlier in the year (and thankfully it didn’t). The hybrid eClose is a safer process and offers a substantially improved experience for the consumer.

Chart 5

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.When we look at closing technologies, it is actually an amalgamation of different technologies, including closing collaboration, eSignature, hybrid eClosings, full eClosings, eRecording, eNotarization, eNote creation and eVault technology. Given the increase we’re seeing, one could assume that digital closings are building up like a giant ocean wave. But according to our 2020 data, closing lags most of the technologies we are tracking with net adoption (which takes into account both lender adoption and user adoption) of only 16 percent.

Chart 6

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.Also, while 43 percent of lenders told us in 2020 that they had the capability to do hybrid eClosings (up from only eight percent in 2017), only 12 percent said they had achieved greater than 75 percent adoption.

Lenders are in motion toward digital lending, but it continues to be a long, slow journey.

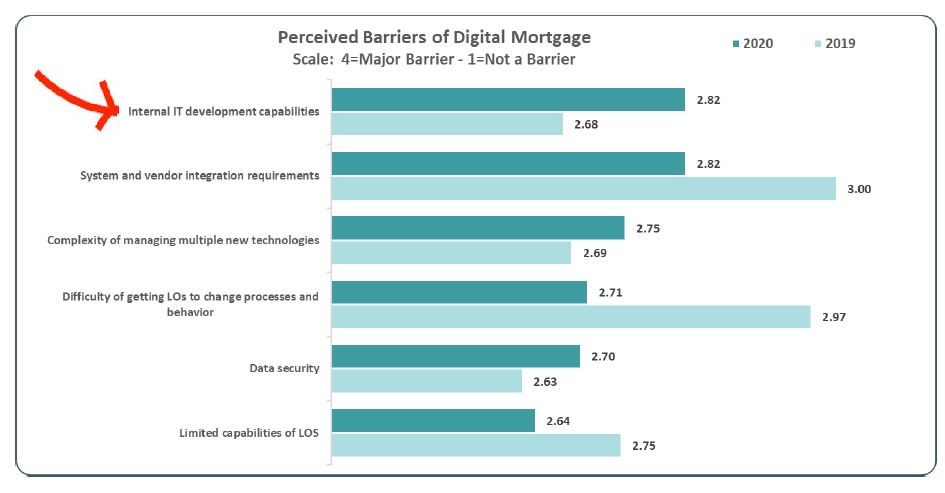

The data in our most recent study suggest that lenders are spending money on technology but are struggling in terms of adoption. Part of that has to do with getting the new tools installed, configured and ready to go.

We asked lenders to rate the barriers they perceived standing between them and the digital mortgage on a scale of 1 (not a barrier) to 4 (major barrier). Internal development capabilities ranked seventh among all barriers that lenders faced in 2019. By 2020, it had moved to number one. It edged out system and vendor integration, last year’s most significant barrier, to take the top spot.

Chart 7

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.

Source: © 2020 STRATMOR Group, 2020 Technology Insight® Study.Lenders are getting used to working harder to attract loan officers and processors because everyone else in the industry is also looking for them. Finding qualified IT staff is even more of a challenge because everyone in every industry is also looking for them.

One IT problem that can only be avoided by employing the most qualified staff is checklist myopia. The IT department has sourced, acquired, installed, and configured a technology that the lender requires to advance toward digital lending and then promptly checks it off the list. Checking the technology off before the staff has been fully trained and incentivized to use the new software is why 82 percent of lenders say a technology is live, but less than half show significant internal adoption. We’re taking off our shoes and throwing them on the conveyor belt.

Another challenge comes from the lender’s own sales departments. Anxiety that technology will replace the human worker is nothing new, but when new tools can perform in seconds, jobs that loan officers previously spent hours or days working out, some begin to question their role in the process or they mistrust the outcome.

Those fears are misplaced, of course. We have plenty of data to show that borrowers want to have a person guide them through the loan origination process. They just don’t want to wait around for them.

We have worked with lenders who needed our guidance in the implementation of online application technology but did not want to implement product and pricing (PPE). They didn’t want a machine helping their borrowers choose a product because they felt it undermined their loan officers.

During highly competitive periods when every lead is cherished, you don’t want customers to serve themselves when you can have a human building that relationship. But what happens when loan volumes rise, thereby overwhelming your sales team?

After COVID struck, lenders who had previously asked us to implement Point of Sale solutions sans PPE invited us back to help them get their products and rates up on the web.

Naturally, we saw the adoption data surge in our survey with PPE going from 27 percent to 60 percent, but that wasn’t because lenders had suddenly implemented real time pricing capabilities. They were there all along, but they just hadn’t been turned on. Again, the game isn’t over until the tools are adopted.

If the new 2020 data tell us anything, it’s that lenders are willing to put their money where their aspirations are. The challenge is getting a good return on those investments and advancing toward their ultimate goal of digital lending. Here are five ideas that will empower lenders to make measurable gains.

More lenders are struggling with this than any other challenge on the road to digital. It takes a strong team to get this job done, but nothing says everyone on that team needs to work inside the lender’s shop. Often, these teams are built with both internal and external resources. The key is to have strong governance. Good technology implemented well is the goal, but lenders must focus on the humans in the equation because they will account for 90 percent of the cost.

High adoption only comes when both process and technology are well aligned, a well-planned change initiative is managed well, and a program is implemented that drives high adoption. That takes a good team.

Change initiatives are among the most challenging to manage well. The more people involved in the process, the more complex it becomes. When the change requires the participation of personnel from outside the enterprise, the complexity rises by another order of magnitude.

When considering adding a vendor, lenders should carefully consider whether the new vendor integrates well with the existing technology. If not, you should carefully think whether you will get the level of adoption to make it worth it. We see this in our data very clearly when it comes to adoption. When the lender can implement the change on their own, such as the online application or appraisal report submission, adoption will tend to be higher. As soon as you add an un-integrated vendor, adoption rates will suffer.

Lenders also need to be very candid about their ability to support integrations. For example, we see clients who have implemented technology and assumed that they could leverage the vendor APIs to make it all work together. Some of these lenders are still waiting for their own staff to tackle these integrations.

Failure to train everyone on the lender’s staff as a new technology is implemented virtually guarantees low adoption. This is especially true if the lender is working with numerous vendors or implementing a lot of new features. A corollary to this rule is to invest in technology that has been designed to be easy to use. The more complicated the software, the more training will be required and the more likely adoption will suffer.

Because technology can be expensive, buyers tend to lean on providers to get as much value for their money as possible. This can be a trap. Many vendors are experts at pushing the implementation toward completion, but that may have to do with the way their payments are structured. Successful lenders drive their own implementations and follow their own roadmap.

Because rates are still low and volumes are high, lenders will be best served by making it possible for prospective borrowers to work themselves into the pipeline without the intervention of the lender’s staff. Today, that means giving them product and pricing information at the Point of Sale. Technology should require the borrower to opt in, and it should collect the information required to move the deal forward electronically. The lender should know if the deal will work before a loan officer ever meets the borrower.

Nothing in our data is designed to be an indictment of lenders for the rate of their progress. Progress is being made and lenders are working hard under a heavy workload of new mortgage business to get new technologies installed and adopted.

After all, with the challenges they face in implementing and winning adoption of any new technology, it shouldn’t be too surprising that they are allocating 10 percent or less of their total company expenses to technology.

The work continues, but no one should expect the trip to digital to be a quick one. That’s just not how we fly here in the mortgage business. Garth Graham

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.