Sometimes I feel like we live in a world of extremes. Extreme political and social views seem to dominate social media and the 24-hour news cycle. And many of us get sucked into the drama and line up on one side or the other.

I know that there are times when radical action is required to effect change in any corporate body including society at large, businesses, churches and other types of organizations. Society is improved when leaders serve as agents of change (e.g. Martin Luther King, Jr.) and do not accept conventional norms. This forces us to think in new and different ways. I get that.

But on a day-in, day-out basis, most of us don’t operate in a world of extremes. We go about our daily lives trying to strike the right balance between competing objectives and sometimes making life changing decisions. For example, is it better to take a job with significantly lower pay if that job would be more enjoyable? Or, should a married couple with children take in an elderly parent with failing health?

It is the same in business. Each day is filled with decisions that often involve balancing competing objectives in a way that is aligned with corporate mission, vision and values. That does not sound exciting or sexy, and it certainly won’t make for an interesting sound bite. But in STRATMOR’s experience, that is precisely how mortgage bankers succeed, and it plays out in the realm of strategy, risk management, capital markets and operations.

It’s all about balance.

The mortgage banking balancing act plays itself out as executives and shareholders wrestle with critical strategies and risk management decisions. Do we take the risk for a higher return? Can we manage the risk, or should we avoid it altogether? Here are some key examples of where the tradeoffs occur.

This is the classic balancing act — at a high level, shareholders must decide where they want to be on the risk/return continuum. Are they willing to take more risks for the potential for higher returns? For example, Quicken Loans® has taken more risk than most lenders by developing the Rocket Mortgage® platform and the marketing machinery and investment that goes with it. By taking on this risk, shareholders have the potential for monetizing their investment with excellent returns based on the recently announced plans for an IPO.

Is it better to grow via acquisition or organically? While some would view the acquisition of a mortgage production company to be a risky endeavor, for companies that successfully manage the key risks (including potential sales force flight) there are often outstanding returns. For example, where would Guild Mortgage Company and Caliber Home Loans be without executing a series of successful acquisitions throughout their history?

Risk vs. return decisions are not just based on the personality profile of shareholders. The amount of risk a shareholder is willing to take is also driven by his or her confidence in management’s proven experience and core competencies.

In today’s COVID environment, the country is managing the virus risk in a variety of ways. Total risk avoidance would mean shutting the country down completely, and in the early days of the crisis, it seemed prudent to err on the side of caution. But now, in fits and starts, the country is winding its way down the risk management path, attempting to strike the right balance between safety and public health and the viability of the economy and household income and employment.

For mortgage banking executives, too, there are times when complete risk avoidance is in order. Such was the case when catastrophic margin calls in March forced lenders to shift to a best efforts sales strategy to lay off hedging risk to investors. But, over time, risk avoidance flipped back to risk management as lenders began to move back into best execution mode.

Mortgage bankers must strike the right balance between living in the present and investing in the future. Without forward-thinking management making prudent investments in people, processes and technology, lenders will quickly find that the world passes them by. For example, eClosings and the use of process automation tools such as BOTS, AI or machine learning require an investment of time and resources that take away from short-term profits but have obvious long-term benefits.

Mortgage banking executives must exercise great discipline and judgement in order to ensure the long-term viability of the enterprise. The challenge in our volatile mortgage business is that lenders are either too busy or lack the capital required to make the necessary changes.

Lenders need to devote enough time and resources to “skate to where the puck is going” versus operating solely in the world as we know it today.

Pricing and Capital Markets

Some of the classic mortgage banking decisions on tradeoff occur in the capital markets realm. Capital markets executives attempt to strike the right balance every day as they manage the price/volume dynamic, best execution and product offerings.

Price vs. Volume

The tradeoff between price and volume is always at the center of any capital markets strategy. In the current market, lenders have the luxury of using price to manage capacity. In STRATMOR’s recent Capital Markets Oversight Workshop, we polled executives on the most common techniques they use to manage capacity. While overtime came in at number one, raising pricing margins was a close second. Of course, in a down market, the opposite occurs. Margins are reduced to generate enough volume to keep the mortgage “factory” operating profitably.

Early in the COVID crisis, Congress passed the CARES Act, which allowed borrowers to request forbearance from their mortgage payments. Lenders were concerned about closing loans with borrowers seeking forbearance before the loan could be sold on the secondary market. Lenders were also concerned about the risk of having to repurchase loans where borrowers sought forbearance after being purchased by the investor. Here is the trade off: lenders sold loans as fast as possible even though it was not necessarily the best possible execution.

During the current surge in origination volumes, independent mortgage bankers are struggling to stay within warehouse line credit limits. This creates intense pressure to sell loans more quickly (e.g. agency cash window) even if the execution is not the best.

This is one of the ultimate balancing acts in mortgage banking. Like any business, due to competitive pressures, there is only so much potential profit from the origination and sale of a mortgage loan. The price to the consumer must be competitive and reasonable, the amounts paid to employees must be sufficient to attract and retain quality staff and there must be enough money left over to create a reasonable return to shareholders given the risk of the business.

The classic example in mortgage banking is around sales expense, the biggest component of which is originator compensation. Assuming required shareholder returns are relatively constant, more sales expense means more revenue is required, and this could mean a less competitive price to the consumer.

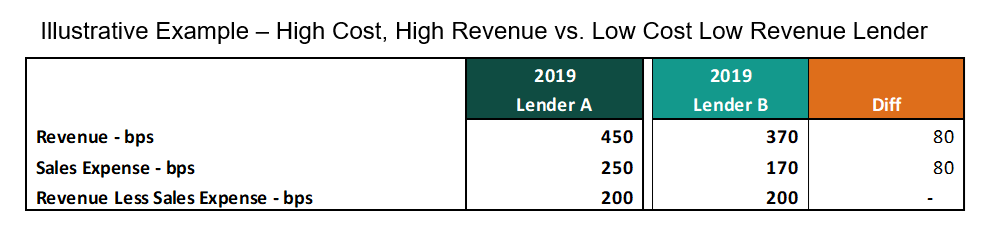

The following table reflects a common example:

In this example, Lender A has a high cost, high revenue model while Lender B reflects lower costs and revenue. While there is an 80 bps difference in gross revenue, after subtracting out sales expenses, the net difference is zero. In the case of Lender A, its higher sales cost of 250 bps requires higher revenue to cover the cost. Since revenue includes both origination fees and backend gain on sale, the price to the consumer is certainly a key element. Of course, product mix and operating model are key drivers. For example, a high touch government lender focused on first time home buyers will likely have higher sales expenses.

In general, there is a tradeoff between the number and complexity of loan products offered to consumers and operational efficiency. In a down market, the tendency is to broaden the product set and move down the credit curve in search of more volume. In today’s white-hot market, the tendency is to simplify and tighten credit in order to limit the amount of variability in loan processing tasks and workflows.

For example, with little or no excess capacity in the mortgage fulfillment operation, and plenty of high FICO and low LTV loans available to originate, why would lenders maintain exception processes and workflows for “one-off” products? Also, why create rep and warranty exposure on higher risk loans that are more likely to go delinquent or into forbearance when you don’t have to?

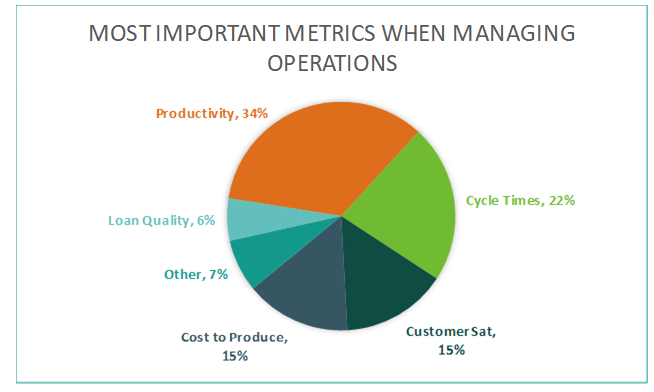

In a recent STRATMOR Workshop for senior production operations executives from 25 top lenders, we polled the group regarding the top three to five metrics they use to manage the business as shown below.

Chart 2

© Copyright STRATMOR Group, 2020.

© Copyright STRATMOR Group, 2020.The results reflect the natural tension between different business objectives and the balancing act that operations executives face. Wouldn’t a sole focus on productivity and cost increase the risk of a decrease in loan quality? If mortgage companies drove down cycle times to a very low level, wouldn’t that put upward pressure on costs? Here are the key conflicts found in mortgage production operations.

Cycle times can be an important element of customer satisfaction, and in this context, our definition of customer includes the borrower, loan officers and referral sources such as Realtors®. All things being equal, it is better to shorten the length of time between loan application and closing, especially if your competitors are closing loans more quickly. But at what cost?

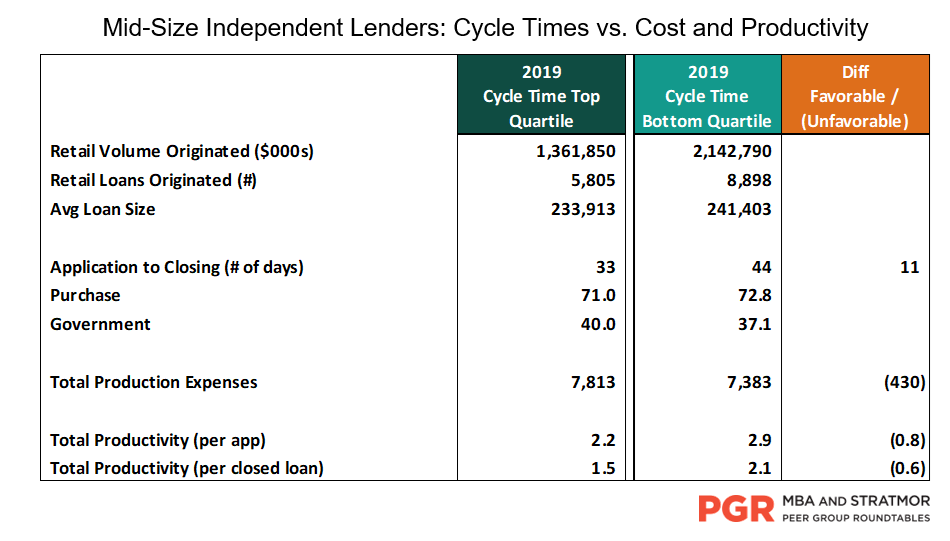

To quantify the relationship between cycle times and cost, we analyzed data from the MBA and STRATMOR Peer Group Roundtables (PGR) program for 2019. For the Mid-Size Independent peer group, we created two subsets of lenders — one with the highest average cycle times and one with the lowest cycle times. The results are shown below:

Chart 3

Top quartile lenders averaged 33 days from application to closing, while bottom quartile lenders averaged 44 days. Purchase and Government mix were roughly equal between the two groups. The top quartile lenders with the fastest cycle times reflected higher costs ($430/loan) and lower productivity than bottom quartile lenders with the slowest cycle times. This illustrates the tradeoff between cycle times and cost.

Should operations add more staff to improve cycle times when that would increase costs to produce? Should the company invest in technology to reduce cycle times when that would increase cost in the short run? What if the ROI is not there?

One could argue that a refinance customer will be somewhat indifferent about whether the lender closes their loan in 20 days vs 30 days, as long as the lender sets the right expectations and then meets those expectations. But if lenders conclude that they want to drive down cycle times, then the benefit should be worth the cost and there is most certainly a tradeoff.

Factory vs. Team Workflow

There are a variety of ways to organize operations and fulfillment resources. Some lenders tend to use a “factory” approach where each employee is focused on executing certain tasks much like a manufacturing assembly line. Loan-related tasks are allocated to employees on a round robin basis. Another common model is a team or pod approach, where a given sales team has a specifically dedicated team comprised of some combination of processors, underwriters and closers.

While a task-driven “factory” workflow would appear to be inherently more efficient, what are the implications for customer (i.e. LO, Borrower, referral source) satisfaction? What good will it do to gain some efficiency while hurting the borrower experience and alienating the sales force?

As loan volumes ebb and flow, a team approach would appear to be a more costly and less efficient way to allocate resources across the enterprise. For example, you can’t have half a processor in a small branch when volumes drop.

The fulfillment model decision represents a classic balancing act and many lenders employ a hybrid approach. Customer-facing roles, such as processors, are often employed on a team or dedicated basis, while back office functions such as closing tend to have a more factory or round robin model.

Standardization of Roles vs. Flexibility

At STRATMOR, we often hear lenders say they need more standardization of roles across the company and we generally support that notion. Standardization helps companies operate more efficiently with respect to training, setting expectations, measuring performance, adopting and sharing best practices and improving scalability.

No one would argue that more standardization theoretically decreases cost and improves scalability, but there may be a trade off in customer experience if flexibility is limited depending on the role.

Taken to an extreme, standardization can cause problems. Because mortgage transactions are unique, strict adherence to standardized processes could introduce risk as unanticipated situations arise. If roles are so rigid that employees are unable to solve customer problems, customer satisfaction may decrease as they feel they are dealing with a “black hole.”

Rush Requests

Ah, rush requests, the bane of every back-office employee. While it is inherently less efficient to disrupt workflow and communications to accommodate a rush request, they are sometimes needed to meet customer expectations. There is certainly a trade-off here, and striking the right balance can be a challenge.

As shown above, operations executives rank productivity as the number one metric by which they manage. But a sole focus on productivity and cost reduction may have negative implications for loan quality. What good would it do to shave five basis points off the cost to produce while incurring ten basis points of expense due to loan repurchases and indemnifications?

Here are some examples:

Simply put, if you work too fast, you increase the risk of making mistakes. There are many examples of tradeoffs here, including:

While remote work is a necessity in today’s environment, there is a trade-off between culture and communication and safety and efficiency. Of course, in the short run, safety is paramount and trumps all other considerations. But post COVID, lenders will have to strike the right balance between remote and in-office work. A hybrid approach that varies by position is most likely. For example, some employees may work in the office a couple of days a week under a shared desk arrangement with split schedules.

Now more than ever, lenders are concerned about the effect that COVID-related stress and long hours from record volumes are having on their staff. Operations executives are trying to strike the right balance between adding enough staff to temper the strain and preserve at least a modicum of work-life balance, but not adding too much staff that would result in layoffs when the cycle ends.

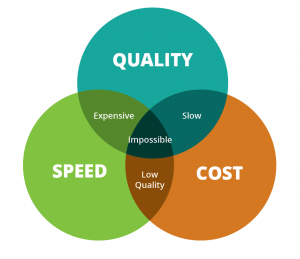

In many ways, the balancing act that operations executives face is the classic conundrum of the tradeoffs among speed, cost and quality.

A focus on speed alone has negative implications for cost and quality. A focus on cost alone runs the risk that speed and quality are compromised. A focus on only quality may increase cost and slow down the process to unacceptable levels.

Managing operations is not a game of extremes. Rather, it is a day-in, day-out balancing act among speed (cycle times), cost (productivity and cost to produce) and quality (level of loan defects and customer satisfaction). How operations executives strike the balance among these three major objectives should be aligned with the culture, vision and values of the company.

In STRATMOR’s experience, successful mortgage banking executives understand risk vs. return while taking into account their (and their investors’) agreed upon tolerance for risk. They also understand their mission, vision and values and have a strategic plan and roadmap to achieve a target operating model. After that, it’s all about execution, while striking the right balance between competing objectives and staying true to the company’s mission, vision and values.

I acknowledge that the industry is not well served in the long run without fresh thinking and bold decisions to effect change. New entrants to the business are often able to make substantive progress on long standing challenges because they are not constrained by legacy processes, systems, and quite frankly, old ways of thinking. However, while a world of incrementalism, balance, and tradeoffs is not an exciting one, it is the realm in which most mortgage bankers operate. Again, it’s all about balance. Jim Cameron

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.