The voice of the customer has never been more prominent and sought after than it is today. More than 90 percent of lenders today are utilizing some kind of tool for measuring borrower satisfaction, and many of these same lenders have plans to increase spending in this area in the coming year. But what about the satisfaction of the people who are sending you referral business? Very few lenders have a system in place for gauging the satisfaction of their referral partners. What are the essential elements of keeping referral partners happy and referrals flowing?

Occam’s razor is a principle that says that the ‘easiest’ explanation is usually the right one. So, one might think that the best way to gauge the satisfaction of a referral partner is to simply ask them. Not exactly. What to ask, and who should do the asking, are important factors to consider. When LOs make the request, the results are often skewed positive because the referral partner typically likes the LO and doesn’t want to hurt their feelings with blunt feedback. A request that comes from the lender’s CEO (or another C-level executive) will reduce the skewing effect and reinforce that the company (not just the LO) values the referral source, but it may also come across as too formal compared to the casual and friendly relationship the referral partner has with the LO. Third-party requests similarly can appear to formal. In each of these cases, sending a new survey after every referral risks annoying high-volume referral partners with redundancy, which may cause response rates to suffer. low hanging ones first.”

In 2018, 47 percent of non-builder purchase loans came via a real estate agent referral. We talk non-stop at MortgageSAT about the importance of delighting your borrowers, as this is how referrals from friends and family come about, not to mention repeat business down the road. However, if one in every two purchase borrowers are being sourced by real estate agents, that means half of lending revenue for a great many lenders in the U.S. is dependent on keeping these referral partners happy.

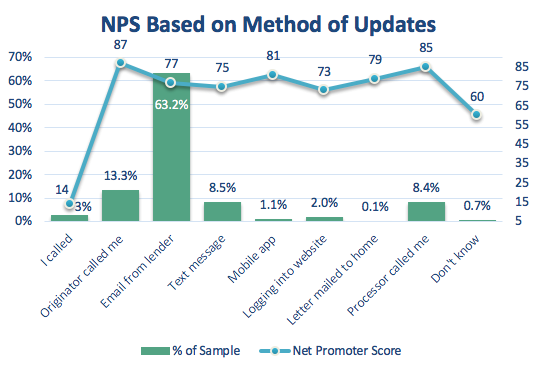

Keeping referral partners happy is about relationship, and relationships live and die with effective communication. When it comes to agent relationships, the depth is far more important than the breadth. In other words, donuts and lunches and golf outings are all fine and dandy, but the real currency of a referral relationship is in transparency, trustworthiness, and reliability. To delight a referral partner, an LO must loop them in if a loan hits a major bump. They also must set proper expectations and then deliver on them. These are the core components of effective business communications with referral partners and borrowers alike. As you look to improve communication with your referral partners, a good place to start is to create touch points that are more personal. We know that borrowers have long preferred a more personal touch when it comes to loan updates. As we see in the chart below, aside from updates by Mobile App which constituted just one percent of the sample, there is a clear trend toward higher NPS scores the more personal the updates are.

Source: MortgageSAT Borrower Satisfaction Program, 2019.

Source: MortgageSAT Borrower Satisfaction Program, 2019.We believe real estate agents are no different. A phone call or stop-by not only gives the LO a chance to deepen rapport with agent, but also allows that agent to voice any questions or concerns they may have.

Another tack LOs can take to improve communication is to set up standing monthly meetings with their referral partners. It doesn’t need to be a long meeting, so long as it’s consistent (i.e. on the calendar) and structured. Having a consistent process to review the details of a consumer survey is a great way to reinforce the LO’s value to the referral partner (and ask for more business). Doing it in person shows the referral partner that meeting with them is a high priority and that the LO takes them and their time seriously. A fifteen-minute call can cover rapport-building, any customer feedback that the partner can pass along, a request for constructive feedback on how the LO might do even better next time around and the sharing of any quotes or testimonial statements given by the borrowers on their post-close surveys.

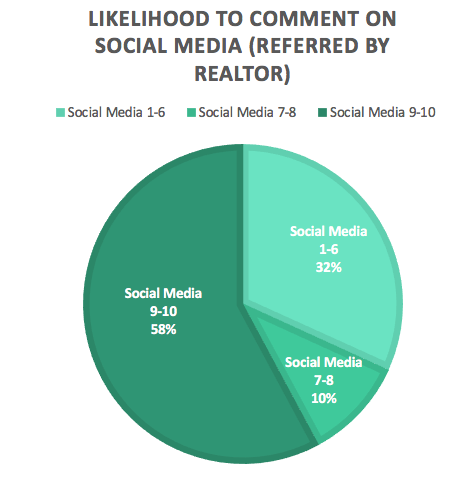

Speaking of sharing testimonials, there should be quite a bit to share. According to MortgageSAT data, roughly three in every five borrowers who are referred by a real estate agent say they are “Highly Likely to Comment on Social Media” (9 or 10 on a 10-point scale). Therefore, you should have a process to ask for these testimonials and ensure they are widely shared.

Source:MortgageSAT Borrower Satisfaction Program, 2019.

Source:MortgageSAT Borrower Satisfaction Program, 2019.Here are three things you can do to insure your referral partners keep sending business your way:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.