In last month’s article, “Checkmate or Checkpoint? Rethinking the Role of Mortgage Servicing,” we challenged the traditional view of mortgage servicing as a passive, back-office function, and explored how servicing is becoming a strategic lever for borrower engagement, operational strength, and long-term growth. In this follow-up article, we shift from strategy to execution: how can servicers turn that strategy into action amid rising digital expectations, regulatory flux, and MSR volatility?

The narrative has shifted: servicing is no longer just about compliance and collecting payments—it’s about turning operational execution into a strategic differentiator. Lenders must now modernize legacy infrastructure, engage borrowers through digital channels that meet their heightened expectations, and find new ways to create value from every servicing touchpoint.

But these transformations don’t happen overnight. They require thoughtful planning, a reimagined operating model, strong partnerships, and a willingness to challenge entrenched assumptions about people, processes, technology, and performance metrics. At this stage, the risk of getting it wrong could be devastating.

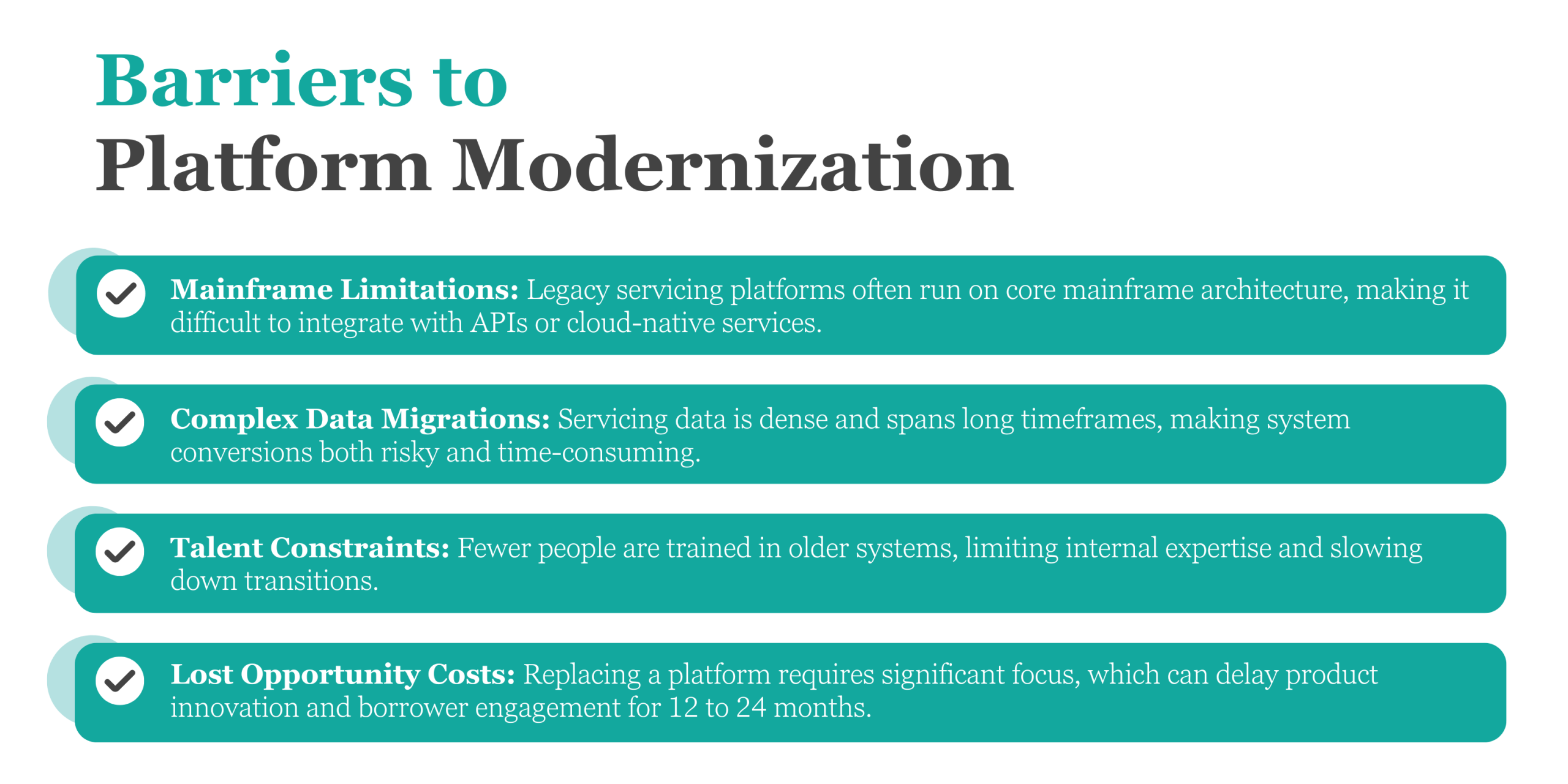

For many mortgage servicers, legacy core servicing systems remain the bedrock of operations. While these platforms are reliable for compliance and investor reporting, they weren’t built for today’s digital-first, borrower-centric world. Most are mainframe-based, difficult to integrate with modern tools, and often rely on rigid, hard-coded workflows that limit flexibility. Replacing these systems can be daunting, requiring extensive data migrations, personnel retraining, and risking operational disruptions during transition periods. But sticking with the status quo comes at a cost: missed revenue, rising borrower dissatisfaction, and mounting regulatory pressure.

To bridge the gap, servicers are modernizing in two primary ways. Some are going all-in on new cloud-native platforms with configurable architecture and API-first designs. Others are taking a modular approach—augmenting legacy systems with middleware, microservices, and third-party APIs, improving borrower experiences, reporting, and compliance without a full system replacement. Regardless of the path, success hinges on a refreshed operating model, proactive change management and investment in talent. Upskilling existing servicing teams to handle data analytics, vendor integrations, and borrower communications is critical. Without the people and process layers aligned to the target operating model, technology transformation efforts often stall.

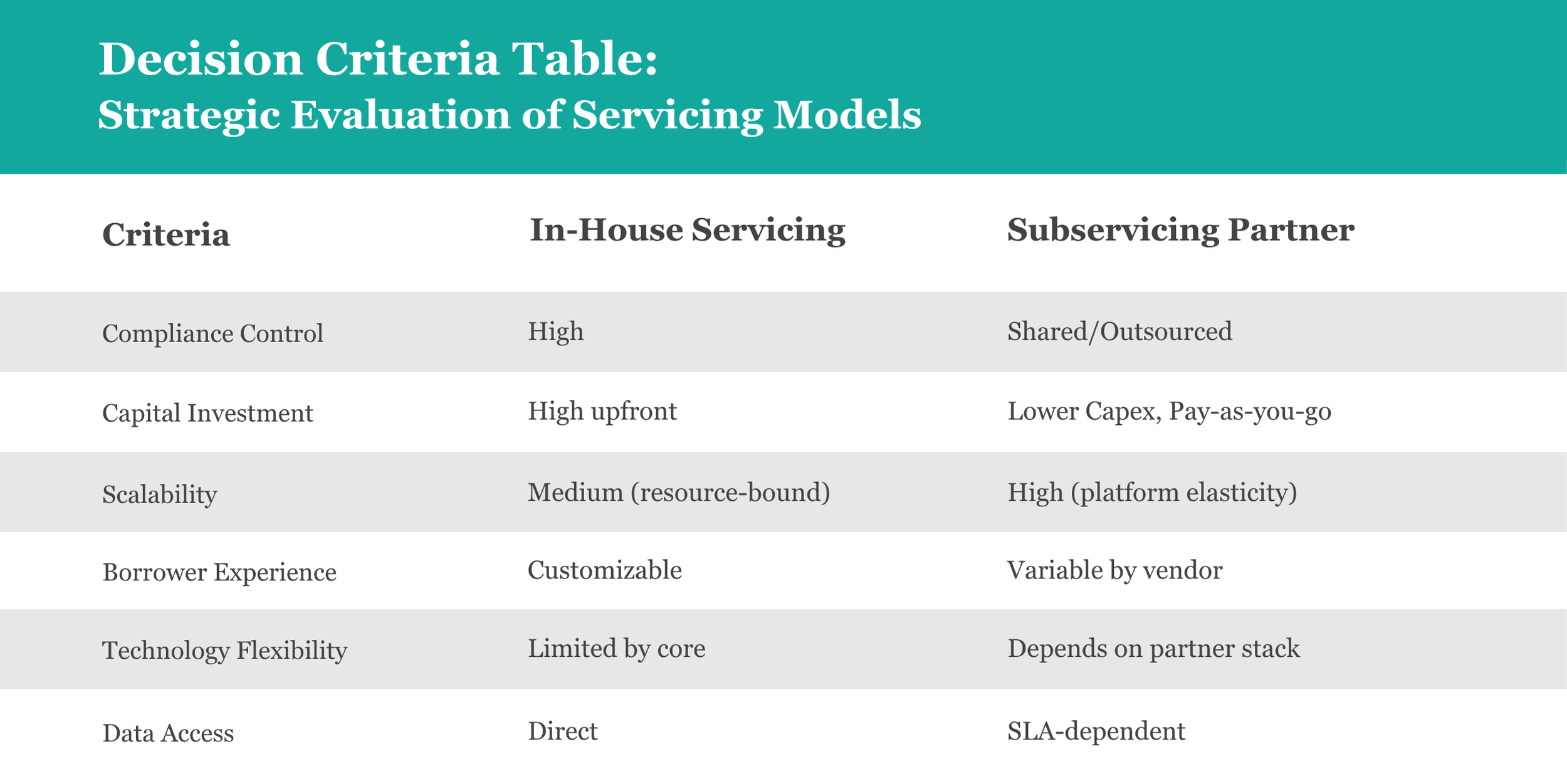

Another critical decision: whether to outsource servicing to a subservicer or continue in-house. For some lenders, retaining control over borrower touchpoints, branding, and data access is central to their customer value proposition. Others benefit from outsourcing’s scalability, cost efficiency, and regulatory support. Each institution must weigh its unique risk tolerance, servicing portfolio composition, capital constraints, and long-term strategic goals. There is no one-size-fits-all solution, but every lender must be clear-eyed in ensuring their servicing model aligns with business priorities.

One of the most overlooked barriers to servicing innovation is the siloed nature of the mortgage technology stack. In many organizations, the loan origination platform (POS/LOS), servicing platform, and customer relationship management (CRM) software operate as separate islands—each holding partial, and often inconsistent, borrower data. This fragmentation prevents servicers from developing a unified view of the customer, limiting the ability to deliver timely, personalized service across the loan lifecycle.

To overcome this, modern servicing strategies must prioritize real-time data integration across these core platforms. When POS/LOS, servicing, and CRM systems are synchronized, lenders can build a 360-degree view of the borrower—connecting payment histories, home value trends, contact preferences, and life event indicators into actionable insights. For example, a borrower whose escrow balance changes significantly might prompt HELOC or insurance outreach. Likewise, servicing call logs can flag early signs of dissatisfaction that trigger retention efforts.

Forward-thinking lenders are already reaping the benefits of true integration. They are using event-driven architectures and real-time APIs to link borrower activity across systems, enabling faster decisions, proactive communications, and seamless transitions from servicing to origination. But integration is not just about connectivity—it requires robust data governance, standardized protocols, and quality assurance routines to ensure accuracy and consistency. Without these foundational disciplines, system integrations can amplify poor data quality instead of solving for it.

That’s why lenders must evaluate hybrid approaches that modernize the servicing tech stack incrementally through middleware, API integration, and selective cloud migration. This step-by-step strategy may not be the most rapid or cost-effective route, but it offers the safest path to a complete platform transformation over time.

Artificial Intelligence (AI) adoption in servicing is no longer confined to pilot programs but is a core component of modern servicing strategies. Leading servicers are embedding AI into production environments to reduce cost, manage compliance, and engage borrowers more proactively.

Beyond MSR valuation and recapture, servicing has untapped potential for non-interest income. Credit monitoring, HELOC origination, and insurance bundling are just a few areas where servicing interactions can yield cross-sell opportunities.

Framework: Monetizing the Servicing Moment

When designed ethically and executed transparently, these programs can enhance borrower value and improve customer retention.

The traditional model of subservicing—where lenders outsource servicing to reduce overhead and shed operational complexity—is evolving. Today’s environment demands more than transactional outsourcing; it calls for strategic partnerships built on shared accountability, transparency, and aligned business objectives. As borrower expectations rise and regulatory scrutiny intensifies, lenders must re-evaluate how they manage and measure subservicer performance.

Leading lenders are implementing modern oversight models that emphasize continuous performance management rather than episodic reviews. Quarterly performance reviews are now standard, often supported by live dashboards and real-time KPI tracking that allow for immediate course correction when needed. Key metrics include call center responsiveness, complaint resolution timeliness, default pipeline efficiency, and adherence to compliance protocols.

Transparency is non-negotiable. Best-in-class servicer/subservicer relationships provide full access to borrower call recordings, audit logs, and complaint analytics. This level of visibility allows lenders to stay connected to the borrower experience even when interactions are handled by a third party. Importantly, subservicers must also demonstrate readiness for regulatory audits, with clear documentation trails, consistent issue management practices, and robust data integrity protocols.

STRATMOR’s MortgageCX program helps lenders refresh current state operating models. Our scorecard frameworks, CX benchmarking programs, and best-in-class performance playbooks give lenders the structure and insights needed to engage subservicers strategically. These tools not only measure performance—they foster a culture of continuous improvement and mutual accountability.

While subservicing remains a dominant model in today’s high-rate, purchase-driven market, its dynamics are shifting. Rising compliance costs and growing servicing complexity have led to greater market consolidation, creating scale efficiencies, while also increasing risks related to concentration, including systemic dependencies and reduced flexibility.

At the same time, niche and fintech-enabled subservicers are emerging with tech-forward servicing models that feature embedded APIs, digital-first borrower portals, and AI-driven compliance capabilities. These challengers are particularly appealing to IMBs and regional banks seeking faster deployment, better borrower engagement, and modern CX tools—without having to rebuild internal infrastructure.

Amid this evolving industry transformation, lenders must approach subservicing relationships as part of a broader strategic framework, not merely a procurement decision. Lenders should evaluate subservicers based on how well they align with the lender’s brand, operating model, risk tolerance, and long-term growth strategy, not just cost per loan. Those who build true partnerships will be in the best position to deliver differentiated borrower experiences and scalable operations in the years ahead.

The question is no longer “Should we outsource servicing?” but “What is our strategic objective?”

Lenders should reassess their servicing operating model annually, ensuring it aligns with long-term strategic goals such as M&A activity, brand control, or MSR monetization. Having an execution roadmap aligned with a strategy is key to driving expected results.

Increased MSR transactions have made servicing transfers more common, but also more complex. The Consumer Financial Protection Bureau (CFPB) continues to scrutinize these transfers, citing concerns about borrower confusion, misallocated payments, and data discrepancies.

Best Practices Checklist (Per CFPB Guidance)

Executing a smooth servicing transfer is not just a best practice, it’s a regulatory and reputational imperative. When done correctly, it protects consumers, prevents operational errors, and minimizes disruption. But when mishandled, it can trigger more complaints, harm borrowers, attract regulatory scrutiny, and cause lasting damage to a lender’s brand.

Mortgage servicers today must operate in an environment where regulatory scrutiny is both intensifying and evolving. The traditional compliance playbook—rooted in static policies and periodic audits—is no longer sufficient. New regulations from the CFPB and a patchwork of state-level rules now require servicers to build agile compliance functions capable of interpreting, operationalizing, and documenting adherence almost instantly.

Emerging Regulatory Pressures and How Servicers Must Respond

The CFPB continues to focus sharply on borrower communication practices, particularly in digital channels. Proposed rules around electronic disclosures, consent frameworks, and digital servicing channels are shifting expectations—moving away from physical mail toward real-time, omnichannel communication with an emphasis on clarity, access, and auditability. Servicers must upgrade their communication infrastructure to ensure borrowers receive time-sensitive updates via their preferred channels while maintaining compliance with opt-in and data logging requirements.

Meanwhile, state regulators are moving independently to establish borrower protection laws around equity retention, servicing fees, and contact frequency. States such as California, New York, and Illinois are introducing complex frameworks that affect default servicing procedures, loss mitigation outreach timelines, and third-party oversight obligations. This introduces operational complexity for national servicers, who must tailor processes to jurisdictional nuances without introducing systemic risk or borrower confusion.

Additionally, regulatory expectations around data governance and AI transparency are escalating. Servicers leveraging AI or algorithmic decisioning—whether for collections prioritization, hardship qualification, or borrower communications—should know that potential model audits are on the horizon. Servicers must be prepared to show explainability documentation, lineage tracking, and data retention policies that meet evolving state and federal standards.

Operationalizing Oversight

To manage this complexity, servicers are rethinking how oversight is conducted, especially for subservicers. Risk-based audit models are becoming the norm, allocating more intensive reviews to higher-risk segments (e.g., default servicing, non-performing loan portfolios, or jurisdictions with active enforcement environments). These risk-based models consider factors such as historical performance, complaint volume, call center metrics, and responsiveness to policy changes to dynamically adjust oversight scope.

An emerging trend is the adoption of compliance-as-a-service—where third-party platforms and advisory firms provide ongoing monitoring, audit support, and regulatory horizon scanning. These models can be particularly useful for mid-sized servicers that lack the scale to maintain a dedicated compliance innovation team, as well as for lenders who outsource servicing and need independent verification of their partners’ compliance practices.

STRATMOR plays a critical role in helping servicers stay ahead of regulatory expectations by providing the tools and insights needed to navigate today’s complex market. With proprietary benchmarking tools, audit templates, and peer comparison frameworks, STRATMOR enables lenders to quantify their risk exposure, prioritize remediation efforts, and prepare for regulatory inquiries with defensible data. Whether evaluating a subservicer’s adherence to Regulation X, preparing for a CFPB exam, or integrating compliance considerations into technology selection, STRATMOR helps turn compliance pressure into operational readiness.

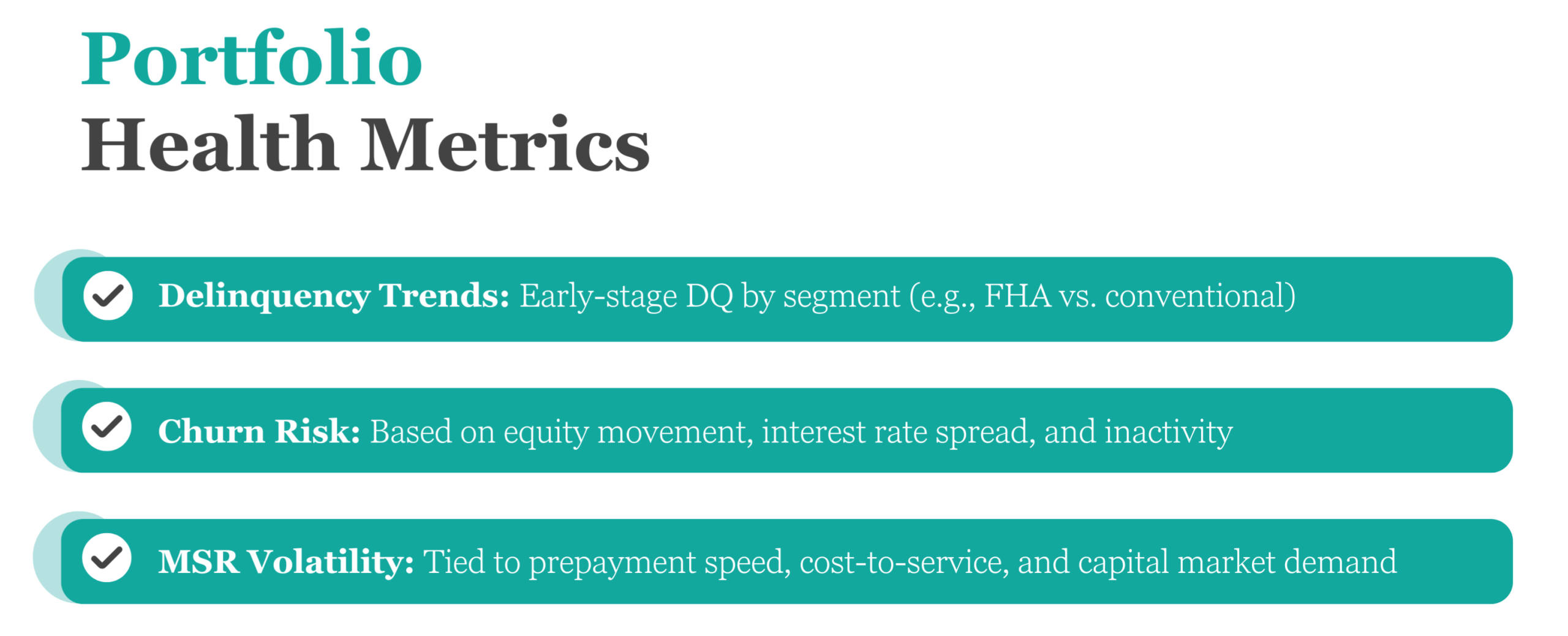

Robust analytics are essential for a modern servicing strategy. Servicers are moving beyond static dashboards to predictive models that guide resource allocation and borrower engagement.

The transformation of mortgage servicing is no longer a conceptual conversation—it’s an operational reality. Regulatory pressures are intensifying, borrower expectations are growing, and technology-driven innovation is no longer optional. The question isn’t whether to act—it’s how and how fast.

For lenders, success now depends on implementation. That means integrating compliance, customer experience, and capital markets strategy with disciplined, data-driven execution.

If your servicing strategy hasn’t been stress-tested in the past year, now is the time. STRATMOR can help turn your next move into your strongest yet—with clear direction, practical execution, and lasting impact.

About the Author: Kris van Beever is a Principal at STRATMOR Group, advising mortgage lenders and servicers on technology transformation, leading product evaluation, vendor selection, and leading successful technology implementations.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.