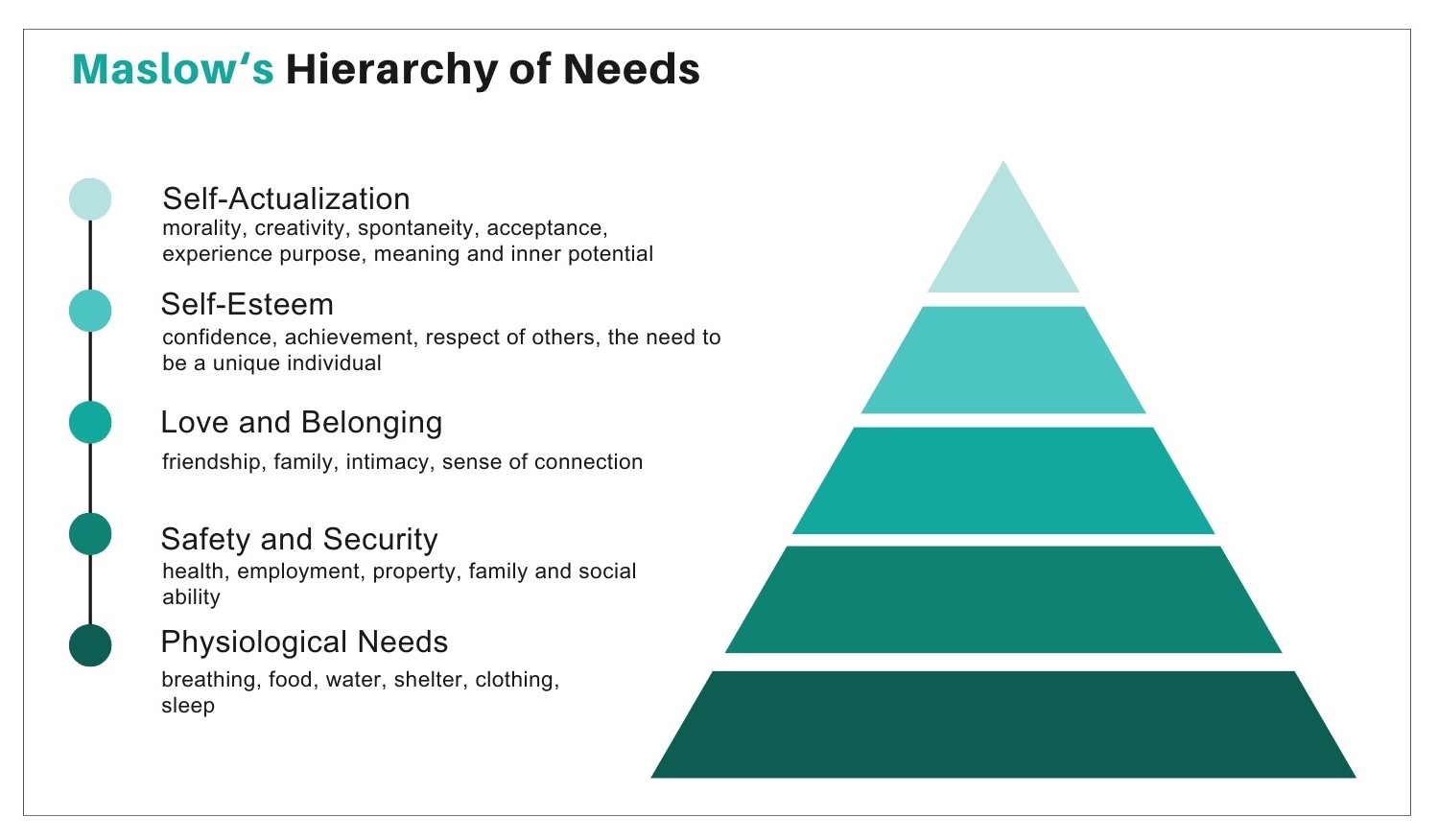

I don’t remember much about my Psychology 101 class from my freshman year in college. I have a fuzzy recollection of concepts like Pavlov’s theory, where dogs drool at the sound of a bell. One of the few things I do remember well is Abraham Maslow’s Hierarchy of Needs:

In Maslow’s view, our basic physiological needs — food, shelter, water, etc. — must be met before we can satisfy our higher needs. Since our most basic need is for physical survival, this will be the first thing that motivates our behavior. Once that level is fulfilled, the next level up is what motivates us, and so on. The key point is that, in human psychology, there is a well-defined hierarchy of needs, with each level serving as a necessary predecessor to the next.

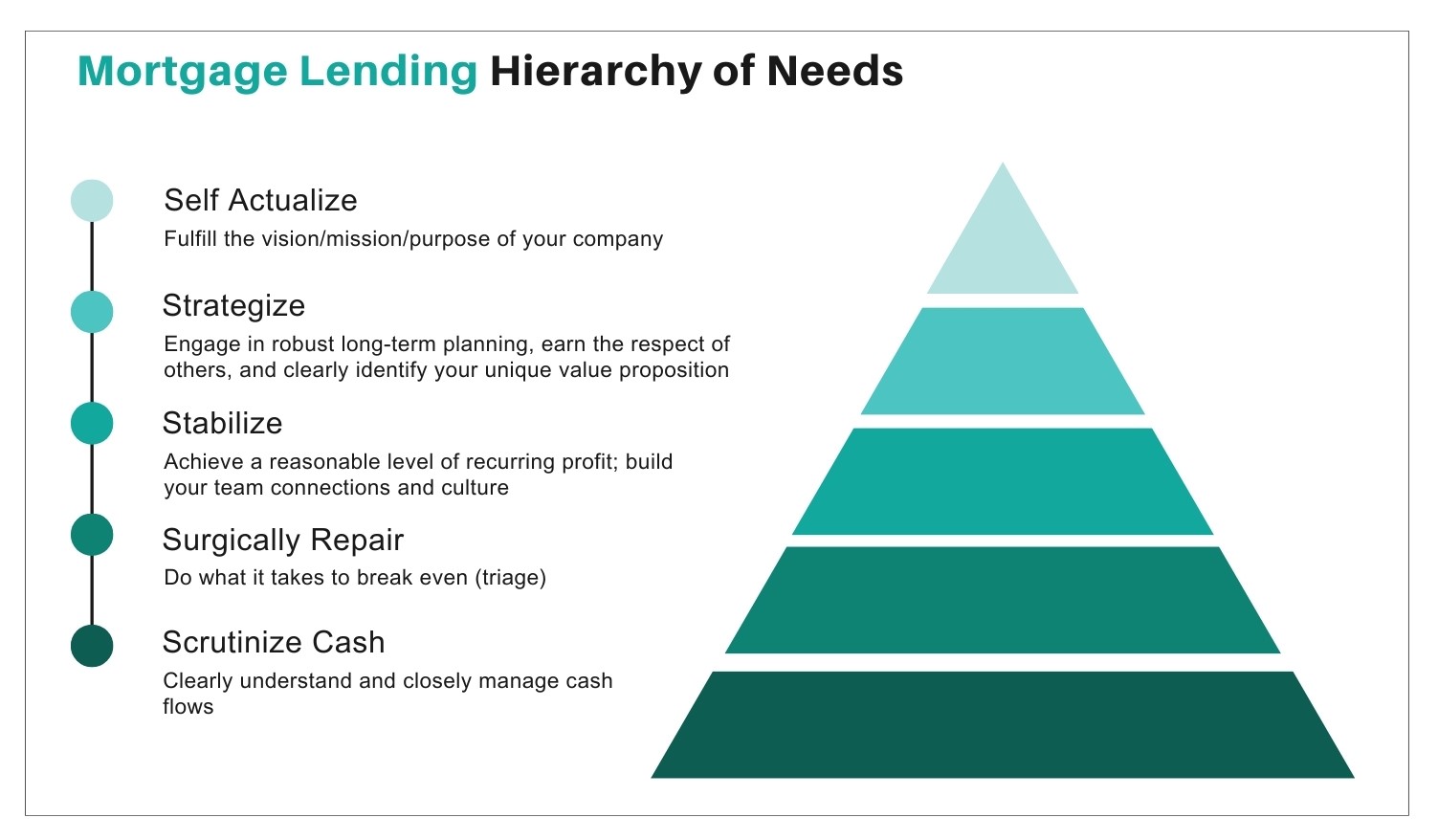

I find myself thinking about Maslow’s hierarchy these days when pondering the state of the mortgage industry. What would Maslow say if he were to create a similar hierarchy to define the different levels of needs for mortgage lenders today? I believe he might create a hierarchy that looks something like this:

Summarizing from the bottom up:

1) Scrutinize Cash – Clearly understand and closely manage cash flows, the lifeblood of any company and the foundation to survival (cash is king!).

2) Surgically Repair – Do what it takes to break even (triage) to build a sense of safety and security in your company’s financial position.

3) Stabilize – Achieve a reasonable level of recurring profit and build your team and culture to create a sense of connection and stability.

4) Strategize – Engage in robust long-term planning, earn the respect of others, and clearly identify your unique value proposition to build your esteem and recognition as an industry leader.

5) Self-Actualize – Fulfill the vision, mission and purpose of your company.

In this article, we will explore the current state of the mortgage industry in the context of this hierarchy.

Like food, shelter, and water is for people, cash is the lifeblood of any company. Nothing else matters to a corporation if it runs out of cash.

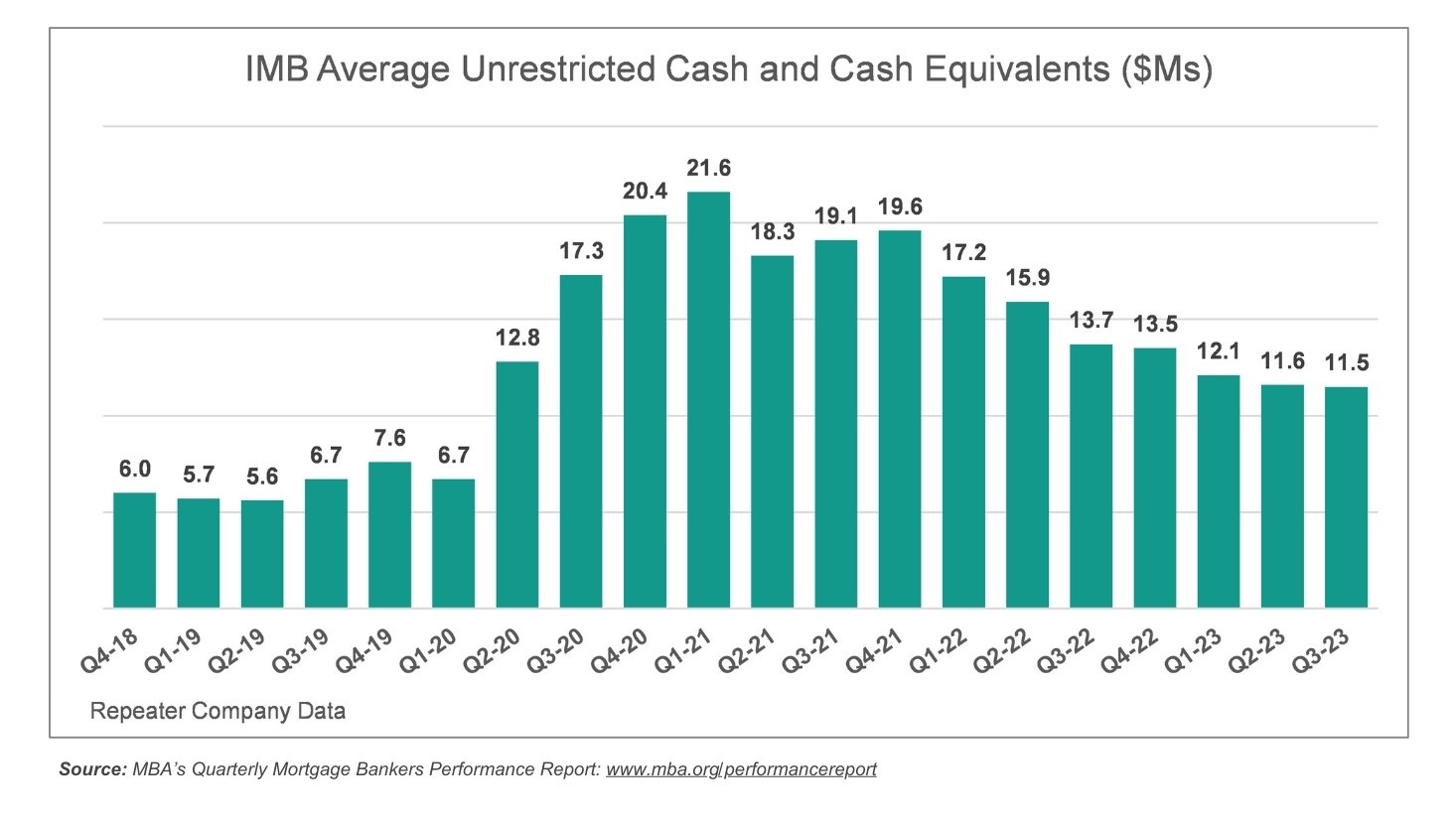

A recent Mortgage Bankers Association (MBA) Chart of the Week paints a picture of average cash balances for a population of mostly Independent Mortgage Bankers (IMBs).

While this data is from IMBs and not banks, it does paint an interesting picture of cash balance trends over the last several years. After bouncing around in the $6- to $8-million range in 2018 and 2019, average cash balances ballooned to the $20-million range during the refinance boom of 2020 and 2021. Companies could afford to think about the stability of the go-forward model and long-term strategies while cash balances were high in 2020 and 2021. The problem was that most lenders simply had no time. They were too busy booking loans! But as Chart 3 shows, cash balances have dropped significantly as operating and cash flow losses have taken their toll. It is important to note that many lenders sold off their servicing portfolios in 2022 and 2023, otherwise the declines in cash would have been much worse.

Cash forecasting is not as high of a priority when lenders are awash with cash. But after a very challenging 2023 and not much relief expected in 2024, lenders must have a renewed focus on cash flow forecasting. And we are mostly talking about IMBs here — depositories don’t have to worry as much about liquidity and capital, although recent bank failures remind us that banks are not immune. As a foundational need, mortgage bankers must ensure that they have a robust mechanism in place to forecast short-term, intermediate, and long-term cash flows. And coming in a close second is the need to get razor sharp with financial and operational reporting and monitoring of key performance indicators (KPIs). Mortgage bankers must be highly skilled at examining both costs and performance across a variety of dimensions, including fixed versus variable and breakeven-point analyses.

And finally, for IMBs, making sure to stay on top of cash means staying close to your warehouse banks. Keep them in the loop on plans and notify them in advance of any issues or problems. Full transparency is paramount. If the banks know that IMBs are fully aware of cash flow issues and have a credible plan to solve them, that goes a long way.

1) How effective are our actual and predictive cash management protocols and are we proactively taking actions based on this information?

2) Are we tracking the right KPIs to tell us the full financial and performance story across all divisions of our company?

Individuals need to find stability in meeting their basic physiological needs before they can successfully attain the things that bring a sense of safety and security — stable relationships, employment, etc. Similarly, for mortgage lenders, once they have a good handle on their cash status, they’re able to focus on doing what they can to repair and stabilize their business to break even.

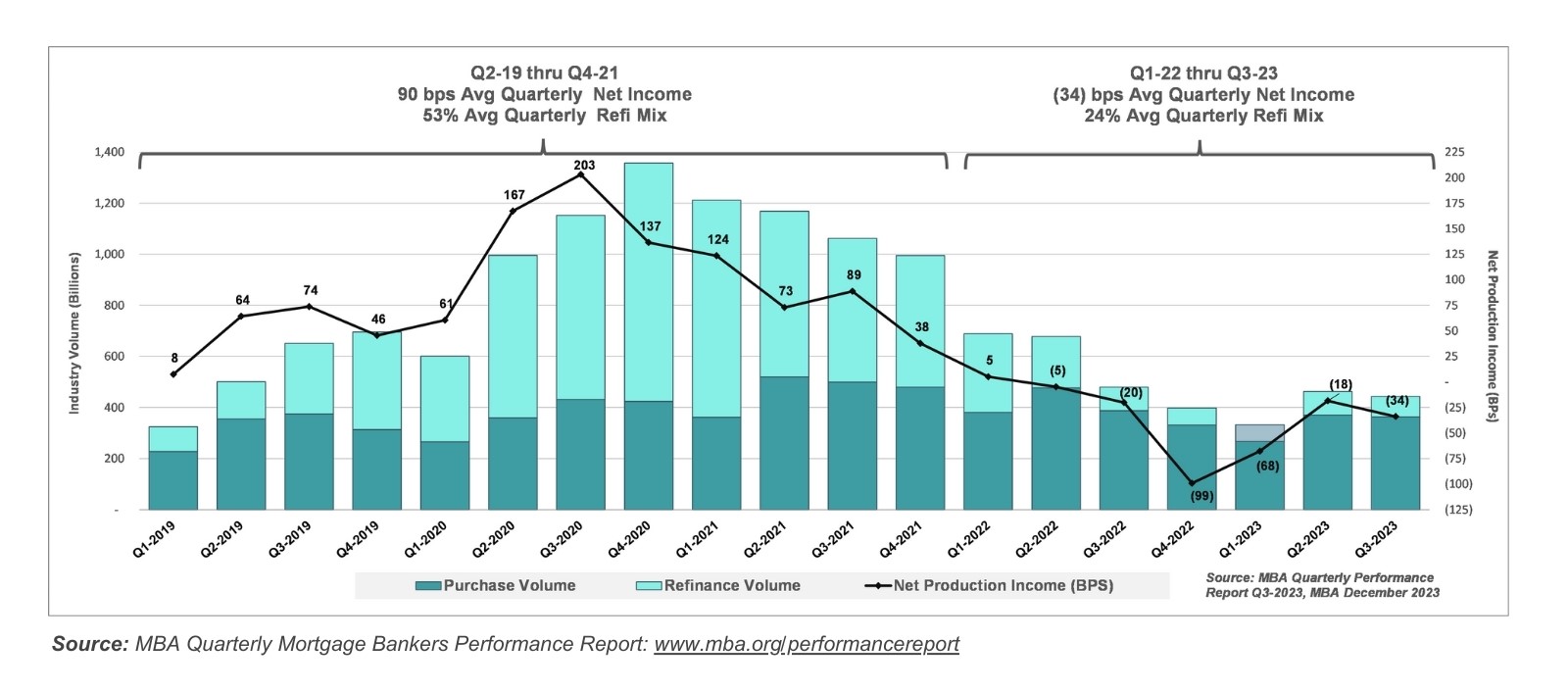

In this second level of the Mortgage Lending Hierarchy, lenders must take bold steps to stem the tide of red ink on the production side of the business (excluding servicing). Recent performance data from the MBA’s Quarterly Performance Report suggests that most lenders are in this category today.

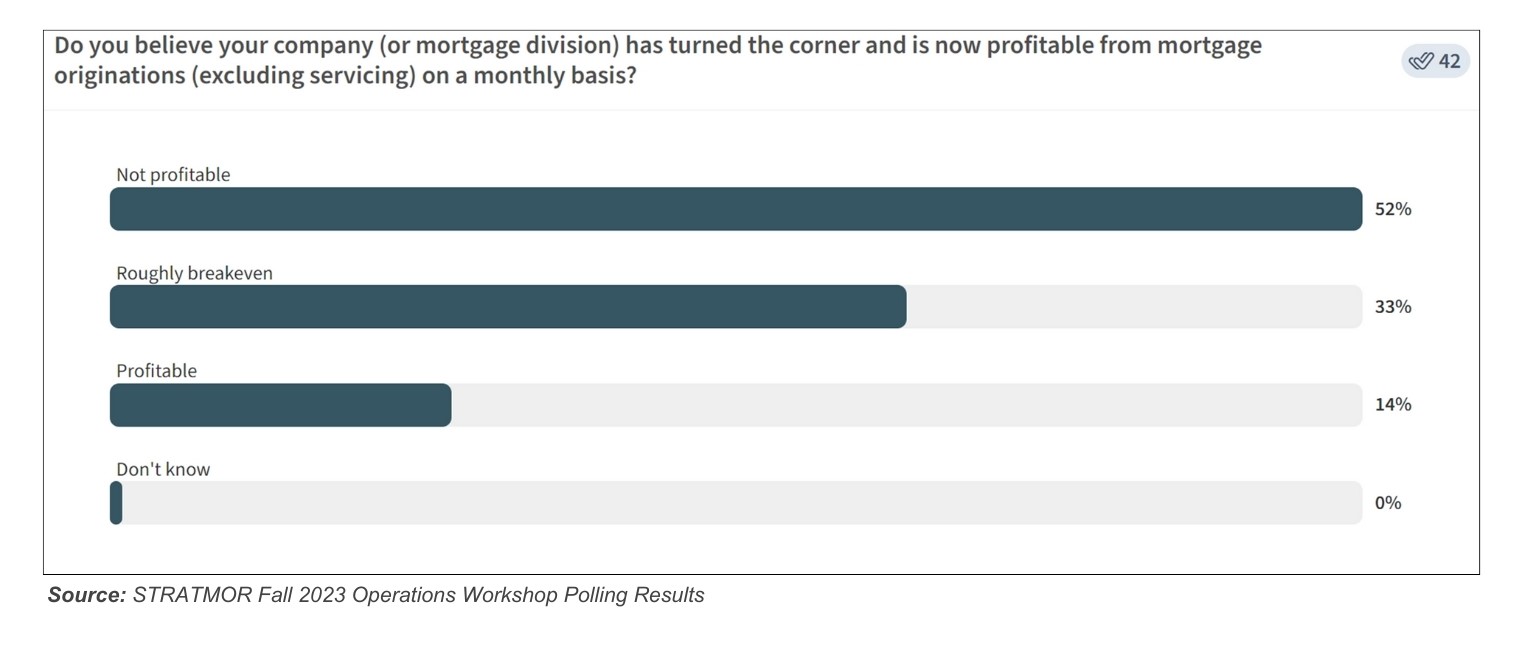

If losses come in as expected in Q4-2023 and Q1-2024, that will signify eight quarters of losses in a row for this large sample of more than 350 IMBs. It has been a rough two years, and a large percentage of lenders are still not making money on production. This is further reinforced by a recent poll of mortgage executives attending STRATMOR’s semi-annual Operations Workshop.

At the time this survey was conducted last fall, approximately 85 percent of operations executives believed that their company was either not profitable or was roughly breakeven from production.

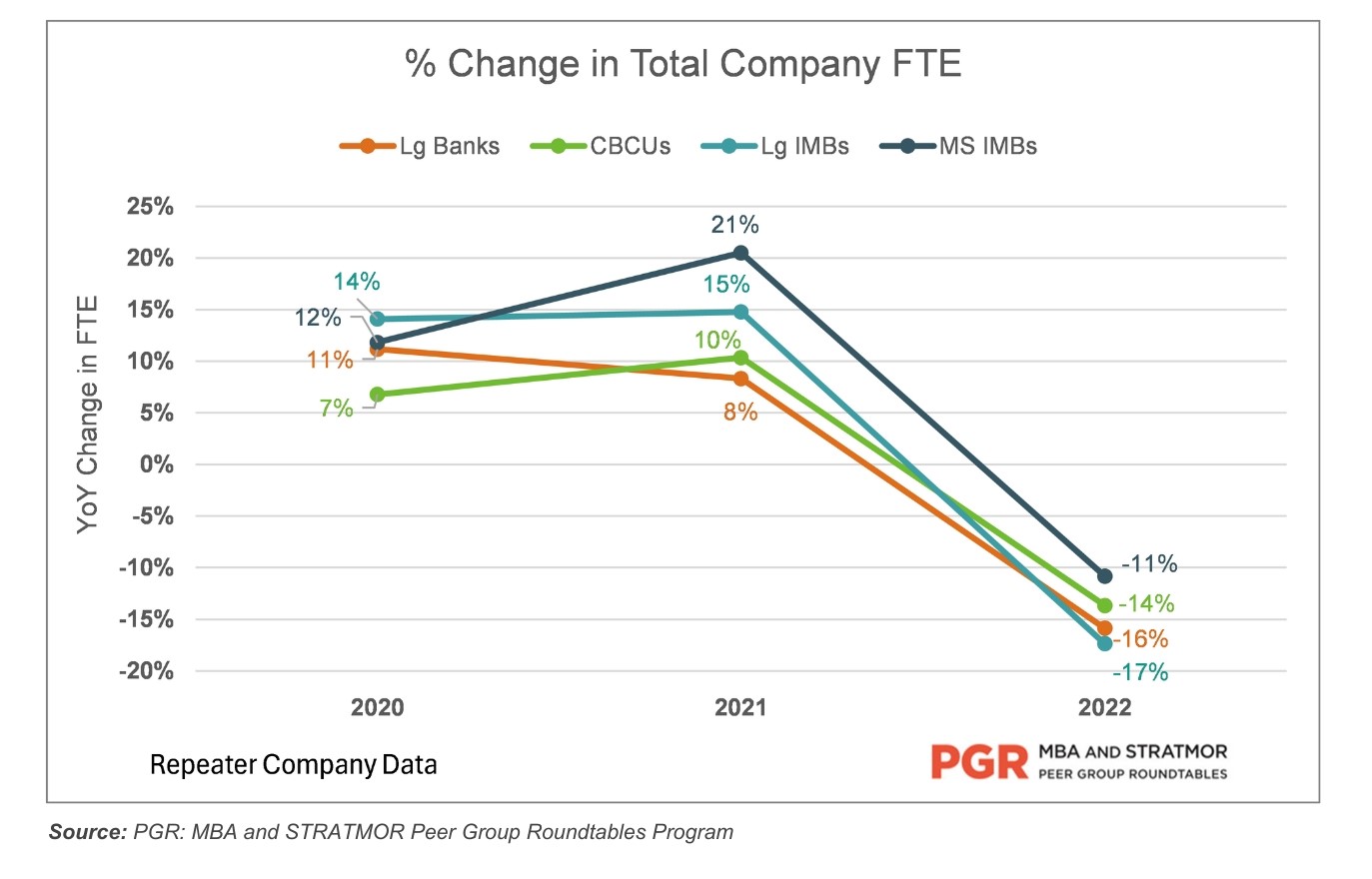

We often tell our clients to keep the main thing the main thing. Labor costs are by far the largest category of expense for lenders. As lenders cut costs, the largest component has in fact been through reductions in staffing.

Both bank and non-bank lenders of all sizes moved aggressively to reduce staff in 2022, and the first-half-2023 data (not shown above) reflects continued significant staff reductions.

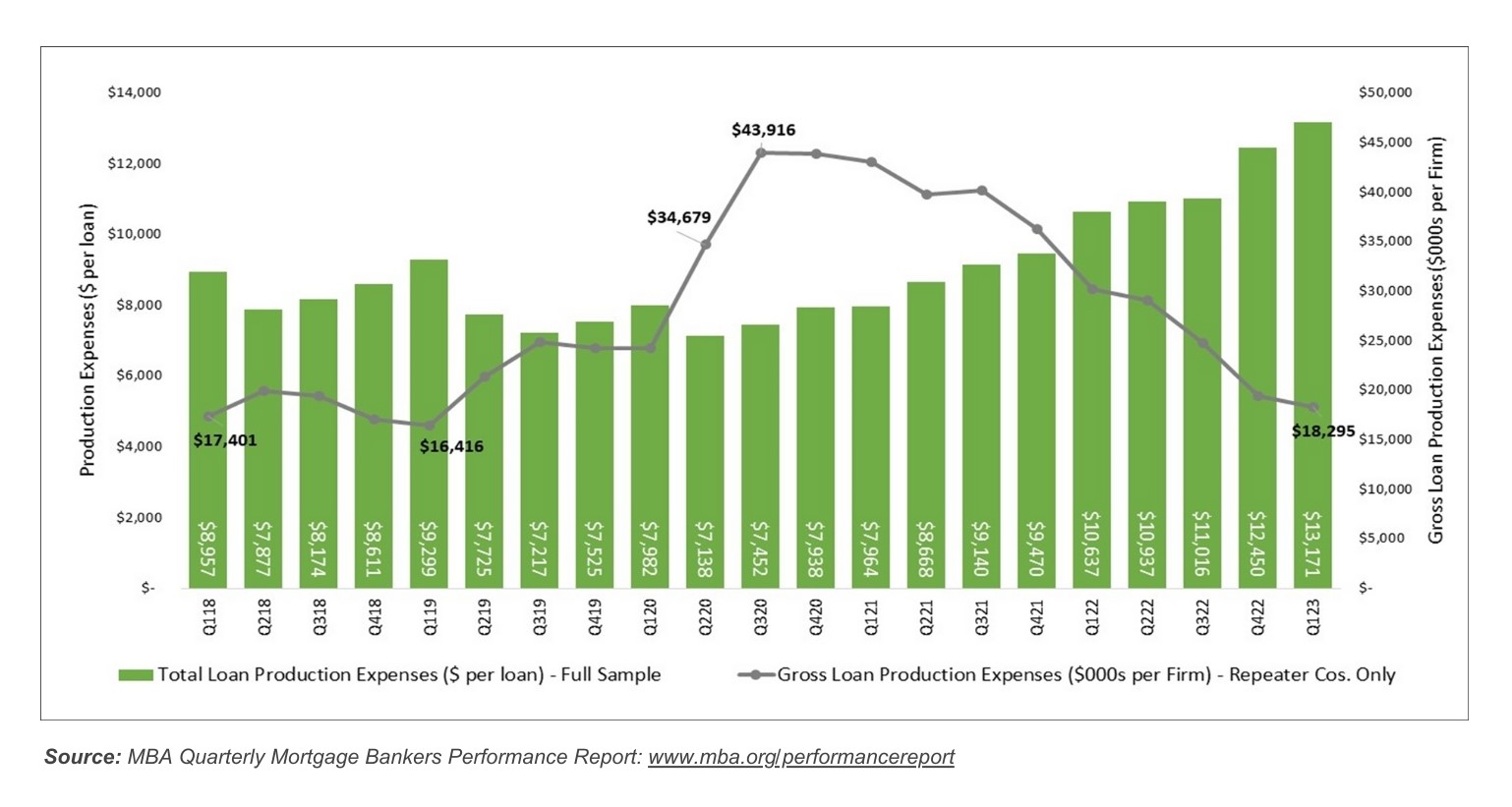

While mortgage bankers have been aggressively cutting costs, and especially labor costs, it has not been enough to reduce production expense per loan as shown below.

While lenders in this sample have made massive cuts to gross production expense from $44 million in Q3-2020 to $18 million in Q1-2023, the cost per loan has increased to over $13,000 per loan, as loan production units dropped off dramatically during that period.

As we head into 2024, it is clear we still have excess capacity and lenders must continue to be disciplined and aggressive in managing staffing levels. We recommend employing sophisticated staffing models using realistic production assumptions and productivity estimates supported by industry benchmarking data such as the MBA and STRATMOR Peer Group Roundtables (PGR) program. We also find that forced ranking staff — which calls for ranking employees into groups based on their performance—based upon a multi-faceted scorecard (not just productivity) is a key to success. With forced ranking in place, when it’s time to reduce staff, lenders will have already identified where cuts should be made.

While labor is the top priority and should be the primary focus, there are many other opportunities to reduce costs. Some of the more significant areas include:

Occupancy costs – given the hybrid work model, there are numerous opportunities to reduce current lease costs and future obligations.

Contracts – a complete review of all vendor contracts is incredibly important.

Technology – while technology that is effectively leveraged to increase productivity and reduce costs is a good thing, lenders should weed out plug-ins and components where there is a high cost and low adoption. While increasing adoption is ideal, if management does not believe that increasing adoption rates is realistic in the short run, many are cutting bait.

Of course, there are a multitude of other cost cuts that lenders can pursue, too numerous to delve into in this article.

1) Have we conducted a comprehensive compensation analysis to ensure that we are competitive with the marketplace, our compensation strategy includes performance goals and accountability, and we’ve adjusted how we compensate to optimize engagement to achieve these goals?

2) Are we still hesitant to make necessary staff reductions, with a keen focus on eliminating non-performers?

In Maslow’s hierarchy, once individuals have their basic safety and security needs met, they can begin to form meaningful relationships and a sense of connection, a crucial step in the journey toward self-actualization. Similarly, this level of the Mortgage Lending Hierarchy is all about building a sustainable and performing production model. At this stage, lenders are not in triage mode, but instead are embarking on a disciplined march down the path of improved profitability and a sense of stability. It is imperative that lenders become solidly profitable on production, independent of servicing, compared to peers. Once that happens, lenders will be on a solid foundation to move into the “Strategize” level of the mortgage hierarchy. Also, this stage is the ideal time for lenders to build team connections and culture. Stable profits and a stable team are important building blocks needed to support strategy development.

Many of the same principles discussed in the “Surgically Repair” level of the hierarchy still apply here. Establishing benchmark targets on cost and productivity is critical to building budgets and forecasts. When forecasting, lenders must ensure that they are profitable at today’s volume, not where they hope volume will be. As of this writing, while there are some signs of hope driven by recent rate drops, this has not translated into material amounts of new business. It is well documented that mortgage volumes are off due to a lack of supply of homes for sale, a historically high percentage of cash sales and affordability challenges.

In our client roundtable meetings, most lenders insist that they will gain market share — which of course is mathematically impossible. As a baseline, lenders should forecast based on stable market share, and any market share gains would be additive. In the base case, lenders should assume that loan volumes will rise and fall in lockstep with overall market trends for purchase and refinance transactions. For example, if market volumes are expected to increase by five to ten percent, lenders should budget for increases in that range, and not any higher, absent major events like an M&A transaction. The key here: lenders should make sure they can forecast a reasonable profit with no market share growth. If market share gains are achieved, that would be the icing on the cake. We often see lenders increase their forecast based on bringing on a large production team, but they fail to account for the likelihood that one or more of their current team members will get recruited away.

In this “stabilization” stage, it is important for lenders to stay the course on revenue enhancement strategies and tactics. This would include optimizing revenue across major categories such as:

STRATMOR works with clients to identify and prioritize opportunities for revenue improvement in these and many other areas.

Veteran mortgage bankers understand that there are innumerable tactics that lenders can deploy to continue to reduce costs. As discussed above in the “Surgically Repair” level of the Mortgage Lending Hierarchy, cost reduction tactics may include but are not limited to:

STRATMOR certainly has a lot to say about cost and efficiency, but that could be the subject of another article. Suffice it to say that the “Stabilize” stage of the hierarchy entails measuring, prioritizing, and tactically addressing a variety of cost saving measures. There are no shortcuts here, but plenty of opportunities.

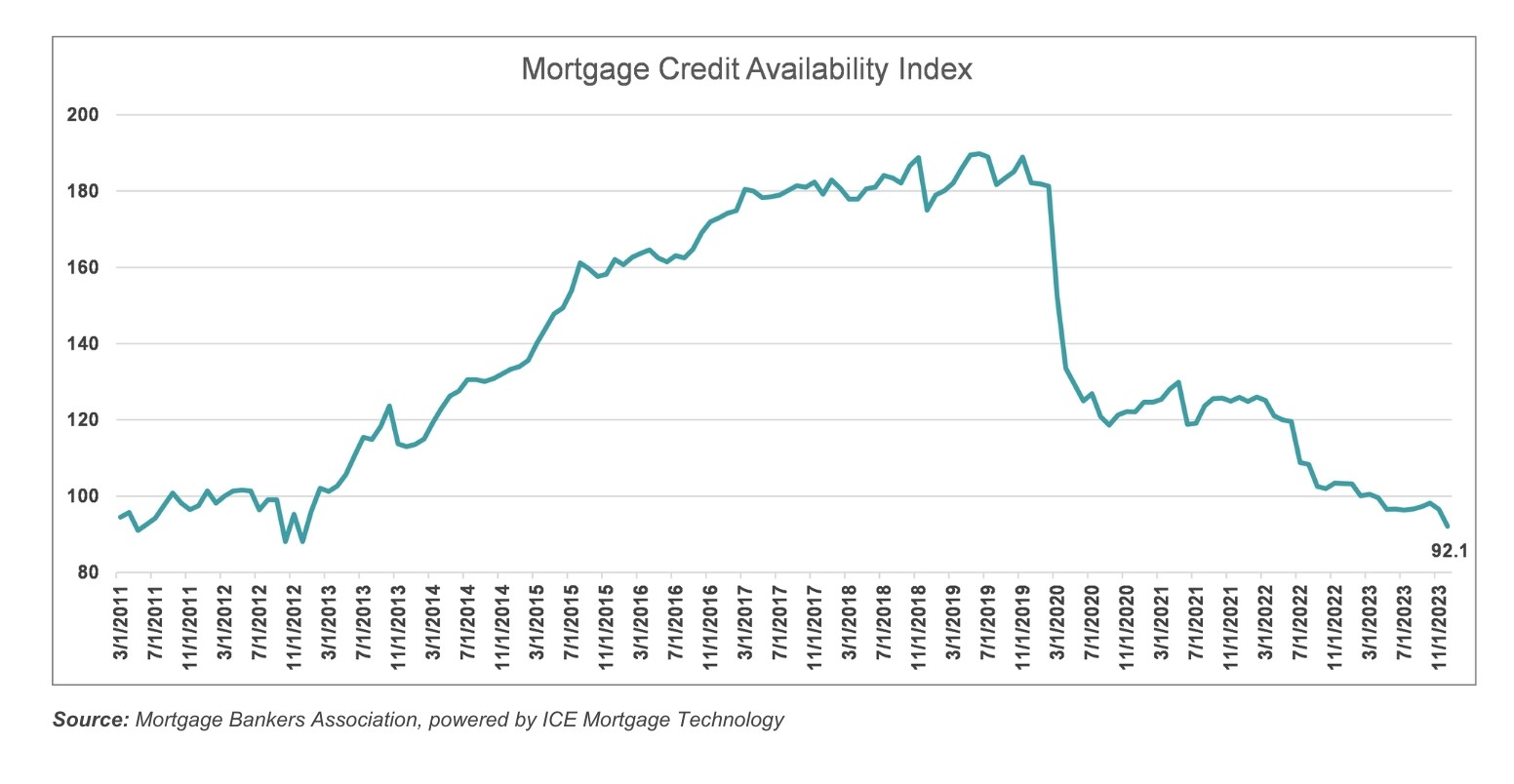

As lenders seek to operate a production model that can consistently earn peer-level net income, keeping things simple is a good idea. This is certainly true when it comes to the depth and breadth of product offerings. When looking at new products or product features, lenders must weigh the potential incremental volume and revenue versus the operational complexity and additional cost. The market trend toward simplification is illuminated by the Mortgage Credit Availability Index (MCAI) data from the MBA:

After steadily rising from 2012 to the outset of the pandemic, the MCAI dropped sharply, then held steady from 2020 to early 2022 but has since drifted downward as lenders struggled to remain profitable. After the recent release of the latest MCAI, Joel Kan, Vice President and Deputy Chief Economist at MBA, said, “ongoing industry consolidation is resulting in more loan programs being removed from the marketplace.”

Lenders that are struggling to earn consistent profits under their existing model should stay away from major initiatives such as:

Major Acquisitions – Lenders that are not able to earn consistent profits are more likely to be sellers than buyers in this market environment. While growing the business organically via thoughtful additions of branches and originators is fine, it is a risky move to try to acquire a large lender. Our M&A team is very busy providing expert advisory services for several buy-side and sell-side transactions, as one would expect in the current market.

Introduction of Significant New Products – As loan volumes decline, lenders often look to offer new products like Non-QM and Reverse mortgages.

Opening New Origination Channels – If a lender is not currently profitable in its primary channel, it does not make much sense to attempt to enter a new channel.

Large-Scale Technology Overhauls

Once lenders have stabilized and are consistently profitable, they can thoughtfully consider executing one or more of the above strategies. That’s what the next stage of the Mortgage Lending Hierarchy is all about.

1) Are our revenue enhancements working as planned and how do we know? Which metrics are on target, and which need our attention?

2) Are we asking our customers about their experience? What are they saying? Have we “secret shopped” our team to experience this through our customers’ eyes?

It is at the fourth stage in Maslow’s Hierarchy that individuals start to feel a sense of dignity and self-worth and begin to desire respect and inclusion from others. Once lenders have demonstrated that they are squarely in the black, earning solid production net income month after month and quarter after quarter, the same sense of self (confidence in the company’s status) and desire for success allows them to shift their focus to thinking more strategically.

This stage entails the establishment of a clear understanding of shareholder objectives, mission, vision, and values, and the assessment (existing) or the formulation (new) of a target operating model. Senior management must be able to articulate key objectives such as desired returns, risk tolerance, investment horizon and exit strategy, if applicable. While some might view a planning exercise as theoretical, it is extremely important to ensure that there is a “North Star,” and all employees and management are driving toward the same outcomes. It is too easy for management to lose sight of long-term strategies and opportunistically pursue strategies that are not consistent with the company’s long-term vision. At this stage, it is all about “knowing thyself” and sticking with it. In our volatile industry, that can mean giving up some upside to build a company that can survive in down markets.

At this level in the hierarchy, lenders may consider major strategies such as:

Servicing – Does the Mortgage Servicing Rights (MSR) asset align with corporate goals in terms of risk, return and volatility? If the company decides to retain servicing, should servicing be done in house or by using a subservicer?

Channel Mix – Would entry into new production channels be in alignment with long-term strategy? Does the lender have the requisite core competency? Should the company build out internally or buy the capability?

Products – Based on the agreed upon strategy, management could consider adding new product categories such as Non-QM or Reverse.

Technology – Management may thoughtfully consider larger scale technology changes such as an LOS or POS conversion or perhaps leverage AI in certain key areas of the business. The company should fully understand the risks and rewards of relying on outside vendors for certain mission critical activities.

Buy-Side M&A – As management considers long-term growth targets and geographical diversification plans, they might consider acquiring another originator. Our team is busy helping lenders on this front, with several deals in process.

It’s all about building the company to reach the final stage of the Mortgage Lending Hierarchy.

1) How do we define success and how will it be measured? Is our current composite of KPIs the best way to measure the success of our strategic plan?

2) Do we have an effective plan to engage our entire company in executing this plan? Everyone in your company should be engaged and accountable for our success.

Just like with Maslow’s hierarchy, this is the final stage and the pinnacle for mortgage lenders. Of course, this is a theoretical construct, and most lenders would be hard pressed to ever say they are “done.” In fact, Maslow believed that few people reach the level of self-actualization and stay there, but we can all have peak experiences. Lenders must stay the course and manage through ever-changing market conditions. STRATMOR has clients that we would consider to be in this stage. But they still manage cash carefully and work to enhance and optimize revenue while being ever mindful of expense management.

Upon reaching this stage, and every stage for that matter, management should celebrate the wins. Building a company that achieves long term goals means helping families buy homes, helping employees achieve their goals and giving back to the communities in which the company operates.

1) Has our Vision, Mission, and Purpose changed? Have we been successful in evangelizing these important cultural statements to employees, customers, and our industry?

2) Do we know our “Why” as a company and as leaders of this company?

No matter where lenders are in the Mortgage Lending Hierarchy, STRATMOR can help.

Strategic Planning – STRATMOR works with lenders to help them along the path to the top of the mortgage pyramid — self-actualization at the company level.

Program Management — We work with lenders on change management and operational review engagements that include some combination of people, process, and technology improvements.

Mergers and Acquisitions – Our team is actively working with several clients on buy- and sell-side engagements.

PGR: The MBA and STRATMOR Peer Group Roundtables Benchmarking Program. We work closely with the MBA on the PGR which is the most comprehensive benchmarking study in the industry. STRATMOR leverages the aggregate data to benchmark lender performance versus peers, which is an important foundational diagnostic tool in our consulting engagements.

MortgageCX – Industry-leading customer satisfaction programs. We have received over one million borrower survey responses to date and have incredible data regarding the drivers of satisfaction and can generate scorecards for management and staff. STRATMOR leverages this data to drive changes that measurably improve customer satisfaction.

Compensation Connection® Study – Annual compensation study covering all the common mortgage banking positions, with breakdowns of base and variable compensation structures.

Technology Insights® Study (TIS) – The TIS represents the most comprehensive data on the mortgage banking tech stack, including a Digital Innovations module.

Knowledge Sharing – This includes our Workshop program which enables participating companies to generate profit improvement ideas through discussions with STRATMOR experts and peers.

In strategic planning engagements, STRATMOR often advises clients to start with long-term strategy and target operating model first before tackling specific initiatives and tactics to achieve the desired strategic objectives. However, in today’s environment, lenders that are losing money from production must focus on shorter-term tactical measures to claw their way back to profitability. No strategy can be implemented if you bleed out — getting back to consistent profits should be the goal. Once lenders have demonstrated that they are squarely in the black and generating consistently positive cash flows, they can then transition to identifying and executing longer-term strategic plans.

Our outlook for 2024 is cautiously optimistic. We see the pace of consolidation quickening in the first and second quarters, followed by a modest rebound in profits during the spring and summer. We see many lenders moving out of the bottom two levels of the hierarchy to adopt a more strategic mindset as they progress to ultimate self-actualization!

*Some Caveats: The Mortgage Lending Hierarchy described in this article is a view of the continuum in the industry as compared to Maslow’s Hierarchy of Needs. It is clearly an oversimplification, as lenders don’t neatly fall into one bucket or another. For example, just because a lender is not consistently profitable, does not mean that they can’t pursue ANY long-term strategies. Or if a lender is in the “Strategize” phase, of course they will continue to manage the business at a tactical level. There is also a significant difference between depositories and IMBs when it comes to this hierarchy. The bottom two levels of the hierarchy are not as clear cut for banks for the following reasons: 1) Liquidity – As depositories, banks are not as focused on cash flows and liquidity, certainly not to the extent of IMBs who must think about making payroll and ensuring that their warehouse line relationships are solid; and 2) Financial Reporting – Production profits of the mortgage division often include net interest spread on loans held for investment (portfolio), thus some banks may not have the same sense of urgency to improve profitability from mortgage production. Jim Cameron

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.