for these free STRATMOR

online publications

I often wonder how I would fare on one of those survival shows. It’s exciting and empowering to watch guys like Bear Grylls of “Man vs. Wild” take on the elements with such bravery and resourcefulness. One minute, he’s saying, “I don’t have a hammer or nails, or planks of wood, but I think I can make something work” and 30 minutes later he’s relaxing in a sturdy shelter on a bed of palm fronds. That’s the can-do attitude we need in the mortgage industry right now. Sure, we may feel a little lost, unprepared and lacking shelter, but with the right survival skills, we too can “make it work.” Our question this month: What survival skills will help originators to “make it work” for their struggling borrowers?

I’ve always loved Swiss Army Knives. From the time I was a child, their utility and their versatility has captivated me. You need a can opener? No problem. A corkscrew? Here you go. A screwdriver? Scissors? A nail file? Got ’em all right here. In today’s mortgage environment, as originators claw and fight for every deal, it will be the resourceful and versatile ones who ultimately succeed.

We discussed in last month’s Tip that the recent rate increases have left would-be borrowers in a tight spot. Many are now having to consider smaller homes or riskier financing. Others are taking no action at all, paralyzed by the uncertainty of a looming recession. As Rob Chrisman put it, “I can think of five people I know who are “waiting for the right time” to buy a house.”

Loan officers need to demonstrate empathy to these borrowers, but they also need to learn (or re-learn) how to have nuanced conversations around the complexities of the financial choices that lie before borrowers. The problem: many originators have been feasting on the surplus of refinance loans for so long that they’ve forgotten these valuable “survival skills.”

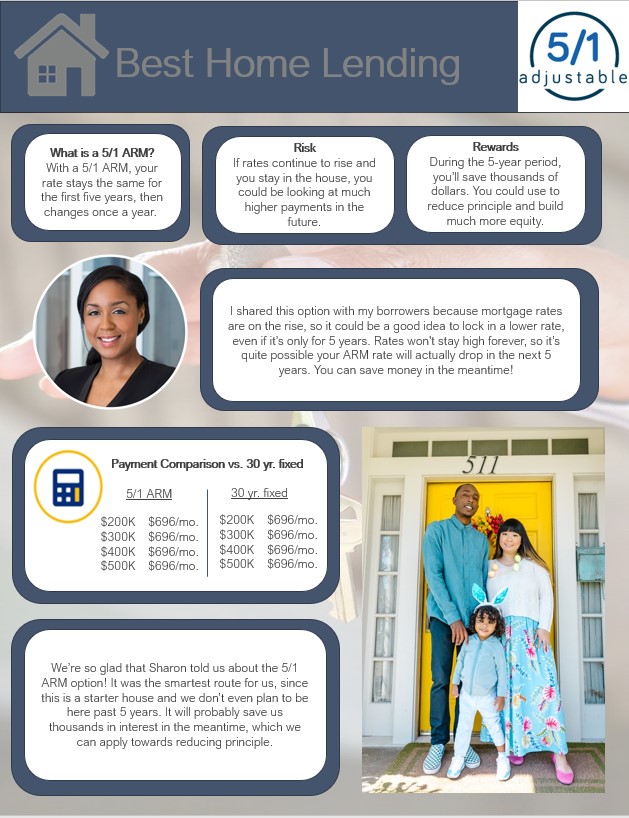

Simple, fast-track loans are yesterday’s news. As margins and loan volumes shrink, originators are having to get more creative to come up with viable options for their borrowers. But how many originators have been around long enough to clearly articulate the risk-reward scenarios of 5/1, 7/1, and 10/1 ARMS. Or what about the innerworkings of HELOCs, seconds, piggybacks, balloon mortgages, down payment assistance programs, or bond programs? It’s time for originators to fill the toolbox with some new tools, or at least sharpen the ones that have lost their edge over the past two years, if they wish to survive, or better yet thrive, in these lean times.

Loan officers would do well to add these three tools to their survival kits – and learn how to use them with mastery:

Full Range of Product Options

Imagine walking into a car dealership looking for an SUV with room for car seats and meeting a salesperson whose knowledge is limited to self-driving, two-door sports cars – “They’re fast…they’re easy!” It wouldn’t be long before you seek out a salesperson with a broader knowledge base, someone who can listen, assess, and guide you to the right vehicle. That’s the exact scenario many borrowers are encountering right now with undereducated originators.

LO’s who perform consistently through “up” and “down” markets are those who have built “trusted advisor” relationships with their clients. This entails acquiring both broad market knowledge and specific product knowledge and staying up to date on changes.

Underwriting Guidelines for Each

Being well-versed in product options is only the beginning. Knowing the underwriting guidelines, nuanced as they may be, is how best-in-class originators set clear expectations with their borrowers and avoid the many pitfalls of borrower frustration during the document collection phase of the loan journey. I’ve heard leadership protest, “LOs shouldn’t need to learn underwriting guidelines. They should be out there selling!” In truth, the underwriting expertise becomes the foundation of their “trusted advisor” relationships and begets countless referrals and repeat business over time.

Risk/Reward Conversations for Each

Anyone can acquire knowledge. The ability to explain what you know with simplicity is far more rare. American folk singer Woody Guthrie put it this way: “Any fool can make something complicated. It takes a genius to make it simple.” Successful originators find ways to explain product and pricing nuances in ways that borrowers can easily grasp. One of these ways is the use of a bulleted pros/cons list or risk/reward list. Laying out the positive and potentially negative impacts of the options helps borrowers digest and assess the information more easily and gives them confidence in their ultimate decision.

Here’s ONE BIG IDEA for how lenders can contribute to their originators’ “survival kits” in the current market:

Have your Marketing team create a One-Pager for each one of your loan products.

Include the following:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

Start receiving monthly Customer Experience Tips