for these free STRATMOR

online publications

One of my favorite things about my wife is that whenever something in our house breaks (like our AC unit, our refrigerator, or our oven, which all broke in the last year), she’s willing to call the manufacturer and play an excruciating game of cat-and-mouse with their automated phone system to figure it all out. I just don’t have the patience for it. In fact, I remember the last time I had to make a call like that. I had to sit on hold for almost an hour, only to have the call drop. The next day I received an ad in the mail for that company. My immediate thought: “Maybe you could spend some of this advertising money on a phone system that calls people back when it’s their turn!” Now, whenever I see this company, I want to run for the hills.

This is about more than evasive automated phone systems — it’s about how we often prioritize marketing spend over process improvements. Maybe it’s time for lenders to rethink their budget priorities and give due attention and financial resources to the greatest influencer of new sales: the Customer Experience. Our question this month: Could process improvements be the most lucrative investment for mortgage lenders in this market?

When I came to STRATMOR eight years ago, there was a lot of excitement in the mortgage industry around online customer reviews and testimonials. It seemed like a new company was popping up every other day promising to collect, display, and automatically post testimonials all over the internet, with the implication that this would ‘passively’ drive new customers into the pipeline and make everyone a bunch of money. Fast-forward to the present day, and very few loan officers and lenders have seen it pan out this way. The same companies are still selling the same implied benefits, but borrower shopping behaviors are not following suit. The truth is, they never have.

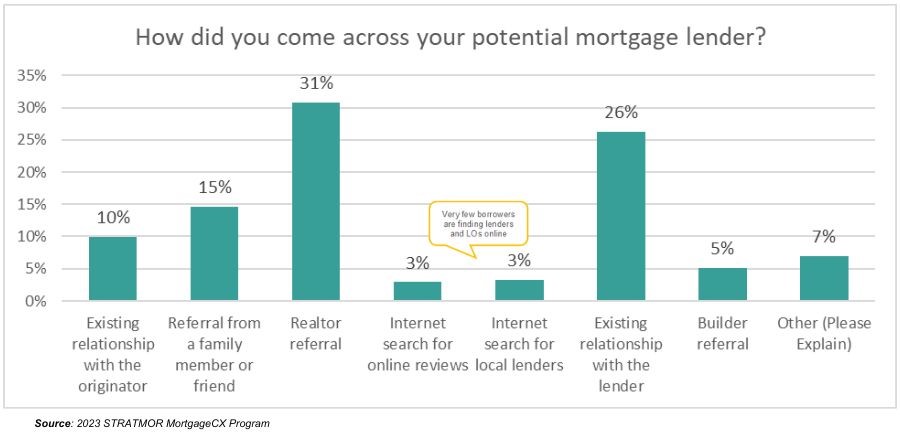

According to data from STRATMOR’s MortgageCX program, the percentages of borrowers who find their lender through online searches (3%) and online reviews (2%), or by knowing and trusting the lender’s brand (2%) are mere drops in the bucket compared to existing relationships, past positive experiences, or experiences of someone they trust, which make up a combined 89%. Couple that with the dwindling number of borrowers reading online mortgage reviews these days (down from 42% in 2022 to just 20% in 2023), loan officer and lender promotion by way of static, online reviews, isn’t quite the silver-bullet solution to increased revenue that we once believed it was. And yet it continues to be a major marketing expenditure for many lenders today.

Marketing is not, of course, confined to social media promotion. TV and magazine ads, direct mail flyers and email campaigns are all used to stay top-of-mind and to increase brand awareness. And I’m not here to tell anyone to stop spending in these areas. I’m simply posing a budget allocation question: If the ultimate goal of marketing is to increase revenue, and if 90% of your revenue is being derived from referrals and relationships based on prior positive interactions with your team and your loan process, is it worth considering allocating some of that budget to improving the loan process and elevating the customer experience?

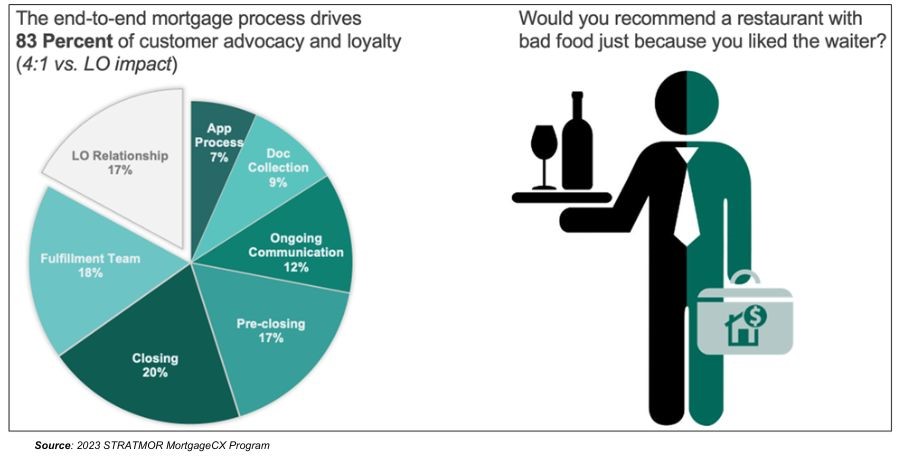

STRATMOR co-founder Matt Lind has long been a believer in the loan process as the main driver of long-term growth. In 2013, he and Senior Partner Garth Graham decided to start collecting industry data to see if the numbers would support or dispel that belief. More than a million borrower surveys and a regression analysis later, the numbers speak very plainly — Process is KING. When measuring various elements of the loan journey for impact on advocacy and loyalty, process trounces the loan officer relationship by a 4:1 ratio.

At first glance, this is surprising for many, but given a bit more thought, it actually makes good sense. Think of the last time you visited a nice restaurant — if you liked the waiter, but the food was disappointing, what are the chances of you recommending that restaurant to someone else? Likely very low. The same is true when a borrower likes their loan officer, but feels neglected, confused, or frustrated by the loan process. These miscues in the process are often enough to destroy any chance of a referral or repeat customer.

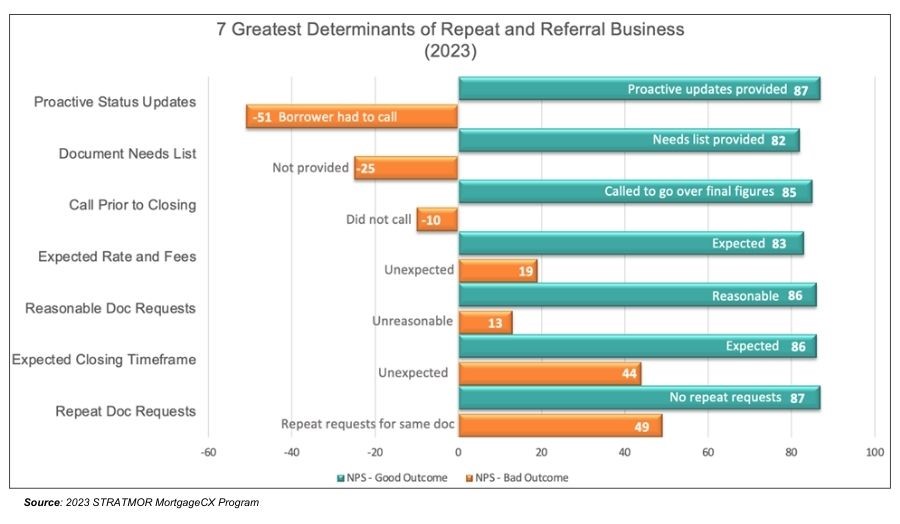

The average lender sustains at least one of the miscues listed on the chart below on 55% of their loans, causing a 75-point drop on their Net Promoter Score (NPS), a measure of the borrower’s likelihood to recommend. Even best-in-class lenders, the top 10% in CX delivery as measured by STRATMOR’s MortgageCX program, fall prey to one or more of these miscues on one in four loans (24%). This chart shows the substantial swing in NPS when these aspects of the process go right (green) versus when they go wrong (orange).

Here are three steps you can take today to make sure you’re “spending money to make money” in 2024:

If you’d like to discuss STRATMOR’s MortgageCX program in more detail, call me at the number below or find time on my calendar to set up a free consultation.

MortgageCX is now integrated with Encompass®!

To find more Monthly Customer Experience Tips, click here.

Start receiving monthly Customer Experience Tips