for these free STRATMOR

online publications

I sometimes wonder where I’d go first if I had a time machine. Maybe I’d go back to 1952 and fulfill my childhood dream of owning a stack of Mickey Mantle rookie cards. Or maybe I would take advantage of some early Apple stock pricing from 1980 (or better yet, some Bitcoin from 2009).

What makes these kinds of mental exercises fun is that we know the outcomes. But history is full of examples of people failing to see the signposts pointing toward a new and different future. Our question this month: “How will history judge our current thinking about the path to success in the mortgage industry?”

It’s 1903. You’re considering investing in Henry Ford’s brand-new company. You go to your banker for advice on the matter, who says, “The horse is here to stay, but the automobile is only a novelty — a fad.” (actual quote from a 1922 biography called “The Truth About Henry Ford”)

It’s 2007. You park your automobile and hear a “ding” from the Blackberry in your pocket. At the office, you watch a video of Microsoft CEO Steve Ballmer reacting to the announcement of Apple’s first iPhone. He chuckles dismissively and says, “That is the most expensive phone in the world! And it doesn’t appeal to business customers because it doesn’t have a keyboard, which makes it not a very good email machine.”

It’s 2024. Blackberry devices are long gone and nearly 20% of the world and 40% of US households have an iPhone. The new “hot tech” is wearable augmented reality headsets, namely Meta’s Quest and the much pricier Apple Vision Pro. Mark Zuckerberg says in an interview, “Quest is so much better for the vast majority of things that people use these headsets for, [especially] with that price differential.”

Sound familiar?

We’d all like to believe we learn from our mistakes, right? Karl Marx once said, “History repeats itself, first as a tragedy, second as a farce” suggesting not only that people rarely learn from their past mistakes, but that the first time a mistake is repeated it’s a tragedy, and the second time it’s absurd.

By now, you’re probably asking, “What does all of this have to do with the mortgage industry?”

In the world of mortgage, just like technology, it’s easy to become ingrained in a way of thinking that has produced past successes and expect that future models will be unsuccessful if they don’t fit the same mold — just like Ballmer expected that any mobile phone without a physical keyboard would fail. It’s time to reevaluate some of our outdated perceptions and expectations and make sure we’re ready for the future of the industry and the new path to success that lies before us.

So, what is the “old thinking” we’re holding onto and what is the “new thinking” we should be giving due attention lest we be judged (or laughed at) by future generations?

Old Thinking: Branding, marketing, SEO, online testimonials and products/pricing are the most significant drivers of new business. We should be setting aside substantial budget for SEO and reputation management tools and using them to recruit talent with the promise of passive lead generation.

Why It’s Outdated: According to STRATMOR data, the primary reasons borrowers find and choose their lenders in 2024 have little to do with any of the aforementioned categories:

New Thinking: What matters MOST to these borrowers is their experiences and relationships. Based on more than one million borrowers surveyed, 90% made their lender choice based on either their own experience with the lender or the experience of someone they know and trust:

Note: Borrowers do use social proof to further vet choices they have already narrowed, but the lion’s share of “leads” are being generated by personal experiences and word-of-mouth recommendations, not online reviews or SEO.

Old Thinking: Borrowers are annoyed by longer surveys, so keep it brief. And all that matters is their overall satisfaction and whether or not they say they would recommend you. Most borrowers love their loan officers. A few mistakes in the process are to be expected and shouldn’t negatively impact referrals and repeat business.

Why It’s Outdated: Borrowers who recently completed a lengthy, anxiety-filled process involving hundreds of thousands of dollars are seldom put off by a three- to five-minute survey – and you can pack a good number of questions into that timeframe. STRATMOR’s MortgageCX program is a good example of this, with 94% of borrowers who start the survey completing it in full.

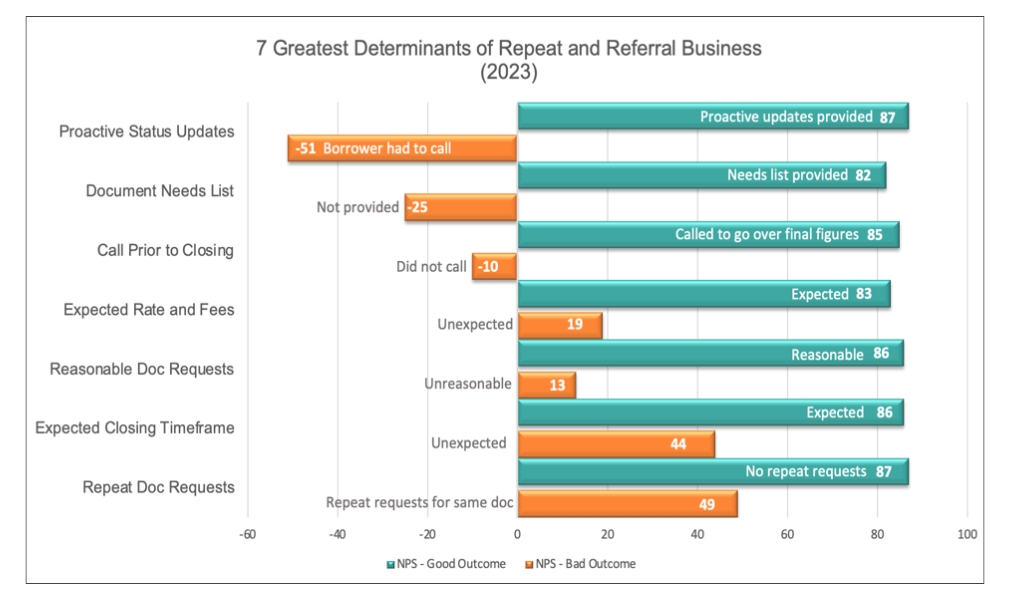

Regarding the impact of miscues, STRATMOR data shows that costly process mistakes happen on more than half of loans, causing an average 75-point drop in NPS, the difference between a raving fan and someone who will more than likely badmouth the company.

New Thinking: Mistakes and poor communication during the loan process have far greater impact on advocacy and loyalty than even the LO relationship (by a 4:1 ratio). Measuring the drivers of Net Promoter Score (NPS) is necessary to determine what needs to be fixed and then fix it. And having a national benchmark for comparison allows lenders to set appropriate goals and focus resources in the right areas to drive referrals.

Old Thinking: Visibility is the main driver of new business, the formula for creating the most visibility and searchability is:

Collect a testimonial, then:

Why It’s Outdated: According to STRATMOR data, borrowers are no longer reading testimonials online at the frequency they once were. From 2021 to 2023, the percentage of borrowers who read one or more reviews online dropped from 42% to 19%. With SEO responsible for just 3% of borrowers’ choice of lender, the old model has very limited impact.

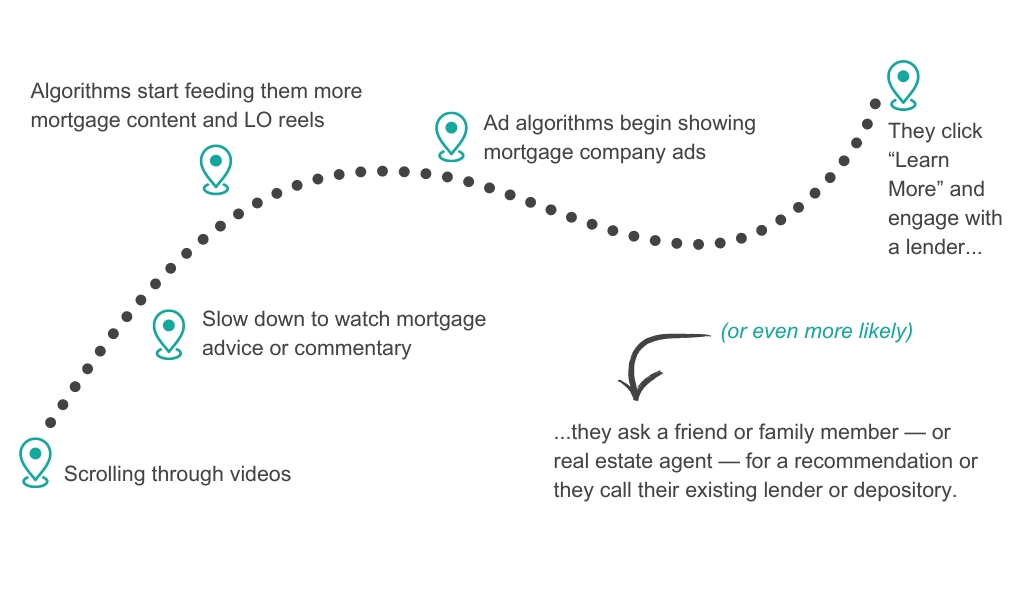

New Thinking: Borrowers in 2024 are consuming news, entertainment, and advice very differently than even a few years ago — namely via short-form video. TikTok, Instagram stories, Facebook reels, and the like are becoming the preferred method of consumption for a quickly growing majority of the population. Borrowers don’t want to expend the effort to search for a loan officer or lender by reading static reviews.

The more likely path for them:

To put it another way, short-form video is the automobile that’s replacing the horse of static online reviews.

Here are three ideas you can implement now to make sure you impress any time-travelers that make their way back to 2024:

If you’d like to discuss STRATMOR’s MortgageCX program in more detail, find time on my calendar to set up a free consultation.

MortgageCX is now integrated with Encompass®!

To find more Monthly Customer Experience Tips, click here.

Start receiving monthly Customer Experience Tips