Pipelines and Pandemic: Managing Through the Virus-Driven Storm

By David Moynan

March 2020

There’s no doubt that the mortgage industry is feeling the effects of the COVID-19 coronavirus. Even as the Fed cut its benchmark interest rate by half a percent on March 3 and sent lenders into a scramble to manage borrower expectations and margins, businesses in Washington and California were encouraging employees to stay home if they were ill and to work from home, if possible.

By the time the Fed cut the rate to zero percent on March 15, the virus reached pandemic status. The U.S. declared a national emergency and gatherings of more than 50 people were canceled. “Stay home if you’re sick, work from home if you can” became the national refrain as life in the U.S. changed in a matter of days.

Businesses are managing, hour-by-hour, edicts from federal, state and local authorities that impact their operations. Mortgage lenders are no exception. Lenders have the added stress of managing the expectations of investors and borrowers through the maelstrom of impacts to the loan process compounded by massive changes in capital markets, MSRs, working conditions and technology needs. It’s all hands on deck just to keep the ship on course, and in this article, we examine what lenders are dealing with as the COVID-19 waves continue to swell.

Capital Markets

Managing capital markets in mortgage banking entails a little bit of art and a lot of science. The goal is to optimize revenue and profits, managing liquidity and mitigating interest rate risk along the way. This is a difficult and challenging job in normal circumstances. Throw in a world-wide pandemic in which financial markets are massively disrupted and world economies literally hit the “pause button,” and capital markets executives have an unprecedented and monumental challenge. At the risk of losing relevancy by the time this goes to print, our goal here is to summarize the key issues and concerns faced by capital markets executives in today’s rapidly changing environment.

Here is STRATMOR’s take on the key concerns and risk areas:

- The MBS Market Is Extremely Volatile. Given interest rate volatility and the corresponding unpredictability of prepayment speeds, plus a likely large increase in unemployment and possible falling home prices, investor appetite for MBS has significantly waned. The spread between mortgage and 10-year Treasury rates recently rose to 250 basis points, nearly an all-time high. The Treasury Department recently announced that they will purchase an unlimited amount of MBS and Treasury securities to support the market, which was welcome news. While this is a promising development, time will tell whether it will reduce market volatility in the near term.

- Non-Agency and Non-QM Markets Are Becoming Illiquid. Another very significant concern is the sudden illiquidity of the Non-Agency and Non-QM markets. Given the market uncertainty, Non-QM lenders such as Angel Oak and Citadel recently announced they are temporarily halting purchasing and funding newly originated loans for a period of two weeks to thirty days. Meanwhile, several warehouse lenders have announced that they will no longer fund new Non-QM loans, and in some cases, Non-Agency (Jumbo) loans due to a perception of increased risk. Both investors and warehouse lenders have concern over jumbo borrowers’ credit performance and real estate values in a down market.

- MSR Values Are Getting Hammered. As discussed in more detail in the MSR section below, actual and expected massive prepayments are having a significant negative impact on MSR values. A decline in MSR values is bad news for mortgage bankers, including but not limited to:

- Margin calls on MSR financing as owners of MSR are writing big checks to their creditors

- Massive MSR Asset impairment write-downs resulting in large P&L charges

- Originators who sell loans servicing released will face large Early Pay Off (EPO) penalties from their investors. As credit performance declines, originators will also face Early Payment Default (EPD) situations resulting in loan buybacks or indemnifications.

-

Pipeline Hedging and Pricing Are Extremely Challenging. Volatile interest rates make it extremely difficult to accurately price and hedge mortgage loans. As loan and MSR values decline, lenders are faced with margin calls which require an immediate cash payment to the broker dealer. If the lender does not have the cash, and in today’s volatile market we are talking a large amount of cash, you have a crisis. One way that lenders are managing risk is by selling a higher percentage of their loans on a Best Efforts basis. This effectively offloads the hedging risk to the investor and the related risk of margin calls.

As volumes have increased dramatically and pipelines have increased by a factor of 3-5x, capacity management becomes the name of the game for mortgage bankers. Having loans in the pipeline for a longer than average time creates additional cost and risk to the lender. Especially in today’s environment, a change in the borrower circumstance (job loss or income reduction) may create an unsaleable loan, not to mention the additional cost to hedge the loan.

Operating at full capacity does have a silver lining — as the pipeline grows, lenders can adjust margins to manage capacity, which is exactly what is happening in the market today.

- Warehouse Lenders Are Cutting Back. Warehouse lenders are banks that typically offer a wide variety of consumer and commercial loans. Given the COVID-19 impact across the broader economy, there is a significant demand for credit in other industries (e.g. airlines, hospitality and restaurant chains). Given a finite amount of capital and funds available to lend, banks must make hard decisions regarding how to deploy their capital. When you consider today’s increased perceived risk in the mortgage loan and MSR asset and capacity constraints, one can see why warehouse banks are cutting back. And cutting back means first reducing their exposure to higher risk loan categories such as Jumbo and Non-QM.

- Cash Is King — Fast Funding and Capital Efficiency Is Key. As always, and especially in times like this, cash is king. Mortgage bankers, especially non-bank lenders, need to be hyper-focused on cash management and capital preservation. Mortgage originators are earning excellent profits these days as pricing is adjusted to manage capacity and the influx of loan units drives down the cost to produce (fixed costs spread over many more loan units). While GAAP profits are good, none of that matters if you run out of cash. This places a premium on getting loans funded by investors as quickly as possible to manage within the constraints of warehouse capacity. While there is often a trade off in loan sale execution, the key in today’s market is to get paid quickly and move on to the next loan.

Managing capital markets in mortgage banking is a tough job, and in today’s market, the challenges are almost frightening with so much uncertainty and so many unknowns. High performing capital markets executives are monitoring markets closely, making mid-course adjustments daily, and above all, keeping an eye on cash.

Mortgage Servicing Rights (MSRs)

The COVID-19 virus is having a significant impact on owners of Mortgage Servicing Rights (MSRs). MSR owners must take a holistic approach in this highly volatile market, taking into consideration many factors impacting cash flows that seem to be changing every day. Here are the critical factors that MSR owners should consider in today’s market:

- Bulk Market Quiet. The bulk market for MSRs for 2020 is very quiet as MSR buyers are faced with uncertain future prepayment speeds as a result of 1) wider than normal spreads between mortgage rates and benchmark Treasury/LIBOR rates and 2) origination capacity issues impacting rates. A few bulk MSR transactions have been consummated, mostly between hedged buyers and hedged sellers and mostly during the first half of the quarter.

- Current Prepay Speeds Up. Prepayment speeds across all servicing portfolios are up materially year over year and March 2020 speeds will certainly exceed February speeds. Some prepayment experts believe that March 2020 speeds will increase 40 to 60 percent from February 2020 levels.

- Potential Float Income Down. In addition to speeds, the value of float income is down materially as interest rates have plummeted.

- Unknown Future Loan Performance. Servicers are faced with uncertainty around rising unemployment and expected increases in delinquencies, leading to higher servicing costs and reduced servicing cash flows.

- Uncertain Future Prepayments. There is significant uncertainly about future prepayment speeds. Given the presence of competing factors (the Fed lowering rates vs. lenders increasing rates to manage capacity), there is great uncertainty as to the level at which mortgage rates reach equilibrium in the coming months which will drive the level of prepayment activity.

- Hedge Windfall. MSR owners using financial hedges are likely experiencing “a financial windfall” as the MSR asset has not lost as much value as the hedge instruments have gained. This is because the value of the hedge instruments tends to move efficiently with the market, while mortgage rates do not drop as far as they otherwise would due to capacity management concerns.

- Portfolio Retention Critical. Companies with an effective portfolio retention capability will feel less pain during this period of elevated prepayments as a sizable number of loans are going to pay off. The question is whether the current servicer will be able to retain those borrowers as the percentage retained will have a dramatic impact on their overall financial results.

- Potential Margin Calls on MSR Hedge. MSR Lenders are making margin calls on highly leveraged portfolios as the value of the pledged asset has declined significantly. The magnitude of the margin call is driven by the amount of leverage deployed (i.e. loan amount in relation to the MSR asset). Therefore, highly leveraged MSR owners experiencing an inordinate decline in MSR value are feeling the most stress. This will be something to watch for as the March quarter end approaches. On a positive note, the cost of MSR financing is down as a result of the lower rates.

- Ginnie Mae Servicer Liquidity. Non-bank servicers of Ginnie Mae face a severe liquidity shortfall as borrowers take advantage of GSE forbearance programs and stop making their mortgage payments for a period of time. Since bondholders must be paid each month, the servicer must advance the funds. As of this writing, the Fed may offer backstop financing for these advances, but the eventual outcome of this is uncertain.

While this may seem like a risky near-term strategy, entities that are able to retain servicing today will build a potential annuity stream of servicing income which will strengthen their financial position once this refinance wave is over. Projecting the cash flow demands of the origination and servicing business in a truly stressed environment is critical. Owners of MSRs need to be hyper vigilant in order to optimize cash flows and mitigate their financial risk.

Going Remote

As the virus began to break in the U.S., Microsoft, Google, Amazon and Twitter all recommended that as many of their employees as possible work from home to help minimize the spread of the virus. Even before President Trump called for older Americans to stay home and for everyone to avoid groups larger than 10 for 15 days to try to slow the spread of the virus on March 16, many more companies were sending staff home to work remotely. For many sectors of the financial services industry, including mortgage banking, remote workers have been in place for some time.

Across commerce, remote workers have become increasingly common. According to Global Workplace Analytics in the March 2020 update to their telecommuting trends report, regular work-at-home among non-self-employed people has grown by 173 percent since 2005, 11 percent faster than the rest of the workforce (which grew 15 percent) and an estimated 43 percent of employees work remotely with some frequency. The report notes that 62 percent of employees say they could work from home (Citrix 2019 poll).

As the spread of COVID-19 drives operational decisions and government directives mandate, more lenders are turning to a remote model to maintain operations and work surging pipelines. STRATMOR encourages lenders to be flexible — give as many roles as possible the opportunity to go remote.

The trend of underwriters working remotely has grown out of necessity through the last few years as volumes grew and lenders were not able to find talent in their local markets. According to data from STRATMOR Group’s Compensation Connection® Study, the percent of underwriters reported as fully remote grew from 20 percent in 2014 to more than 39 percent in 2018. Before the coronavirus crisis, 62 percent of lenders reported they currently allow for remote work in at least one fulfillment position (processors, underwriters, closers).

“The roles associated with closing loans are the ones lenders should look into making remote right now,” says STRATMOR Senior Partner Nicole Yung. “These are the roles that will be buried in work in the coming weeks under the high volumes we’re experiencing. With the recommendations for people to work from home, and because these fulfillment roles are critical to continue to keep the loans moving through the pipeline, lenders would do well to focus on converting in-house closing work to remote as soon as possible.”

Outsourcing

Outsourcing is another option that enables lenders to pick up workloads left incomplete by staff who are decommissioned due to the coronavirus or for work that just cannot be completed due to the surge in volume. Under the best circumstances, executing an outsource strategy is a complex undertaking that cannot be implemented quickly, and as of this writing, a multitude of offshore providers in India, the Philippines and elsewhere have sent their workers home. This has left many industries, including mortgage, scrambling to take over functions previously outsourced. Domestic outsourcing may be the best option with offshore arrangements in short-term crisis.

In the eyes of regulators and investors, the lender is responsible for any function that the vendor does, or fails to do, so even if the lender has strong representations and warranties with the vendor, the lender is responsible for output and outcomes regardless of who performs the work. The lender must be comfortable with how the vendor performs the work, trains and manages their team and that the services rendered will be of more value than the risk the lender incurs by having another entity perform the actual work.

There are two types of outsourcing:

- End-to-end. The outsourcing vendor’s staff performs all fulfillment functions.

- Component outsourcing. The vendor’s staff performs specific tasks on behalf of the Lender to reduce the work need to be performed by their own staff.

End-to-end outsourcing is a long-term solution and is most likely not a viable option for dealing with the immediate needs we’re experiencing. End-to-end requires significant advance preparation, over and beyond the contract negotiations. The lender and vendor must agree to the processes that the vendor prescribes, or the vendor must clone the lender in terms of methodology. Decisions must be made as to the technology that is to be used and the reporting and communications standards between the vendor’s and the lender’s staff and with the borrowers.

Component outsourcing is a viable option for lenders as it focuses on specific tasks, such as file set up, ordering services, scanning and/or indexing incoming documentation, preliminary reviews of documentation, post-closing reviews, shipping loans, obtaining trailing docs, and the like. While these tasks are critical, it is less subjective work and none of the tasks require borrower contact, and it takes much less time to get the vendor’s staff up and running and effective.

Typically, each of these tasks are assigned to specific teams — the team only needs to learn and be proficient at one part of the process. Many large lenders utilize component outsourcing to minimize the amount of work that is performed by their staff, so that they can be freed up to do the more complicated work and to communicate more frequently with the borrowers.

An important consideration during this pandemic is the physical location of the vendor’s staff. Are they in a coronavirus hot spot where they will be subject to the same issues that we currently face? Can their staffs work remotely — and if so, what are the implications for the security and privacy of your borrower’s data? There are advantages to vendors that can orchestrate round-the-clock support, but if security and privacy are compromised, the lender is placed at risk.

Another consideration: is the vendor currently providing the same services for other lenders? If so, you have an advantage in that the vendor doesn’t have to create a new process to support your work. If you agree with their methodologies and processes, then the implementation time should be faster. And, if they can mix experienced staff with new hires for your team, the ramp-up time to get their team fully functioning will be reduced.

The overarching factor in outsourcing is that the lender is held responsible for anything that the outsourcing vendor does or doesn’t do. Regardless of the representations and warranties that are negotiated with the vendor, the lender’s reputation and ability to do business could be at risk, so careful vetting and due diligence of the vendor is needed prior to embarking on a relationship, and then careful management and attention to performance is required after the service is implemented.

Other considerations:

- Quality and availability of the vendor’s staff

- Review documented procedures to ensure quality and compliance

- Assess recruiting and training procedures

- Quality control measures to ensure that your requirements are being met

- Ability to handle increases or decreases in the number of loans being processed

- Service levels (e.g. turn time, quality) guarantees

- Recourse if the vendor does not deliver on Service Level Agreements (SLA)

- Acceptable disaster recovery procedures are in place

The Customer Experience

In a typical market environment, a borrower’s journey through the loan process can move quickly from delightful to dismal based on how communications are handled. In this time of market volatility and interest rate uncertainty, lenders must keep up and even improve communications with borrowers or risk serious damage to their reputations.

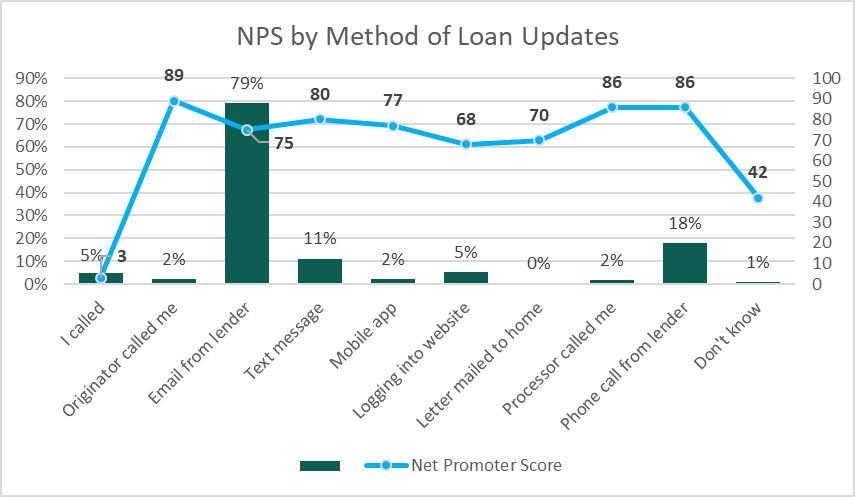

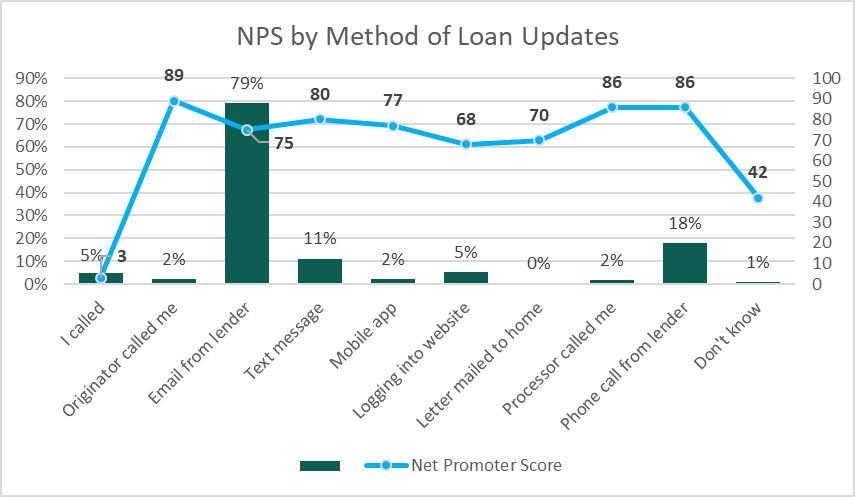

“We live in a world where information about borrowers’ experiences with their lenders is readily accessible to other potential borrowers — and is increasingly important as they narrow down their choice of a lender,” says Mike Seminari, director of STRATMOR’s MortgageSAT Borrower Satisfaction Program. “The data we have from surveying more than 130,000 borrowers annually shows how borrowers expect and prefer to be updated, and even more importantly, how update methods correlate to the difference between borrowers who will recommend the lender and those who will not.” The fact that 79 percent of borrowers receive updates via email — with a corresponding 75 Net Promoter Score (NPS), and just two percent receive updates by personal phone call — with a corresponding 89 NPS, presents a huge opportunity for lenders to differentiate themselves from the competition and garner referral business. “Trust me,” says Seminari, “you’ll need it once this refinance craze runs its course.”

MortgageSAT 2019 Annual Data © STRATMOR Group, 2020.

MortgageSAT 2019 Annual Data © STRATMOR Group, 2020. Seminari recommends:

- Increase Digital Touches: We’re all being told to stay out of public places to help limit our exposure to COVID-19. To maintain and increase interaction with borrowers, accelerate use of digital mortgage functionality, including messaging, chat, email and possibly video conferencing. According to a March 15 article from the Associated Press, the internet can handle any uptick in traffic from the increase in people working and communicating online.

- Pick up the Phone: According to MortgageSAT data, many borrowers prefer to be contacted by phone. As shown in the chart above, the borrowers most likely to recommend were those who received phone call updates from their originators.

- Create Scripts for Common Borrower Questions. Ask your originators and fulfillment staff what questions they’re getting every day and put together Q and A scripts with answers all staff can use. This will ensure your team is sharing a consistent message that focuses on a response that addresses the borrower perspective.

“The lenders that come out of 2020 with reputations intact will be the ones who are able to anticipate the things that could go wrong and create and adhere to a plan to address problems for the borrower quickly,” says Seminari. “This means, more than anything else, encourage originators and processors to ramp up communication throughout the loan process.”

A Final Thought: Heed Good Advice

On March 16, McKinsey & Company released a timely, insightful report about the COVID-19 evolution and implications for businesses. STRATMOR recommends reading this report which we believe does a great job framing current scenarios, economic impact, supply chain challenges and, most importantly, implications for businesses and how companies should respond to this pandemic.

McKinsey recommends seven actions businesses can implement now — STRATMOR suggests lenders consider these steps for your business:

- Protect your employees. At STRATMOR, our people are our most valuable assets. These are challenging times full of uncertainty. Follow the most conservative guidelines posted by the CDC and WHO to protect them. Limit unnecessary travel and practice social distancing by working remotely whenever possible. Outsource work where applicable and step up communication at all levels of your organization.

- Set up a cross-functional COVID-19 response team. Get your staff actively involved in finding solutions. Assign a top executive to oversee every function and discipline and to determine how each are functioning and responding to this ever-evolving environment.

- Ensure that liquidity is sufficient to weather the storm. Lenders will need to tighten belts and model liquidity requirements based on worse case scenarios. This protects your company and your employees. Define strategies (and be prepared to execute them) based on changes and triggers in the economy and your firm’s financial status.

- Stabilize the supply chain. In the mortgage industry, our issue is keeping up with the new demand. The unexpected drop in interest rates have thrown our industry back into a refinance market where most lenders’ staff are tasked beyond their limits.

- Stay close to your customers. Our MortgageSAT tip this month addresses the importance of this and provides tips on how to up your communication with borrowers. Managing expectations, especially with this sudden uptick in volumes, is critical to sustainability during this time.

- Practice the plan. Conducting simulations, roundtables, and providing clear communication are critical factors to ensure stability and a sense of “we’re in control” for your company. Use the STRATMOR discussions in this article on capital market strategies, MSR values and servicing strategies, working remote, possible outsource strategies and the importance of communication with your customers to start conversations with your team.

- Demonstrate purpose. This, in our opinion, is McKinsey’s best advice: “Businesses are only as strong as the communities of which they are a part.” STRATMOR wholeheartedly agrees with this statement. We are in this together and need to remain calm, in control, and work together with our companies and our industry to get through this unforeseen crisis.

We hope this article provides value to STRATMOR clients and our industry. Contact us for additional information and assistance.

How Can We Help?

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.