While the past year has been a gift of high volume for the mortgage industry, it has also been a source of frustration to strained fulfillment teams and to originators trying to communicate with borrowers about extended closing timeframes. With more of the same high volume forecasted for the near future, lenders need strategies for how to frame client expectations around closing timeframes.

At STRATMOR’s recent Operations Workshop, participants were abuzz with questions that have dominated conversations in the mortgage industry for the better part of the past twelve months. How do we create efficiencies to handle strained capacity? How do we balance hiring and overtime compensation to stave off employee burnout? Is the work-from-home model a sustainable strategy to create higher productivity? And finally, how are we supposed to delight customers when our cycle times are longer than they’ve ever been?

These are all very valid questions. According to STRATMOR data, the average time to close a refinance loan is currently right around 60 days, with many lenders (depository institutions in particular) experiencing average cycle times in the 90-to 110-day range. It’s certainly hard to delight customers when a loan takes more than three months!

2020 gave us very favorable conditions for customer satisfaction in the form of historic low rates, and oftentimes, borrowers who were too preoccupied with a public health crisis to nitpick over hiccups in the loan process. This minimized the effects of steadily increasing loan problems, as borrowers were just happy to complete a loan at all. With a turning of the tide on the pandemic just around the corner and volumes that are showing no signs of slowing in the next several months, that circumstantial goodwill has a fast-approaching expiration date.

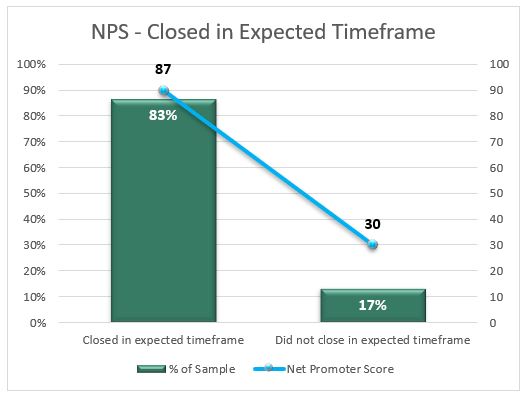

The failure to close a loan in the expected timeframe costs a lender 57 NPS points, effectively turning a Promoter— a raving fan — into a Detractor — someone who will badmouth you to friends and colleagues. This affected 17 percent of loans in 2020, with NPS dropping to just 30 when the miscue occurred.

Chart 1

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

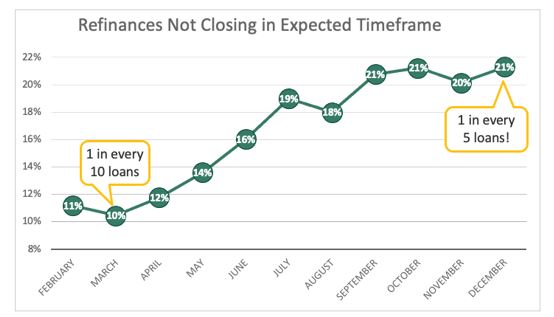

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.A look at the monthly progression over the year shows an even more troubling story. Just one in every ten refinance loans in March 2020 closed outside of expected timeframes, but that number grew steadily worse throughout the year, eventually effecting one in every five refinances from September forward. Stated another way, one in five loans in Q4, a record volume quarter, had an NPS of 30 due to missing the expected closing date.

Chart 2

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.At first glance, originators tend to equate this metric with extended cycle times. They look at their overloaded pipelines and 75+ day cycle times, throw their hands up and say, “There’s nothing I can do to make it go faster, so I give up.” In truth, this metric is all about expectation setting, which is very much under their control. Set the right expectation up front — and adjust it accordingly as the loan progresses — and you can still delight your borrowers on a 60-day, 75-day or even a 90+ day closing.

Here are three ways originators can delight borrowers when cycle times are out of control:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.