By all accounts, the buzzword for mortgage lenders headed into 2022 is growth. In our meetings at the most recent Mortgage Bankers Association Annual Convention, virtually every lender we spoke to said that their number one priority for 2022 was to achieve growth. Lenders in our virtual workshops have been saying much the same thing. It seems that everyone is hoping to grab more market share in the year ahead.

But not everyone will.

As the refinance tsunami with its sky-high wave of profits fades and the purchase market rises, price wars will ensue. But successful lenders in a purchase climate won’t win on price. Multiple studies have shown that when it comes to gaining business, the customer’s experience outranks price and fees. In fact, a customer is four times more likely to leave and go to a competitor if a problem in the process is service-related versus price-or-product related.

And that is why a Customer Experience (CX) strategy is crucial for mortgage lenders, especially now.

The truth is, every company already has a customer experience. It may not be intentional, and it may not be the one the company thinks it provides or actually wants to provide. In recent studies, financial institutions are citing customer satisfaction as a higher priority than profits, and although 84% of companies who work to improve their customer experience report an increase in revenues — most don’t have a budget line for CX, nor are most clear on who in the company is actually responsible for improving their customer’s experience.

This may not be a huge problem for companies in some industries, but here in the mortgage business, in a purchase money market with rising mortgage interest rates and increasing regulatory compliance oversight, it has never been more important to have dedicated resources and designated staff for your CX initiatives. In the purchase market ahead, the lenders who are intentional about creating a positive customer experience will be the ones that grow the fastest, protect their margins and actually gain that coveted market share.

One of the statements that gets the most wide-eyed looks from attendees of our national lender workshops is when we remind them that they are already CX experts. We all are. We are all consumers, and we know what feels good and what doesn’t. What we don’t do often enough is put ourselves into our borrowers’ shoes.

Over the past few years, the primary path most borrowers took through the mortgage lender’s process was the refinance route. The purchase money mortgage journey is significantly different. It’s not that lenders have totally forgotten how to cater to purchase borrowers, but their muscle memory right now is mapped to refinance. That needs to change.

Think about the difference between the two loan paths. For a refinance, the borrower already has a home and a mortgage. They would like a rock-bottom price deal, but if they don’t close on a refi or if their closing timeframe gets delayed, they still have their home.

It’s not the same with purchase money loans, where the potential downside is losing their dream home. The borrower is often navigating a life change that has led to the new home purchase, be that a marriage, divorce, new child, or job relocation. A home purchase is the biggest financial transaction of most people’s lives, making it a very stressful event, and borrowers, loan officers and real estate agents all have a lot to lose if the deal doesn’t go through. And lenders haven’t exactly been knocking the ball out of the park in this area lately.

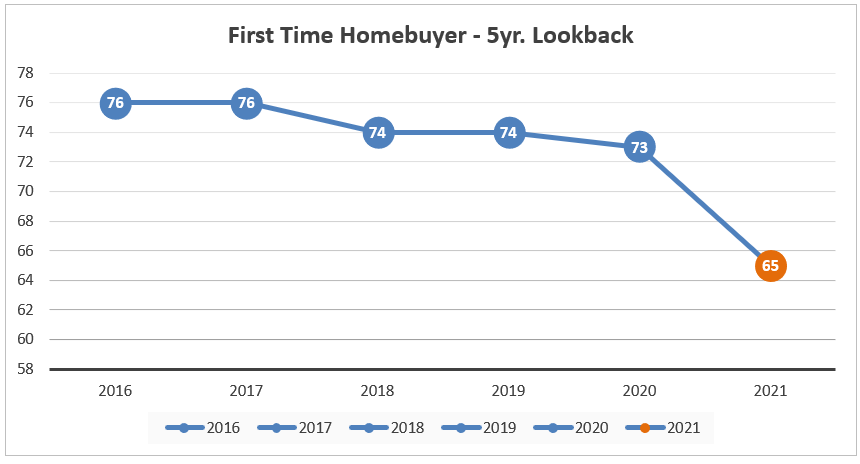

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. Whether or not lenders have created a detailed customer journey map in the past, now is the perfect time to revisit it and do the work of carefully analyzing the borrower’s path through the purchase money transaction. This means evaluating interactions at each touchpoint in the customer’s journey to ensure that the experience you deliver is intentional and excellent.

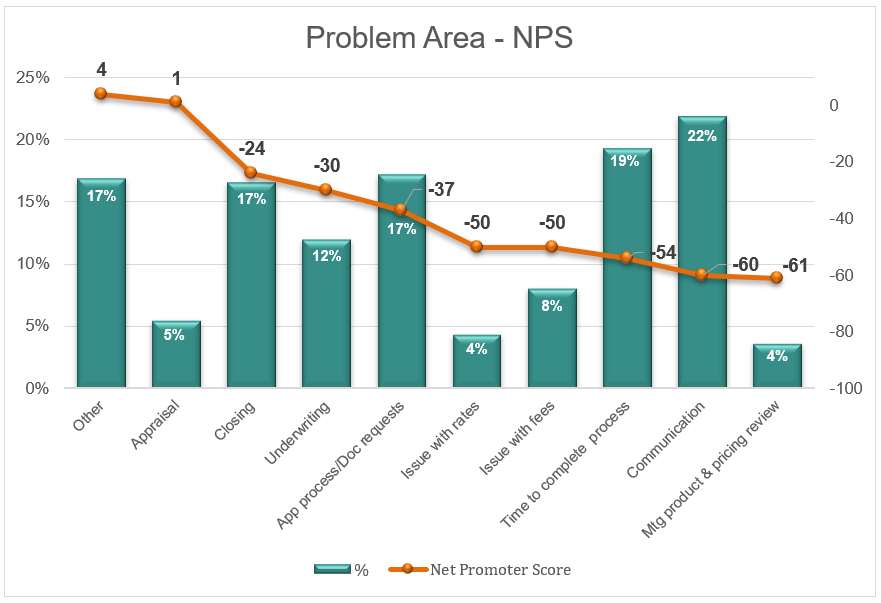

When we ask about their biggest CX challenge going into 2022, lenders consistently tell us it is communication with their borrowers. MortgageSAT borrower data confirms this (see below), with more than one in five problems cited by borrowers tied to communication issues.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group.

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. Furthermore, the industry’s Net Promoter Score (NPS) for mortgage origination, which was trending downward in 2020, continued to fall in 2021 despite sustained low interest rates and an easing of capacity issues.

Why are we having such problems communicating with our borrowers? After much study and countless conversations, it appears that lenders are still thinking about their interactions with borrowers in terms of their own workflows instead of the customer’s journey.

As mortgage automation has matured and taken over more of the work of manufacturing a home loan, executives have peered deeper into their process in search of opportunities to take people and paper out of their process. As a result, lenders know their internal workflows very well and are always working to optimize them.

The problem is that the borrower knows nothing about the lender’s internal workflow and really doesn’t care about it. They see the journey through the mortgage origination process quite differently. They travel from lender touchpoint to touchpoint, either feeling better about the process or more concerned, depending upon the information the lender communicates to them, and that’s assuming the lender does consistently communicate with them.

Every single touchpoint between the lender and the borrower is an opportunity to build trust and strengthen the relationship. When lenders effectively communicate with borrowers, they benefit in many ways:

Communication with the lender is the basis of the customer’s experience. Whether the lender has good communication protocols in place or not, they are already offering their borrowers a baseline customer experience. The question is: is this experience positive, and is it intentional?

Is it the customer experience the lender wants to offer and the borrower wants to receive? The best way to find out is to map out the borrower’s journey and explore each touchpoint along the way.

When the topic of journey mapping comes up, we find executives are worried that we are going to ask them to hire a new team of people to embark on a year-long study. That’s not what we’re talking about.

As part of our work, we help companies pull together teams made up of representatives of each of their departments to begin the work of walking through the process, from the borrower’s perspective and then mapping the touchpoints on huge white boards.

The place to start is always with the existing process and customer experience. This analysis helps determine what the lender is doing well and what parts of the process and the customer journey aren’t getting enough attention.

Being able to see the current reality clearly is paramount to effecting real change. Once the existing map has been drawn, company leadership can work with the team to decide what they want the experience to be.

As our STRATMOR colleague Jennifer Fortier, CMB, often says, the benefit of this exercise is that not only do you discover gaps and areas to improve the customer journey, but at the end of the exercise, you have a documented artifact of your customer journey to continue to improve on over time.

Increasingly, we’re seeing companies appoint an executive, very often in the C-suite, to be responsible and accountable for this process and for the resulting customer journey. Doing so makes it possible to ensure a cohesive, positive experience across the entire journey because a senior executive is there to oversee the cooperation of all departments.

It is very important that the map that comes to light through this work is focused on the customer’s best experience, which may or may not align perfectly with the company’s ideal workflow. Workflows may appear complete from application to close, but gaps may be hiding in the borrower’s journey that degrade their experience.

Another caveat is to be sure to include any negative space in the map, the places where, from the borrower’s perspective, nothing is happening. This is often missed in these exercises and can be a source of hidden gaps in the overall borrower experience.

Finally — remember these are living, breathing documents — no customer journey map is ever “done.” Much like utilizing Google Maps or Waze vs a paper map, the route to an ideal destination changes over time due to construction, weather, and traffic patterns. As the market continues to evolve with new technologies, interest rate changes and consumer expectations, so must our customer journey maps continue to evolve.

At their core, customer journey maps are a powerful competitive tool. By carefully controlling the customer experience offered, the lender sets itself apart from the competition with its own unique “CX signature.” But this only works if the journey map is used to improve the customer experience.

Improving the customer has never been more important. At the same time our business is shifting to purchase money business, consumers are becoming acclimated to customer experience in a digital world. We’re not just talking about the Amazon Effect here. We’re talking about the new way consumers interact with all the companies that serve them.

If a borrower goes online to find their new home and accesses a webcam to view the neighborhood, takes a virtual walk through of the home, then surfs to a lender site to use a mortgage calculator and uses another lender’s POS software to get a prequalification, they begin to feel like the whole process is pretty modern and generally satisfactory.

But once the loan goes into production, everything changes. For many of us, workflows are still based on old processes and our borrowers are often left wondering what is happening and whether they will get financing for their home in time to close their new purchase transaction. Is it any wonder that borrowers become annoyed and confused when they are asked for information twice?

By carefully mapping out our customer’s journey, we can create better experiences for them. But that’s just the beginning. Within this mapping process are a variety of additional — and very exciting — opportunities.

Profit Margin Opportunity

When asked about initiatives for 2022, lowering the cost to produce a loan is on the tip of many lenders’ tongues. And anytime the market is poised for lower volume, this always-important exercise takes center stage.

It cannot be stated strongly enough: mapping the customer experience can result in increased profitability by adding to revenues or lowering expenses. Lenders often discover areas of inefficiency or waste and find gaps that an existing technology solution can solve in a scalable and consistent way. Many see where current or future profits are running off due to a poor experience. Best yet, mapping helps ensure strong pull through, repeat and referral business, increased lead generation from testimonials and proven results gained by an excellent customer experience.

The Diversity and Inclusion (D&I) Opportunity

D&I has been an industry imperative for a few years now, and for good reason. On every level, companies benefit when they bring together diverse teams for the benefit of a broad customer base. A good journey map will uncover weaknesses that may be keeping the company from effectively serving some borrower segments.

It’s important that company leadership take this seriously, given that recent research shows that even sophisticated AI-based technologies can have bias built into their algorithms. By giving the borrower’s journey the attention it deserves and carefully examining the touchpoints, lenders can open the doors to more diversity, both on their own teams and in the borrowers they serve.

The Business Referral Partner Opportunity

During the whirlwind of record refinance numbers, real estate agents and other relationship partners may not have received ideal levels of attention from their lender. These partners are important stakeholders to the borrower journey and customers to the lender in their own right, and lenders should consider mapping out real estate agent journeys as well.

Just like many lenders are planning on gaining more market share, many MLOs are planning on gaining more real estate agent partnerships to fuel their business in 2022 — and most of those will come from those leaving their current lender of choice, generally due to a lack of attention or good service. Now is the time to pay close attention to these important business referral partners and make every touchpoint work for them and their home buyers.

The Recruiting Opportunity

One challenge that lenders have worked hard to overcome for at least two years is recruiting the best people to join their teams. This is another place where a good borrower’s journey map can help lenders stand above their competitors.

You can’t create an awesome customer experience without also improving the experience of the people inside your firm. It’s a natural result. Particularly for loan officers, who know that they will receive more referrals from happy borrowers, this work can be a powerful recruiting tool.

So much of our work in improving the borrower’s experience comes back to effective communication. But like any other tool a lender uses to improve its business, it only works if it can be scaled. Fortunately, it is possible to scale effective communication and still make it seem personal and specific to each borrower.

Video is a powerful tool for this. Generic videos that provide useful signposts and status updates for borrowers can be inserted into the lender’s workflow at appropriate times to respond to borrower journey touchpoints. By seeing a loan officer’s or loan processor’s face on the video, the borrower feels that one-to-one connection, even if the same video is being sent to hundreds of other borrowers at the same time.

Traditionally, these loan status updates were sent via email because studies showed that most borrowers preferred an update through that medium. But things have changed. Younger borrowers prefer text-based updates and often won’t check email. Neither will they answer a phone call, preferring to read the voicemail to text SMS message their phone carrier sends them afterward.

In the middle and then again at the end of the loan origination process, customer surveys, which are a low bar and very affordable, will give the borrower the perception that the lender actually cares about their experience and welfare. And the more feedback you can collect, the more actionable you can make it.

But a well-researched buyer’s journey map will show that top lenders start communicating effectively with their borrowers before they even apply for a loan. Because nine out of ten people find their lender through a personal relationship and the happiest of these are the ones who received a loan officer’s positive reviews from a friend, colleague, or real estate agent, smart lenders are making it easy to find and share these reviews.

It’s very affordable to set up an online destination that displays positive testimonials for each loan officer in your shop. Put their picture beside it and a link that makes it easy to share and you’ve made the first touchpoint in the borrower’s journey a very positive one.

Lenders can’t differentiate themselves very effectively by focusing on products or interest rates. Heavy compliance oversight keeps everyone playing on the same field. The only real opportunity to stand out and to grow in 2022 will be to master the customer experience.

Remember, you already have one. What you must do now is find out if what you are providing is positive and intentional. Are you providing a customer experience by default or by design? Does it represent a unique “experience signature” that lives up to the brand you want to be renowned?

Customer experience impacts every aspect of every business. The only way to ensure that the customer’s expectations are met is to map out their journey and analyze each touchpoint. Because the way we communicate with our borrowers has such an impact on the overall experience, we must be very intentional about every step in their journey to ensure they have the exceptional experience we want them to have.

It’s time to rethink everything about your purchase money buyer’s journey and STRATMOR can help. We know both the technology and customer experience. They both matter now, more than ever. Mike Seminari and Sue Woodard

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.