for these free STRATMOR

online publications

As I was turning onto a highway on-ramp the other day, the front left corner of my car dropped and I heard an ominous “KA-CHUNK!” as my tire succumbed to a nasty pothole. With previous vehicles, this would have been a mere inconvenience, as I was raised knowing how to change a tire in short fashion. Plus, the tires themselves only used to cost about $100 each. But in 2023, I’m driving a Tesla, whose otherwise brilliant designers decided for some reason to forego the built-in spare. And individual tires now cost $400. Throw in an hour’s wait for a tow and these combined elements were not priming me for a delightful afternoon. But then, somehow, Tesla was able to completely flip the script.

In the mortgage industry, the borrower journey is riddled with potholes. Some borrowers are lucky enough to never hit one, and others create their own luck by paying close attention at every turn. Yet some potholes are simply unavoidable. Perhaps we can learn a thing or two from Tesla’s approach to protecting and preserving customer delight even when things break down. Our question this month: How can lenders preserve borrower delight against inevitable bumps in the loan journey?

Have you ever met a Tesla owner? Trust me, you would know if you had. They have a knack for slipping it into every conversation (or article). Love them or hate them, it is undeniable that Tesla has some of the most devoted, “raving fan” customers around. In 2022, Tesla’s Net Promoter Score (NPS), a measure of customer advocacy, was an astonishing 97. How do they do it?

Most lenders would love to see their NPS in the high 90s. Afterall, according to STRATMOR data, the average NPS for the mortgage industry last year was 72. Best-in-class was 91.

No matter how good our steering, mortgage borrowers will inevitably encounter some bumps — and those bumps are typically very costly to lenders, with NPS dropping an average of 75 points when a borrower cites a problem on their loan journey. Perfection should be our aim, but not our realistic expectation on every loan. The fight, then, is for protecting and preserving advocacy despite bumps in the road. Can you get away with one bump and still maintain high advocacy? How about two? Maybe even three?

One of the most popular metrics tracked by STRATMOR’s MortgageCX program is something we call “Perfect Loan Percentage.” The metric looks at the percentage of loans that make it through the loan process with a positive result for each of the following criteria:

In the fourth quarter of 2022, the National Average was 45 percent and the best-in-class lender achieved 64 percent. The reward for a loan in this “perfect” category is an NPS of 97, a guaranteed raving fan on the level of forementioned Tesla owners. Imagine the impact that going from one-in-two to two-in-three raving fan borrowers could have on your revenue!

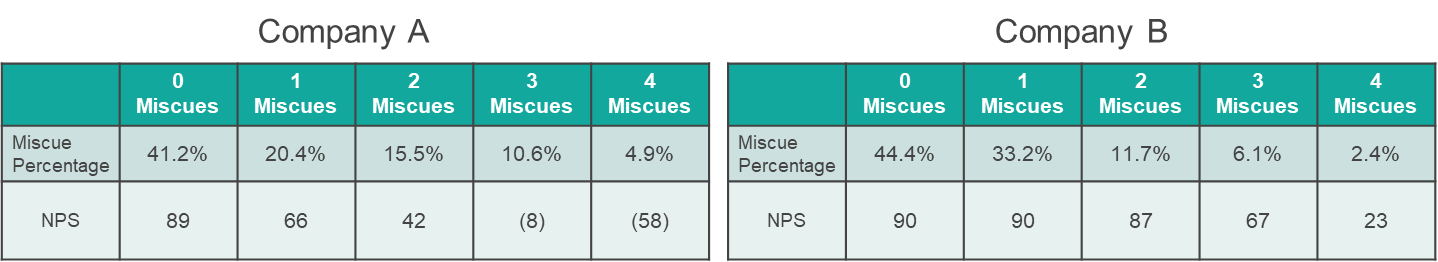

Where it gets really interesting is when you start to evaluate the elasticity of your customer goodwill when one or more of these criteria are breached. Consider the two companies below: Company A loses 47 NPS points (89 to 42) when two things go wrong. Company B only loses 3 NPS points (90 to 87). The difference between the two is in the ability of the lender to preserve and protect delight when things go wrong — something Tesla has mastered.

Source: © 2023 STRATMOR Group, Mortgage CX program.

Source: © 2023 STRATMOR Group, Mortgage CX program. Back to my story for a moment. As soon as I pulled over and checked my tire pressure, I pulled up the Tesla app on my phone and hit the “Roadside Assistance” button. It pulled up a live chat, and a few questions later, I got a personal call from the person on the chat session who asked if I was okay and told me there was a tow truck on the way. Arriving at the Tesla service center, I walked into a beautiful, clean reception area, where I was greeted by name (they knew I was coming) and offered free WIFI and a buffet of snacks and drinks. I was able to watch the progress of the work being done through a “pizza tracker” feature on my phone app, then I reviewed the cost, approved and paid through the app too. I was in and out in maybe 30 minutes. WOW.

My flat-tire experience started my afternoon on a bad note, but my tune had totally changed by the time I pulled back into my driveway at the end of the ordeal. It was unexpected. And it was — dare I say — delightful.

Here are three strategies you can borrow from Tesla and employ today to preserve and protect customer delight amidst inevitable bumps in the road:

Find out more about STRATMOR Group’s MortgageCX program and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

Start receiving monthly Customer Experience Tips