In the mortgage industry, we have survived a tsunami — in fact, we have ridden a wave of profits that the refinance tsunami gave the industry over the past year. Record volume and sky-high profits gave us enviable numbers while other industries struggled to survive the pandemic fallout. But I believe the refi wave is fading, and this article is about how to get a beachhead in the new purchase climate that we are heading into. (By the way, I live in Florida, so I have decided to torture the ocean analogies because it is better than the alternative headlines that Florida is nationally known for — to mask or not to mask).

There are storm clouds on the horizon, and those storm clouds are going to create a climate that will require lenders to compete more aggressively on purchase loans, which will have a major impact on the lender’s business. It’s not just that the refinance loans are going away and that there will be less total volume. It’s also that lenders are worried about how they are going to keep up their volume and their profit margins in a purchase market. So, why is purchase business so much harder to come by, and why do profit margins on each loan tend to be lower on purchase loans?

In this article I will outline what makes purchase lending so much tougher and what lenders can do to prepare for the inevitable change to a purchase market.

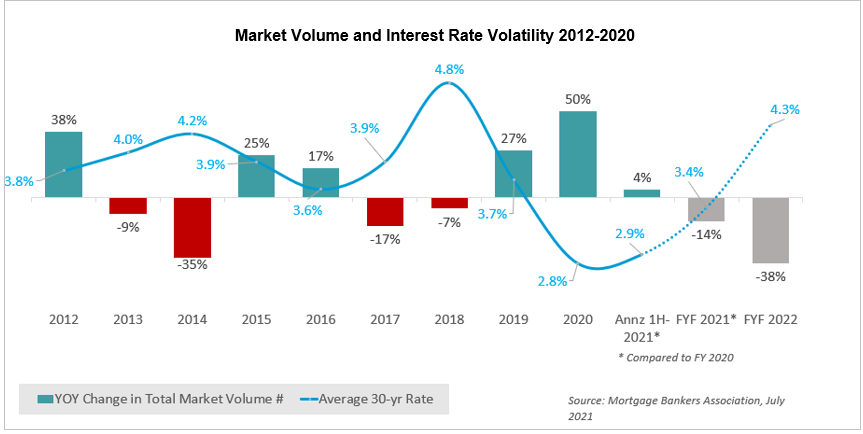

Over the last 10 years, when looking at the total number of mortgage units, the market has fluctuated up or down by up to 50% each year. The chart below tells the story and shows that the trend of interest rates (up and down) drives higher and lower units.

Chart 1

It’s clear that we work in an industry that is subject to high fluctuations — for example, the total number of mortgages in 2020 was up 50% over the previous year, which was up 27% over 2018. That is a lot of fluctuation compared to most industries. Of course, the prediction for 2021 is a drop of 22%.

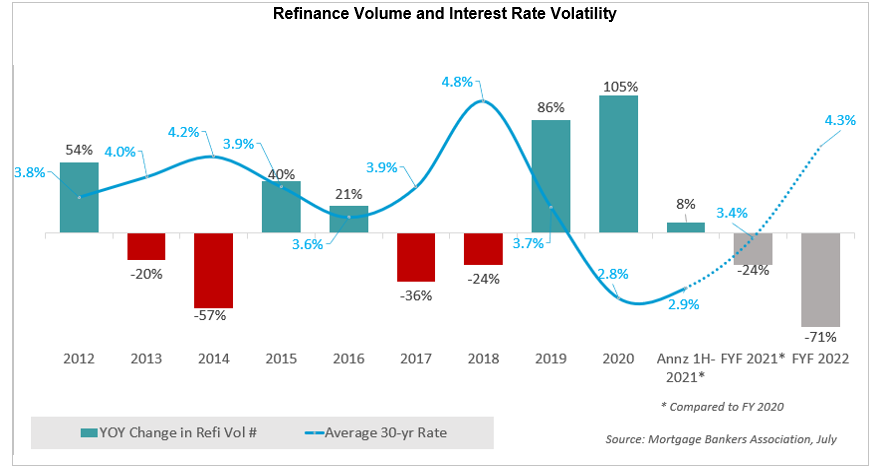

However, if you look at the refinance and purchase data separately the story becomes even clearer. Chart 2 reflects the trend of refinance only — and we now see that the total increase in 2020 was 105% after an increase of 86% in 2019 (wow!). In the first half of 2021 we saw a slight increase in refinance units — up 8% over 2020, but that is expected to reverse the last half of 2021 (drop 24%) and then down 71% in 2022.

Chart 2

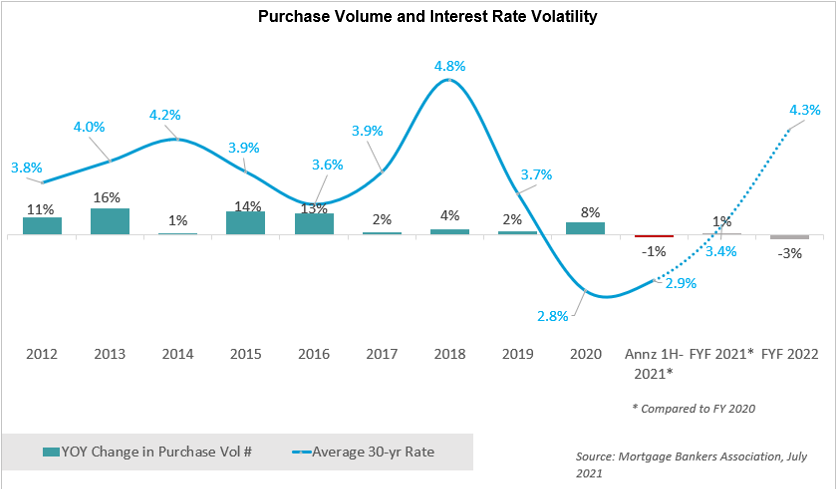

Meanwhile, the purchase market is relatively steady. In fact, there is not a single year where there was more than a 16% adjustment year-over-year. Since 2017, we have averaged only a 5% annual adjustment. Meaning, the purchase market is predictable, with year-over-year adjustments that do not break the business plans of purchase-centric lenders. The challenge is that when the refinance business skyrockets (or falls back to earth), it upsets the entire origination market.

Chart 3

One impact of refinance volume is the overall profit margin for the industry, most notably, the impact on profitability. Chart 4 shows refinance and purchase volume and the quarterly profits of mortgage originators. Profits are high when refinance is high, while they drop significantly with a drop in refinance.

Chart 4: Total Market Volume and Net Income Trends

In the first quarter of this year, we saw the first drop in refinances (Q4 2020 refinance made up 71% of total loan volume; Q1 2021 was 56% — a 15% drop). Q2 2021 is projected to drop again to 49% percent based on the Mortgage Bankers Association’s (MBA) July 2021 forecast. Further, the margin dropped from 203 basis points to 137 by Q4 2020 and to 124 bps in Q1 2021. If the MBA estimates for the rest of this year and into 2022 are correct, we will see margins drop even more.

We know that it is going to be painful in the next year because we’re going to see a big drop in refinance volume. But we are probably going to have a good purchase market, and purchase volume is going to be within a predictable range.

Good lenders will at least be able to build a plan to grow purchase volume in their marketplace, and the number of purchase transactions is likely going to be pretty darn close to what they expect.

Based on the charts above, it’s clear that lenders make more money during heavy refinance cycles. So, the biggest impact of the drop in refinance will be a drop in profits overall. Here’s the rub for most lenders: Purchase loans are harder to market and convert, harder to process, and generate lower revenues and higher expenses. Let’s explore why.

The demand — and costs — for high quality loan originators goes way up.

People trained to do purchases tend to require higher compensation because they have likely spent years developing relationships with real estate agents and others who provide the purchase referrals. Our data shows that Independent Mortgage Banker (IMB) originators are paid more than bank originators. Bank originators are more likely to take the deals that walk in the front door, like a refinance, and thus aren’t paid as much. However, IMBs tend to do more purchase loans, and they tend to devote years to developing a salesforce focused on real estate agents and homebuyers. Purchase loans are more complicated transactions and lenders need originators who have relationships that bring in referrals. Thus, when recruiting in a purchase market, lenders don’t want originators who have only feasted on refinances. And the lenders are willing to pay more for those originators.

Lenders who thrive during this shift are the ones who have paid attention to their employee experience and have a satisfied sales force that proves to be more immune to advances from other lenders.

There’s a fight for the deal.

In a purchase climate, we’re more likely to see multiple originators fighting over the same deal. Just like today’s real estate market where multiple buyers fight for each home because there is not enough home inventory, loan officers fight for the opportunity to do the purchase loan. They are competing based on their reputation and they are fighting for the referrals — but they also are more likely to compete on price to get the deal.

So, sales costs go up (to get the better originators) while revenue goes down because you are fighting on price a little more. Now lenders have higher sales costs and lower revenue. Not a good start to the story.

The purchase process isn’t a straight path.

One of the biggest challenges of changing for a purchase market is being sure the originators change the way in which they interact with the consumer. Refinances are linear. For example, a typical conversation starts with the originator asking, “What’s your current loan?” What’s your current rate?” And then: “Great, I have a lower rate. That means our new monthly payment is lower than your old monthly payment. I can save you $200 a month. Do you want to refinance your loan?”

If the answer is yes, It’s not much more complicated than that. As long as the originator can get the loan to the borrower at the terms quoted and close quickly enough, the borrower is likely to close. Even when the consumer shops the rate, the conversations and cadence do not change much, even if it is repeated a few times with a slightly better rate offering.

Last year, the toughest thing was there were so many of these opportunities. It was hard to juggle them, but they were all much like the scenario described above. Now, let’s roleplay the purchase scenario.

Consumer: “I’m interested in buying a home.”

Originator: “Great! Where are you in the process?”

The answer will most certainly vary significantly.

The consumer may tell the originator that they haven’t even spotted a house to buy yet, or that they may or may not be working on a purchase with a real estate agent. They may or may not have actually sold their current home and may or may not want to use the proceeds as the down payment for their next home. The consumer may or may not agree with his/her partner, parents, friends, or other influencers who say that purchasing a home may or may not be a good decision right now. And the consumer will ask: “If I can find the home I want, can I win the bidding battle?”

Sue Woodard, Senior Advisor at STRATMOR Group observes that, “The purchase transaction is often emotionally loaded for the customer, unlike the refinance in the scenario above, where it’s purely a financial play. Smart lenders have paid a lot of attention to their customer experience and ensured not only that there are no gaps in the process to heighten the stress on their customers, but also that they are proactively providing the touchpoints that are needed and expected by today’s consumer.”

Every step of the way, through all these points, the lender has to be there. This is why I say that purchase is episodic. Rarely can you close a purchase deal on a first call because there is either an influencer that needs to be sold or there are a host of things the lender doesn’t even control that have to be accomplished before the originator can sell them that mortgage. There are a LOT of scenarios and they don’t all have a happy ending.

This is also why selecting the right technology stack for communication and customer journey is so critical — the loan originator cannot be everywhere all the time — and great technology can help ensure that no balls get dropped in a critical moment. An LO cannot convert nearly as many purchase opportunities as refinances.

Instead of having 50 to 100 simple refinance opportunities in a month, a good originator may only get 25 to 30 purchase opportunities that are harder to manage and will have to be juggled for up to six months because that’s how long it will take for that borrower to work their way through the sales cycle and become a buyer. A great originator may convert 10-15 of these opportunities. And that’s a top producer. The originator can’t handle as many and will need to be paid more because they are probably the ones who sourced the referral in the first place.

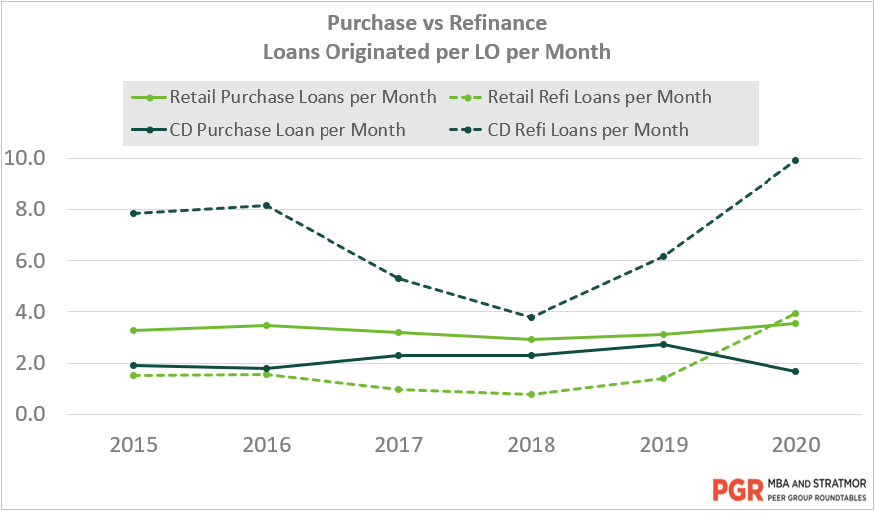

Chart 5

Plus, the borrower isn’t the only one the originator has to sell. There is also the Realtor® and anyone else who delivered the referral — financial planner, previous customer, someone you go to church with, et cetera.* That is a lot of influence over a process that is already tough to maneuver.

More customers are seeking their own financing options, but the influence of the Realtor should not be understated. Realtors often say, “Oh, I got a lender you need to talk to.” The best loan originators, if they didn’t get the referral from the Realtor themselves, are the ones who are now making outbound phone calls to the purchaser’s Realtor to collaborate with them to try to help this person find a home and close the loan. In fact, the originator may be called upon to build confidence with the listing agent, which is an opportunity to influence, and that is another sale the originator must make.

So, the originator is in this episodic, six-month cycle with the buyer and has to sell to all these constituents and the consumer just to keep them in the pipeline.

The purchase process is a lot harder, and we’re not even halfway through it yet.

* Did you know if you use the name “Realtor” it must be capitalized and is trademarked? It’s because of their unbelievable level of professionalism and experience over the decades that they have earned the title.

Purchase loans have very specific deadlines that must be met.

We all hear the horror stories. “The moving trucks are already set up…. I’ve got to move that weekend because the kids have to go to school…. We have to close before the baby is born…. I am planning to have Aunt Ethyl’s birthday party the weekend after closing….”

There is no question mark at the end of these statements.

When you work with a refinance borrower, they want to know when they can close. However, the purchase borrower wants an assurance that it will close on a specific date.

Refinance transactions do not have a fixed closing date. It’s always “Get me everything as fast as possible.” But the originator does not commit to the date of application on a refi — the date is not confirmed upfront because it does not have to happen on a certain date.

Think of it in project terms. We do a lot of project management at STRATMOR, and you must understand the Iron Triangle of project management — time, features and resources. If any of these elements are fixed, the others must be flexible. All three cannot be the primary driver of a project.

On a purchase loan, time is fixed, so resources must be flexible. The lender must staff every single function in operations for peak on-time delivery. With refinances, the lender can spread the loans out across the month and balance staff accordingly. Not on a purchase. Like a project, with a set date at the end of the month, all activities must be planned against that date and finished by the due date. Underwriters, processors, closers — all need to be finished on time.

Then there is the matter of preference about timing. Even when the “life” issues described above do not apply, borrowers tend to want to close at the end of the month. There is also an issue of duration: in this competitive climate, purchase contracts are written with short turn times, often to be competitive with cash buyers who can close quickly with no contingencies. If the lender commits to a 30-day close, and does not deliver, the lender and the originator get a reputation in the community of not closing loans on time.

With purchase loans, the timetables are tight, the deadlines are unforgiving, and the borrowers are concerned about missing the closing date. Other than that, it’s easy!

At closing, every loan is a new experience.

With refinances, an originator might have one or two title agents or escrow companies, often based on a referral or affiliated business arrangement that the lender controls. For a purchase, it’s a chaos of closing agents, who are typically chasing the same Realtors for referrals. This means that every relationship on a purchase may be the first time the closer has ever dealt with this company.

Plus, there is a significant difference between purchase and refinance loans around when the closing process begins. On a purchase, the closers go to work much earlier in the process. They have to find out from the closing agent: “What e-closing platform do you use?” “Can we share data?” “When do I have to get this to you — do you already have the title binder cleared?” And there is also a significant difference about the all-important Closing Disclosure. The best lenders will send out the Closing Disclosure before the loan is clear to close because they have to — the date is fixed. On a refi, which is linear, when the loan is clear to close is when the disclosure is sent out.

Given all of this, it is not hard to understand why some lenders hear “purchase” and feel a little ill. Lower revenue, lower productivity and higher costs doesn’t sound great after a sit-down, stuff-yourself buffet of refinances. However, there is opportunity here. It requires, now more than ever, a focus on people, processes, and technology.

If it is hard, there is a barrier to entry.

Not everyone can do purchases well. If you are an originator experienced with purchase loans, you are not going to have to compete with refinance originators for long because they don’t have the skills and purchase muscle memory to pull it off. Now, the best lenders are going to take those refi originators, and they are going to train them, bring them up the curve and give them those skills.

And if you are a great purchase lender, and your staff have these skills, you are in luck. You have a processing team that knows how to deal with borrowers who are emotionally invested on a fixed closing date, and a closing team that knows how to work with the local closing agents. You will have underwriters who are committed to closing loans on time by making sure their turn times are appropriate and their conditions are reasonable. You will have a product team that has built a menu of all the esoteric options needed for success, including first time homebuyer loan programs and down payment assistance programs.

Not every lender has many of those skilled people in their operation.

It is going to be harder, but if you have those sorts of skills and you have created a culture of excellence with satisfied employees, you know you are well positioned for the purchase market.

There is a training opportunity at every step in the process.

People who are engaging with consumers need to be trained on how to handle a purchase if it is something that is not built into their muscle memory. Lenders, if your originators haven’t done many purchase loans, or if their skills have diminished through the refi boom, train them now. They need to understand the world, the Realtor and all the counterparties. Train your processors. Train your underwriters who may or may not remember how to review sales contracts. Train your closers because they are going to have to do hand-to-hand combat with closing agents. Train them once, twice or three times. And then be sure to measure the results, and train them again.

The top of the purchase sales funnel is different.

STRATMOR has created and deployed borrower journeys on behalf of lenders, and we find that typically there are only two types of refinance journeys but there are six types of purchases. In less than a minute, can you identify which of the six journeys or profiles you are working with? If not, you’re probably not selling purchases effectively. You should have a strategy for every purchase profile, and if you don’t, contact STRATMOR for help.

The technology tools exist to do purchases well.

The technology and products are not dramatically different for purchase vs refinance lending, but they need to be used differently. For example, a refi-centric marketing solution is typically focused on figuring out who is in the money for a refinance, or who is shopping for a new mortgage loan. You might build campaigns focused on reminding prospects to consider the option, to create demand for the product. A purchase is more meeting the demand created by changes in the consumer’s buying journey. Marketing for purchase mortgages also means configuring campaigns and communication focused on Realtors® and other referral sources, not just consumers. Solid CRM and automated marketing capabilities are needed, but they need to do different things.

Lenders need to have a slick, digital process for taking applications that enables borrowers to continue to engage easily. For example, purchase borrowers want to generate pre-approval letters again and again — over their weeks of looking for a home. With a refinance, they just want the upfront process to be completed quickly.

Technology must support the episodic nature of the purchase process, too. Granted, everyone worked a lot of hours during the refinance boom because we had so much volume. In purchase, it may not be a sheer number of hours, but on a Saturday afternoon when the Realtor needs an approval letter or needs to re-quote or talk about the challenges of a property with multiple bids, the lender better have someone on hand to take that call. And, in some cases, that may mean having the technology accessible by phone because the originator may not be in a position to run to the nearest laptop to get help. So, mobile capabilities are more important.

Lenders, you may not need to overhaul your entire tech stack, but you certainly need to optimize for purchase business. Do not just continue with refinance-centric implementations and expect the same results.

We can argue about what day the refinances will finally all go away, but smart lenders are already focusing on their purchase money business, preparing to weather the storm that will wash away the lenders who only know how to originate refinance business. Preparing will involve a careful analysis of your team’s skill set, your tech stack and your origination process. If you haven’t already started this work, do so today. If you need help, and most lenders will benefit from objective support, remember that this is the work STRATMOR does. We can help you brave the storm and emerge a leader. Garth Graham

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.