Recently, I asked a lender what his company was doing to reduce processing errors and he told me, “We’re looking into robotics.” I was not surprised by his answer — Robotic Process Automation (RPA) and Artificial Intelligence (AI) are a natural next step in the evolution of Digital Mortgage. Many lenders and servicers are already implementing RPA technology into their operations and are seeing impressive results.

I was, however, surprised that his company was still only “looking.”

RPA, also referred to as “bots” — short for robotics — is more than the latest technology trend. Across many industries, RPA is helping to eliminate tedious tasks, dramatically increase efficiency and reduce costs in processes. According to Gartner, the RPA market, while only $250 million in 2016, will grow to $2.9 billion in 2021. In the mortgage industry, RPA has landed solidly, particularly with the most forward-thinking lenders, and it is helping these companies re-engineer processes and transform the customer experience. RPA is going to change the way the mortgage industry conducts business, and in this article, we’ll endeavor to give you a better understanding of what every mortgage lender needs to know about RPA.

What is RPA, technically speaking? RPA is the automation of rote tasks. It’s programming that focuses on automating high-volume, repeatable (repetitive) tasks — like queries, calculations, transactions and record maintenance — so people can work faster and are freed up to do higher-valued tasks. Investopedia defines RPA as:

Software that can be easily programmed to do basic tasks across applications just as human workers do. The software robot can be taught a workflow with multiple steps and applications, such as taking received forms, sending a receipt message, checking the form for completeness, filing the form in a folder and updating a spreadsheet with the name of the form, the date filed, and so on. RPA software is designed to reduce the burden of repetitive, simple tasks on employees.

The key terms here are “high-volume, repeatable tasks.” The industry is transitioning to a process-driven management philosophy. In the mortgage process there are tasks that must get done — get the customer address, map over application data, get the title data — core processes that take time and need to be done right the first time. RPA can handle a host of these types of time-consuming and redundant mortgage tasks from origination, processing, disclosures, quality assurance and compliance to servicing. RPA says, “Go do these ten tasks this way a million times over” and the “bot” — the program — performs them relentlessly. Tasks are done quickly and efficiently without human errors that typically take time and money to correct, if they are discovered.

The benefits to implementing RPA in the financial services industry are significant:

Those leading the way are achieving greater revenue generation, reduced costs, few errors and improved compliance.

One STRATMOR Credit Union client used RPA to replicate document and data retrieval while using Optical Character Recognition (OCR) capabilities to capture key data fields required for analysis. For the specific program, there was a 40 percent reduction in the estimated resources that would have been needed if the tasks had been done manually. The cost savings — an estimated $1.1 million.

Our experience with RPA projects highlights the following specific mortgage industry benefits:

The payback with RPA is often immediate. Once you understand the process and the detailed processing steps you are working within, it all comes down to dotting the i’s and crossing the t’s within an RPA programming environment.

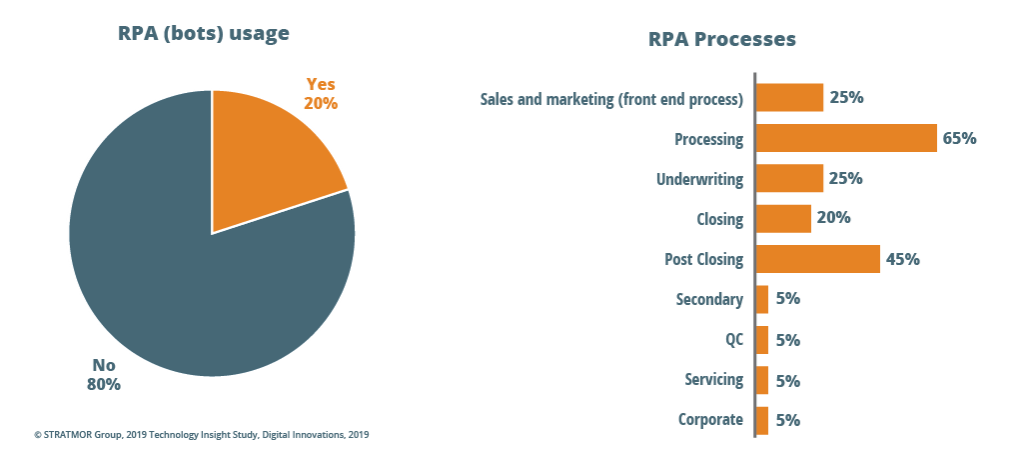

In the 2019 Digital Innovations survey of the 2019 Technology Insight® Study, STRATMOR asked lenders about their RPA use and in what areas of their business RPA is in practice. Illustration 1 shows 20 percent of responding lenders are already using RPA, primarily for processing tasks.

Illustration 1

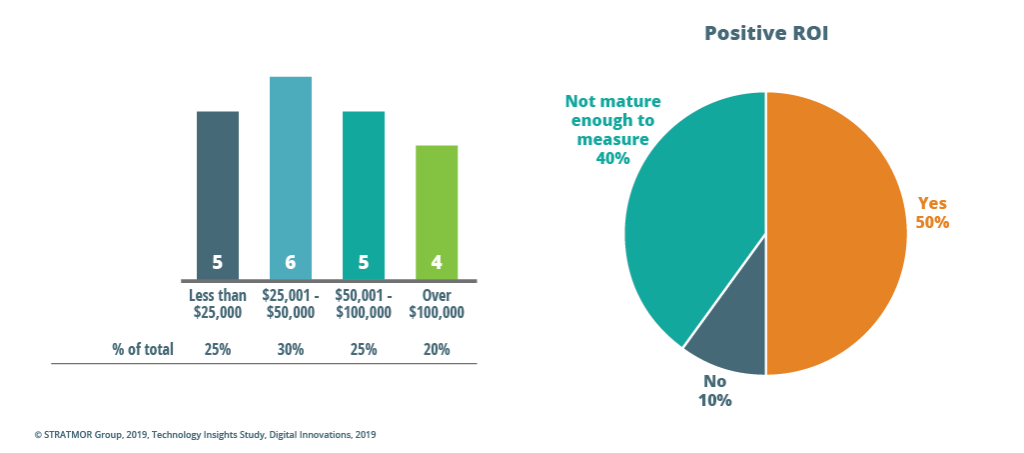

Eighty percent of the lenders in the survey reported investing under $100,000 in RPA, and 50 percent said they saw a positive ROI for their efforts.

Illustration 2

An example of RPAs at work: a global bank utilized Automation Anywhere (an RPA technology provider) to improve their world-wide HR form tracking processes and is saving over a million dollars annually. The savings is gained from the new automation capability in the form of improved efficiencies and less errors.

My best advice in starting with RPA: walk before you run. Go after the low hanging fruit; mundane tasks that could reasonably be automated to gain some quick RPA wins. Show employees that bots at work can not only save the company money but can also improve their overall employee job satisfaction by allowing employees to be assigned more meaningful work (versus replacing these valuable human resources with bots) and, most importantly, can improve the customer’s overall experience.

To effectively implement RPA technology, build a team that includes both processing and analytics people. Most lenders do not have the staff in-house to implement RPA work as it requires deep knowledge of the engineering/root cause analysis discipline. Finding people with this background, or even finding qualified RPA service providers for the mortgage business, can be difficult. Implementation is more than developer skills — success requires an individual or team with skills in:

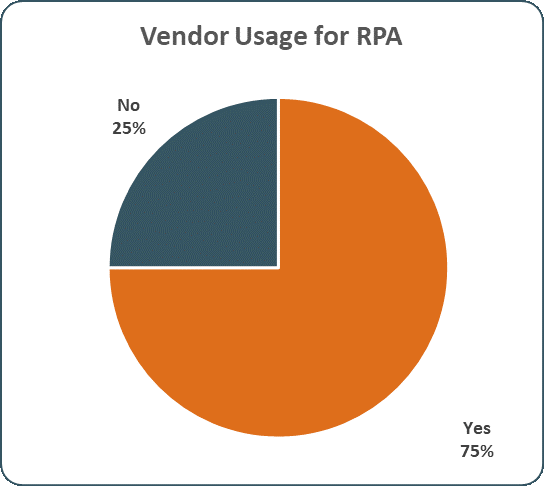

Another option to consider is to work with a third-party provider. According to the result of the Digital Innovations Survey from the 2019 Technology Insight® Study, 75 percent of lenders worked with a third-party provider to implement RPA in their businesses. UI Path, Blue Prism and AIF are the most popular third-party providers, and all offer training and certification in RPA through their websites. STRATMOR can assist in selecting a provider from the growing list available.

Illustration 3

Besides putting together an RPA team and selecting a third-party provider, one of the biggest challenges for lenders in deploying RPA is determining where to begin. The first RPA implementation must be successful, so pick where the highest opportunity for success is with this automation tool. Start by asking, “Where is our reporting detailed enough to know where errors are occurring?” With that fact-base, the lender can complete a pareto/root cause analysis to identify where the RPA opportunities exist and then do a meaningful ROI/CBA (cost benefit analysis). In considering where to automate first, be sure to keep the customer’s journey in mind, those “Moments of Truth” in the process that make or break the borrower experience.

.

It is best to start with an internal process versus a customer-facing one. STRATMOR suggests looking first at regulatory items where you can reduce costs and risks components to avoid compliance issues. Much of the regulatory process can be fully automated eliminating TILA and similar types of mistakes.

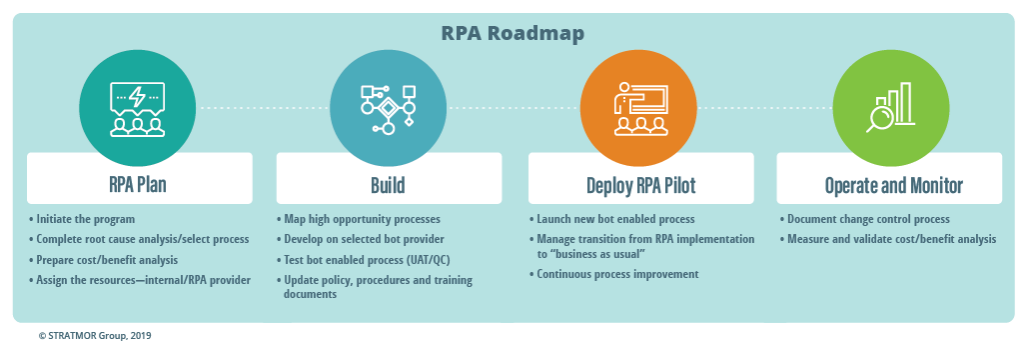

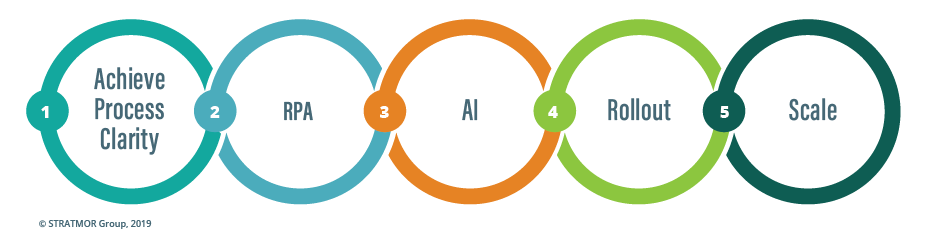

Develop a results-oriented RPA Roadmap that includes the steps noted in Illustration 5 (STRATMOR Group can assist with the road-mapping process).

Illustration 5

With project and process rigor, the RPA programming should move fast. One day 100 people will be performing a task and, three weeks later, the RPA is executing this same task for these 100 people — no disruption, no big kick off, no transition or cutover date — it just happens behind the scenes. After a week or two of processing, the return on investment is a rapid return. These are people-hours saved — automated tasks replace people doing keystrokes — so now employees can focus on providing quality customer service and not on rote tasks.

Another challenge the company will face with deploying RPA will be putting in the necessary procedural controls to manage and track changes to the bots. The speed at which RPA is implemented can distract from what is being automated — a very complex loan process with many moving parts. Changes to the loan process are inevitable — think of how often a form change happens. Bots will need to be given changes, and those changes will need to be monitored. A bot faced with an unscripted process change will still do its task, but the data it produces could be wrong.

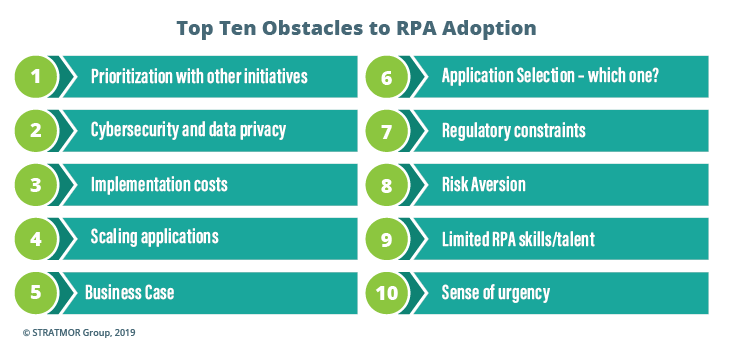

Lenders can manage the obstacles to an RPA adoption with the right team, right approach and right tools.

Illustration 6

The big takeaways for implementation success:

Get one RPA effort under your belt, communicate its success, and then queue up the next RPA to get momentum going and people talking.

Whether you refer to company employees as staff, workers, employees or “people,” there is a very human part to the RPA process beyond the programmers working with the RPA. The 100 people who were performing a task before a bot took it on might wonder if a bot is going to be able to do their tasks.

Like other technology used with digital mortgage solutions, RPA is just one of many technology components that has a role to play. Lenders need to educate their staff about RPA and its role in helping retool their POS and LOS. RPA adds value by improving the internal employee experience and by positively impacting third-party originator and borrower experiences. Lenders need to deliver a balanced platform alongside a clear, benefits-laden message to employees explaining that RPA is positive step in the evolution of the mortgage process.

With the cyclical volumes and the current market, most lenders have run out of capacity. Bots can help alleviate the pressure. When there is excess capacity, there will be an opportunity to deploy employees to more customer-focused jobs that create a better customer experience. As RPA comes in, offer opportunities for staff to upgrade their skills by offering training in analytics, customer service, and in RPA support. RPA is not going to take jobs — it will relieve employees of dreaded, mundane tasks and provide opportunities for these employees to learn new skills.

RPA is a foundational capability, and once deployed, it is time to apply Artificial Intelligence (AI) technologies.

Appraisals are a good example of a process that could work with AI. An AI appraisal capability would feed the bots versus having a person take the appraisal or having the appraisal be system driven. Deploying AI-input to the bots makes for a more robust view of automation. There might be more steps with AI — the bot could have 15 RPA steps and AI adds another 10 — but the 25-step automated process will be complete and holistic.

Illustration 7

STRATMOR is not yet seeing a lot of AI as it relates to core mortgage processes, or even in lead generation. We think the greatest application for AI is likely in advanced underwriting and in some type of behavioral analysis for lead generation.

STRATMOR is currently working with lenders of all sizes and in all areas of the country, both Bank and Independent, to bring RPA to their organizations. We provide:

That lender who was still looking at robotics? If he is still looking in 12 months, he will be 12 months behind. The lender is already at a competitive cost disadvantage as many other lenders are already moving down the RPA path. You’ll be at a disadvantage, too, if you don’t start RPA — soon.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.