for these free STRATMOR

online publications

In a year and an industry when every month seems to produce its own variety of madness, there’s something settling about the reliability of March Madness to give us hope and thrills, excitement and anxiety as we root for our favorite teams in the tournament of tournaments. And no matter who you’re rooting for, it’s undeniable that the final minutes of those games are almost always electrifying. That’s because so much can happen. One misdirected pass or a clutch shot can mean the difference between tears of joy or tears of sorrow. In the mortgage industry, the last days — or even hours — of the loan journey can create that same anxious energy for borrowers. Our question this month: How can lenders make some last-minute clutch shots to win customer delight?

Just like the end of a nail-biter NCAA tournament game, so much can happen in the last hours or days leading up to a loan closing. Suppose the closing itself (the actual appointment) doesn’t start on time or there’s a clerical error on the paperwork — or worse, an unexpected or misunderstood fee. While these miscues may not be enough to completely derail the closing of the loan, they could be enough to flip the borrower from a raving fan to someone who will badmouth you. Regardless of who is at fault, the blame for any miscues at a closing will often be passed along to the lender or originator, particularly when they are not physically — or virtually — represented.

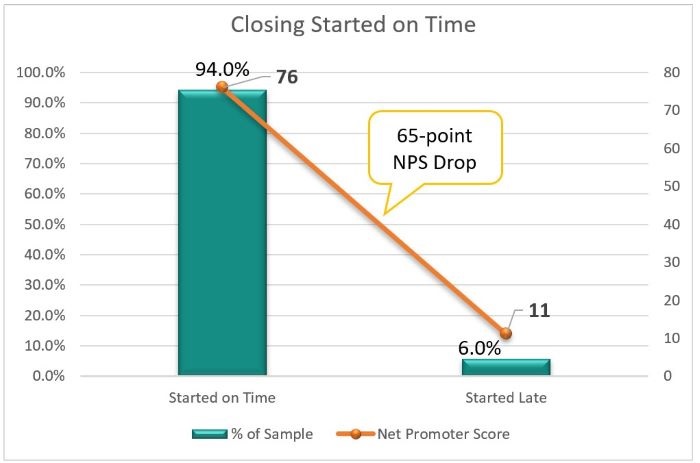

Consider the extent to which Net Promoter Score (NPS) suffers when one or more of these three missteps occur:

Closing Does Not Start on Time

When a closing fails to start on time, an already anxious borrower may start to feel panic as they imagine worst-case scenarios. It’s like the opposing team taking a time-out with ten seconds left on the clock. Nervousness drains delight and NPS falls 65 points.

Chart 1

Source: © 2023 STRATMOR Group, MortgageCX Borrower Satisfaction Program.

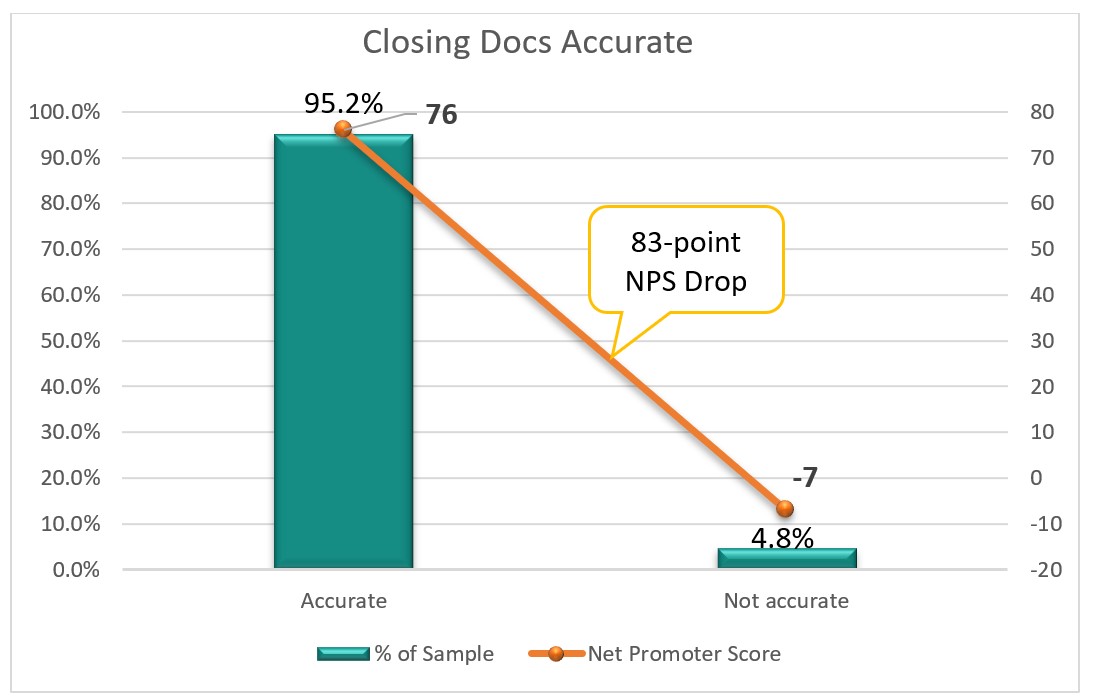

Source: © 2023 STRATMOR Group, MortgageCX Borrower Satisfaction Program. Closing Documents Are Not Accurate

When a borrower sees an error on their closing documents, oftentimes a clerical error like a misspelled name or street address, it erodes their confidence that the remainder of the closing package is accurate and NPS falls 83 points.

Chart 2

Source: © 2023 STRATMOR Group, MortgageCX Borrower Satisfaction Program.

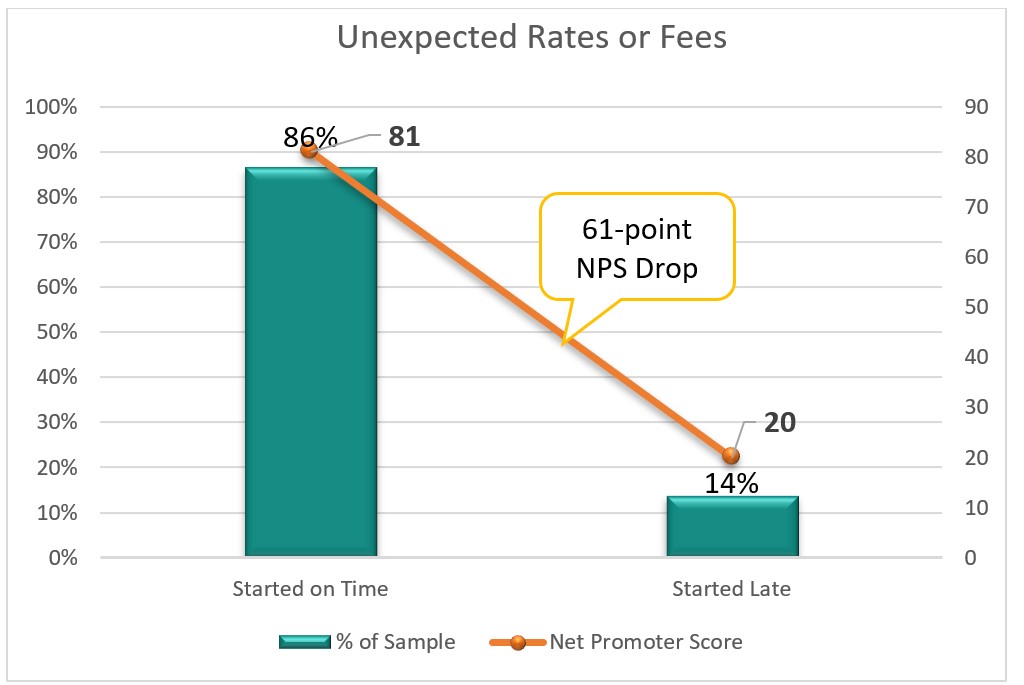

Source: © 2023 STRATMOR Group, MortgageCX Borrower Satisfaction Program. There Is an Unexpected Rate or Fee

When a borrower perceives unexpected rates or fees, they may wonder whether someone pulled a fast one on them. Even a hint of suspicion of hidden costs or a changed rate quickly forfeits the chances of a referral. NPS falls 61 points.

Chart 3

Source: © 2023 STRATMOR Group, MortgageCX Borrower Satisfaction Program.

Source: © 2023 STRATMOR Group, MortgageCX Borrower Satisfaction Program. Here are three ways originators can minimize last-minute miscues and bring home the victory:

Find out more about STRATMOR Group’s MortgageCX program and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

Start receiving monthly Customer Experience Tips