I read recently that some homes in California are going for more than $1 million above their asking price. My first thought? Good luck to the appraisers looking for comps to support those values. Whether it’s due to today’s skyrocketing home values or the egregious turn times and soaring appraisal costs (sometimes upward of $3,500) of the Pandemic Era, the appraisal phase of the home loan journey has received a lot of attention lately.

If you know a thing or two about the appraisal landscape over the past decade, you know that appraisal operations have not exactly been synonymous with innovation and modernization. While other key areas of the mortgage process, like Point of Sale (POS) and closing, have benefited from great technological leaps forward, appraisal technology has been comparatively slow going to market and gaining adoption. This stands to reason when you consider that new technology is often driven by the perceived demands of the market. In this case, lenders witnessing the maturation of a mobile-dependent millennial generation prioritizing technology and innovation investment where it had a direct customer-facing impact. That included anything that might make the mortgage experience more personal and more convenient (i.e., online applications, document upload portals and e-signing documents).

Appraisal innovation didn’t make that cut.

Long neglected and often outdated from a technological perspective, appraisal operations finally got their chance to stand in the spotlight when turn times turned ugly in 2020-2021. Lenders started to pay attention to the fact that there was an enormous blind spot in visibility and general Service Level Agreements (SLAs) around appraisals. The blind spot was not only impacting the lender’s ability to deliver on promises and expectations, but often left the borrower feeling helpless and completely out of the loop.

These unwieldy timeframes and high costs spurred innovative thinking in two areas: eliminating the need for appraisal reviews with risk score calculations (a.k.a. Summary Submission Reports or SSRs) and eliminating the need for appraisals altogether with property inspection waivers (PIW). While both proved impactful during the refinance boom, they are having less of an effect as we settle into these new, more suppressed market conditions. PIWs heavily skew to no-cash refinances, which are dropping like a rock. So, these “innovations” did help ease some of the capacity pressure that was so intense over the past two years, but the needs they were addressing are much less pressing now.

Now that volume is down and lenders are catching their breath, they can finally turn their attention to alleviating the continued pain felt around the inefficiency, the lack of visibility and the overall lack of control associated with the appraisal process. The next innovation appears to be appraisal management tools that afford some control and visibility from all angles.

The new hurdle: Who has the budget in a constricted market to go out and buy technology tools? The age-old question lenders continue to face is how to keep up with digital trends when you are either too busy or cash poor. Since lenders rarely have both excess cash and time on their hands, it takes strategic, long-game thinking along with a certain amount of gumption to bite the bullet and embrace tools that will help your team — and ultimately your customer experience — flourish.

At STRATMOR’s Operations Workshops, we are privileged to hear the unfiltered commentary of lenders in the thick of these struggles. For the past two years, there has been major pain felt in just trying to find an appraiser to take a job, much less at a reasonable cost.

Data from a recent STRATMOR study on appraisal operations (conducted in Q1 2022), commissioned by appraisal management software company Reggora, confirms that sentiment. In the study, lenders were asked to provide feedback on appraisals with a specific focus on the past 30 calendar days to capture current market conditions as closely as possible.

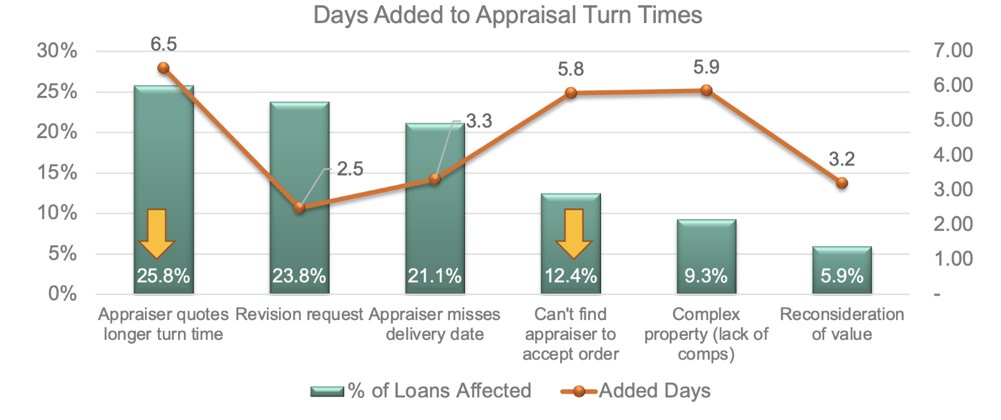

The results revealed that, despite the recent downturn in volume, the busyness of appraisers continues to be a major contributor to turn time delays. Nearly four in ten loans (a combined 38 percent) are still being impacted by either extended turn time quotes by the appraiser or the inability of the lender to find an appraiser to accept the order.

Chart 1

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022.

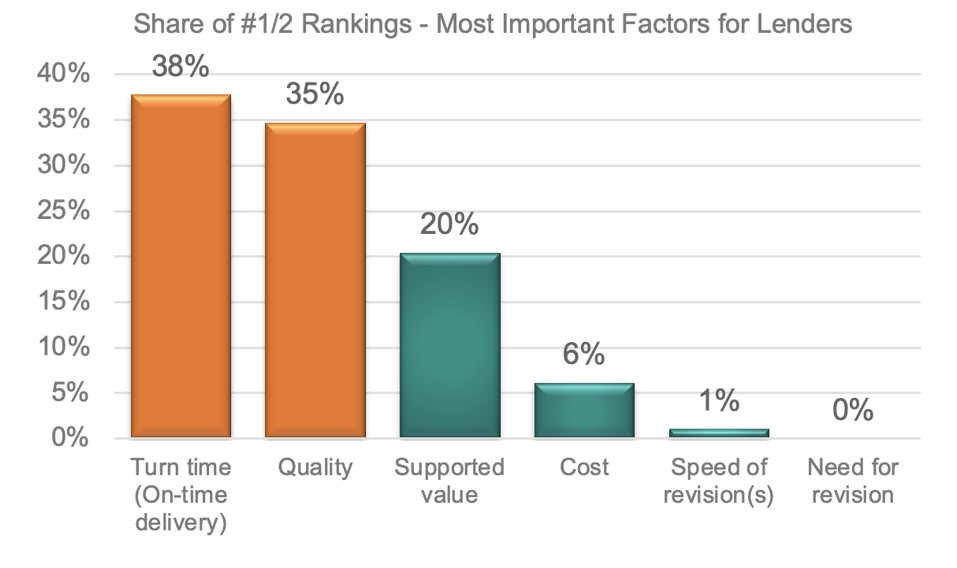

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022. Unsurprisingly, lenders prioritized turn times as the most important factor in the appraisal process (38 percent), with “Quality” following at a close second (35 percent).

Chart 2

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022.

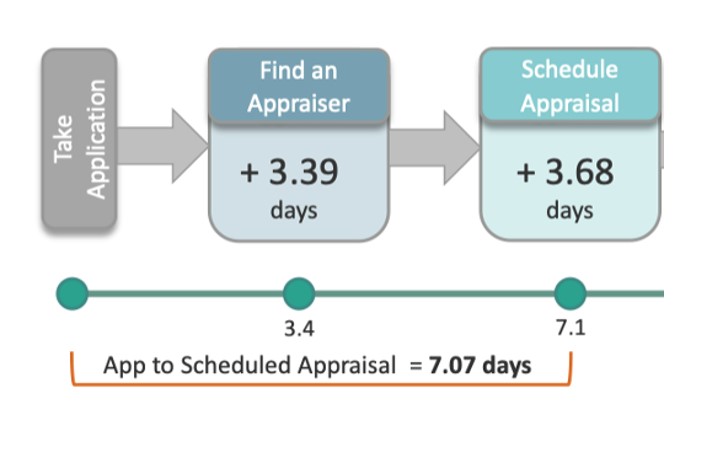

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022. In the same study, lender respondents said it was still taking an average of more than seven days from the time of application to the scheduling of an appraisal. In other words, the major volume decrease and supply constriction have had limited effect on bringing appraisal turn times down. This is one area where leveraging technology may be the answer, with some appraisal management software vendors claiming to cut this timing down by two or more days.

Chart 3

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022.

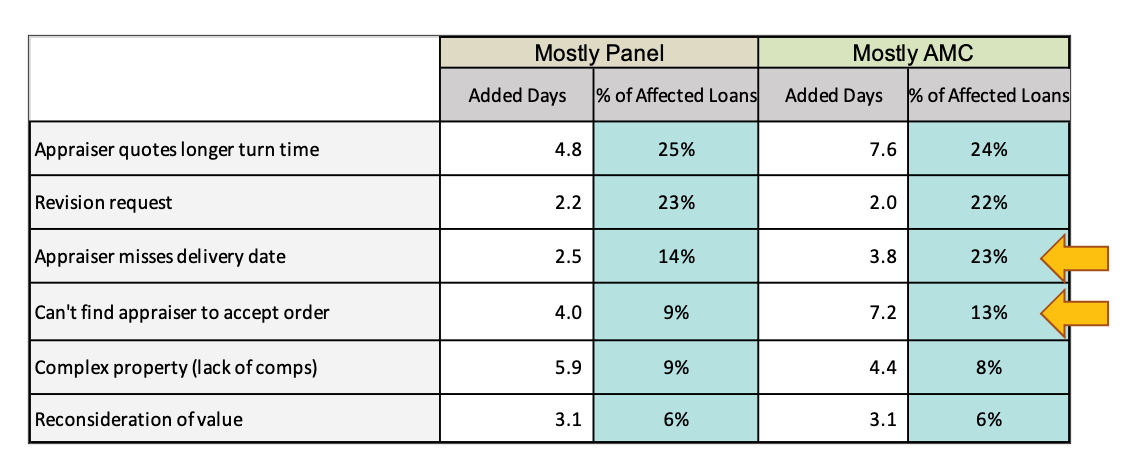

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022.While appraisal turn times have been poor across the board, the study showed marked differences in performance between lenders who manage appraisals through a Panel approach versus those who have an AMC manage appraisals for them. Lenders who use AMCs see appraisers miss delivery dates more often than those who use a Panel approach (23 percent vs. 14 percent). They also run into delays more often than those using Panels (13 percent vs. 9 percent).

Chart 4

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022.

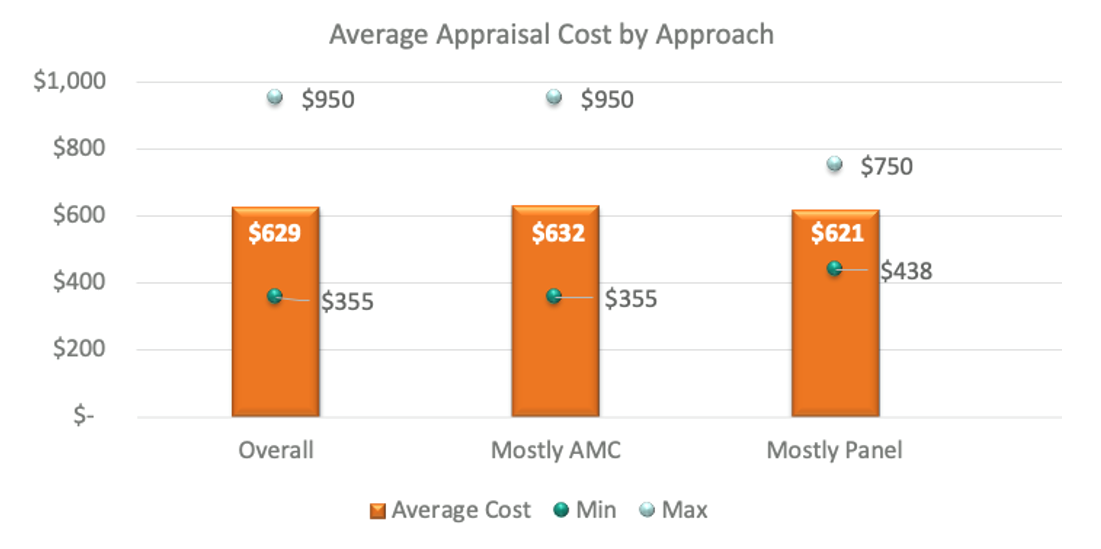

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022. While there are many factors that impact “average” appraisal costs, such as the market, property complexities, and property type — not to mention the busyness of the appraiser — there are a few consistent observations that can be made from the survey data. For one, appraisal costs in general have spiked over the past several years. Granted, they were suppressed for a long time, but the average price of a full appraisal has increased from around $350 a decade ago to $629.

Additionally, we can see that there is a good deal more variation in AMC pricing versus Panel pricing; AMC pricing had a wide range from $355 to $950, a difference of $595, while the Panel approach ranged (from $438 to $750, a variance of $312. We theorize that this may have to do with the dynamic in AMC relationships that creates more separation between the appraiser and the lender and perhaps fosters an environment where appraisers feel more at liberty to request large price hikes. Another theory is that it may have something to do with panel appraisers earning more money per appraisal than AMC appraisers which may make them less likely to overcharge on the more complex appraisals because their overall compensation is better.

Chart 5

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022.

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022. High costs and long turn times are not the only two issues STRATMOR hears about in our workshops, though they happen to be the most prevalent. Workshop participants also cited frustrations around collecting appraisal fees, placing orders, and lack of transparency.

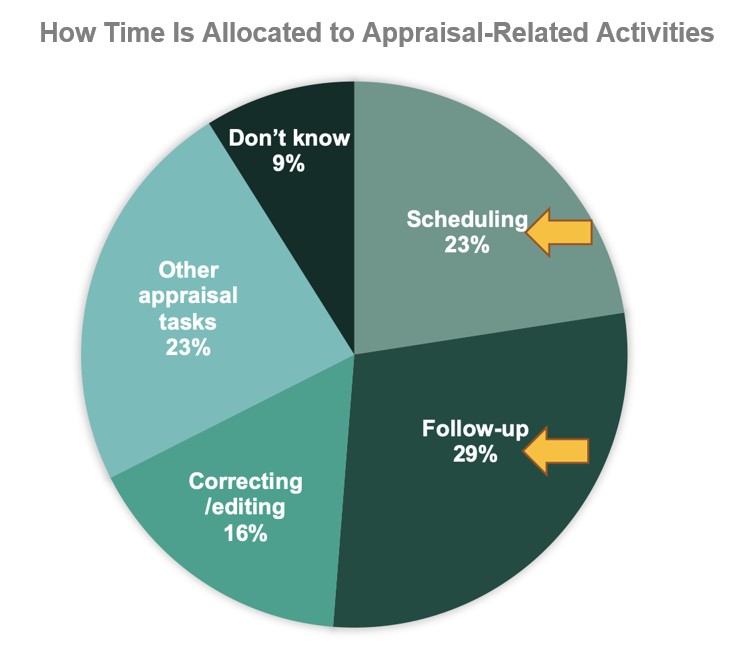

There is one thing everyone agreed upon: when it comes to appraisal processes, the industry’s reliance on manual methods like emails and phone calls is tedious and time-consuming for all parties involved. When asked how they allocate time to appraisal-related activities, survey respondents said they spend more time following up (29 percent) than on any other appraisal task. Scheduling was the second most cited task at 23 percent for time allocation. Correcting and editing ranked third at 16 percent.

Chart 6

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022.

Source: STRATMOR Q1 2022 Lender Appraisal Study, commissioned by Reggora, © copyright 2022. There also is a trend causing increased consternation among lenders: low appraisals.

In the current environment, when home buyers are bidding UP the sales price of homes, Realtors® have realized that it is highly likely that the appraised value will not support the sale price. In previous times, this led to a renegotiation scenario — where seller and buyer come to the table and narrow the gap. The sellers are now beginning to pre-negotiate this, or more accurately refusing to negotiate at all and telling the buyer so upfront. So, contracts are being written to include assurances that the buyer will make up any appraisal gap. This means that the borrower should care about the valuation process, but it is still something that they have little control over.

So, what do lenders think about these metrics and trends? STRATMOR held several focus group sessions with lenders to discuss the survey results in depth and they turned out to be much more than just “venting sessions.” Yes, we gave lenders a chance to air their concerns, but they also were eager to share their strategic ideas for solving the problems as well to discuss vendors that are trying to improve the lender experience and the overall appraisal landscape.

Part of the difficulty in getting momentum behind technology improvement in appraisal operations is that lenders fail to see how many stakeholders are actually affected by the appraisal process. The appraisal desk, operations personnel, originators, underwriters, appraisal vendors and borrowers are all impacted by the speed and quality of appraisal operations. Here are a few examples of how moving from a manual, “old school” approach to a more digitized, “new school” approach could impact various parties.

Old School (Panel): Ordering and scheduling an appraisal involves playing phone and email tag with appraisers or manually completing processes in software with a narrow field of view.

New School (Panel): Appraisal software provides one place to manage an entire fee panel, ensures appraiser independence requirements and tracks all appraiser licenses via asc.gov. Additionally, it provides automatic appraisal allocation based on coverage areas set by the appraisers, clear and compliant communication between the lender’s team and the appraiser, an Appraisal Scorecard for each appraiser, and notifications of pricing changes. Finally, it provides visibility to many different stakeholders, thereby minimizing internal status updates.

Think of the difference between using your phone to call a taxi versus using the Uber app and being able to see the driver’s vehicle make, their rating score, advance notice of the cost of the trip and knowing when the driver will pick you up.

Old School (AMC): Appraisal team members jump between different platforms for different appraisal vendors or use a disjointed user interface from within a Loan Origination System (LOS).

New School (AMC): Appraisal software integrates directly with AMCs, giving appraisal team members access to all the features in a workflow designed specifically for them.

Old School: Appraisal Operations team members bend over backwards, typically using manual communication methods like emails and phone calls, to ensure each stakeholder in the mortgage department has the information they need to close loans on time.

New School: Software solutions use rule sets to make the sharing of relevant information and documentation automated and immediate. This allows team members to spend less time dealing with logistical tasks.

Old School: the lender pays for appraisal, but the borrower chooses another lender, or the lender cannot originate the loan, which means lost revenue.

New School: Appraisal software collects payment directly from the borrower and pays the AMC or the appraiser directly, eliminating any potential revenue leakage from transactions that do not close.

Old School: The originator emails and calls to check with the appraisal department for status updates.

New School: The originator has visibility into the status of an appraisal, when borrowers have received and completed payments, pricing disclosures, and immediate access to orders to quickly determine whether they are over or undervalued. The information the originator needs (and only what they need) is made readily available, keeping them in the loop.

Old School: Underwriters spend valuable time doing an initial review of an appraisal for missing or inconsistent data.

New School: With some new appraisal software tools, underwriters can automate the first step of the review process by flagging missing and inconsistent appraisal data based on a lender’s own customizable ruleset.

Old School: The appraiser receives orders via phone and email from various lenders with whom they have personal relationships and from several AMCs.

New School: An appraiser, after creating a free account with an appraisal software platform at the request of a lender, receives faster payouts and more consistent orders. The appraiser communicates directly with lenders through the software’s messaging system, where both parties keep each other updated with the latest status or comments on each order.

Old School: The borrower receives a bill for the appraisal from a company they’ve likely never heard of before, which has often been a source of confusion. Clicking a link takes them to a generic payment processing site, which can also make them feel uneasy. Yet, lenders do not want to bring this in-house because of the sensitivity of handling credit card information.

New School: The appraisal software vendor sends an invoice to the borrower on behalf of the lender/AMC and takes care of collecting and processing the payment. Lenders can then track their itemized payment receivables.

As we’ve seen over the past two years, the appraisal process can delay the loan cycle by weeks while lenders look for someone to accept an order, juggle appraisal management companies (AMCs) and perform endless follow-up tasks (53% of lenders’ appraisal-focused time is spent on scheduling and follow-ups). Additionally, accounting teams spend valuable time tracking payment requests from the borrower and paying out appraisers, and most underwriters manually review each appraisal for accuracy, often sending them back to the appraiser for revisions.

What does this mean for lenders? Today there is an opportunity for appraisal streamlining and automation, and ultimately, higher productivity and lower per loan cost. After decades of lagging from an automation standpoint, there are solutions available today that can eliminate manual tasks and shorten appraisal turn times. The big question is, do the return on investment (ROI) numbers pencil out? In a constricted market like the current one, lenders have their hands full just trying to stay afloat.

But the even bigger question may be, can lenders afford to ignore appraisal innovation? Clearly, investment in technology that automates manual processes and potentially shortens cycle times is a good long-term strategy. And while STRATMOR has yet to see appraisal solutions take center stage like other innovations before them, it may only be a matter of time before they will. As STRATMOR Principal Tom Finnegan put it, “It may be like eClosing tech… it wasn’t something anyone was talking about… until it was.” Contact STRATMOR for assistance with your next steps with appraisal technology. Seminari

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.