Time has taken on a whole new meaning in 2020. While we wade through the likes of a pandemic not seen in 100 years, and experience interest rates lower than they’ve been in 50 years, we’re simultaneously moving at a feverish pace towards digital advancements like virtual house viewings and e-closings. As the digital change accelerates, lenders should be asking themselves, “What does this mean for the customer experience?”

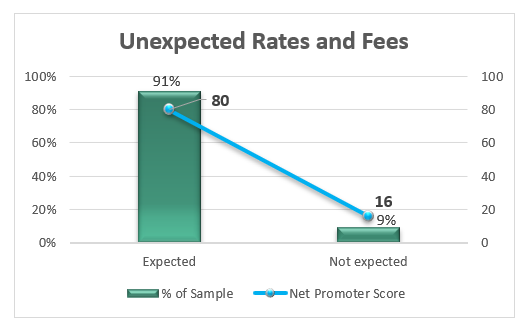

Remember the Wild West days of pre-TRID, when borrowers would often walk into closings having no idea what to expect? Thankfully, TRID (the Closing Disclosure specifically) has improved communication to the consumer, though closing problems still linger. According to MortgageSAT’s National Benchmark data, with a sample size of more than 140,000 year-to-date, one-in-ten borrowers still see unexpected rates or fees at the time of their closing.

Traditionally, one of the surest ways to address and resolve misunderstandings about rates and fees has been for the loan officer to attend the closing in person. The data supports this, showing the Net Promoter Score (NPS) 18 points higher when the originator attended (87 vs. 69). Yet, there has been a substantial wave of lenders moving to some element of e-closings, and because of pandemic restrictions that wave is building. Some sizable lenders are already reporting more than 60 percent of their loans are closing remotely. The truly remarkable thing: Their borrower satisfaction results are hitting new peaks.

The migration to e-closings is a slow-moving train, but it will arrive, and every lender will have to get on board sooner or later. STRATMOR survey data shows that in 2019, only 10 percent of lenders have any meaningful installation of e-closing capabilities, and the adoption amount that lender group was well below 50 percent. The good news is that late-adopters can learn from the companies who are already beginning to have success. Digital path-carvers have been able to focus on — and automate where possible — the touch points that matter most in the borrower journey as the closing approaches.

An originator’s primary role at the closing is to be a source of grounding for all the live wires at play. Whether it’s the borrower’s nerves, a late closing package, unexpected numbers, or inaccuracies on the documents themselves, a loan officer can answer questions and make phone calls to verify and clarify details. Being at closing also prevents the lender from being blamed for anything else that comes up — after all, if the buyer, seller, borrower, Realtor and title company are sitting around the table, and something goes wrong, who might be the convenient person to blame?

A look at the numbers tells us how impactful this can be. When a borrower is surprised by their rates or fees at closing, NPS drops by 64 points, all but forfeiting the goodwill needed for a referral to friends or family.

Chart 1

Source:MortgageSAT Borrower Satisfaction Program, 2020.

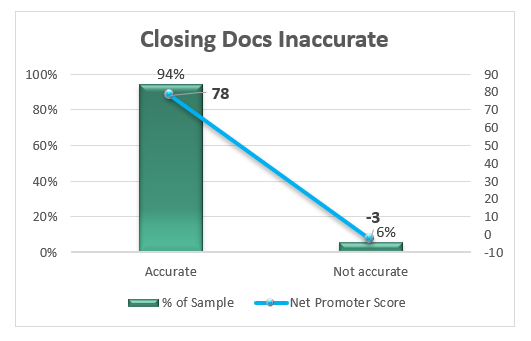

Source:MortgageSAT Borrower Satisfaction Program, 2020.And when a borrower finds inaccuracies on their closing documents, there is an even larger drop in NPS of 81 points. That’s a sizable amount of goodwill and potential organic growth going out the door.

Chart 2

Source:MortgageSAT Borrower Satisfaction Program, 2020.

Source:MortgageSAT Borrower Satisfaction Program, 2020.Customers with a bad experience are not only more likely to share their experience than the happy ones, but they also tend to share with more people (the majority share with five or more). In addition, negative customer experiences with surprise rates and fees can lead to unflattering social media reviews, compliance issues and worst of all, BBB or CFPB complaints.

The key for originators is to find ways to stay engaged, even when they can’t attend the closing. This may mean finding digital ways to interact with the borrower during their review and signing of the closing documents, or it may mean finding other appropriate, social-distanced ways to interact in a face-to-face setting.

Here are three things that best-in-class companies are doing to make sure e-closings go as smoothly as in-person closings:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.