Laying the Foundation for a Seamless Digital Mortgage Experience

By Nicole Yung

April 2025

Last month, STRATMOR Principal Kris van Beever laid out a compelling vision for what’s possible through AI, automation, and digital transformation. But as any lender knows, vision alone isn’t enough—now it’s time to examine what’s actually being built.

Are we laying solid foundations for automation and AI within our organizations, or are we encountering constant delays, rising costs, and missed expectations?

The results from the Digital Innovations module of STRATMOR’s 2024 Technology Insight® Study offer a clear-eyed look at the state of digital adoption across the industry. Think of it as an on-site inspection of the mortgage tech foundation, highlighting the real progress being made—and the barriers that still need to be addressed.

A Decade of Insights—and a Front-Row Seat to Change

Since 2014, STRATMOR’s Technology Insight® Study (TIS) has exclusively surveyed mortgage lenders each year to understand their digital capabilities, perceptions on the benefits and barriers of digital mortgage technology, and their overall technology lifecycle.

The TIS is divided into two modules:

- Lender Intelligence: Measures satisfaction levels and Lender Loyalty® scores. The 2025 Lender Intelligence module will open soon.

- Digital Innovation: Traditionally conducted in the last quarter of the year, this module assesses the digital capabilities implemented by lenders and their level of adoption.

The 2024 Digital Innovation module, conducted over the last quarter of 2024, examines three critical areas:

- Automations: Focuses on the use of robotic process automation (RPA) and AI technologies.

- Benefits and Barriers: Gathers lender opinions on the perceived benefits and barriers of digital mortgage technology.

- Digital Capabilities: Assesses the implementation and adoption levels of various digital capabilities.

STRATMOR’s 2024 TIS Digital Innovation survey results provide valuable insights into the current state of digital adoption, highlighting key trends in automation, artificial intelligence (AI), and overall digital capabilities. The results also uncover the challenges lenders face in leveraging digital innovations to enhance their operations. STRATMOR’s study captures both sides of the story—what lenders hope to achieve, and what’s holding them back.

Read on for actionable strategies to elevate your performance based on these findings.

The Rise of Robotic Process Automation (RPA)

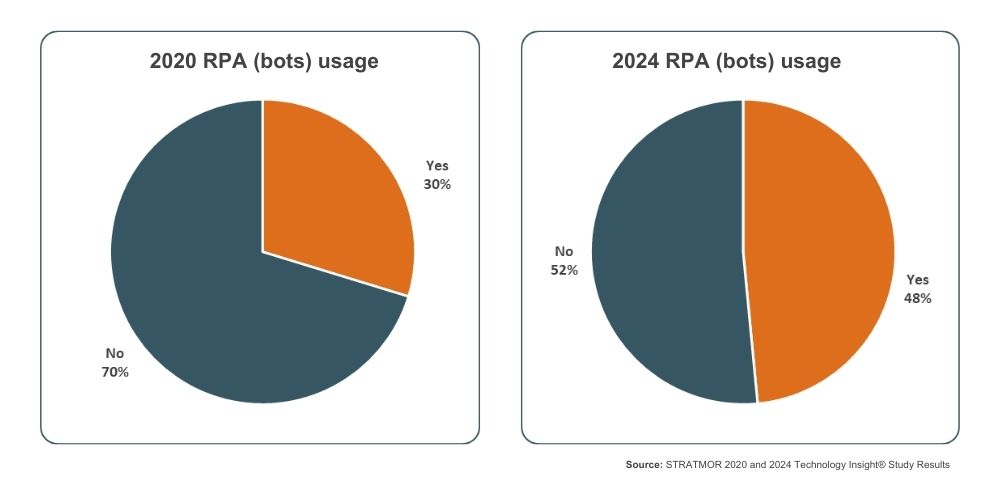

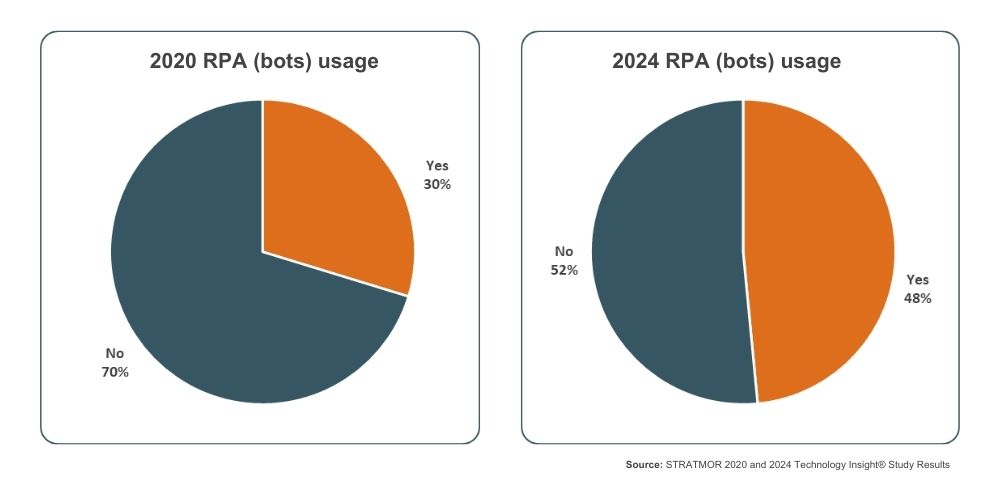

One of the most significant trends we’ve observed is the increasing adoption of Robotic Process Automation (RPA), or “bots.” In 2020, only 30% of lenders reported using RPA. Today, that number has climbed to 48%. This steady increase underscores the growing recognition of RPA’s potential to streamline operations and improve efficiency.

Key Findings

- Processing is King: 59% of lenders utilize RPA in processing, primarily for tasks like ordering appraisals and credit scores.

- Internal Development: The reliance on third-party vendors for RPA development has decreased from 75% in 2019 to 52% today. This indicates a growing trend of lenders building internal capabilities to develop and maintain their own bots.

- Continued Growth: 47% of lenders expect to increase their use of RPA, with 57% of those citing internal development capabilities as the driving factor.

- LOS Integration: Some lenders are decreasing their reliance on custom-built bots due to the availability of native automation features within their Loan Origination Systems (LOS).

Laying the Foundation for Lenders

- Evaluate Your LOS: Begin by thoroughly assessing the native automation capabilities within your LOS. Many modern LOS platforms now offer robust automation features that can streamline routine tasks.

- Explore Vendor Solutions: If you’re new to RPA, consider partnering with a reputable vendor to implement and understand the technology. This can provide a foundation for future internal development.

- Invest in Talent: Develop your internal expertise in RPA. Even with vendor assistance, having in-house talent to maintain and adapt bots is crucial for long-term success.

- Maintenance Matters: Remember that RPA bots can be “brittle” and require ongoing maintenance. Ensure you have a plan for monitoring and updating your bots to prevent disruptions.

The AI Revolution: Document Classification and Beyond

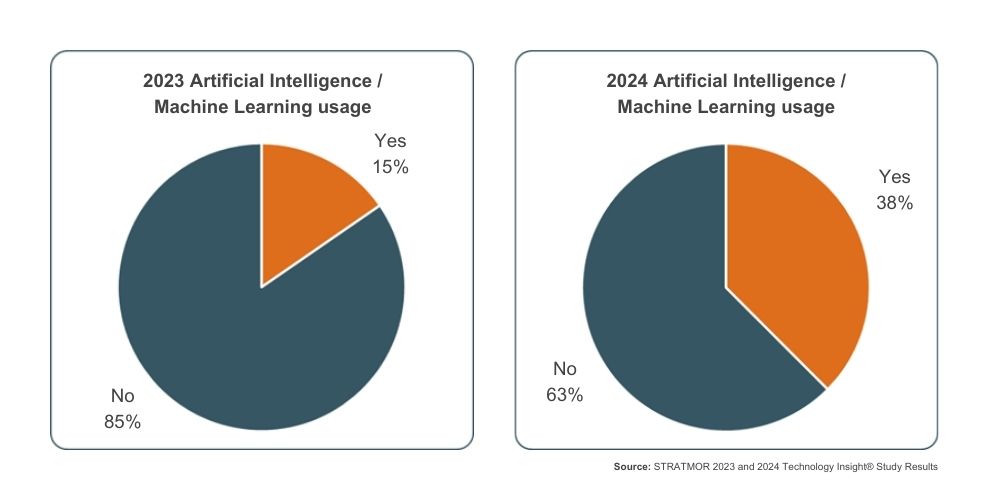

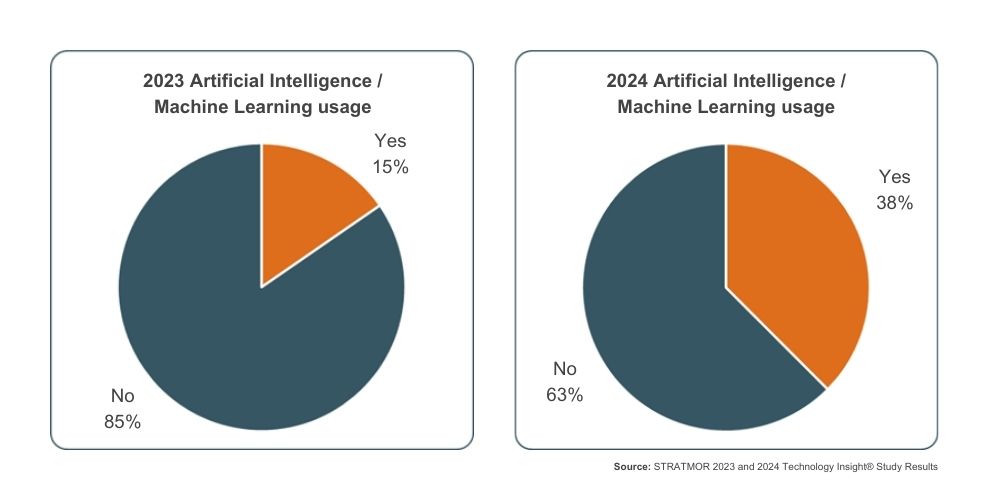

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming the mortgage industry. In 2023, 15% of lenders reported using AI/ML. By 2024, that number surged to 38%.

Key Findings

- Third-Party Solutions: 63% of lenders using AI/ML rely on third-party solutions, while 21% are developing their own internal AI capabilities.

- LOS Integration: 17% of lenders are leveraging AI features native to their LOS.

- Document Processing: 63% of lenders use AI for document classification and indexing, and 54% use it for document reading. This is a significant shift from previous years, when AI was primarily used for sales and customer targeting.

Laying the Foundation for Lenders

- Embrace Document AI: Explore AI-powered solutions for document classification, indexing, and reading. This can significantly improve efficiency and reduce manual processing.

- Assess AI Options: Evaluate third-party AI solutions and the AI capabilities offered by your LOS vendor. Consider the benefits of each approach and choose the one that best aligns with your needs.

- Invest in Training: Machine learning requires ongoing training. Be prepared to dedicate resources to teaching your AI algorithms to accurately classify and process documents.

- Data Security: AI implementation requires careful consideration of data security. Ensure that any AI solutions you adopt comply with relevant regulations and protect sensitive borrower information.

Perceived Benefits and Barriers

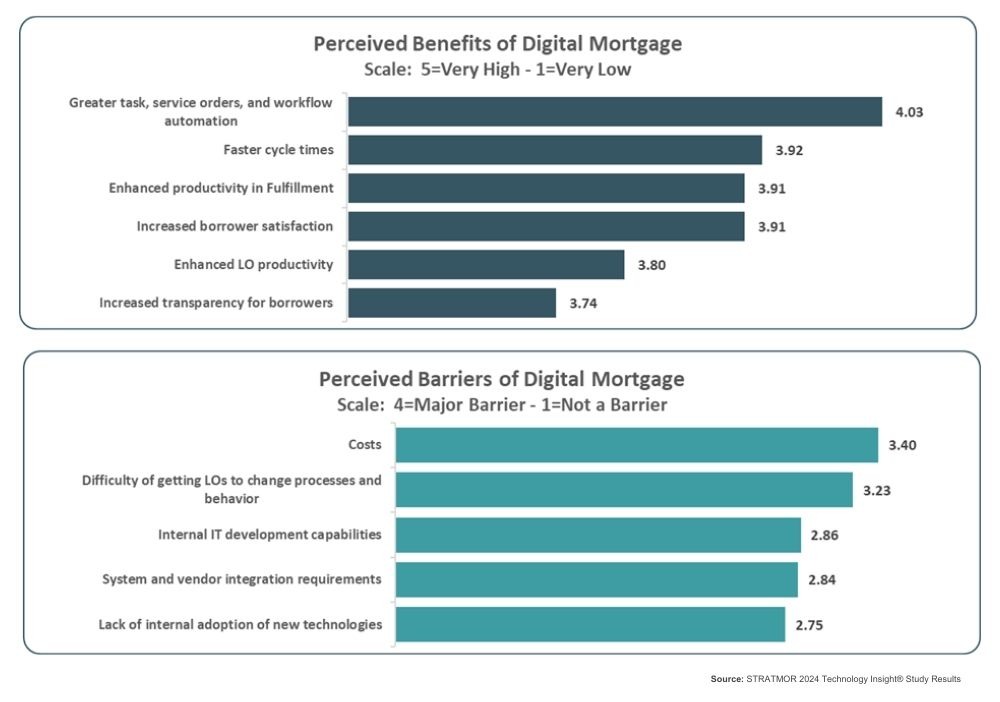

Understanding lenders’ perceptions of the benefits and barriers to digital adoption is essential for strategic planning.

Key Findings

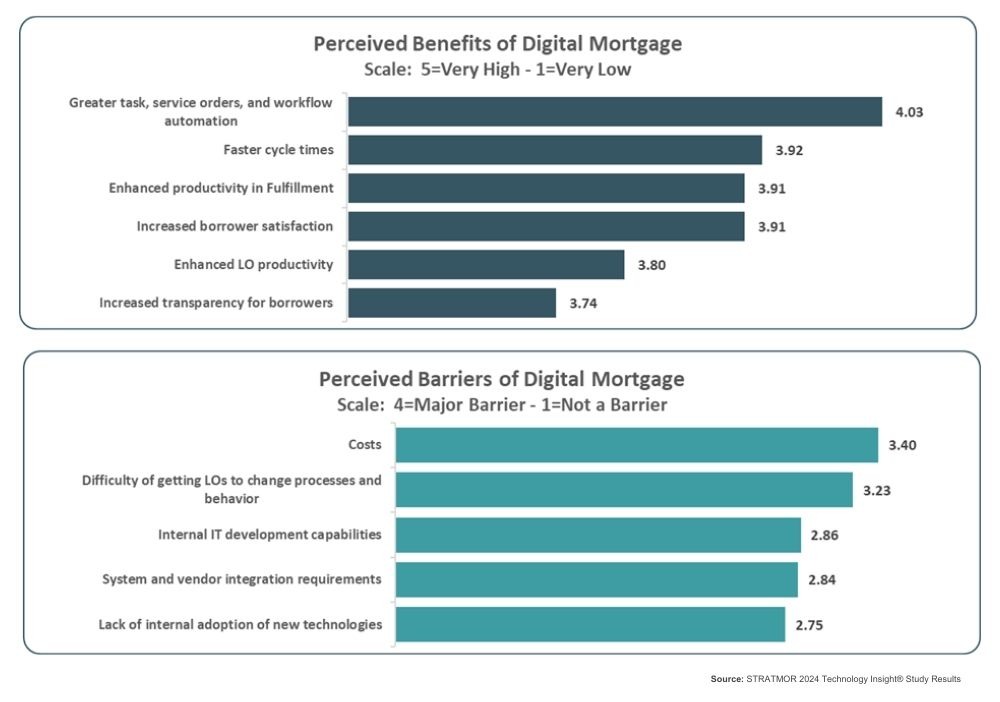

- Top Benefits: Lenders perceive the greatest benefits of digital as greater task service order and workflow automation, faster cycle times, and enhanced productivity—all of which represent a focus on increasing efficiency.

- Borrower Satisfaction: While efficiency is the primary focus, lenders also recognize the importance of enhancing borrower satisfaction and transparency.

- Top Barriers: The top barriers to digital adoption are cost, difficulty in getting LOs to change processes and behavior, system and vendor integration requirements, internal development capabilities, and lack of internal adoption.

Laying the Foundation for Lenders

- Focus on Efficiency: Prioritize digital initiatives that streamline workflows and improve productivity.

- Enhance Borrower Experience: Don’t overlook the importance of borrower satisfaction. Implement digital tools that improve transparency and simplify the loan process.

- Address Cost Concerns: Carefully evaluate the costs associated with digital adoption, including both hard costs and the soft costs of process changes and training.

- Drive Adoption: Develop a comprehensive change management strategy to ensure successful adoption of new technologies.

- Strengthen IT Capabilities: Invest in your IT infrastructure and talent to support digital initiatives and ensure seamless integration of systems.

Digital Capabilities: Where Are We Now?

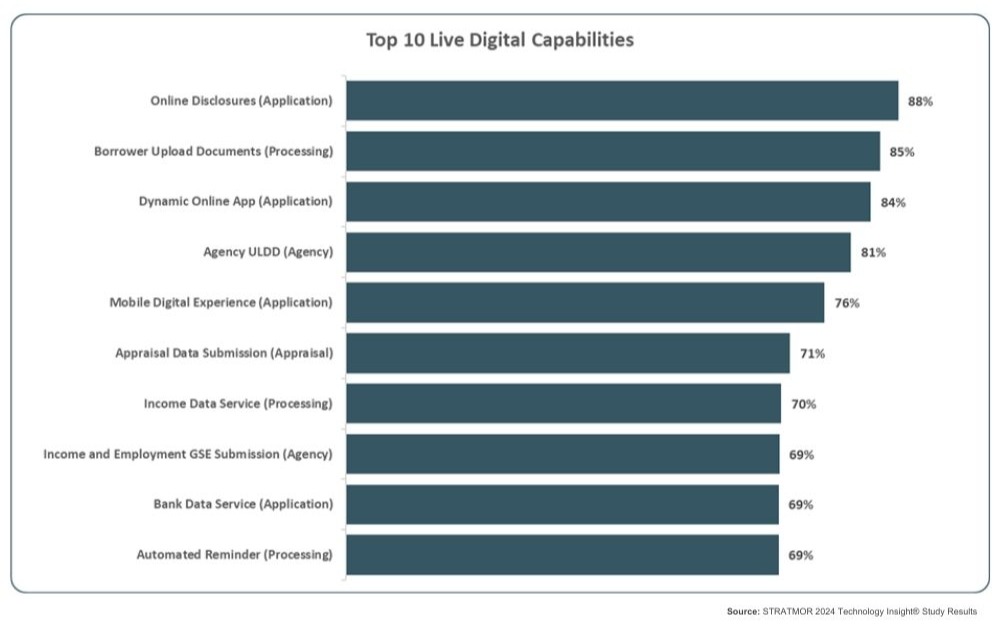

Our 2024 TIS Digital Innovation survey examined 56 digital capabilities across eight areas, including borrower engagement, application processing, and closing. For each of the capabilities, lenders indicated their level of adoption and then for those that are live, they were asked to estimate the level of user adoption. These levels were then used to calculate Net Adoption which considers what capabilities are being deployed by lenders and what capabilities are ultimately being used in the origination process.

- Lender Adoption = The percentage of lenders who report “Live” for a capability

- User Adoption = The reported level of user adoption for lenders who report live capability

Key Findings

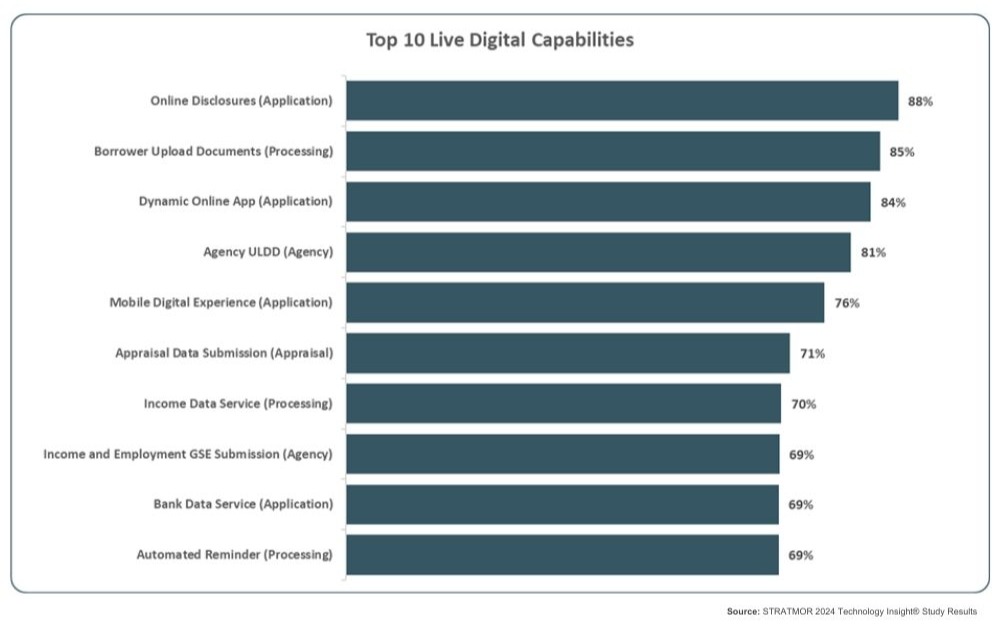

- Top Live Capabilities: The most widely implemented digital capabilities are online disclosures (88%), borrower uploading documents (85%), and dynamic online applications (84%). All of which are concentrated in the front-end of the origination process.

- Application Focus: Lenders have heavily invested in digital capabilities related to application processing, such as online disclosures, document uploading, and data verification.

- Biggest Gains: Income data service processing saw the most significant gain in digital implementation over 2023 data, increasing 22%.

Laying the Foundation for Lenders

- Prioritize Core Capabilities: Ensure that you have implemented the essential digital capabilities, such as online disclosures and document uploading.

- Optimize Application Processing: Focus on streamlining the application process with dynamic online applications and automated data verification.

- Advance Closing Technology: Explore digital closing solutions to improve efficiency and enhance the borrower experience.

- Customer Experience: Continue to look at areas to improve customer experience, even after the loan has closed.

From Blueprint to Build: Making Digital Stick

Technology alone doesn’t transform an organization. It takes a blueprint—a clear strategy grounded in business goals and operational realities. It takes a skilled project team that can align stakeholders, manage timelines, and communicate effectively. And it takes a commitment to change—not just in tools and systems, but in culture, mindset, and expectations.

The good news is that many lenders and servicers are already on their way. They’re embracing automation and AI in targeted, thoughtful ways. They’re investing in foundational digital capabilities. And they’re learning from each other—sharing what works, what doesn’t, and what’s next.

At STRATMOR, we don’t just study digital transformation—we help drive it. We partner with lenders and servicers every day to build that blueprint. We evaluate their people, processes and technology to assess digital capabilities, prioritize the right initiatives, and guide organizations through complex transformation efforts. If you’re ready to move from vision to execution, we’re ready to help you build on a solid foundation. Nicole Yung

How Can We Help?

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability

and accelerate growth. To discuss your mortgage business needs, please Contact Us.