I often talk to leaders in the mortgage industry about their customer experience vision and hear things like, “We want customers for life,” or “We put customers first.” These vision statements are a great place to start, but the real challenge is in getting that vision to catch fire within the whole organization. How can lenders translate a customer experience vision from leadership to loan originator and include the entire company in the drive to create a better borrower experience?

Jack Welch, former chairman and CEO of GE, once said: “Good business leaders create a vision, articulate the vision, passionately own the vision, and relentlessly drive it to completion.” It’s that last part that seems to trip people up, and not for lack of desire or effort.

When I sat down at the 2019 MBA Annual Conference with a handful of CEOs, each was able to articulate their unique expression of a customer experience vision. And, each was passionate about it. They just weren’t sure how effective their efforts were in spreading that vision across their entire organizations.

In a recent survey noted in the Harvard Business Review, only 28 percent of respondents reported feeling fully connected to their company’s vision. Vision answers the question, “Why are we doing this?” It is essential for leadership and loan officers to have alignment on the answer to this question in order to create a positive and pervasive culture around borrower satisfaction.

Consider the statement, “We want customers for life.” It certainly answers the question for leadership, but may not resonate with loan officers who are more concerned with getting their next deal than the long-play of a customer who might move or refinance in five to seven years. A better way to align the vision for leadership and loan officers alike might be to say, “We want to delight our customers so much that they can’t help telling everyone they know.”

Experts agree that changing culture requires a shared vision as a starting point. Staff will work harder and leadership will make better decisions when everyone buys into a shared vision. Fostering that kind of buy-in across the company means creating awareness and establishing accountability across the organization.

Awareness

How would you rate company-wide awareness of your Customer Satisfaction and Net Promoter Score (NPS)? This includes everyone from executive leadership to branch managers, to loan officers, processors, underwriters and closers.

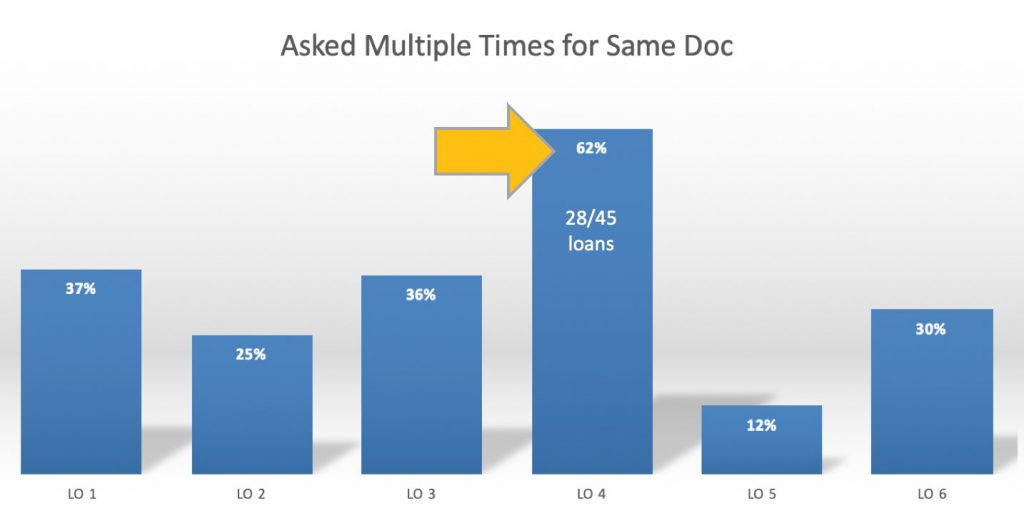

One of our MortgageSAT lenders had a loan officer who had no idea that her borrowers were unhappy about being asked for the same documents multiple times because they always seemed happy when she spoke to them. Survey results revealed that the problem had occurred in 28 of her last 45 loans, and it was costing her 52 NPS points, which meant a lot of lost referrals.

Multiply this type of situation across your loan officer base and the detrimental impact of “lack of awareness” looms large.

If you want loan officers to buy into your vision, they first need to know where the company is, and how they fit into and influence the current state, before they can get on board with where you want to go. In other words, metrics like NPS and The Seven Commandments should be visible to all employees, including loan officers, processors, underwriters and closers. I’ve seen whole companies band together to right the ship in these areas, with everyone committing to improvements, but it could not have happened without everyone first understanding the present state of affairs.

Accountability

Accountability gives managers and loan officers and immediate answer to the question, “Why should I care about borrower feedback?” Whether you tie these metrics to compensation or not, holding leadership and loan officers accountable to satisfaction KPIs will encourage good communication and good habits.

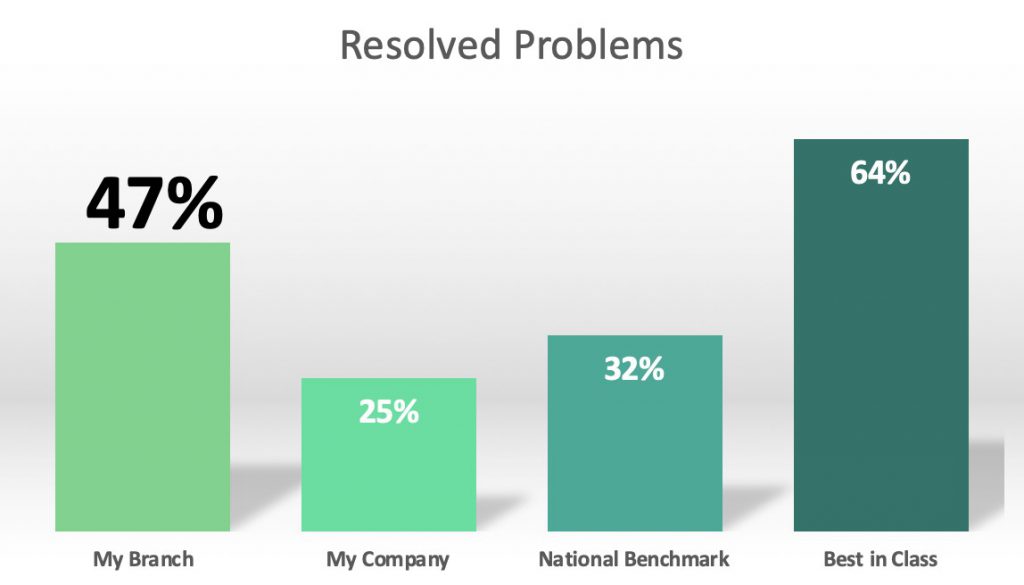

With MortgageSAT, manager reports allow branch leaders to see their own performance versus their company, the National Benchmark, and Best-in-Class:

Having visibility of performance versus peers, both internal and external, helps leadership identify key areas of potential growth and set realistic goals for improvement. According to Kevin Crichton, President of E Mortgage Management, changing the big picture starts with accountability on the small things: “It’s true that the little changes and adjustments we find in MortgageSAT really do add up. Over the past year, just by finding coachable moments fr our team, we were able to climb above the National Average in Overall Satisfaction, NPS, Loan Officer, and Application Process scores.”

Here are three ways to drive your customer experience vision to completion:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.