It seems that when it rains, it pours.

After wrapping up a banner year in 2020, the mortgage industry is showing few signs of slowing down. It appears that the downward pressure on rates that created the booming refinance market may be the gift that keeps on giving in 2021 — but not indefinitely. The MBA’s latest forecasts show refinance volumes dropping off substantially in Q3 and Q4, which may look like a cliff for many lenders and originators who have feasted primarily on refinance loans for the past year.

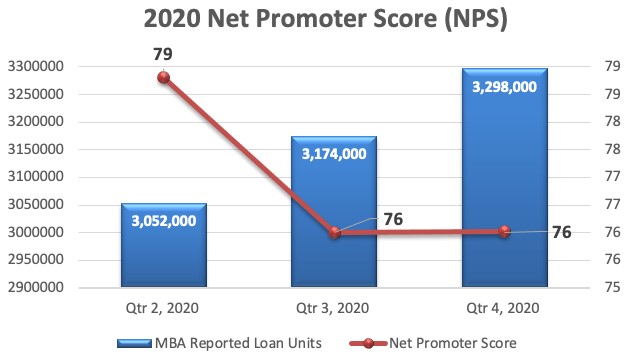

As any seasoned farmer will tell you, while rain may be great news for crops, that same rain can also cause your machinery to rust if left untended. The mortgage industry faces the same dichotomy as we settle into 2021. On the one hand, mortgage volumes — refinances specifically — remain incredibly high and are expected to be sustained through at least the first half of the year. On the other hand, borrower sentiment, as measured by satisfaction ratings and likelihood to recommend, has declined over the past several quarters due to problems with strained fulfillment capacity and a diminished lender focus on customer delight. In other words, lenders and loan officers have not been tending to the machinery of the loan process and rust is forming.

Chart 1

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.When refinances taper off (possibly as early as the second half of this year), expect a price war and tightened margins to ensue. Many lenders who were able to pad their “war chests” from huge 2020 profits will have increased flexibility for subsidizing pricing, further exacerbating the price wars. In that environment, it’s the lenders and originators with the established client relationships, known for delighting their customers, who will emerge as the winners. Relationships provide immunity from price shopping and price matching, which can save lenders hundreds of thousands of dollars in subsidies.

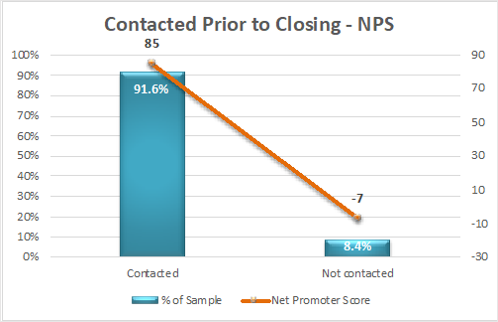

The rusty build-up on the loan process tends to come down to communication (or lack thereof). In fact, nearly every one of STRATMOR’s Seven Commandments for Optimizing the Customer Experience is rooted in communication problems, and the result is not just a breakdown of the loan experience in question, but the sabotage of future business that might come from repeat and referral business from that customer. Take, for instance, failure to call a borrower prior to closing to go over final figures. Forgetting or failing to make time for this task costs 92 points on the NPS scale, flipping a would-be Promoter (someone who will refer business) into a Detractor (someone who will actively turn people away from your company).

Chart 2

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

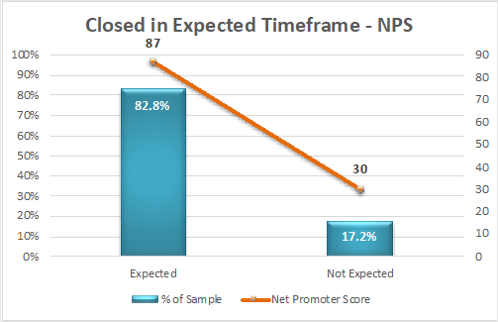

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.Another misstep that tends to occur when business is plentiful is a failure to set proper expectations around the closing timeframe. This happened on a whopping 21 percent of loans in Q4 2020, up from 12 percent in Q1 2020. The damage? 57 points on the NPS scale. That means for every 100 loans that had that issue, 57 would-be Promoters jumped ship and became Detractors. Yikes.

Chart 3

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.With bursting pipelines, it’s easy to let seemingly innocuous details slide. After all, a few underwhelmed customers here and there are barely noticeable, and they’re constantly being replaced by eager new customers, especially in a refinance-rich environment. The danger in this line of thinking, however, is that it becomes increasingly short-term with each month of 2021 that passes. Referrals may not seem important today but mark my words; they will be your lifeline at some point within the next twelve months. When that time comes, you will be glad to have had the foresight to put practices into place that will keep your borrowers happy, resulting in a pipeline that is healthy and full.

Here are three simple ways you can shake off the rust and set yourself up for higher profitability in 2021 and beyond:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.