Last week, several of us from STRATMOR attended the Welcome Conference in New York City. For those who haven’t been, it’s the most influential gathering of hospitality legends anywhere in the world. Founded by Will Guidara, the restaurateur behind Unreasonable Hospitality, the event convenes a single stage of world-class presenters — this year’s lineup included organizational psychologist Adam Grant, Ogilvy advertising guru Rory Sutherland, and Jesse Cole, the flamboyant founder of the Savannah Bananas.

What struck us most was the diversity of the crowd. Restaurateurs and hoteliers were there in force, but so were leaders from finance, healthcare and beyond. Curiously, mortgage was barely represented. That’s surprising, given that no industry has more at stake.

Buying or refinancing a home is among life’s most emotional, stressful, and consequential financial experiences. Yet the process is often transactional, confusing, or simply forgettable. Too often, borrowers walk away feeling stressed, confused, and frustrated instead of cared for.

As we left the conference, one thing was crystal clear: If your customers or members are human, then you’re in the hospitality business.

At STRATMOR, we’ve been thinking a lot about this idea. In fact, we’ve formed a Hospitality Experience offering dedicated to helping lenders put hospitality at the center of their borrower journey. We’ll share more about that later in this article—but first, let’s explore why this shift matters so much for our industry.

One fantastic speaker was Jesse Cole, the founder of the wildly successful Savannah Bananas.

If you haven’t heard of the Savannah Bananas, you should—they’ve been called “the circus meets baseball,” and every decision they make is guided by Cole’s mantra — Fans First. Their approach is simple but radical. From ticketing to voicemails to on-field antics, the Bananas ask one question before every decision: What would be remarkable for our fans?

They don’t chase revenue. They earn loyalty. And the revenue follows. As Cole put it:

“No one wakes up in the morning and says, ‘I want to be sold to today’ or ‘I want to be advertised to today.’ But everyone wakes up and says, ‘I want a great experience today. I want to feel cared for. I want to feel served.’ And if you serve and you care for and take care of people, they will take care of your bottom line.”

That’s a powerful idea for mortgage. For decades, we’ve obsessed over the usual metrics: cost to produce, operational efficiency, pull-through rates and tech stack performance. What happens when you flip it and start with “Borrowers First?” You begin asking different questions. You design different processes. And you earn loyalty that lasts.

Or as Will Guidara says: “Service is black and white. Hospitality is color.”

In our industry we should be thinking: Transactions are black and white. Relationships are color.

Let’s be clear: this is not about cookies at closing or balloons in the branch lobby. Hospitality is not cosmetic, performative, or random.

Hospitality is a repeatable framework that delivers care, clarity, and confidence every single time. It’s the foundation, upon which training, technology, and people all build. Without it, service becomes inconsistent and forgettable.

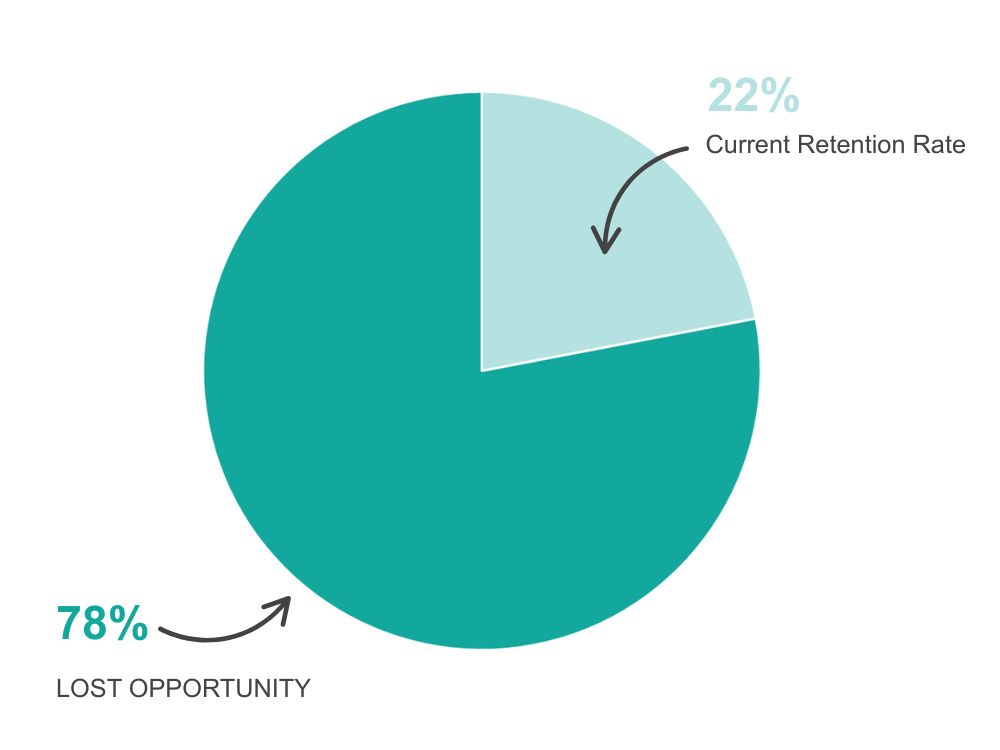

And the absence of that system is costing lenders dearly. Industry data shows:

That’s staggering when you think about it. Mortgages are high-value, high-relationship, and high-stakes transactions. By all rights, they should be “sticky.” Instead, borrowers often start over with a competitor, because their prior experience felt transactional, not relational.

As Guidara reminded us: “You’re alongside people during one of the most exciting and anxiety-filled moments of their lives. The impact you can make is nothing short of extraordinary!”

This is the heart of the opportunity. You’re not just processing a loan.You’re helping someone navigate one of the most emotional financial journeys of their life. Imagine if your refinance borrowers—those who came to you for a lower rate—stayed for life because the experience was so smooth, thoughtful and reassuring. Marketing costs would plummet, referrals would skyrocket, and their trust would be unshakeable.

Here’s the thing: you can’t wow people if you’re still confusing them. True hospitality starts with effortlessness. That’s why the design philosophy we help clients implement follows two phases:

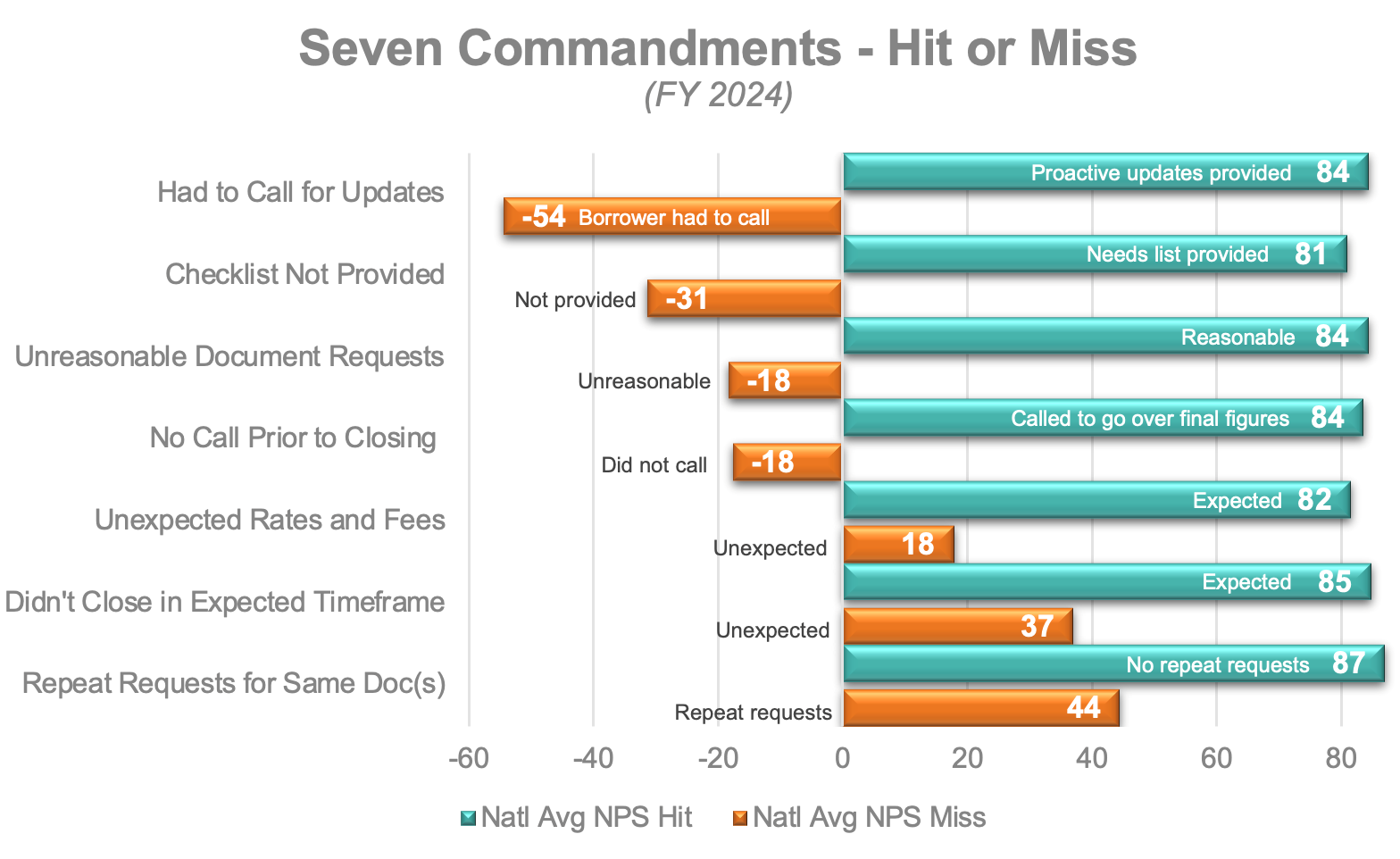

And STRATMOR’s MortgageCX data proves how powerful this is. When lenders consistently deliver on the Seven Commandments of Borrower Experience, borrower satisfaction doesn’t just improve — it spikes. Borrowers who experience these basics report dramatically higher Net Promoter Scores (NPS) compared to those who don’t.

Consider just the first four commandments:

Each touchpoint alone makes a difference. Together, they form a system of trust that reduces churn and strengthens loyalty.

This is what we mean by systematized hospitality. It’s not random acts of kindness. It’s the consistent, reliable delivery of what borrowers actually value. Once the basics are guaranteed, then you have the foundation to create memorable, emotional peaks that turn borrowers into advocates.

We’ve seen lenders across the country wrestle with this challenge. Many asked for guidance, which led us to create the Experience Advisory group.

We’ve outlined nine key points to work with leadership teams to redesign the borrower journey — not around internal workflows, but around systematized hospitality.

This is not about training people to “be nicer.” It is about giving them tools, training and structure to consistently deliver hospitality across teams, channels, and customer types.

So why is this urgent? Because the market isn’t standing still. Loyalty is low. Rates are volatile. Borrower expectations are higher than ever. And most companies are using some combination of a handful of tech stacks.

Hospitality is the differentiator because it’s human, not hype.

Guidara puts it simply: “In a world where everything is becoming more transactional, hospitality stands out as the thing that makes people want to come back.”

This is not about putting on a show. It’s about building a better system — one that puts borrowers first and makes them feel cared for every time.

Unreasonable Hospitality’s core insight is the difference between service (getting the job done correctly) and hospitality (making people feel cared for). In mortgages, service means processing the loan efficiently. Hospitality means understanding that buying a home is often the largest, most emotional financial decision of someone’s life. A refinance may not carry the same emotional highs as buying a first home, but the joy that comes from a smooth, well-handled mortgage experience can be just as meaningful.

What matters most are outcomes: A shorter loan term that lets a family retire sooner. A refinance that lifts the crushing weight of debt. A first home that changes the trajectory of a household for generations. That’s where true hospitality lives.

The mortgage industry has long focused on compliance and efficiency. Necessary, yes, but insufficient. To thrive, lenders must also create memorable, anxiety-reducing experiences that turn a stressful transaction into a moment borrowers actually remember fondly.

Systemized hospitality doesn’t mean scripted gestures or surface-level perks. It means building a framework that consistently delivers care, clarity and confidence at every touchpoint. Do that, and you’ll not only close loans—you’ll create advocates who come back again and again.

Want to learn more about STRATMOR’s Systematized Hospitality Advisory? We’ll help you identify where to focus—and whether Systematized Hospitality is the leverage your team has been missing. Contact us today.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.