for these free STRATMOR

online publications

The other day at the grocery store, I overheard someone mention the name Tom Cruise, only to have their teenage child respond with, “Is that the old guy from the “Top Gun” movie?” This was devastating to me on more than one level. First, I grew up wanting to be Tom Cruise, so the mere mention of his name is a reminder that this did not, in fact, happen. Second, if he has now transitioned from cool to old, it’s a sobering reminder that I too, am well on my way down that inevitable path. The oldest Gen Z-ers are currently just 27 years old, but as Tom Cruise’s fading glory reminds us, life comes at you fast.

Those of us in the older generations have a choice to make — slowly go extinct or adapt and find new ways to engage younger borrowers. One thing is certain; survival begins with assessing the environment. Our question this month: What should lenders know about attracting and engaging Gen Z borrowers?

Generation Z (those born between 1997 and 2012) is on the move and eager to replace Millennials (1981 to 1996) as the largest generational mortgage buying block. A hearty 37% of Gen Z individuals are on the lookout to become homeowners in the next one to three years, according to a recent Rocket Mortgage survey. And that number grows to 72% when you extend the timeframe to six years. That’s a lot of new borrowers coming on the scene! What’s more, they don’t seem to be afraid of high rates, with less than two percent of respondents citing high rates as a perceived roadblock to buying a home. So, they’re thinking ahead and they’re confident. Now they just need down payment money.

Assuming the industry can adequately educate Gen Z on low down payment options, the mortgage world could be poised for a “roaring 20s” after all. So, it behooves us to understand the psyche and buying behaviors of this powerful future buying block.

By some estimates, the Gen Z population share (approximately 32%) has already surpassed both Millennials and Baby Boomers. As the first generation to grow up with their faces all but glued to their smartphones, their buying behaviors are a little different from the ones current mortgage leaders (typically Gen X and Baby Boomers) are used to seeing. The temptation is to throw advanced technology at the issue, but that won’t entirely solve it — it’s more complex than that. And ignoring it certainly won’t make it go away. If lenders want to engage with Gen Z borrowers in meaningful ways and get an edge on their competition, they must start with understanding their borrowers (and future borrowers) better.

Learning how to attract and engage Gen Z borrowers starts with understanding what makes them tick and what makes them unique compared to other generations. Consider the following three distinguishing markers of Gen Z:

Gen Z individuals are reported to have an attention span of just eight seconds; a few seconds shorter than millennials, who come in at approximately 12 seconds. That’s bad news for loan officers and lenders who have spent lots of time and resources bolstering their online presence and are counting on borrowers to search for them on Google and then sift through and read a bunch of customer reviews.

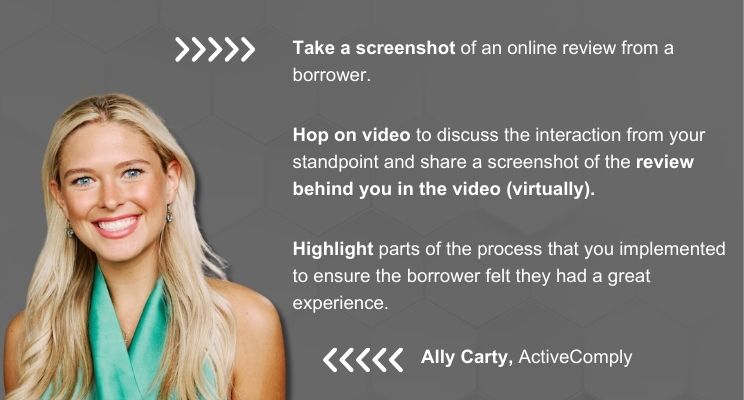

Gen Z has become accustomed to being spoon fed small doses of concentrated messaging through social media platforms, so the world of personal branding and reputation management will need to adapt. ActiveComply’s Ally Carty, both an expert on Gen Z buying behaviors and a member of Gen Z herself, suggests the following tactic to weave static reviews into a video strategy:

“This is much more engaging and captivating for Gen Z viewers,” says Carty, “than viewing stagnant images and having to find and read written reviews.”

As for vendors who offer reputation management services, unless they can find a way to deliver content in a way that not only is succinct and visually stimulating but also tuned into the delivery algorithms of video platforms, they may soon find themselves fighting to maintain their relevance. Lenders keen on capturing the attention of their borrowers would be wise to incorporate video testimonials in place of written ones and explore how they might feature them on leading social platforms as well as their own mobile apps.

Fifty-five percent of Gen Z uses smartphones for more than five hours a day. Most have no patience for confusing or slow user interfaces and, just like they prefer text messages to phone calls, they also prefer auto-sign-in mobile apps to manual web logins. The most forward thinking lenders are already leading the charge to improve the borrower’s mobile experience.

Don’t be left in the dust in five years when the Gen Z buying population has doubled and is expecting a smooth and attractive mobile experience. According to STRATMOR’s MortgageCX program data, mobile and text loan updates correlate with some of the highest advocacy and loyalty scores, so it’s a worthy investment from more than one perspective.

According to STRATMOR research, fewer and fewer borrowers are actively seeking online reviews. The percentage of borrowers reading online reviews has dropped significantly in the past several years, peaking at 42% in 2020 and falling to just 20% in 2023.

We expect this trend to continue as more Gen Z borrowers enter the buying market. According to a recent study, 92% of all Gen Z adults credit social media influencer recommendations as the most important driver of their purchase decisions. Here’s what one Gen Z first-time homebuyer had to say:

“When it comes to influencers, does the individual look knowledgeable? Do they have a ton of negative comments? Do they seem genuine? Are they talking about homes this week then next week something totally different? I would want home ownership to be their brand.”

Comments like these are eye-opening for Carty, who has also found that Gen Z individuals looking for mortgage guidance “gravitate towards influencers in their 40s or 50s over a 20-to-25-year-old on Instagram or TikTok because they believe the former group has more experience and has helped more borrowers long-term.”

For anyone looking to get into the influencer game, here are Gen Z’s favorite places to consume information, in order of importance:

Here are three ways you can start gearing up for the coming wave of Gen Z borrowers:

If you’d like to discuss STRATMOR’s MortgageCX program in more detail, email me at mike.seminari@stratmorgroup.com or find time on my calendar to set up a free MortgageCX consultation.

MortgageCX is now integrated with Encompass®!

Start receiving monthly Customer Experience Tips