This month, I sat down with fellow STRATMOR Principal Jennifer Fortier to wade into the murky waters of process improvement. Successful execution of process changes is something every mortgage lender strives for, but doesn’t always achieve in a sustainable, effective way. In this exchange, Jennifer and I explore the benefits of regular process reviews and why the path to process improvement requires a combination of things to be effective. We also look at the pitfalls that can derail sustainment of new processes and how to overcome them.

SMITH: Hi there, Jenn — thanks for taking some time to talk about process improvement with me. I recently went down a rabbit hole with a friend of mine to see if old shows we loved were available for streaming. One that I pulled up was “Highlander” — remember that series and movie? The tagline was “there can be only one.”

Sword fights and quickenings aside, it got me thinking: I see so many mortgage lenders apply a “there can be only one” mentality to the processes they have in place. Simply getting someone to even consider examining a single process for any possible efficiency gain seems to be abhorrent to them. There are dozens of reasons lenders are hesitant to even take a look at their processes: (perceived) cost, lack of internal process improvement expertise, inertia, or delusions that they already have THE perfect process, to name just a few. What have you been seeing in the industry, Jenn?

FORTIER: In my early consulting days, I did a lot of operations reviews in which the lender’s request was to “come look at our process and tell us THE right way to do it.” Or worse, “tell me which system has THE perfect embedded workflow” (with an implied, “so I can go buy it”). Of course, my advice to them never directly addressed either question. At some point, we would have a conversation about the fact that there are a thousand dials to turn in a mortgage process and there are lots of combinations that can be very effective. So, if there’s no ONE perfect process, where’s the magic? The magic is in the execution. That’s where I think it gets hard to dig deep, to look at root causes, to reassess long standing policies, and to deal with the dozens of reasons you alluded to.

One of my favorite television quotes is Homer Simpson’s advice to his son Bart — “If something is hard to do, it’s not worth doing.” That’s my go-to humor to lighten my mood when I’m feeling discouraged about process improvement. But on a serious note, do you think that sentiment is sort of at play? There are so many constraints and complexities, and so much heavy lifting to improve processes that I can see where lenders could start to feel like Homer.

SMITH: Oh my gosh, I love that quote and I do think that sentiment is at work with some lenders. It takes real grit to want to look under the hood with an objective eye and to do so on a regular basis. I see operational reviews as an annual check-up or semi-annual teeth cleaning: you don’t necessarily want to do it, but you need to. Lenders need to get in front of potential issues before they become a real problem — or discover a problem early enough to easily fix it. Ideally, operational reviews are embraced as part of a continual process improvement mindset or a fact-based management approach with consistent monitoring of dashboards or other reporting; however, even customer experience or employee experience surveys can provide clues—or alerts—to process issues.

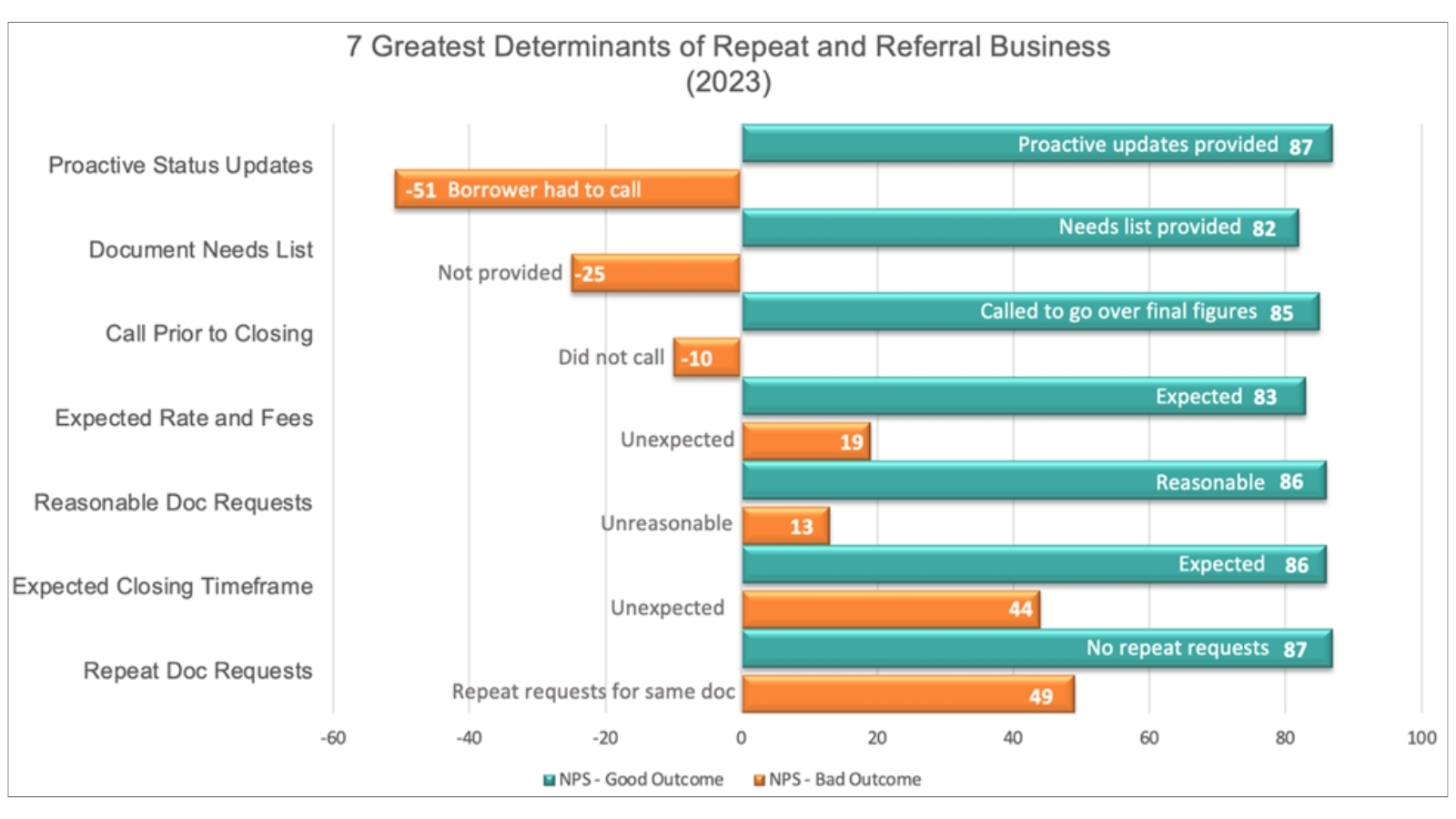

STRATMOR’s MortgageCX data shows that there are at least seven key process mistakes that can directly impact repeat business and referrals. These mistakes are clearly articulated in customer satisfaction surveys and are worthy of investigation.

Source: 2023 STRATMOR MortgageCX Program

FORTIER: Some of these are pretty easy to manage: Just call the borrower before closing! Others are potentially pretty tough. Some are a little harder to recognize. Asking for the same document more than once, for example. The borrower thinks, “You need the bank statement again?” while the lender thinks, “I need all the pages this time.” This is when lenders must look beyond just workflow tasks, such as sending the request for a document, and look at how they execute that task:

Where do we even start?

I think Michael Scott from “The Office” captured it well: “I knew exactly what to do. But in a much more real sense, I had no idea what to do.”

Jen, you are a Six Sigma expert — are there any approaches you use or other techniques you find effective to deal with these sorts of dilemmas and the complexities of implementation and execution?

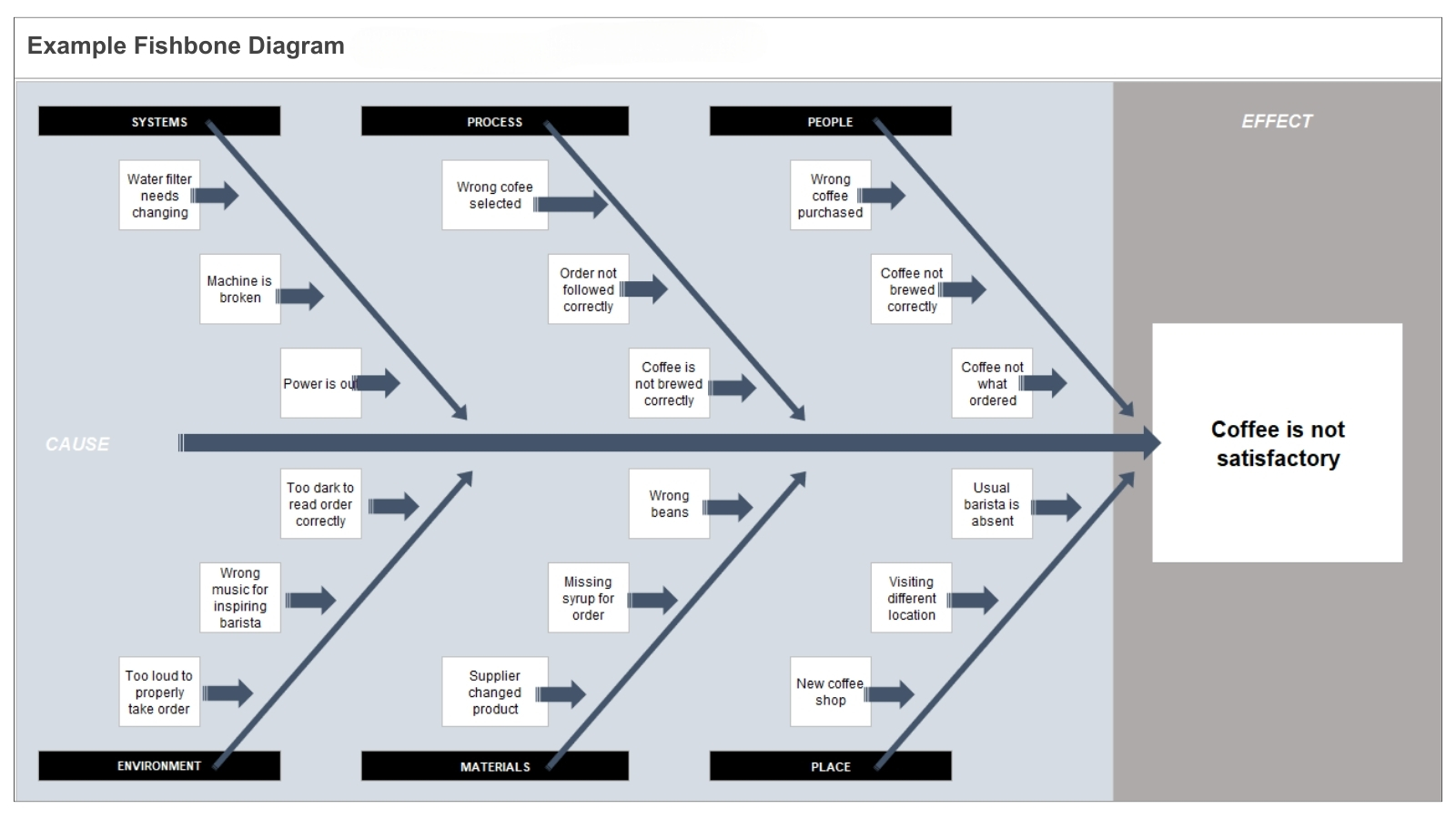

SMITH: There are several effective approaches or techniques that I’ve leveraged, but the first that jumps to mind is the fishbone diagram, also known as the cause-and-effect diagram or Ishikawa diagram. This approach can be used when trying to identify all the possible causes of a problem or when you’re stuck in a rut like Michael Scott. It’s a super easy exercise that can be done with materials you already have on hand: a whiteboard and marker, a template in Excel or Smartsheet, or even just pen and paper.

Starting with the problem statement on the right side in a box (the “head” of the fish or effect) and a long horizontal arrow pointing to it, brainstorm the major cause categories to create “fishbones” coming from the arrow. Then keep asking “why does this happen?” over and over to create more fishbones coming from each of the categories.

To illustrate, I’ve prepared a very simple and high-level example of a fishbone diagram to investigate the possible causes of receiving an unsatisfactory coffee order in a coffee shop. When preparing this type of diagram, include subject matter experts and other stakeholders in the exercise to gain more detail and a wider range of possible causes.

This technique is great for getting to the heart of the matter; however, when trying to deal with the complexities of implementing and executing changes, I find what is most effective really boils down to focusing on helping users adopt and sustain the new process. I love the deep Tao-like wisdom of Ted Lasso: “Be curious, not judgmental.” Like the fishbone diagram, embracing the question “why?” and understanding objections, roadblocks, and potential pitfalls can point you in the direction of where to focus your change management efforts regarding adoption and sustainment.

Speaking of Coach Lasso, Jenn, you’ve helped lead many high-profile teams through very successful process changes — what do you find resonates most and drives successful adoption and sustainment?

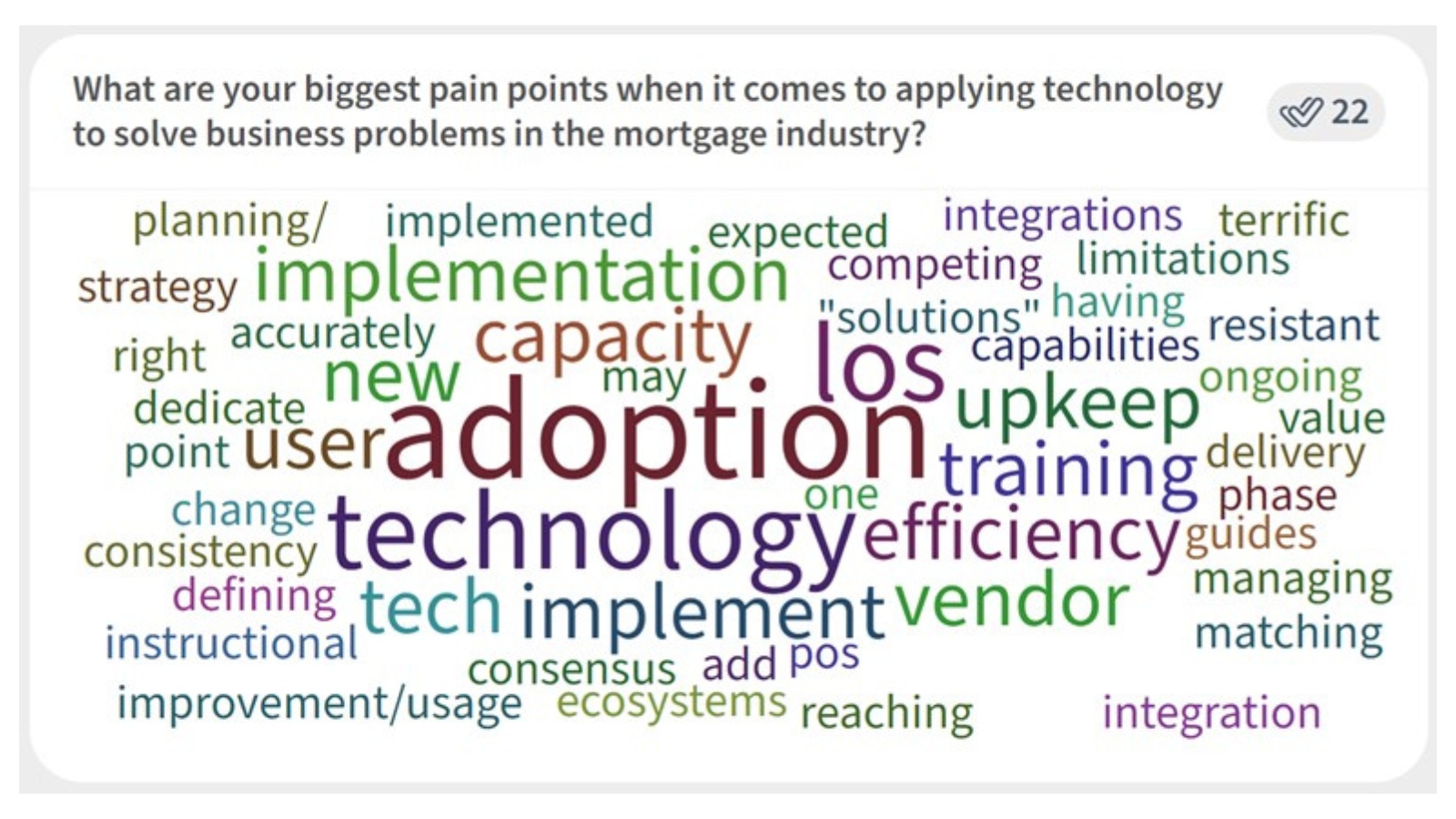

FORTIER: Well dang, Jen. We were having fun here, then you threw that curveball! Seriously though, adoption is tough, and we continually hear lenders struggling with it. It’s always a hot topic in our operations and technology workshops. As you can see in Chart 3 below, in our most recent Technology Workshop, when asked about their biggest pain point related to applying technology to solve a business problem, mortgage lenders cited adoption as their biggest challenge.

Source: STRATMOR Technology Workshop, December 2023

I agree with Coach Lasso — first you have to BELIEVE! But beyond the soft skills and implementation sort of stuff — culture change, training programs, pilot programs, finding change champions — I think lenders have to keep a close eye on what’s happening “in the wild” and use hard facts to validate outcomes. A very big part of that is spending a good bit of time really (and I mean REALLY) analyzing how the future state will be executed differently than the current state BEFORE you finalize and implement change. I promise, time invested by lenders doing this will pay off by helping them find and smooth out the wrinkles and identify where and why users may try to work around the process. Then observe, observe, observe, and assess whether the process is behaving the way you thought it would. If you skip that upfront analysis or the follow up, you’ll never really understand why your changes worked or didn’t work. As Captain Raymond Holt in “Brooklyn Nine-Nine” said, “There’s always a better way, a shortcut, a work-around, you just gotta find it.” I would add to that, “then you gotta make sure it sticks!”

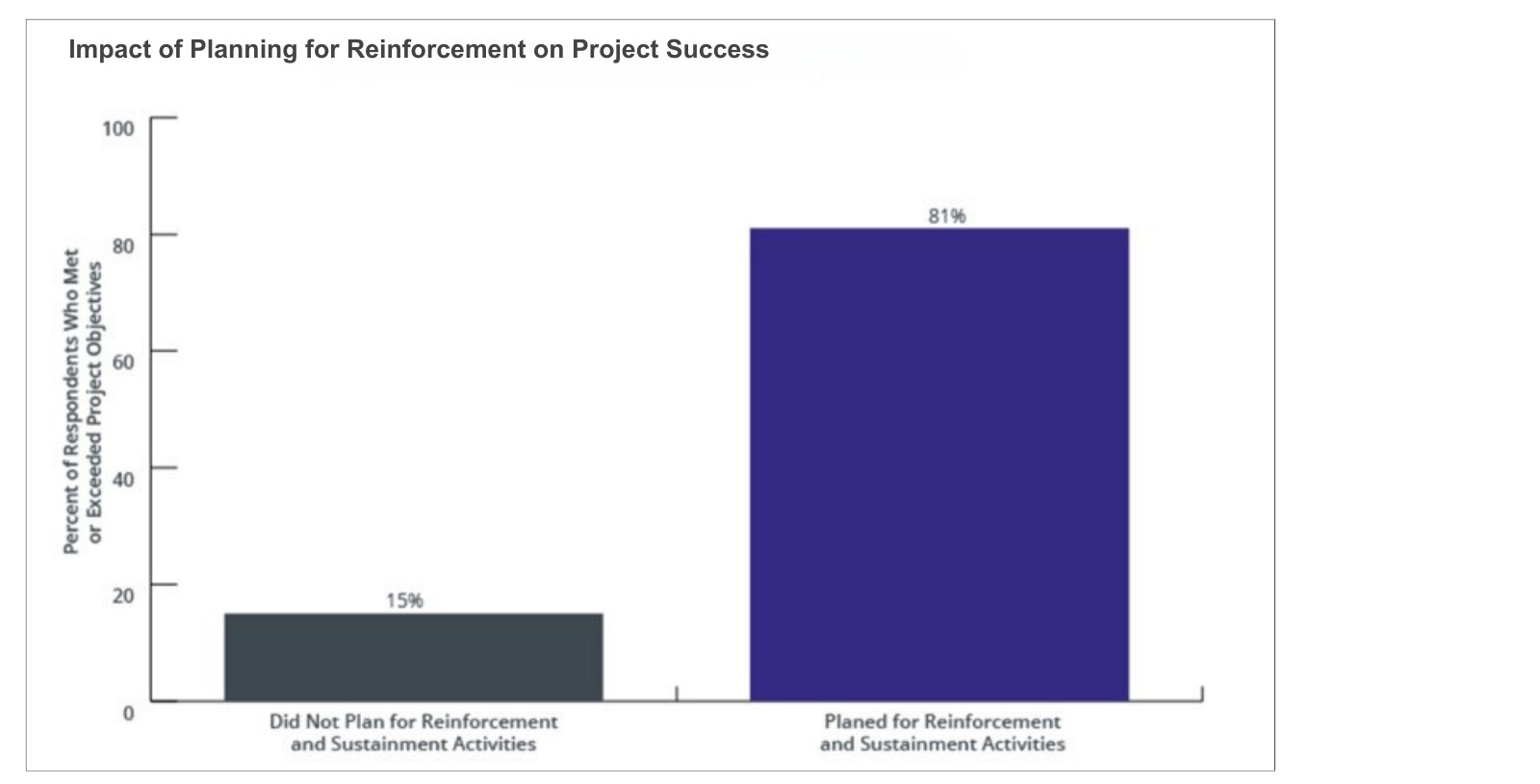

SMITH: That’s so true and the data supports that: a Prosci study on maintaining change outcomes found that projects that met or exceeded objectives had documented plans and greater leadership and team support for sustainment.

Source: Research Hub, 2023 Prosci, Inc.

When working with lenders on transformational changes, I encourage them to put real thought and effort into identifying who is going to be a supporter, a detractor, or neutral to a change. That alone can be critical in designing communication plans — also a must — to drive adoption and reinforce for sustainment. Being thoughtful with training plans (as applicable) and clearly defining and measuring what success looks like also helps promote sustainment of a change.

When a change doesn’t stick, it’s most often because adoption and sustainment weren’t considered in the planning process. Additional causes I’ve frequently seen include lackluster leadership support, insufficient communication and/or training, inadequate reporting or tracking of adoption, or a combination thereof.

The practice of change management has many tools to help promote and reinforce adoption so it sticks. Incorporating some of these methods into a lender’s improvement plans and having a leader on point see them through will greatly improve the odds of sustainment. Ultimately, the method(s) employed need to be tailored to the type of change, organizational culture, and the magnitude of impact.

Lenders, if you need help tailoring your processes, including review, redesign, implementation, and adoption, the team at STRATMOR can help. We consistently work with mortgage lenders to evaluate their people, processes, and technology to identify ways to deploy strategies for better operational performance and to improve the customer experience.

You know what else is tailored: my streaming feed. I’m off to catch up on Season 2 of “Good Omens” — it’s simply … ineffable! What about you, Jenn?

FORTIER: Well, you know I’m always interested in what the Jennifers are up to. It just so happens I’ve got “Afterparty” queued up. I’m off to fire up the TV! Jennifer Smith Jennifer Fortier

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.