In our consulting practice at STRATMOR, there are recurring themes that our clients tend to approach us about in terms of improving their businesses. Many can be summed up with the following question: “Am I missing out on the latest technologies?” usually followed by a comment like, “I see all the articles about the large industry players investing in various technologies, improving the process so that this complex mortgage transaction can be reduced to a few simple steps, or finally breaking through with dramatic cost reductions in the fulfillment of loans, and I want to make sure that we’re on the right path.”

Often, this question is asked in terms of some aspect of automation or “digital mortgages,” loosely defined.

It’s not surprising that mortgage company executives and managers are asking this question. We know that there is a strong interest in process improvement which is reflected in the great participation in our operations, customer experience, and consumer direct workshops. The likelihood of lower volumes in the next few years due to the burnout of refinance opportunities, which will put pressure on profits and a premium on efficient operations, is driving mortgage bankers to look at how they can best earn income and spend their dollars. Add in worries about not being part of the latest technology trend and more than a few lenders start looking under the bed for the bogeyman.

The term “FOMO,” or “Fear of Missing Out” refers to “the feeling or perception that others are having more fun, living better lives, or experiencing better things than you are.” Like most phobia, there is the suggestion that the fear is not totally rational.

While some lenders may not relate to the idea that others are “having more fun” (although if mortgage bankers weren’t having fun, would so many people stay in it for their entire careers?), the idea that other mortgage bankers may be experiencing better things (like breaking the code on a wonderful new technology or process) seems to be right on point.

But that’s not where the real bogeyman is hiding. The reality is that lenders need to spend less time worrying about missing out on new technology and concentrate more on giving technology context through process and adoption. Failing to make this important shift means that they will never enjoy a suitable return on any new technology they implement.

STRATMOR has tracked technology spend per loan for more than 20 years as part of our collaboration with the MBA in the PGR: MBA and STRATMOR Peer Group Roundtables Program. Over time, it has been difficult to see much, if any, correlation between technology spend and either lower fulfillment cost per loan or higher net production income for banks or independents.

According to PGR data for 2020 and 2021, total technology spend, including direct production technology costs as well as enterprise support costs, averaged in the 8% of total cost range, although the range from lowest to highest percentage is large — from 2% to 23% in the most recent six months for the Large Independent PGR subgroup. Also, fulfillment cost per loan, which has been in the $1,500-$2,000 per loan over the last few years, represents only 20-25% of total, fully allocated origination costs. The potential for dramatic changes in cost per loan or per-loan profitability from reductions in fulfillment cost is constrained by this fact.

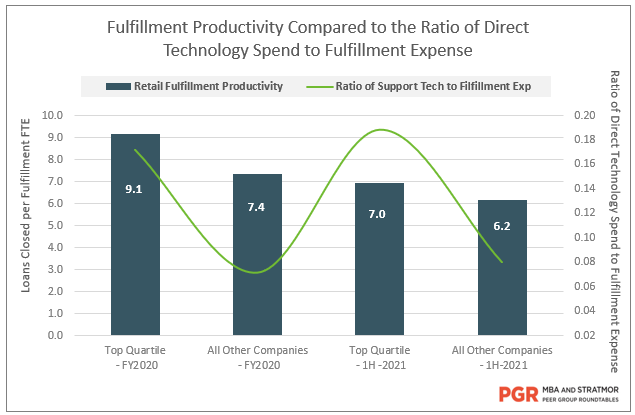

However, PGR data for the Large Independent retail channel subgroup does appear to show a developing positive correlation between technology spend and productivity expressed as closed loans per fulfillment FTE. The following chart highlights this emerging trend.

Chart 1

The chart suggests that companies with a higher technology spend as a percentage of overall fulfillment expense are experiencing higher fulfillment productivity than lenders spending less on tech. Also, the impact of lower volumes in 2021 was interesting. It appears that the higher tech-spend lenders were not able to adjust staffing as quickly as would have been needed to maintain the very high productivity levels of 2020. The lower tech-spend lenders experienced a lower percentage decrease in productivity. So, the jury still may be out on the long-term trend of this metric.

Further, we are not able to ascertain any correlation between technology spend and production profitability in the retail channel at this point.

How can this be? Lenders spend millions on technology to gain efficiencies and earn higher profits, but the data says the correlation is weak or non-existent. Are technology investments immaterial or is there some other factor at play? We would argue that seeing a return on technology investments comes back to context and process.

If there were a technology magic bullet, the provider of that ammo would likely be the most successful mortgage software company on the planet. Over the years, our Technology Insights® Study has identified those providers with a significant market share and high customer satisfaction, and several providers do very well in capturing share. However, our practice experience suggests that no technology in isolation can provide a “magic bullet” impact, whether in efficiency, cost, or customer experience.

That is not to say that mortgage banking firms don’t need to stay current and aware of what is going on in terms of technology and process and continue to embrace improved technology within their companies. A healthy concern about the competition is a key ingredient to staying sharp and improving operations. For example, meeting the customer in the manner of their choosing — whether in-person, by phone or online — the front end of the digital process has become table stakes in terms of customer experience, which can’t be ignored by lenders of any size.

But focusing the lender’s energy on identifying the best possible technologies is actually less critical than focusing on the people who will adopt and use the tools inside the lender’s enterprise and the process by which they will use these tools to add value to the borrower.

We have observed many instances where a strong, focused staff can overcome somewhat inferior technology, but few or no examples where a weak team can effectively deploy the newest technology well.

Rather than being cost-free, technology can add additional burden to the organization. Not only do time and resources need to be expended in the search process, but ultimately the vendor must be paid, and the new technology will require focused implementation resources, support and maintenance resources, training resources, and vendor oversight. So, to determine whether there is an actual benefit to adopting new technology, the total cost of deployment and adoption must be weighed against cost savings, added revenue or the expectation that additional capacity without the addition of FTEs has been put in place. The technology also must fit the company’s strategic approach and objectives.

The secret sauce for successful companies is very rarely (if ever) about finding the best possible technologies to employ and more often in the areas of organizational structure and planning, people and process (execution).

Rather than expending energy worrying about keeping up with the Joneses, we suggest that mortgage bankers work on developing an improved framework around technology decisions and implementation.

As my colleague and STRATMOR Principal Jennifer Fortier, CMB, describes it, mortgage bankers must work on becoming a “different kind of company,” one in which the focus is on how technology fits in meeting business objectives, rather than worrying about missing the latest technology breakthrough. Business objectives can differ greatly from company to company — a firm with a focus on high-touch customized loan products will have substantially different criteria than a more production-oriented shop focused on conventional, fixed rate agency-eligible loans.

The characteristics of that new kind of company include:

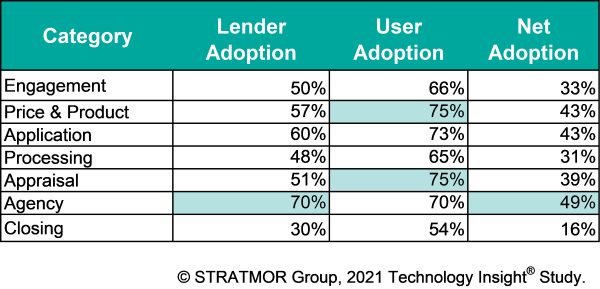

Chart 2

Don’t just buy the technology. Be the kind of company capable of working toward full adoption and implementing process change that will enable the best use of the technology. Follow through with the implementation for enough time to make sure that it is optimized and achieves the intended goals, and that adoption across the company is high.

And don’t forget about the other side of the equation — revenue. Even minor tweaks to pricing or fee structures can have benefits which are at least as powerful as cost savings via use of technology, and marketing and business development is at the heart of revenue generating volume.

Lenders that focus on their people and process first will see a greater lift from any new technology they implement, regardless of whether the Joneses are using it. STRATMOR continues to observe the benefits of having an intense focus on the people and process aspects of technology adoption at our clients’ shops — making sure that existing technology investments are being fully utilized and integrated into the process, and that new technology will work well for the client.

So, sleep well, mortgage bankers. Get those structures in place and don’t worry quite so much about missing out. Remember, the goal is profitable operations through all business cycles, not chasing after technologies that you perceive other lenders are deploying. Tom Finnegan

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.