Recently, I spent nearly half an hour on the phone with a loan officer who wouldn’t remember me the next day.

Let me back up.

I was secret shopping under the alias “Wes Arnold,” a recent divorcé preparing for a relocation to Nashville. STRATMOR conducts this kind of Secret Shopping on behalf of clients to understand how consumers experience a lender’s people, processes, and technology, and to uncover the moments where the experience falters.

Unfortunately, we find a lot of missed opportunities. But most frustrating is when we find people who drop the ball when they have a real chance to engage.

In this scenario, “Wes” was cautious but hopeful and trying to start over. The LO’s response? A checklist:

“Credit score?”

“Should be good. 740. As I mentioned.”

“Down payment?”

“Twenty percent.”

Each time I tried to share some context — that I was nervous about the move, overwhelmed, adjusting to a major life change — he redirected me back to numbers and documents. If I had been a real borrower, I probably wouldn’t have called back.

But as part of the evaluation and our Secret Shopping service, I did call back on the same line the next day and recognized the LO’s voice.

“Hey! This is Wes Arnold. I think we spoke yesterday—”

“I’m sorry, who?”

“Wes. We talked for a while … about my move to Nashville?”

Pause. “Can you remind me of the details?”

Here’s the thing: I knew this was a secret shop. I wasn’t actually buying a house. But I still felt a real emotion: I felt forgotten. This particular LO had two chances to connect and didn’t take the opportunity to do so. For an actual homebuyer, that moment is more than disappointing; it’s defining.

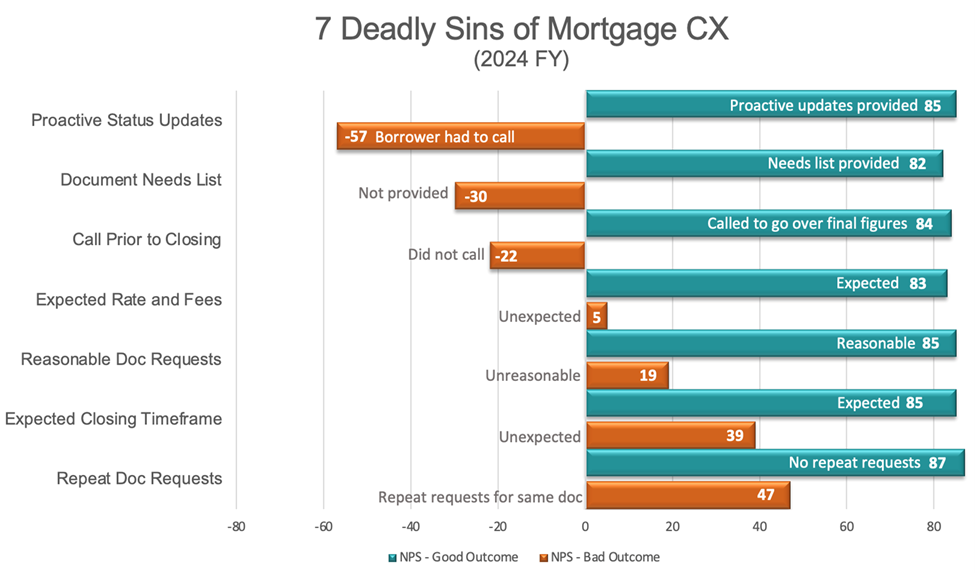

In STRATMOR’s secret shopping research, one phrase continually shows up in borrower feedback: “It felt too transactional.”

That’s the quiet killer of conversion, trust and long-term loyalty.

Lenders pour millions into marketing and technology, yet lose qualified borrowers because the experience feels mechanical and impersonal. LOS and CRM systems capture the what and how, such as credit scores, income, and milestones, but almost never capture the why.

That missing “Why” is exactly where trust breaks down. And right now, in a market where the cost to acquire each borrower has doubled or quadrupled from just a few years ago, ignoring their Why isn’t just poor service. It’s poor economics.

Our secret shopping reveals two critical breakdowns in the customer journey:

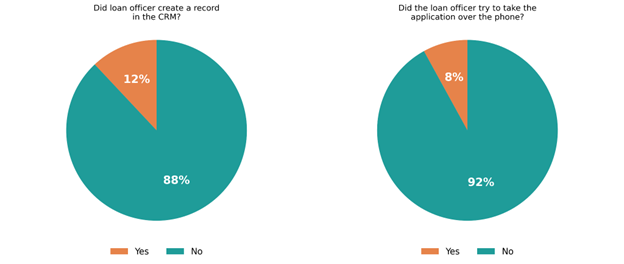

First, the digital gap: We sometimes call the loan officer using the phone number on their web page. A few days later, we ask the client to search their CRM for our shopper’s record (providing name, email, and phone number). Nearly 9 times out of 10, no record exists. The lead never enters the system. It simply evaporates.

Second, the missed relationship opportunity: Taking a phone application is arguably one of the richest human-to-human interactions in the entire mortgage process. Borrowers share intimate financial details most people never discuss openly. Yet in over 90% of our calls, the LO ends with: “I’ll email you a link to apply online.”

Together, these two breakdowns reveal a fundamental problem: the consumer is responsible for moving the transaction forward. Loan officers are essentially hoping the borrower follows through, which explains low conversion rates and the overwhelmingly transactional sentiment borrowers feel.

Two observations stand out:

That leads to a bigger question: if the process feels purely transactional, why would a consumer return to a human the next time? But the inverse is even more powerful: if the borrower feels understood, guided, and remembered, why would they choose a purely digital, human-less path?

In a world that can feel increasingly impersonal, the CRM and the way we use it should be the engine that drives real relationships, not the thing that dilutes them.

Behind every purchase, there’s a life event — a “D” moment driving urgency. You’ve probably heard them before:

Each is emotional before it is financial.

If LOs don’t recognize the “D” driving the decision, they miss the chance to adjust tone, pace, reassurance, or celebration to what the borrower truly needs.

True hospitality starts with curiosity. You can’t connect with someone you don’t understand.

That’s why we advise lenders, and the technology teams supporting them, to build intentional capabilities to capture the borrower’s WHY and deliver that throughout the process. During the first conversation, the WHY should be learned and documented, and then for each interaction that follows it is remembered and reinforced. Every processor, underwriter, and closer sees the “Why.” Instead of file #45698, the notes read: “First-time homebuyer, moving to be near his daughter’s school.”

It’s simple. But it turns a transaction into a relationship. Empathy is no longer accidental. It’s built into the workflow.

When you understand a borrower’s “Why,” everything changes. The experience shifts from transactional to relational, from mechanical to meaningful.

Service is black and white; hospitality is color. You can check the boxes and still leave no emotional footprint. But when borrowers feel seen and valued, it makes every subsequent step easier. They’ll forgive small issues and remember you for all the right reasons.

That’s a great example of systematized hospitality.

Hospitality isn’t random acts of kindness — it’s a repeatable system.

At STRATMOR, we build those systems with lenders every day. In partnership with Will Guidara, author of Unreasonable Hospitality, our Million Dollar Moments work helps lenders identify and redesign pivotal borrower moments, one at a time — turning good intentions into intelligent process design.

Hospitality means handling each “D” differently.

That’s the real work of systematized hospitality: codifying empathy so every borrower feels personally understood every single time.

Or as we often say: Lenders have automated everything but empathy.

It’s time to fix that.

The math is simple: remembering people costs nothing. Forgetting them costs a fortune.

That brings us back to “Wes Arnold.”

What if the loan officer had actually engaged with “Wes” on a personal level and uncovered his “Why?” What if they had an empathic conversation and the LO also entered just one note: “Recently divorced, relocating to Nashville for a fresh start?”

Instead of fumbling a lead, the LO could have begun a relationship. When you get the “Why” right, everything else follows.

“Wes” needs a home loan, but what he really needs is someone who sees the person behind the application to help him through this next uncertain stage of his life.

This article is meant to spark thinking about the Million Dollar Moments in your own process that shape how borrowers feel and how those moments can be redesigned to build deeper connections and greater conversions. The key is spotlighting the seemingly small borrower moments that can deliver massive results.

If you’re ready to identify the moments that matter most in your borrower experience, we can help you define and implement the system that brings them to life.

To get started, contact us or email garth.graham@stratmorgroup.com. William Ayer

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.