for these free STRATMOR

online publications

About a year ago, I convinced my friend to buy a Peloton. Last week I found out that he’s now using it exclusively as a laundry rack. To quote him, “I thought I’d use it, but then I found this new app that finds workouts for you.” Apparently, he didn’t need to actually get in shape—he just needed to search for new ways to exercise.

That’s a lot like what’s happening in mortgage sales right now. Lenders are spending big on shiny new tools—review automation, AI search optimization, CRM automations—chasing what they hope will be the next great source of business. Meanwhile, their greatest growth opportunity is sitting right in front of them—in their own borrower database.

Our question this month: If new business is gold, why are so many LOs mining the wrong mountain?

STRATMOR’s MortgageCX Servicing data shows that the happiest borrowers in servicing portfolios—those who give the highest Net Promoter Scores and the most referrals—share one simple commonality: They’ve received a “thank you” communication within the past six months.

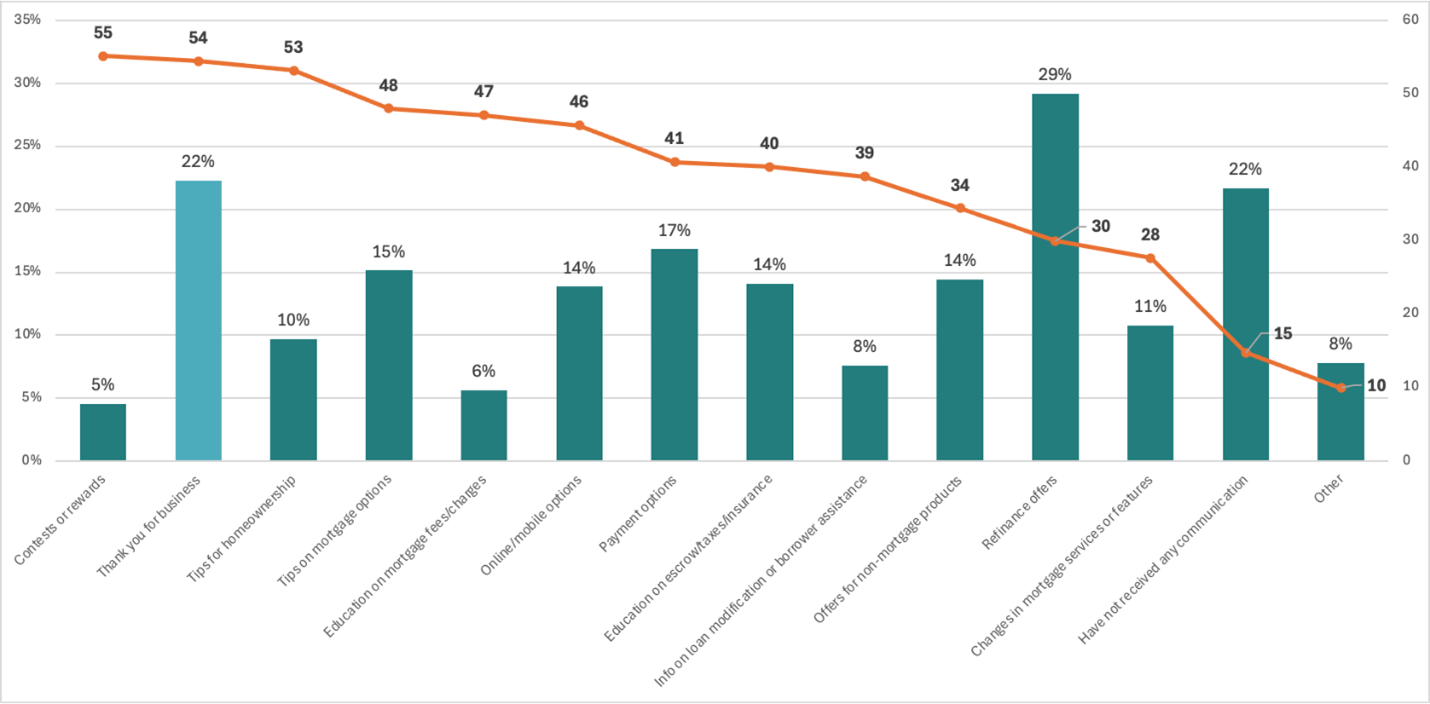

We’re not talking about sales pitches, marketing blasts, or even a “happy birthday” email sent from a CRM. Just a simple, human, thank you. Check out this data from STRATMOR’s ongoing National Servicing Benchmark Study, showing percentage of borrowers receiving various types of communication from their servicer, with the corresponding NPS outcome:

That one simple gesture of gratitude correlates more strongly with borrower advocacy (54 NPS) than almost any other factor in the servicing relationship. And yet, only 22% of borrowers said they received that kind of communication over the past 6 months.

If we really look at our borrower experience, we’ll find that most loan officers haven’t reached out to their past clients since closing day. Maybe they sent a “Congrats on your new home” text. Maybe they liked a Facebook post. But real, intentional contact? That often fades as soon as the next pre-approval pops up. It’s not because LOs don’t care—it’s because the industry trains them to chase: New leads, new apps, new pipelines. The pace of production rewards hunting, not cultivating.

But this is problematic in the long run, because when all you do is hunt, you’re not building loyalty.

Psychologists call this ‘novelty bias’—our brain’s tendency to chase new stimuli because they release dopamine. Every new lead, every new tool, every “fresh” opportunity triggers a tiny hit of excitement. Meanwhile, reaching out to past clients feels…routine. Predictable. And therefore, less rewarding. As organizational psychologist Adam Grant once said, “We forget that relationships are not one-and-done transactions; they’re compounding investments.”

And compounding, as any investor knows, takes time, patience, and consistency.

Yet most LOs don’t treat their relationships that way. Instead, they spend thousands generating new leads—while their best prospects, the people who already trust them, sit ignored in their CRMs like uncashed checks.

STRATMOR data shows that only 1 in 5 borrowers nationally return to their original lender for their next loan. But among those who have been thanked or contacted authentically within six months of closing, that figure jumps significantly. Gratitude breeds connection, and connection breeds loyalty.

When I talk to loan officers about retention, I often hear something like: “I stay in touch—I send birthday emails and drip campaigns every month.” That’s not connection though. In fact, it’s probably just noise to your client.

Borrowers can tell the difference between a personal note and a mass email the same way you can tell the difference between a real compliment and a scripted one. A “Happy Birthday!” from your CRM feels like junk mail with emojis. A two-sentence note that says, “Hey John, I was just thinking about the day you got the keys to your house—it still makes me smile,” feels human. The difference is effort.

The irony is that most LOs already understand this instinctively. They just feel too busy to act on it. So, they outsource authenticity to automation, hoping technology will make them “feel” personal at scale. Only it doesn’t. AI can help you organize your outreach, but it can’t make you authentic. The most effective LOs use tech as a reminder, not a replacement. They let automation handle timing—but the voice, the gratitude, the humanity is theirs.

That’s the missing link in most retention strategies: we’ve optimized for efficiency at the cost of empathy.

Here’s a number worth taping to your monitor:

Borrowers who receive even one authentic “thank you” communication in the six months following closing score an average of 30 points higher in NPS than those who don’t. And it’s not just a feel-good metric. That 30-point lift translates directly to referral volume and repeat business.

Think about that for a second. You don’t need a new lead source. You need a thank-you strategy.

Here are three ways you can turn gratitude into growth today:

1. Replace the “Drip” with a Dialogue. Stop sending robotic “touch points” and start real conversations. Instead of a generic “Hope you’re doing well,” say something specific: “I was thinking about you this week—how’s the new kitchen remodel coming along?” You’re not asking for business. You’re building memory equity. When their next need arises—or a friend’s does—you’ll already be top of mind.

Pro Tip: Authenticity doesn’t scale easily, but it compounds beautifully. Ten thoughtful touches will outperform 1,000 automated emails every time.

2. Say “Thanks” Even When There’s No Transaction. Gratitude doesn’t have to wait for a transaction. In fact, it’s often more powerful when it’s not tied to one. Send a note that simply says: “Just wanted to say thank you for being someone I’ve had the privilege to serve—and to remind you I’m always here if a need ever arises.” That’s it. No pitch. Just genuine appreciation.

3. Build a Rhythm of Relationship. Top-performing LOs set aside one hour a week to reach out personally to five past clients—just to check in, congratulate, or say thanks. Those “small” weekly investments add up. Over time, you’ll have touched every borrower in your database in a personal, authentic way, something no algorithm can replicate. Relationships grow through consistency.

Final Thought

There’s no shortage of tools promising to find you the next hot lead. But the data—and the psychology—both point the same way: the most reliable source of new business is the one you already have. If you want to grow, you need to deepen your roots. Borrowers who’ve already trusted you are still your best opportunity. They just need a reminder that you still remember them.

So, here’s your challenge this month:

And when the time comes for their next loan—or their friend’s—you’ll be the name they remember.

To find more Customer Experience Tips, click here.

MortgageCX is now integrated with Encompass®!

Start receiving monthly Customer Experience Tips