If New York City is the finance hub and Paris is the fashion capital, then Los Angeles is undeniably the epicenter of storytelling. Whether in film or television, on TikTok or YouTube, LA is full of people eager to share their stories with the world. You can hardly step from one star to the next on the Hollywood Walk of Fame without bumping into someone with a fascinating and complex tale full of hope and despair, rejection and elation, love and heartache.

People from all corners of the globe flock to LA to test their mettle and pursue their creative dreams. Some, like me, came all the way from Minnesota.

When I moved to Los Angeles 15 years ago, I was bright-eyed and expectant, sure that my name and my music were on a rocket ship to stardom. And I had good reasons to be confident — record labels were clamoring for a chance to sign my band, I’d just entered a lucrative publishing deal with Sony Music, and I was constantly surrounded by other creative and talented people. The only skeptic at the time was my father, who warned that “less than 1% of people make it in the music business.” I just looked him in the eye and said, “That’s me … I’m the 1%.” And the rest is history. My band, Now The Rabbit Has The Gun, is world-famous and I’m a celebrity.

Wait a second (record scratch) … you haven’t heard of me? Or my band? Like so many aspiring creatives who come to LA with hopes and dreams, I never reached the heights of success that at one time seemed to be dangling at my fingertips.

But my story didn’t end there. It simply continued in another industry with an equally diverse and intriguing cast of characters. The mortgage industry, as many of us know, is made up of a very eclectic group of people, very few of whom dreamed their whole life of working in the mortgage industry. Rather, most of us sort of “fell into it.” We joke that once you’re in, there’s no way out, but the reality is, we kind of like being a quirky band of misfits, united in helping others achieve the dream of homeownership. Every time I meet someone new at a conference, I’m fascinated by the stories I hear. One person is a published author, another runs an Airbnb side hustle with campers in Big Sur, and another goes to every Bruce Springsteen concert within 500 miles. There’s even a “biker-chick” who spends weekends on biking adventures.

The point is: everyone and every business has a story. And we all love to hear stories. They help us connect with people, simplify complex ideas, and leave lasting emotional impressions. Most importantly, stories build relationships, retain leads, attract recruits, and even drive revenue.

So, why do so many conversations with would-be borrowers sound like an oral exam given by the DMV?

If your loan officers are worried about AI taking their jobs and this is how their customer conversations sound, they probably should be worried. We are in a business of stories, and every prospective customer and referral partner that comes in contact with your brand has a story to tell, if you are willing to listen.

Think about your company website, especially the heavily visited “about us” section. If I held my hand over the logo, would I know the difference between your company and every other lender out there?

You, your team members, your customers, and your partners all have stories to tell. And today, it’s more important than ever.

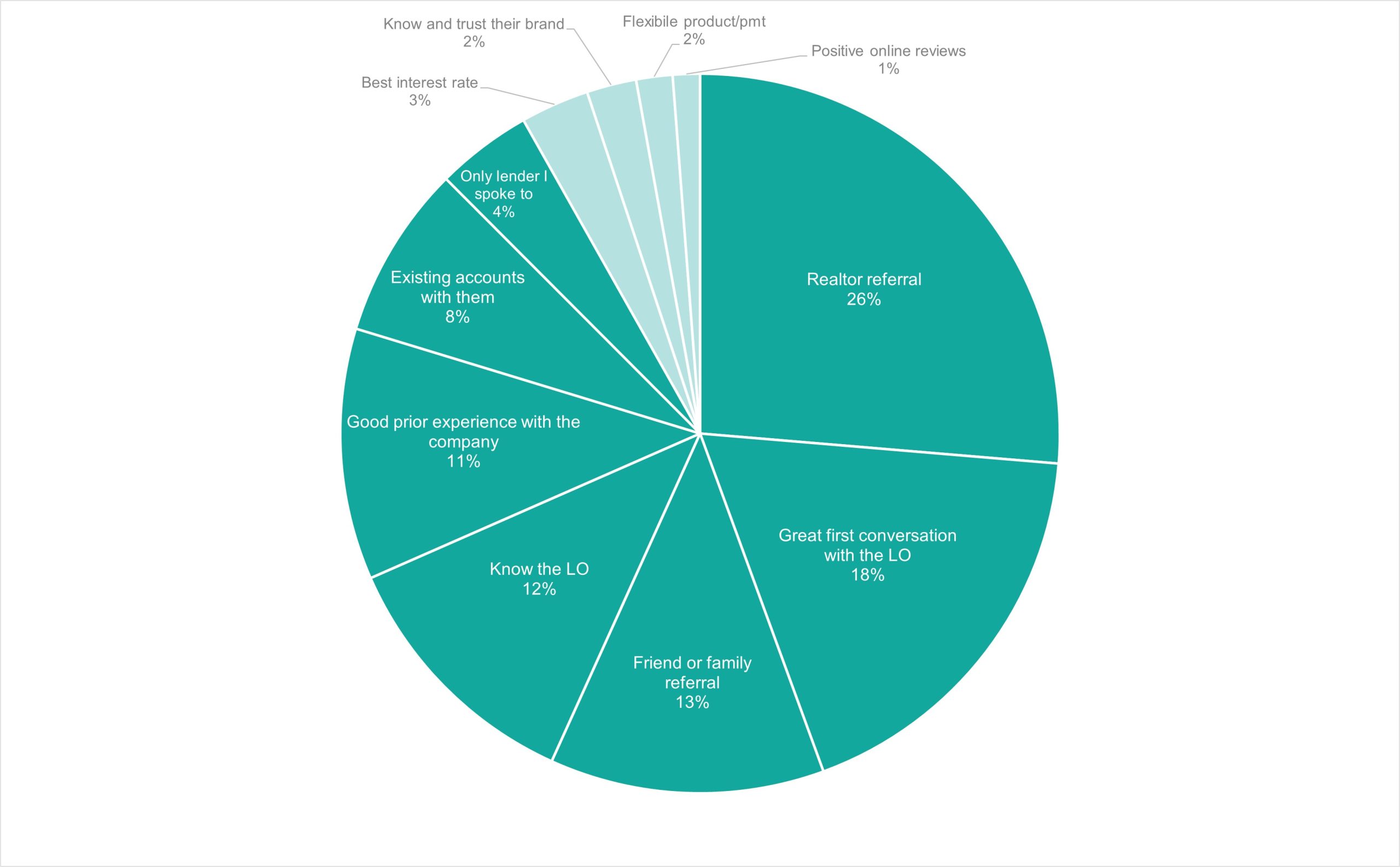

According to STRATMOR data, 90% of borrowers made their lender choice based on either their own experience with the lender or the experience of someone they know and trust. And experiences stand out when stories are shared. According to a study by Stanford professor Chip Heath, around 63% of people can remember stories, while only 5% can recall a single statistic. Leveraging the strength of your stories will allow you to build deep connections with borrowers who will willingly promote your company through their own storytelling.

So, where do you start?

Origin Story — How did your business start? Why is your business here today? Why do you do what you do? What sets you apart? This is crucial to your overall brand story and can help establish your company’s identity, values and purpose.

Fairway Independent Mortgage Founder and CEO Steve Jacobson shares how its origin story shaped the company’s core values:

“There’s a humility part of Fairway that’s very important and that came from being brought up in a small town. Playing college basketball, it became evident that the way people were treated and how talent was treated directly affected performance. If you believe in your teammates, they can do amazing things. This is the environment we set out to build at Fairway, and which drives our core values:

- Humility first

- Foster growth and knowledge

- Have fun

- Create an amazing experience for you

- Speed to respond

- Seek wise counsel

- Respect, listen and stay balanced

- Committed to serve

- Consistent honest communication

- Family-focused

We strive to make our team members and customers feel like a part of the Fairway family while providing exceptional customer service, speed, and support by being kind and humble and giving 100% every day — it’s WHAT we do and it’s WHO we are.”

For Fairway, this origin story is such a part of their culture that it’s prominently displayed on their home page for employees and customers to understand.

Brand Story — Your brand story is a narrative that encapsulates your company’s identity, purpose and values. To gain a deeper understanding of your company’s identity and culture, there’s no better resource than your own employees.

Here’s an employee story from Heather at Guild Mortgage:

“I joined Guild Mortgage in 2016 seeking to grow my marketing career, and growth is what I found throughout the company as a whole. Guild had just completed its fifth acquisition, driven by its forward-thinking, strategic growth principles. Our leadership listened when I recommended new marketing strategies and in 2019, promoted me to a national role handling retail content marketing.

Since that time, we’ve added six more companies, expanding our presence in the Midwest and Northeast markets, welcoming each group by learning from their history, encouraging creative thinking, and incorporating great ideas. With each one, we have not only grown larger, but stronger. I now oversee all marketing content for the entire organization and affiliates, including the Guild Giving Foundation, and no matter how large we grow, I have full confidence that Guild will maintain its collaborative, pioneering spirit, welcoming the like-minded who care deeply about what we do.”

Customer Story — Your customers are your most valuable assets in finding new and repeat business. Collect their stories about their experiences with you and share them with others through your marketing channels.

Here’s a story from a borrower about a loan officer who changed his life:

“Having no idea what to do to even start getting a mortgage, Gail helped me from the first day I came in with everything I could think of. She walked me through the process of what I would need to do to be considered for a loan and helped me follow the steps to get there. She really went above and beyond by personally helping me all the way through to the end. I had spoken with a few other mortgage companies prior, and I was ready to give up, assuming it wasn’t possible for me to get a house at this point in my life. It was because of Gail’s expertise and willingness to guide me through each and every process that I managed to finally get a real home!”

Employee Story — Your LOs have seen it all and have a wealth of knowledge and experience. Their personal stories can help customers feel more at ease when they encounter a challenge, and they can also make borrowers feel less isolated. Encourage your LOs to share their stories with customers to build emotional connections and foster trust in your business.

Here’s a story from Kara Berglund, a top performing LO at HomeStreet Bank:

“I celebrated my 21-year work anniversary as a loan officer this month, and I cannot imagine being in another profession. I come from a family of loan officers, but I didn’t always want to follow in the family’s footsteps. In college, I studied psychology with the idea that I’d become a therapist. Looking back, it’s interesting how my passion for understanding and helping people has translated to my current work helping people along the emotional and often anxious journey of buying a home. I really enjoy breaking down the complex (and sometimes overwhelming) loan process and helping clients feel confident in achieving their financial and homeownership goals. My go to line is, “There are no dumb questions in lending!” The mortgage industry is always interesting, exciting, changing, challenging. It is all at once familiar and excitingly new. I have truly never been bored in the best way possible!”

Auditing your own company stories is just one (very significant) piece of the puzzle. You should also be thinking about the role you play in your borrowers’ stories.

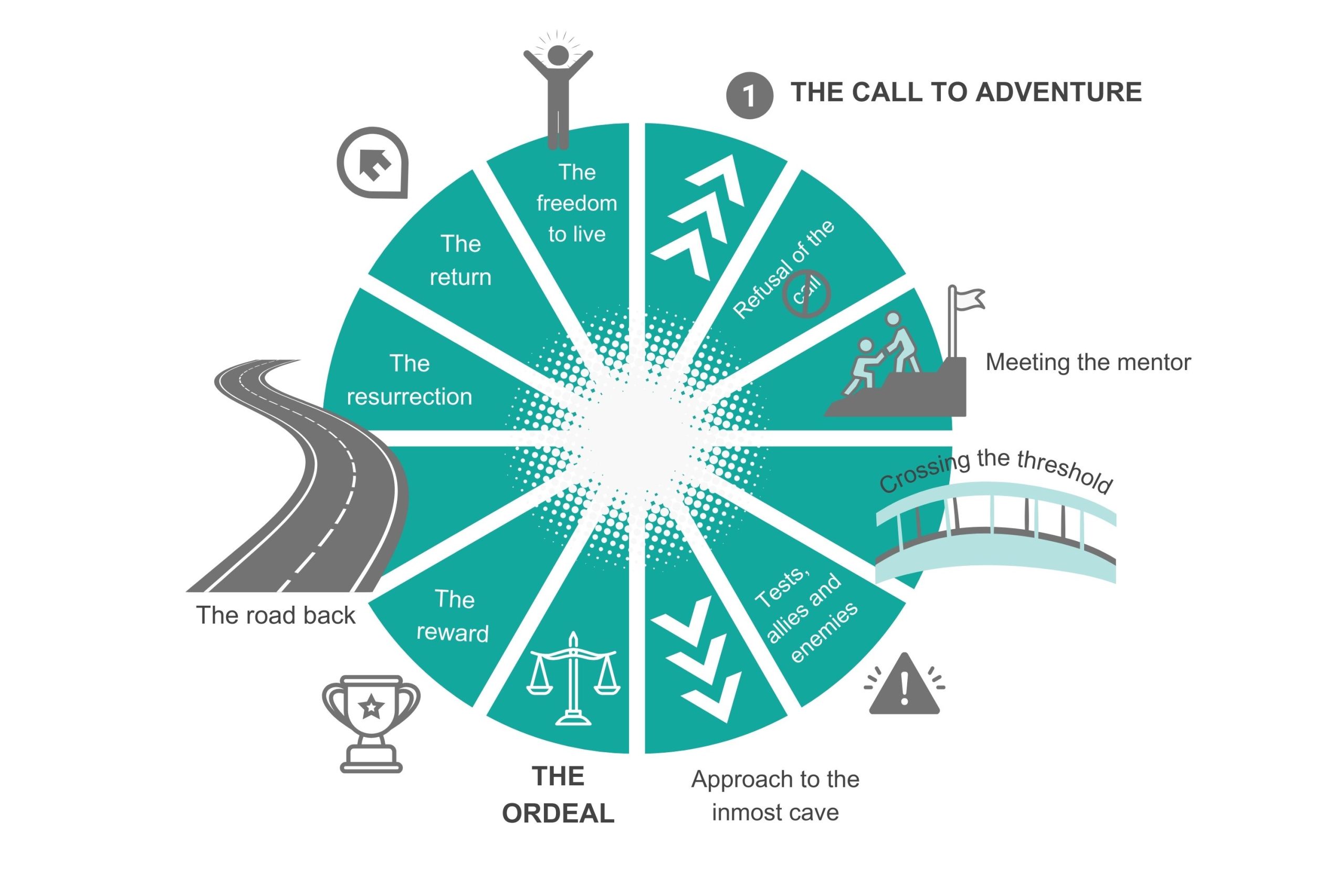

In storytelling, the Hero’s Journey is a common story structure in which a hero goes on a quest or adventure to achieve a goal, and has to overcome obstacles and fears, before ultimately returning home transformed.

Every borrower embarks on their own Hero’s Journey, and your loan officers must provide valuable aid to them along the way to make their experience memorable and worth relaying to others:

Being a meaningful part of your borrower’s journey requires more than just good intentions. Here are some effective strategies and skills you can implement and teach your team members to help them excel in their supporting character roles.

According to a Healthline article, “memories of emotional events are often more vivid and accurate than memories of neutral experience.” In other words, your brain remembers emotional stories more clearly. So, if your borrowers are able to make a positive emotional connection with your lending team throughout the process, they’re more likely to remember the experience and bring it up to their friends and relatives when they’re looking to purchase a new home.

My colleague Garth Graham wrote an article a while back about the importance of understanding and connecting with the emotional drivers for all borrowers. “When the person who is buying a home contacts the lender, the LO must connect to the emotions of the borrower. I often challenge consumer direct lenders to make the connection by considering how they would respond to someone at a cocktail party by saying something like, ‘That’s exciting. Why are you doing this?’ Once that emotional connection is made, the LO can get to the real reasons for the transaction.”

Oral tradition, written words, audiobooks and more. The methods of storytelling have evolved over time and we’re fortunate to have even more channels today. Make good use of your website, social media, marketing materials and industry events to share your stories effectively. Your employees are also a valuable source of storytelling.

If someone were to ask anyone employed with your company why they should choose you as their lender, what would they say?

Ensure that your employees are aware of the stories shared throughout the office and empower them to capture and relay their own stories.

Does your business have a method for capturing stories? Stories can come from anywhere and some of the best can get lost if not shared. Work with your marketing and customer experience teams to create an easy way for employees and customers alike to submit their stories.

STRATMOR’s MortgageCX Program helps LOs capture positive feedback from borrowers and then use it to promote their excellent service. Here are two stories of how loan officers went above and beyond the call of duty when working with their borrowers.

Borrower Maria C. shared this about her loan officer:

“I’ve known Amy for a little over a year now. About a year ago, my husband and I were planning on buying a home, but it ultimately wasn’t our time. We picked back up a year later and she remembered ALL of our wants and needs! Amy and her team made the whole loan process EASY. She and her team were there for us when we had questions and would reply to us super quickly! We’re really happy and lucky to have had the pleasure of working with her! Amy came to our closing and was super sweet. Her team made us a cutting board as a homecoming gift. Truly a pleasure working with her and her team!”

Borrower Lena S. shared this about her loan officer:

“We are first time home buyers and weren’t familiar with the process of owning a home and thought it was impossible, till we spoke with Caleb and he turned our dream into a reality. Caleb went above and beyond answering our million questions, educating us and giving us the most transparent, and up to date information and answers. He’s different from other loan officers. We didn’t feel like all he wanted to do was convince us to take out a loan like the other loan officers. He was genuine, really listened to our needs, took the time out of his schedule and even weekends and vacation time to make sure everything went smoothly. He truly was an expert, very knowledgeable on every single detail. He made the process so seamless and easy for us. We were lucky to find him and I recommend him as a loan officer to all of my friends looking to buy.”

Our stories are constantly evolving. And it’s important to remember that your job title doesn’t define your entire narrative. I was a musician, then a loan officer, then a software salesman, then I was a program director. But these experiences are just chapters in a much larger story that encompasses my passions, friendships, adventures, faith, family, and dedication to an industry based on making people’s dreams for homeownership come true.

Whether you’ve had a long career with the same company or have been in many roles in different industries, discover your unique story and share it. Encourage your employees to do the same and watch as genuine friendships, referrals, and loyalty flourish.

By implementing these storytelling strategies and empowering your team, you can create a more engaging and personalized experience for your borrowers. This will not only lead to stronger relationships but also drive positive word-of-mouth and increase your business. If you’d like help getting borrower comments like the ones in this article — with mentions of how easy and simple the process was — MortgageCX can help. Contact STRATMOR for more information on the program. Mike Seminari

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.