These are challenging times. Times that bring out the best and worst in people, including leaders. In our July 2020 Insight Report, STRATMOR talked about balance. It’s hard to balance being an inspirational leader during times of crisis while also effectively leading a government or business through transformation. It takes real leadership to develop the level of deep-seated confidence, trust and respect in those being led to overcome such challenges.

As many of our readers are aware, STRATMOR is a data driven advisory firm and believes that the most successful mortgage bankers live by their numbers. We’ve observed this to be true for countries as well; in fact, in the face of the pandemic, the most successful world leaders have embraced change and created a culture of accountability and transparency. Watching these leaders thrive through the COVID-19 crisis created a clear picture in my mind of what works and what does not work when it comes to communication and managing risk. And, there is a direct correlation between how a country feels about its leader and the level of success that leader has had so far in navigating this world crisis.

The steps we see taken by effective world leaders through this pandemic are mirrored in the successful steps taken by our industry, particularly by lenders who have created cultures of accountability and transparency within their organizations. An exemplary case of this approach is Guild Mortgage, and in this article, we’ll look at Guild’s strategies for managing through the pandemic. We’ll also look at how nations around the world are dealing with the COVID-19 crisis.

Several world leaders have received accolades for effectively maneuvering their countries through this pandemic. These leaders took early, decisive action and used data to guide their next big moves. They didn’t look for scapegoats. They didn’t invoke personal political interests. And, they chose to heed warnings from their top medical advisors. Trust and confidence work both ways. For people to trust their leader, the leader must also trust their people. These leaders have several key attributes in common.

We’ve all been on the receiving end of a communication — spoken or written — that leaves us wondering what we’ve just read or heard. Communicators who hint around, vacillate or who are deliberately vague send messages that are open to multiple interpretations and ultimately create confusion.

New Zealand Prime Minister Jacinda Ardern was blunt and clear in her instructions to her country’s citizens, leaving no room for ambiguity: “To be absolutely clear, we are now asking all New Zealanders who are outside essential services to stay at home and to stop all interaction with others outside of those in your household,” she said. Result: 1,695 confirmed cases and 22 confirmed deaths as of late August 2020.

In Norway, Prime Minister Erna Solberg received praise for relaying messages that were relevant and on point with her audience. When the schools were shut down, she took the anxious reactions of Norway’s children seriously and said, “It’s okay to be scared.” As such, Norway was able to lockdown early, allowing scientists to drive medical responses and monitor its progress.

Key Takeaway: We need leaders who communicate their decisions clearly, relay details accurately and help the people they are leading to understand the situation. When the stakes are high, communications need to be carefully conveyed, clearly and consistently, to successfully drive adherence and adoption.

To effectively manage risk, first it must be measured. Data is king, and New Zealand and Norway were rewarded with positive results due to their consistent and impressive handling of the coronavirus pandemic. In New Zealand, the prime minister took early action to shut down tourism and impose a month-long lockdown on the entire country to limit coronavirus casualties.

There are other examples: In Iceland, anyone who wanted a test, could get one. The country also implemented a contact tracing program and social distancing restrictions. Extensive testing and early containment gave officials the data they needed to recommend additional directives that were less restrictive than other countries.

In Taiwan, early intervention measures controlled the coronavirus pandemic so successfully that it is now exporting millions of face masks to help the European Union and others.

Germany oversees the largest-scale coronavirus testing program in Europe, conducting 350,000 tests each week and detecting the virus early enough to isolate and treat patients effectively.

For contrast, compare the United States’ management of testing to that of South Korea. Both countries recorded their first case of COVID-19 on January 20. By mid-March South Korea had conducted 290,000 coronavirus tests, while the U.S. reduced testing (e.g. not gathering data to create a baseline to monitor the progress of the virus and its subsequent risk), and at that time had performed an estimated 60,000 tests. The difference is even more significant when you consider that the U.S. population is seven times larger than that of South Korea.

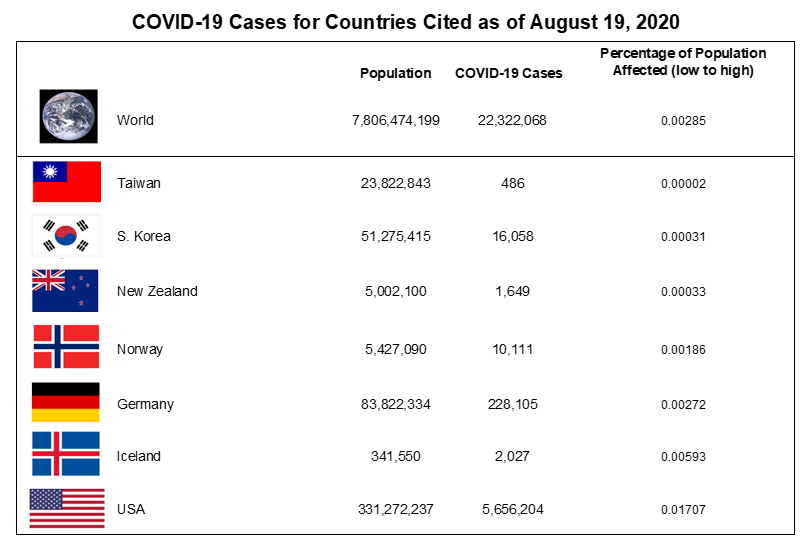

The chart below illustrates the effectiveness of the world leaders cited in this article. Note that most of the countries mentioned are below the World Average of Population Affected except for Iceland, which is slightly above the world average, and the U.S., which is significantly higher. The U.S. statistics are, in my opinion, indicative of what happens when data measuring risks are not considered when critical decisions are made.

Source: Population Source: worldometer. COVID-19 cases: statista.

Key Takeaway: You can’t change what you don’t measure. Leaders need to tap into the data available and use it to inform their decisions. Recognize the risks and then act. Taiwan noted what was happening in China and immediately limited travel to their island. More importantly, leadership also implemented mandatory health checks and case tracking to limit the spread of the virus.

A country’s confidence, trust and willingness to follow the recommendations of its leader were key attributes to the success of the leaders noted above. A dedicated and relationship-focused approach to leadership, especially during crisis (as opposed to a command and control approach) builds trust and alleviates fears. This “transformational” leadership style invokes compassion, care, respect and equality when the leader is making decisions and executing recommendations. As Benjamin Hardy said in Inc. Magazine, “Transformational leaders are role models who, through their actions and values, inspire those who follow them. They take risks, follow values and display convictions that create a sense of confidence in their followers.”

But it’s also important to note that leadership is not about friendship. A transformative leader is tough-minded and is prepared to make tough decisions. Let’s face it. No one wants to wear masks, or stop seeing family and friends, or constantly worry about precautions for safety when going to the grocery store. No one wants to breathe through a facemask while exercising outdoors. But leaders like the New Zealand Prime Minister Ardern are willing to take that stand, enforce those rules, and then stand behind them. She built a relationship with the people of her country that expects not just compliance with her edicts but collaboration and community around implementation of the life-saving measures that resulted in positive outcomes for her country.

Key Takeaway: Effective leaders understand that groups are smarter than individuals. They understand that as leaders, they need the wisdom that good counsel provides — get advice and then act. This isn’t ‘decision by committee,” but decision by interaction, understanding and relationship. It’s about recognizing and relying on leadership instincts and innate abilities to understand those you are leading and then acting accordingly.

American author, speaker and leadership expert John Maxwell once said: “We cannot escape crisis situations. Although unable to avoid them, we can learn to lead people through them. In fact, dark, difficult times may be the moments when leadership is needed the most.” In his article, Leading Through Crisis,” Maxwell cites seven principles that leaders can follow while leading their teams through crises, including the pandemic.

This is exactly what Mary Ann McGarry, CEO of Guild Mortgage — a great example of an effective leader — accomplished by invoking a transformational leadership campaign at the onset of the COVID-19 crisis. Mary Ann and I had a conversation in mid-August about how Guild was managing through the recent challenges.

At mid-year 2020, Guild is ahead of financial projections (like many lenders in this market), but also continues to maintain high customer satisfaction scores and retention rates that are among the highest in the industry. Despite the need to quickly transition to remote work in March, Guild has maintained high productivity in operations and servicing, while providing attentive, personal service to its customers. The company reported record loan volume of $14.60 billion and saw its servicing portfolio grow to a record $52.80 billion through June 30, 2020.

In line with John Maxwell’s principles for a crisis, McGarry’s first act when the pandemic began in March was to call meetings with executives and representatives of every department to quickly lay out Guild’s challenges and where she wanted her team to focus. There was a significant amount of coordination and collaboration among Guild’s production operations, servicing, human resources and IT departments, retail branches, and virtually every other department in the company. Together they created an effective response, concentrating their focus on three main areas: Manage risk of forbearances, deploy e-closing technology, and optimize front-end MyApp technology.

Guild proactively addressed the impending COVID-19 forbearances.

“At Guild, we’re committed to developing customers for life and that means serving our borrowers in challenging times,” McGarry said. “Providing customers with forbearance options is the right thing to do, as so many have been impacted by the pandemic and need financial assistance. Regardless of the challenges, we’re working to make a difference in people’s lives and help keep customers in their homes.”

Through May 24, Guild’s portfolio of loans in forbearance related to COVID-19 as granted under the CARES Act remained significantly lower than the industry. IMBs are at 8.21 percent whereas Guild was at 4.99 percent.

To achieve the above, Guild effectively executed a website strategy that included updating their messaging education at the onset of the pandemic — not weeks or months later. The company directed all web traffic through an education funnel and used a waterfall of landing pages on its website to walk borrowers through the pros and cons of forbearance.

In addition to the website strategy, Guild monitored its geographic forbearance distribution network. The company’s geographic portfolio is favorable, as it has limited operations in the Northeast, where states like New York and New Jersey saw a high number of cases early on. Guild is well established in markets that have experienced strong price appreciation, such as the Northwest, Colorado, Texas, California and Arizona, and continues to increase its footprint in other growing markets. Guild also benefited from a customer base committed to staying in their homes, as 94 percent of those who requested a forbearance were current on their loan at the time of their request.

Even before the pandemic, Guild’s team was keenly focused on developing and deploying e-closing automation.

“The customer experience is critical to our model and the success of our company. We always keep the customer’s perspective in mind when making decisions,” said McGarry. “At Guild, we’re committed to building lasting relationships and offering a personal experience for every customer. Technology can help support that relationship and experience. We use technology to streamline and improve the mortgage experience through faster and more accurate processes in origination, servicing, compliance and home-loan education. Technology and automation allow our loan officers and staff to focus on connecting with people, educating them about the mortgage process and building relationships.

“E-closing technology provides the customer with the option to complete the transaction more efficiently, and more flexibility to review their final loan documents in advance of closing,” said McGarry. “On our side, loan officers can provide more personal attention and guidance to each customer at closing. And with an increased demand for digital transactions due to the pandemic, e-closing helps ensure the safety of our customers and partners.”

The executive team focused on the following benefits — again, note that the customer experience is at the forefront, thereby validating the importance of consistent messaging and acting accordingly.

Customer Experience

Efficiency and Cost Savings

Warehouse Financing

Guild set an aggressive goal early on to achieve 85 percent of eligible transactions and then monitored progress toward that end. Remember that this is in a market where e-closings were still conceptual, not reality, for most lenders. This gave Guild a jumpstart on their competition, but, more importantly, it allowed Guild to optimize the borrower experience during a time when uncertainty and inaccessibility to resources were driving forces.

From STRATMOR’s perspective, it’s clear that the overall industry has shifted to focus on e-closing and Guild has a significant jumpstart toward this end.

Guild’s investment in technology continues to be a key driver toward a better customer experience and efficiency gains throughout the loan manufacturing process. As of this issue, Guild is starting to see results that include better lead conversion and an ability to close more loans with fewer FTEs. This is a significant step forward in achieving Guild’s annual goals. McGarry and her team continue to focus on their primary objective: “All technology related to production needs to be centered around our vision of creating customers for life. From lead generation to closing, our technology is designed to engage and create a positive customer experience.”

The COVID-19 pandemic brought an increased need for digital processes, cloud-based platforms and collaborative software tools. Guild’s IT department enabled its workforce to transition to remote work in March, issuing many laptops, MiFis (devices that connect mobile devices to networks), soft-phones and more. Guild also instituted Microsoft Teams and remote conferencing capabilities and ensured adoption and cross platform compatibility. Further, Guild is actively instituting a consistent branch costing model with the pandemic’s remote requirements in mind. The IT team, and every one of the company’s nearly 4,000 employees, should be congratulated on the success of this transition.

“Fortunately, we were well-prepared for a transition to remote work and a new model for serving our customers, said McGarry. “Our commitment to investing in technology and infrastructure allowed us to initiate this transition easily and effectively. Our teams have been collaborative throughout the process and have proven to be very productive working from home.”

The safety and well-being of their employees and the communities they serve will always be Guild’s top priority. “We expect remote work to be part of our strategy long-term,” said McGarry. “We’re currently looking at a hybrid approach where people have the flexibility to work remotely when it makes sense. Not everyone will want to work from home and sentiment may change over time, but we plan to provide people with options to determine what’s best for them based on their situation and job function. We’re exploring appropriate solutions that align with our culture.”

Again, the above are examples of positive outcomes when a transformative leader is clear, concise, and consistent, while keeping active initiatives focused and straightforward.

Striking the right balance between pushing for results and moving forward while, at the same time adapting to constantly changing rules and guidelines during this pandemic, has created multiple challenges for leaders. To overcome these challenges, leaders must be clear and consistent with their communication and directives, keenly focused on identifying and managing risk, while constantly keeping in mind that it is people that they are leading. People thrive on, and respond to, a relationship-based approach to leadership. Leaders who are followed are leaders who are trusted. Confidence is key to adoption of any directive.

Mortgage leaders, to find success through the tough times, STRATMOR highly recommends that you use data, both internally derived and externally extracted, coupled with business sense and instincts to make strategic decisions and communicate expectations clearly and consistently. Effective, transformative business leaders must institute change needed to navigate these new waters while also being willing to win by eliminating people, products, services, processes and policies that stand in the way. At the same time, great leaders know they must never lose sight of the relationships they are nurturing and the people that they are leading in their efforts to meet their goals.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.