It is no secret that mortgage industry volumes and profits are under extreme duress. Mortgage originators are scrambling to generate new business as demand for refinances has dropped dramatically, and purchase volumes are down due to a lack of inventory and ongoing affordability issues. In addition to scrambling for volume, loan originators must decide on the best model for them. Should they be a loan officer in a distributed retail branch model? Pivot to a lower-cost consumer direct (CD) model or consider opening their own branch? Or does it make sense to become a mortgage broker? Under which model can they best serve their customers and optimize earnings in this cycle?

Meanwhile, lenders in search of additional revenue and cash flows may consider entering the wholesale channel. The idea of increasing variable costs and reducing fixed costs in this market is very appealing. In this article, we will cover what drives loan originators and their decision to operate under the broker wholesale model, and we will also touch on key factors that lenders should think about when considering expanding into the wholesale channel.

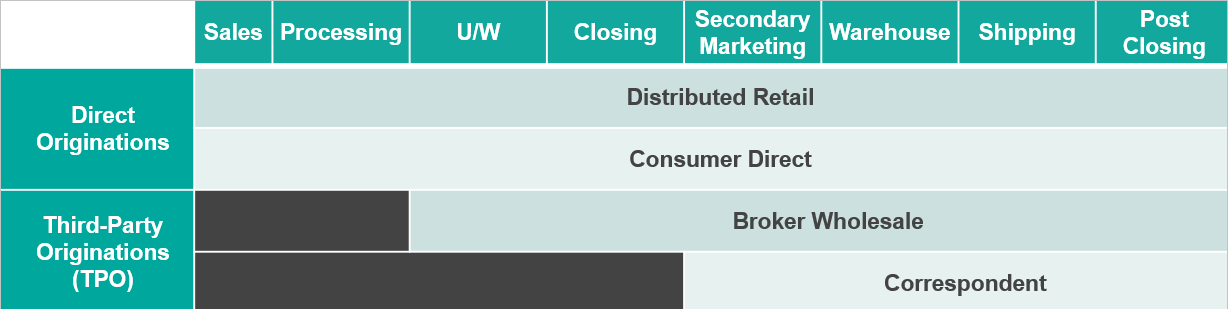

To set the stage, let’s start with the basics. Chart 1 below summarizes the various production channels used in mortgage banking and the typical mortgage banking functions associated with each.

Chart 1: Mortgage Origination Channel Summary

Source: © 2023 STRATMOR Group.

Source: © 2023 STRATMOR Group. Distributed retail and CD lenders interact directly with customers at the point of sale and execute all the typical mortgage banking functions from sales through post-closing. Third-party originators (TPO) include broker wholesale and correspondent lenders. Correspondent lenders acquire closed loans from other lenders that originate loans via some combination of retail, consumer direct or wholesale channels. Wholesale lenders source loans from mortgage brokers. Brokers originate loans directly with borrowers, do some level of processing and then turn the partially processed loan over to the wholesale lender to complete processing, underwriting, closing and delivering the loan.

In short, borrowers interact directly with three categories of originators at the point of sale:

On a national level, the relative share of lending from these three “direct” lending channels has ebbed and flowed over the years as we will discuss further below.

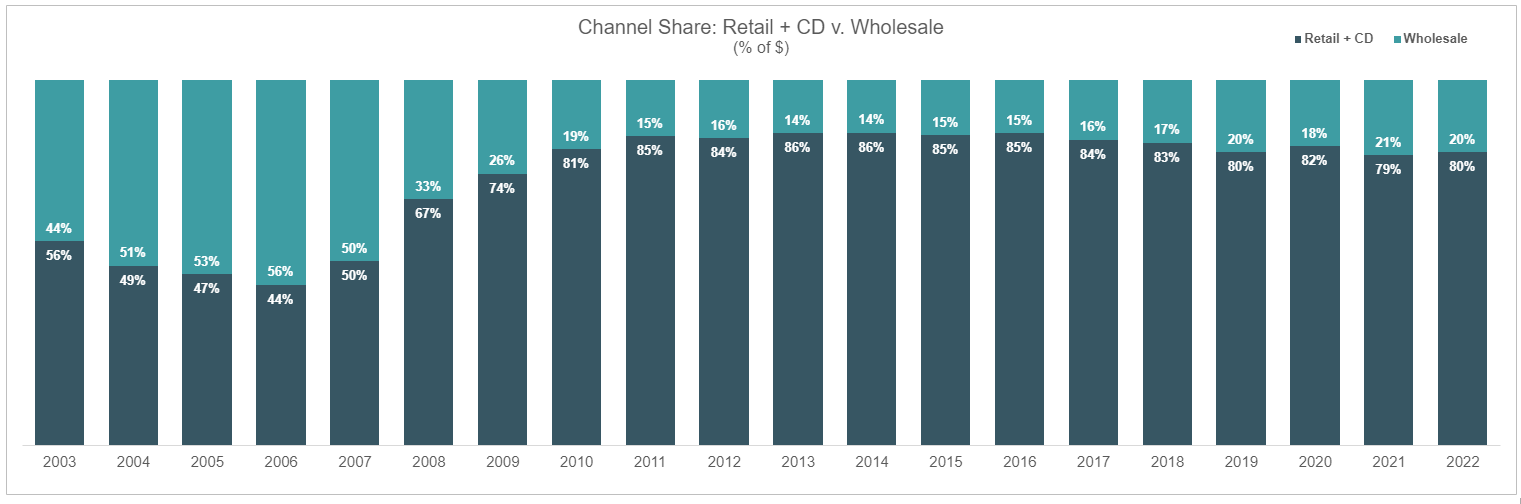

To understand the current state of the wholesale channel, we need to examine its development over time. Chart 2 below summarizes the relative channel share of retail (distributed retail plus consumer direct) and wholesale.

Chart 2: Wholesale Channel Share

Source: Inside Mortgage Finance, Copyright 2023. Used with Permission.

Source: Inside Mortgage Finance, Copyright 2023. Used with Permission.Wholesale share peaked at 56% in 2006 just prior to the Great Recession and was propelled by the emergence of many subprime and Alt A lenders at that time. In the 2007-2010 timeframe, the drop in wholesale channel share was driven by several factors:

From 2011 to 2017, wholesale channel share was consistently in the 14-to-16% range. Since 2018, broker share has increased to the 17-to-21% range according to Inside Mortgage Finance (IMF).

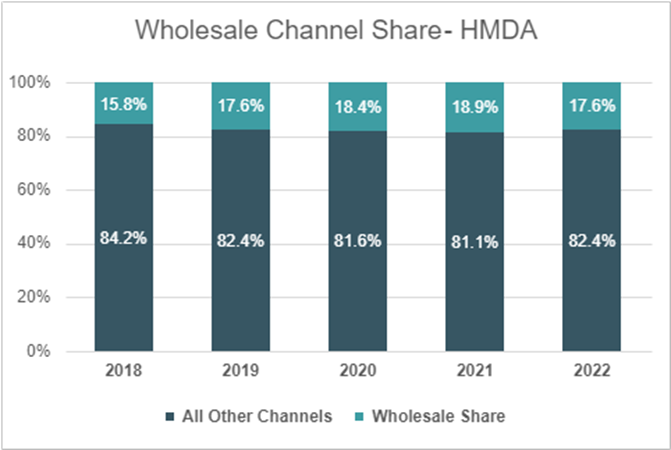

To further assess wholesale channel share, Chart 3 below summarizes recent HMDA data.

Chart 3: Wholesale Channel Share Based on HMDA

Source: Polygon Research HMDAVision.

Source: Polygon Research HMDAVision. From 2018 to 2022, wholesale channel share has ranged from about 16% to 19%, according to Polygon Research HMDAVision, as compared to 17% to 21%, per Inside Mortgage Finance. Based on these two datasets, we can conclude that wholesale channel share has been in the range of 16% to 21% over the past five years but has not markedly increased or decreased during that timeframe, whether we look at IMF data or HMDA data.

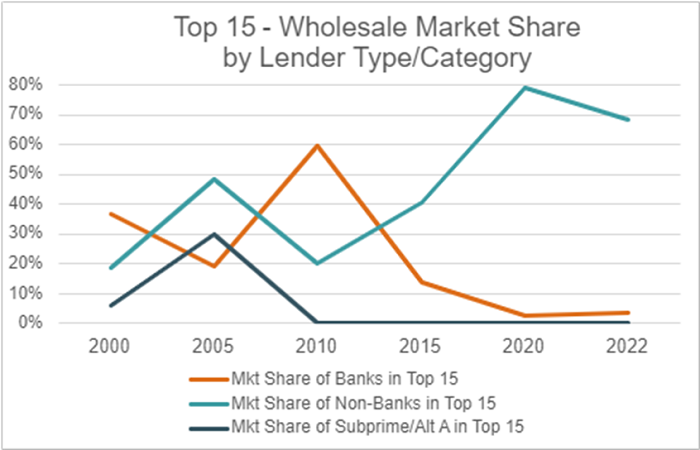

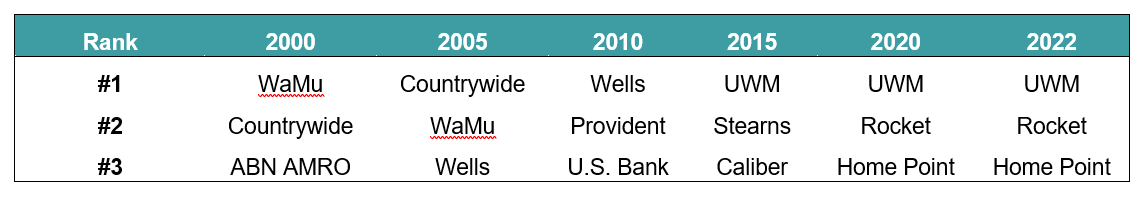

As we shift our discussion to the lender share within the wholesale channel, Chart 4 below summarizes lender share for the Top 15 banks, non-banks, and subprime/Alt A lenders at five-year intervals since 2000, plus 2022.

Chart 4: Market Share of the Top 15 Wholesale Lenders by Lender Type

Source: Inside Mortgage Finance, Copyright 2023. Used with Permission, STRATMOR analysis.

Source: Inside Mortgage Finance, Copyright 2023. Used with Permission, STRATMOR analysis.Banks dominated the wholesale market in 2000 with lenders such as Washington Mutual, ABN Amro, Wells Fargo, Bank of America and Chase. In 2005, non-banks took the lead in market share with the emergence of lenders such as Countrywide, Argent, New Century and Greenpoint. The mix of lenders had a decidedly subprime and Alt A flavor at that time. In 2010, after the Great Recession essentially wiped out subprime and Alt A lending, banks regained market share with Wells Fargo leading the way, but also including U.S. Bank, Bank of America and Flagstar in the Top 5.

In 2015, the bank market share in the wholesale channel dropped precipitously and non-banks took the lead with the emergence of United Wholesale Mortgage (UWM), but also included players like Stearns, Caliber, Freedom Mortgage and Plaza Home Mortgage. In 2020 and through 2022, non-banks continued to dominate, with UWM building its market share to over 35%, Rocket Mortgage’s TPO unit a distant second with an 11% share, and both followed by Home Point Financial, NewRez/Caliber and loanDepot.

The challenging market of 2022 and 2023 has taken its toll as the following major lenders — representing about 12% of the 2022 wholesale channel market — exited:

Another interesting development in the wholesale channel has been the increased concentration of market share at the top.

Chart 5: Market Share of the Top 3 Wholesale Lenders

Source: Inside Mortgage Finance, Copyright 2023. Used with Permission.

Source: Inside Mortgage Finance, Copyright 2023. Used with Permission.The combined market share of the Top 3 wholesale lenders has generally trended upward since 2000 except for 2015. As banks exited the wholesale channel in the 2010 to 2015 timeframe, that channel’s Top 3 share dropped, but then the Top 3 concentration increased from 2015 to 2020, led by UWM, Rocket and Home Point. Today the Top 3 market share concentration is still well above 50%.

In our view, wholesale lenders can be divided into three distinct segments: scale lenders, niche lenders and relationship lenders.

Scale Lenders

Most of the volume in this channel is originated by large-scale players like UWM and Rocket. The value proposition to their broker counterparties includes the following:

Niche Lenders

Niche lenders offer products that require specialized expertise, which makes it more difficult to scale. For example, non-QM lenders like Angel Oak or Deephaven may offer non-agency products, like bank statement or Debt Service Coverage Ratio (DSCR) loans that have unique underwriting and investor requirements. American Financial Resources (AFR) offers a range of Construction and Renovation products. The wholesale channel is ideal for niche lenders because they can cast a wide net over thousands of brokers who can originate the product as the need arises, and who want to work with a lender who has the expertise to efficiently underwrite and close the loan.

Relationship Lenders

This category includes lenders that have long-term relationships with counterparties who broker loans to them. This may include wholesale lenders catering to smaller community banks and credit unions that need and want high-touch service. These financial institutions want to offer mortgages to their customers and value a one-on-one relationship with a wholesale lender who can manage the business for them. In this model, a bank salesperson interacts with the borrower at the point of sale, but quickly hands the loan off to the wholesale lender partner. The bank is not typically “shopping” the loan with other wholesale lenders, but rather values the relationship with the wholesale lender and trusts they will treat their customer well.

This age-old question came up during recent client meetings. Why would a retail originator or branch manager want to become a broker? Or vice versa — what would cause a broker to want to go to work for a retail lender? What are the key factors? What is “the math?”

Similar to the three categories listed previously, loan originators can work in one of three models:

Consumer direct originators work primarily in call centers or virtually and have leads driven to them via a variety of methods such as referrals from affiliates, various forms of advertising, and/or the acquisition of leads from third parties. The key to the CD channel is efficient conversion of leads to closed loans at the lowest marketing cost per funded loan. CD loan officers are typically not “hunters,” per se, as they usually don’t rely on referral sources such as Realtors®, builders, or a personal network of contacts. Therefore, it would be highly unusual to see a CD originator become a mortgage broker.

It is much more plausible for a retail originator to pivot to become a broker originator or vice versa. After all, they are doing much the same thing — beating the bushes to generate business, whether they are employed by a retail lender or a mortgage broker. The key factors to be considered include:

Let’s tackle the earnings potential question with an illustrative modeling exercise. Our analysis covers four scenarios:

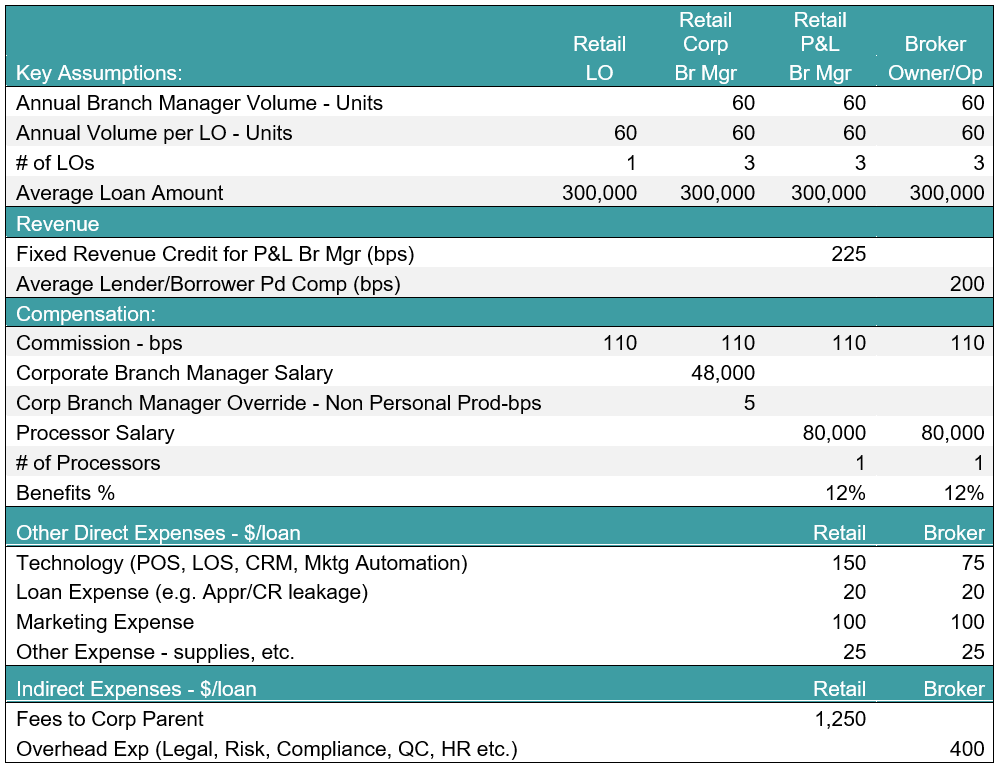

We have made certain assumptions for this analysis to illustrate key concepts. Caveat: The “math” for lenders and brokers may vary greatly from what we used in our example. Here are the key assumptions:

Chart 6: Key Assumptions for Illustrative Model

Source: © 2023 STRATMOR Group.

Source: © 2023 STRATMOR Group. To ensure an “apples-to-apples” comparison across the four categories, we kept many of the assumptions constant, including volumes, average loan size, commission levels, salaries and other expenses. Originator earnings are highly sensitive to the following key assumptions, which may vary widely based on product mix and supply/demand dynamics:

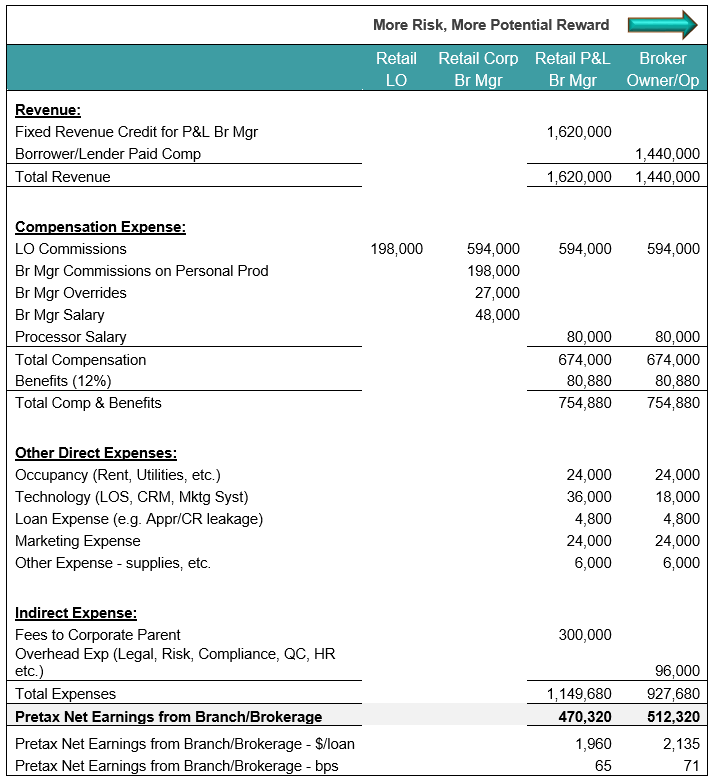

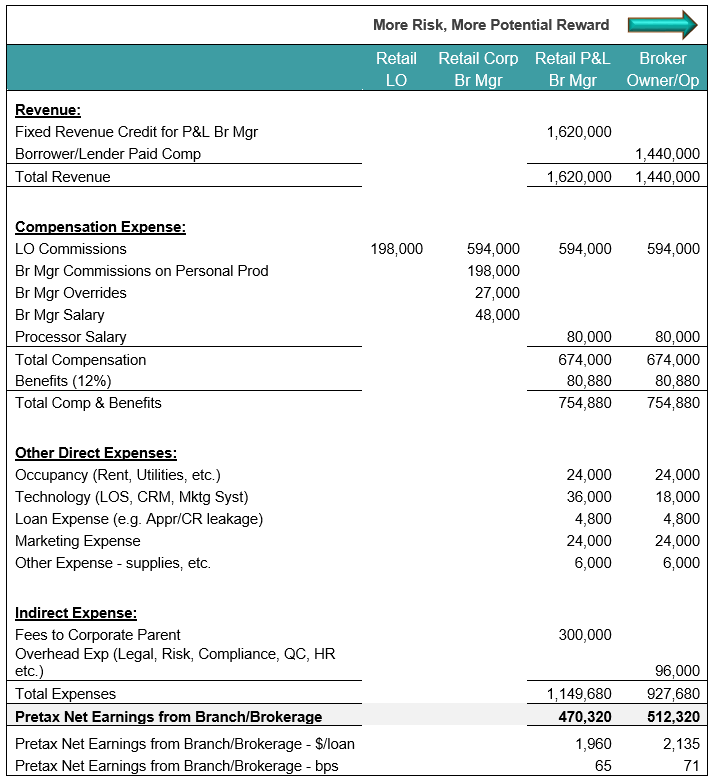

Chart 7: Pro Forma Summary Economics

Source: © 2023 STRATMOR Group.

Source: © 2023 STRATMOR Group. Retail loan originator and corporate branch manager scenarios are straightforward. Their compensation is based on a combination of commissions, overrides and salary. The more interesting comparison is between the retail P&L branch manager and the broker owner/operator. P&L branch managers earn a fixed revenue credit, after subtracting the amounts paid to loan originators and processors, other direct expenses of the branch and a dollar amount per loan paid to the corporate parent. The broker earns lender-paid or borrower-paid fees minus compensation paid to loan originators and processors as well as other expenses. The chart below summarizes the earnings to the originator across the four categories:

Chart 8: Pro Forma Pretax Earnings

Source: © 2023 STRATMOR Group.

Source: © 2023 STRATMOR Group. In this example, the retail LO earns $198,000 and the corporate branch manager earns $273,000, which includes commissions on personal production, salary and overrides. The retail P&L branch manager earns $470,320 based on the fixed revenue credit minus all expenses. The broker owner/operator earns $512,320 based on lender-paid/borrower-paid fees after subtracting all expenses of the brokerage. Earnings ramp up from 51 basis points for retail corporate branch managers to 65 and 71 basis points for P&L branch managers and broker owner/operators, respectively.

What are the takeaways from our illustrative model? The overarching theme is that there is a clear risk/reward tradeoff for retail originators.

Since the overall wholesale channel share has not moved materially since 2018, we appear to be in a state of equilibrium. While some retail originators do convert to a brokerage model, there seems to be just as many brokers who have chosen to join retail lender teams based on aggregate channel share data.

As discussed earlier, in markets like today’s, lenders are looking to increase revenue and that may include consideration of new channels of production. Lenders considering the wholesale channel should think about the existing segments and decide where they can create a sustainable competitive advantage.

Scale Lenders

To compete with large-scale lenders like UWM and Rocket, lenders need a tremendous amount of capital and the ability and willingness to go big. To operate in a third-party channel like wholesale or correspondent, a lender needs to have the ability to sell to the agencies on a servicing-retained basis, which requires even more capital, as well as a stomach for earnings volatility.

third-party channel like wholesale or correspondent, a lender needs to have the ability to sell to the agencies on a servicing-retained basis, which requires even more capital, as well as a stomach for earnings volatility.

Given the growing list of large-scale lenders who have exited the channel, this segment is not for the faint of heart. To have a chance to compete in the wholesale or correspondent channels, a huge commitment of time and resources would be required to build out the sales, operations and technology infrastructure – and this infrastructure build-out will take years, not months, to develop. One thing to note: Entry into the “scale” segment could be jumpstarted via an acquisition. The Citizens Bank acquisition of Franklin American is a good example. In a more recent example, The Loan Store acquired the remnants of the Home Point production platform.

Niche Lenders

If your company already has the expertise in a particular niche product for which there is reasonable demand, consideration could be given to entering wholesale and focusing on that niche. Niche products like non-QM, reverse and construction are a natural fit for this channel. Acquiring a team that specializes in a niche product would be a good way to start.

Relationship Lenders

This is good business if you can get it! That is, many community banks and credit unions already have a relationship with a wholesale lender or a credit union service organization (CUSO), so attempting to “sell” them on the notion that they should switch lenders can be an uphill battle. But once you win the battle and establish yourself as a reliable and trusted partner, the model can create steady cash flows for wholesale lenders. Like the niche lender segment, relationship lender volumes are not likely to be anywhere near the volume levels of the large-scale lenders. But it could be a nice supplemental channel for an existing retail lender.

We’ve covered many aspects of the challenges and opportunities of working in the wholesale channel. What are the key takeaways?

Lenders, if you need help in developing your mortgage banking strategy, including channel selection and focus, STRATMOR can help. Once your strategic path is confirmed, we have the expertise to assist you with building out the roadmap and then executing initiatives to make the necessary changes in human capital, organizational structure, process and technology. Our consultants have deep experience in mortgage banking and execute engagements in a highly collaborative fashion, leveraging real-world data derived from our various data products and programs. Cameron

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.