“The biggest challenge facing banks today is the ability to stay engaged with the customer. Those that do this well will win market share over the next five years.”

—Moorad Choudhry, author of The Principles of Banking

Winning market share in this purchase environment is the name of the game. But this is an expensive commitment; the right investments must be strategically made, coupled with an execution plan that successfully engages with customers on the customers’ terms. More customers generate higher profits, and valid data is the driving force for lenders to make the right strategic decisions to attract and satisfy these customers.

At STRATMOR, our perspectives on the mortgage business are drawn from well-sourced data. This data includes proprietary data-generating programs such as Technology Insight®, Originator Census® Study, and Compensation Connection®, as well as external sources such as HMDA, MBA’s Quarterly Performance Reports, and the U.S. Census and Federal Research (FRED), to name a few. We also work with numerous lenders each year to execute their strategic plans. And of course, STRATMOR has collaborated with the MBA in conducting the PGR: the MBA and STRATMOR Peer Group Roundtables Program, since 1998.

This Spring we conducted seven PGR meetings with the MBA that included over 100 participating lenders. MBA, STRATMOR and the participating lender executives at each meeting sat around the table and reviewed performance results – results which differed from group to group. The largest originators by volume are, as a group, the large banks-banks which averaged $12 billion in Retail mortgage production in 2018. Unfortunately, the trends we noted in our large bank group were consistent with what STRATMOR is finding across many of our large bank clients- low revenues, high expenses and trend lines that are moving in the wrong direction.

Large banks have underperformed the other peer groups year after year in terms of the profitability of their mortgage banking production operations. Each year at the PGR roundtables, STRATMOR, MBA, and our participating Bank executives explore the root causes of this comparatively weak performance and we ask: “If these results accurately reflect performance, what changes are being made? What are the problems, and what potential solutions unique to the mortgage lending challenges being faced by large banks are being pursued?”

This article builds on those discussions and represents a collaborative assessment of key factors driving the large banks’ poor performance as a group and possible actions that can be taken to reverse this trend. Note that this article will focus primarily on the performance in the Retail channel, which is more comparable to the typical model of the Independent Mortgage Banker (IMB).

As a starting point, what do we mean by production profitability? In the PGR, we view the origination and sale of mortgages as a distinct component of the overall mortgage business. We analyze origination and sales separately from servicing of mortgages and, for deposit gathering institutions, from the investment in mortgages for the loan portfolio. We also ignore the benefit of cross-sell, or “relationship deepening” that may occur by depositories. By analyzing the business in this way, we can compare all types of mortgage originators using a common approach.

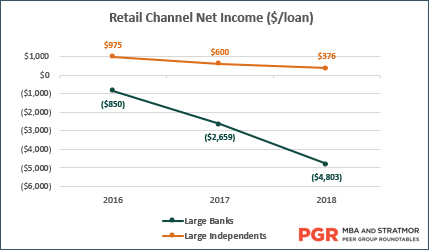

Using this approach, as a group, the large banks lost a somewhat amazing $4,803 for every mortgage originated in the Retail channel in 2018, an 81 percent increase over the $2,659 per loan loss in 2017. By comparison, the large independent PGR subgroup showed a PROFIT of $376 per loan in the Retail channel in 2018, off 37 percent from the $600 per loan in 2017, but a profit nonetheless. Of course, these are averages — there are much better performers than the average inside the group, and much worse.

However, knowing that you have a bottom line issue is only useful if you understand the components of the bottom line – the issues in revenue and expense that are driving this performance challenge.

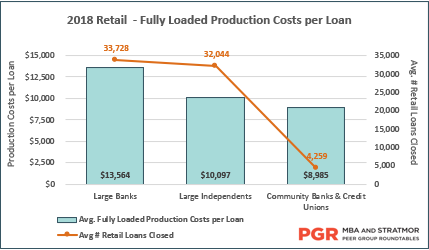

A critical driver of these results is expense per closed loan. In the Retail channel, large banks recorded total per-loan expenses of $13,628 (375 basis points based on loan size) in 2018 — an all-time PGR record high. This compared to $10,095 (381 basis points) for the large independents — a big number, but one that still allowed for a small profit per loan due to much higher revenue per loan for this group. An even more interesting comparison is that smaller regional banks spent “only” $8,985 per loan in performing the same functions — 66 percent of the expense per loan reported by their large bank brethren. The average large bank in the PGR closed 33,728 retail mortgages in 2018. At a loss of $4,803 per loan, this represents $162 million in economic losses for the average large bank!

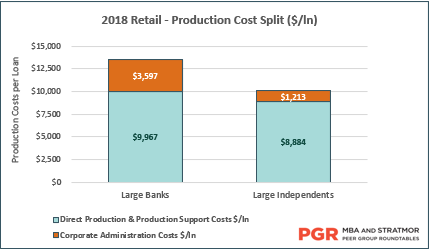

Also, in the expense category, large Banks experience a significant disadvantage in the expenses we categorize as “Corporate Administration.” These include both direct corporate costs of running the mortgage business as well as allocated overhead from the parent company, including specifically identifiable costs such as human resources, accounting and legal expenses, and general allocations of corporate overhead that the large independents do not have. This category of expenses also includes corporate technology, and the large banks’ spend in this area is much higher on a per-loan basis than any other group. Corporate Administration costs amounted to $3,654 per loan in 2018 versus only $1,213 per loan for the large independents — a $2,441 per loan disadvantage for the large banks.

Differences in revenue are a bit more problematic to analyze since the large banks retain 58 percent of their originated loans in their owned mortgage portfolios, rather than originating for immediate sale. In the PGR, we ask the banks to assign an amount for transaction-based revenue on these portfolio loans. The goal is to approximate what the gain on sale and servicing value would be if the loans were in fact sold to an investor. The lack of a robust secondary market for jumbo loans (which represent a significant portion of portfolio originations) and the very competitive pricing environment for these loans is reflected in estimating per loan revenue, especially when expressed in basis points per loan rather than dollars.

A significant question arises here as to whether portfolio loans, and jumbo loans specifically, are being priced too aggressively by the banks, leading to imputed revenue which is lower than might be expected otherwise. Evaluation of this issue is where relationship deepening” can come into play and impact pricing – what is the value of the deposit or other relationships that a customer may bring to the bank and is that value being estimated properly?

A further factor contributing to lower per loan revenue for large banks as a group is that they do not focus on FHA and VA lending to the same extent as independents or, in a few cases, have virtually abandoned FHA lending participation due to perceived risk of regulatory enforcement actions. These loans typically offer the ability to price with wider margins, therefore, this can also contribute to lower per loan revenue.

As a result, large bank revenue per loan lags the large independents by a very high 154 basis points. Expressed in dollars, revenue is lower by $1,712 per loan.

So, the combination of a lower per-loan revenue profile coupled with the highest overall expense levels of any PGR group has created a poor net production income profile for these banks. Remember this P&L analysis is based solely on originations in 2018, and not on servicing income generated on loans being serviced. The servicing function, which produced modest profits for most of the large banks in 2018, did serve to offset production losses to some degree, as payoff rates stabilized. But using servicing profits to originate new mortgages at a loss hardly seems like a viable long-term strategy.

At an average of 10 million bank households per institution, which STRATMOR estimates would have produced 700,000 mortgages in 2018, large banks captured only 28,000, or four percent of those mortgage opportunities. By comparison, regional banks which averaged 550,000 households per institution captured 8.1 percent of available mortgage volume from their customers. Similarly, the large banks recaptured only 12 percent of the customers who paid off an existing mortgage in the banks’ servicing portfolios, compared to a retention rate of 30 percent for the large independents.

Analyzing the “whys” behind these numerical results is challenging. On paper, the large banks have many of the characteristics that should be very desirable in promoting and offering mortgage products profitably. These banks have:

Theoretical scale advantages have not only NOT materialized, but, based on PGR data, seem to reflect diseconomies of scale in many instances. Possible explanations for these surprising results are:

However, these factors do not appear to be significant enough to explain the performance shortfalls. What does?

When we discuss performance shortfalls as noted above with representatives of the large bank peer group twice each year, there are some reoccurring themes.

Large banks often argue that there is significant unrecorded value present in the mortgage transaction since the mortgage is a foundational product allowing for development of other bank product and service relationships. This is no doubt true — large bank servicing customers average over 3 additional products with the bank, and 21 percent of new mortgages are originated with at least one additional product. However, quantifying this value has been a challenge, and may not be large enough to offset production losses being incurred. The sharper the pencil can become in determining the value of the anchor mortgage relationship, the better the story that can be told to shareholders and analysts about the bank’s overall mortgage and mortgage pricing strategy.

Large banks constantly debate this question, and, judging by our meetings with bankers, the tendency seems to be moving toward “product” as the answer for many banks. However, delivery of that “product” in a profitable way argues strongly for developing or retaining the approaches to mortgage origination that are consistent with running a profitable business. Profitable origination does not just “happen”— it must be intelligently managed, just like it would be if it were a stand-alone enterprise competing for capital to grow. In STRATMOR’s view the quest for leveraging other bank capabilities for the benefit of the mortgage customer is best acted on if the foundational product is delivered in a best-in-class, profitable manner.

Are the large banks just too big to allow for profitable management of the mortgage origination function? Are they willing to sacrifice profitability on this function to provide this key financial product? Mortgage banking production earnings are cyclical even when managed well — not necessarily the type of earnings that lead to a high stock price multiple. The future is going to present ongoing profitability challenges including the adoption of the Current Expected Credit Loss (CECL) standard that will likely raise the cost of holding portfolio mortgages and may either reduce the banks’ appetite as investors in the product or cause them to change their current pricing models. Some may elect to retreat into a more specialized approach to the business — providing mortgages to wealth clients and to customers in low-and-moderate-income communities (to meet CRA requirements) and abandoning their mainstream customer bases on a large scale.

Bottom line: for those banks that elect to stay involved, there will be a continuing need to operate with an entrepreneurial approach, to create “best in class” marketing, and deliver a superior customer experience. Banks also need excellent financial reporting and management of the details of the business to achieve acceptable levels of profitability. In many ways, they need to be more like an “Independent” while leveraging the benefits of being a large bank. For the forward-thinking banker, that should generate a “best of both worlds” performance level. Finnegan

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.