There are two types of mortgage originators; those in it for the short money and those in it for the long money. In other words, there are fair-weather opportunists and there are career builders. When the rates are rock bottom and the refinances are like fish jumping into the boat, it’s hard to nurture a long-term perspective, but — mark my words — long-term strategies will be crucial to surviving the lean times ahead. For many originators, especially the newer ones, it’s hard to remember lean times ever existed, much less the stress and panic that came with them. But they did. And they will come again.

I would much prefer discussing career-sustaining strategies before a market constriction happens than during one, when it will likely be too little too late for the unprepared. So, what are the best strategies mortgage originators can employ to insulate themselves from market constriction?

If you were born and raised in the Midwest like me, you might be familiar with the term, “Make hay while the sun shines.” In other words, take advantage of the good conditions while they last. That doesn’t, however, mean you should neglect to care for the rest of the farm! The equipment still needs maintenance, the off-season crops still need tending, and the animals still need food. In mortgage industry terms, originators who are using all their energy raking in refinances right now ought not to do so at the expense of their long-term career-building strategy.

Projected industry loan volume for 2021 is down roughly 30 percent from 2020. Oddly, few lenders, and even fewer originators, seem to notice. In fact, many lenders are still planning to hire more staff to keep up with capacity overload. When rates do eventually go up, which could be as soon as mid-to-late 2021, the “firehose” of refinances we’re seeing today will reduce to a trickle that could last a while. In fact, refinance volume is expected to drop 50% next year. Given the extended historic low-rate environment we’ve enjoyed since late 2019, refinance opportunities could feasibly stay suppressed for a decade or more. Now is the time for originators to actively build upon their successes in pursuit of a long-term growth model.

Originators interested in investing in long-term career growth should have three focal points: relationships, good habits, and personal brand.

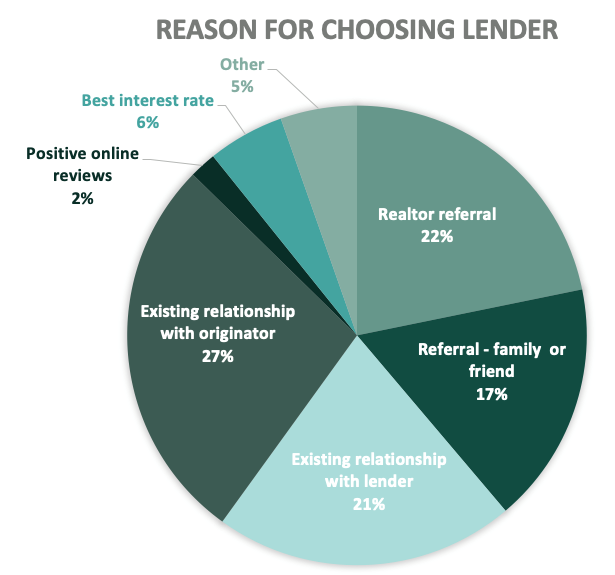

An originator’s relationships are arguably the most important aspect of their longevity. According to year-to-date MortgageSAT data, the average originator gets two in every five loans from referrals, whether from friends or professional partners. In a purchase market, that number is even higher. With that much business at stake, originators not only need to consider how to grow new relationships, they also need to protect the ones they have.

Source: © MortgageSAT Borrower Satisfaction Program, 2020. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2020. MortgageSAT® is a service of STRATMOR Group and CFI Group.It takes years, sometimes even decades, to become a trusted advisor known for reliability, knowledge and wisdom. The best way to protect that hard-earned personal brand is to continue to deliver.

Another aspect of protecting relationships is to strengthen them. I’m sure you’ve heard the adage, “The best defense is a good offense.” The most seasoned originators don’t start over from scratch each year. Rather, they build upon their successes by growing relationships and partnerships. This brings us to our second focal point: turn best practices into good habits.

We often think of good habits as things that are good for us, but not necessarily fun to practice — things like exercise, eating healthy foods, etc. It’s no different in the context of mortgage career longevity. The good news is that habits, by nature, are pretty easy to maintain once you’ve established them. Here are a few best practice habits that will pay off in the long run:

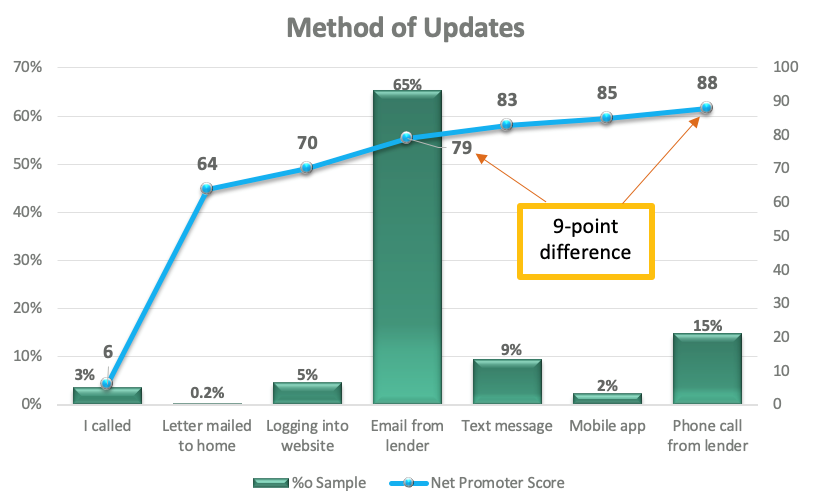

Source: © MortgageSAT Borrower Satisfaction Program, 2020. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2020. MortgageSAT® is a service of STRATMOR Group and CFI Group.Our final focal point for mortgage originators in pursuit of long-term career success is personal brand. It’s the reason why referral partners continue to choose them, why past clients continue to recommend them, and why lenders go to great lengths to retain them. Originators hoping to elevate their personal brand often turn first to social media tools that promise to collect and amplify the voice of the customer (i.e. testimonials). While increased visibility is one aspect of personal brand, it’s far from the most impactful. As seen in the earlier chart, when borrowers are asked for their primary reason for choosing a lender, positive online reviews only account for two percent.

The typical mortgage customer either knows the lender or originator or gets a referral from a friend or a real estate agent – that accounts for 87 percent of borrowers. The main driver of personal brand, therefore, is the creation of a delightful loan process that generates repeat business and referrals.

Having said that, nearly half of all borrowers are perusing online reviews in some fashion, so there is value in collecting and promoting them. When choosing one of the many brand management tools available in the marketplace, keep the following things in mind:

Here are three practical ways mortgage originators can begin to insulate themselves from market constriction:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.