Recently, I found myself in an oddly slow-moving elevator listening to two people engaged in a passionate discussion about the restaurant Five Guys. “No seriously, if I were on death row, I would go with the bacon cheeseburger and Cajun fries as my last meal request, without a doubt.”

Quite the endorsement. It was not the first time I had heard someone rave about their burgers and fries, but when I stepped off the elevator, it occurred to me that I could not recall seeing a single advertisement for their restaurants which opened in 1986. In August 2022, QSR Magazine ranked Five Guys the 30th top earning restaurant chain in the nation and 9th in the burger segment thanks to their explosive growth, which began when Five Guys started franchising in 2003. But here is what impressed me: they spend very little on marketing or advertising, while the big chains like McDonalds spend billions.

So, what is their construct to this approach? It turns out, one of their keys to success is the sixth guy I didn’t know existed: the Secret Shopper. Today, Five Guys operates more than 1,700 locations worldwide. What is interesting is that every single week each location is secret shopped twice. According to CEO Jerry Murrell and CMO Molly Catalano, everyone working those shifts is eligible to share in the secret shopper bonus money when they achieve a top score. ADWEEK reported a few years ago that Five Guys was spending $22 million on the secret shopper program. Their strategy hinges on ensuring consistently high-quality and genuinely enjoyable experiences, which leads to the best kind of marketing — raving fan customers.

Some quick math: 1700 locations multiplied by two audits per location per week multiplied by 52 weeks equals 176,800 secret shopper data points per year around the world.

While many businesses that sell directly to consumers utilize secret shoppers, I often find that banks, credit unions and independent mortgage banks do not. Sure, many have customer surveys that go out and report back — which are extremely valuable — but it’s not often I see a financial institution with a highly structured approach to regularly view their business through the consumer’s eyes and keyboard.

Is prioritizing the customer experience and tracking business results worth your time? According to a report in the Institute of Business Value (IBV) businesses who prioritize the customer experience drive three times more revenue growth than those that don’t. The report notes: “The companies seeing higher revenue are not paying lip service to [the consumer experience]; they’re assigning an owner, allocating budget and creating [Key Performance Indicators]. But most importantly, these CX ‘Experience Leaders’ make it part of the culture, meaning everyone in the company is responsible for CX, not just a separate team.”

In this article we’ll look at the secret shopper approach and apply it to the customer experience in the mortgage industry.

Secret, or mystery shopping, is done by individuals hired by a business to act as a customer of the business to perform market research. The incognito shopper gathers specific information — pricing, quality of service, methods of communication, updates and other data — and reports this experience data to the business.

The secret shoppers are given a set of instructions on the interactions they should have and what they should expect to happen during these interactions. All the steps they take and the interactions they have are documented, analyzed and compiled to provide the business with insight into what customers actually experience at the company’s hands — which is, more times than not, totally different than what the company’s management thinks customers are experiencing.

In STRATMOR’s view, secret shopping is the best way for lenders to remove the disconnection between perception and reality and pave the way for meaningful improvements in customer experience. It can be used to explain why consumers might feel a certain way about a business, or more importantly why they might choose not to finish a transaction with a lender. When done discreetly, and well, it provides an unbiased audit of products, services and employees that can generate actionable data to use to improve overall experience and brand performance.

A home loan is a complicated product that typically takes 30-45 days to complete so it’s not like strolling into Pottery Barn to report on your experience buying a hand-loomed wool rug from sales associate Benjamin. I have asked lenders why they don’t secret shop, and the most common answer I hear is that they simply never consider it because it can be such a complicated process. Or they answer that they rely on their internal users to let them know if there are issues, but how reliable is that?

It’s true that it’s not easy to do a full, end-to-end secret shopping experience, but the experience can be broken down into meaningful parts which can yield valuable insight.

When was the last time you:

The answers to these questions represent the easiest but often the most important part of the process: the upfront shopping experience. This is where a consumer subconsciously frames their opinion on how easy a company might be to work with, how responsive the company is, the quality of the information the company provides and whether they will make a connection with the brand and employee(s) to the point of moving forward with a transaction.

These are the input variables that directly impact the conversion outputs you probably see in your regular sales reports. If you really want to understand your sales conversion data, compliantly record all customer sales calls and just listen to the recordings of calls that lasted at least five minutes, were not dispositioned as “no opportunity” and have not yet moved into applications. I have learned more about sales successes and failures through this one activity than anything else.

Another reason lenders don’t secret shop often or ever is because they live in different digital worlds than their customers. One of the biggest issues for most lenders is that their employees do not use the same software as their customers. While the staff is toiling away, usually inside the confines of the Customer Relationship Management (CRM) software and Loan Origination System (LOS), the consumers float around a lender’s website first, and then when they are ready to transact, they are on the digital island known as the Point-of-Sale (POS).

This affects the customer directly. On multiple occasions, I’ve heard loan officers on the phone ask the borrower to send a screenshot of what they are looking at so they can answer their question. Not a great experience for the customer.

To address this disconnected experience between loan officers and consumers, some POS providers have deployed co-browsing functionality which will allow a loan originator to open a secure virtual session with a consumer to “see” what the consumer sees. This is a necessity when you don’t have a shared technical experience. We have one client who built their own technology stack on a single platform. The co-founder said, “Our people can speak with authenticity to our customers because they know the experience inside and out since we all share the exact same digital experience. It makes a tangible difference for the consumer because our employees convey subject matter expertise that builds trust and reduces transactional friction.”

Over the years, I’ve come up with one simple way to know how confident an employee is about the experience their company offers, from the CEO to the post-closer. I preface the discussion with a scenario and then ask the question that tells me the answer: Imagine someone close to you in life — your best friend, a neighbor, perhaps your in-law — calls and says, “I need a home loan. Can you help me?”

Is your response, “You bet. Just go on our website and call the number or click ‘Apply Now,’ fill out the application, and you will be contacted by our first available loan officer.” Or do you hand pick the originator and ensure the head of operations puts the top processor, underwriter, and closer on the file? Plus, do you request updates to make sure everything is going well?

If you say you would give the first response, that’s impressive given how complicated originations can be. I’d like to hear what you’ve designed that gives you that level of confidence. If you are in the second response group, I’d say you are not alone. Most people in the industry I know do not leave the experience of their personal referral to random chance.

That brings me back to Five Guys. Imagine a friend of Five Guys’ CEO Jerry Murrell calling him up and asking which restaurant to go to in Los Angeles. I doubt he would say, “Go to the one on Wilshire Boulevard and ask for David who should be working the grill Thursday through Sunday between 2 and 10 p.m…. If Joe is flipping the patties, leave. He’s the human form of the word disaster.”

Is it fair to compare ordering a burger in 10 minutes with obtaining a home loan over the course of 45 days? That’s a reasonable question worth debating, but the point is: how many senior mortgage bankers can truly say they 100 percent understand their consumer experience in detail because they regularly test it themselves? Or that they really know the consumers’ perception because they survey at a deep level?

For the sake of this discussion, I decided to hand pick some companies at random from the list of the thousands of readers of STRATMOR’s Insights Report to check various experiences. I gave sincere thought to balancing the need for the research and having respect for the time of each company’s employees. I decided to test just two easy and common experiences: contact forms and online applications. All companies are presented anonymously.

I tested to see how long it would take for an institution to email, call, or text after submitting a request for contact. To give each lender the best opportunity, I chose the middle of the day in the middle of the week to inquire rather than inquiring at night or on the weekend.

To preface, HubSpot Research reports that 90 percent of customers rate an “immediate” response as important or very important when they have a customer service question. Sixty percent of customers define “immediate” as 10 minutes or less.

Chart 1 summarizes my experience.

Chart 1

Lender 1 crushed it. This is exactly what I would expect from a consumer direct model where the lead gets posted to a CRM or Lead Management System (LMS) that distributes to the first available agent, loads the dialer for an immediate call, automatically kicks off an email journey based on the outcome of the call (e.g., called / left voicemail), and pushes a compliant text message thanks to the Telephone Consumer Protection Act (TCPA) language on the form and the ability for me to text STOP to opt out. They were the only lender to text.

On the opposite end of the spectrum, Lender 5 is a retail operation that didn’t respond at all. Perhaps there is an issue with the workflow, or maybe someone was assigned to reach out and just missed it. Nonetheless, as a real consumer I would just move on to a competitor.

The risk here is impatience. Several studies have shown the direct correlation between a fast response rate and higher contact rate which leads to more conversions. A CEO once shared the reason they are so successful is because he was obsessed about response times. “We call the moment we know a product we sell is on their mind,” he said.

Next, I tested what happened if I started an application but stopped at a common exit point, inputting the social security number. I know POS partners have the functionality to push real-time application progress updates to the CRM/LMS. I’ve seen high contact rates when lenders call within 10-15 minutes of the application being started if the application has not been submitted. Some argue they do not want to interrupt the consumer, which is a valid point, but my recommendation is if for some reason the application is not assigned to an originator, go ahead and reach out to at least let the borrower know you’re there to help. I indicated on the website application I was not working with anyone yet to see what would happen.

Chart 2 summarizes the responses I received when I stopped the application.

Chart 2

Everyone did a pretty good job with automated emails reminding me to complete the application. Lender 2 sent a personal email in addition to the system generated emails.

When Lender 3 called, they were the only one that used a branded caller ID. It put the name of the bank on my cell phone instead of an unknown number or worse: some calls came through as “Spam Likely.” After this bank’s representative left a voicemail, I also received a compliant text. A+ work.

I was surprised that Lenders 4 and 5 did not make any phone calls as they are both large banks, and I expected they would have built this follow-up into their workflow. I was also surprised Lender 6 did not make any calls because it’s a very technically sophisticated independent mortgage banker (IMB).

While on the topic of online applications, here is another point to inspect. I have reviewed a large data set of consumer feedback tied to the online application. Customers of banks and credit unions often ask why their existing data cannot be imported. As my colleague Garth Graham has lamented, “The primary value proposition of a bank is this: I know you and you know me, and you can trust us with additional products.” So, when bank mortgage applications don’t integrate with bank data, you have squandered the value proposition.

Solutions do exist. I can think of at least one major client and provider in the POS application space that provides a Single Sign-On (SSO) using XML-based SAML 2.0 protocol which unifies the experience for customers of a bank and allows the application data to be pre-filled. I am curious how many banks do this today, what challenges they’ve had, and if they have had any feedback from customers.

The point here is there is much room for improvement in mortgage services and secret shopping is a great way to get customer data on their actual experiences with your organization.

Positive, memorable experiences help drive retention, which lowers long-term acquisition costs. Secret shopping the front-end is important because that is where the funnel is widest. It also gives insight into the experience people have when first introduced to your brand because they aren’t a direct referral to one specific individual. The larger the top of funnel, the better the odds for growth.

My colleague Mike Seminari is the Director of Customer Experience at STRATMOR. I appreciate the passion he has for the topic, and I regularly learn from his research. He has found his calling in life.

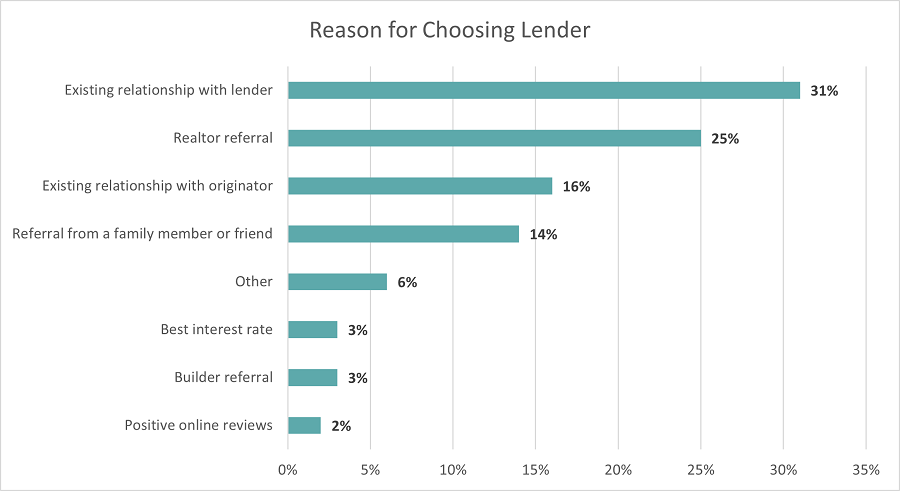

Mike has helped lenders survey hundreds of thousands of consumers about their experience and one chart he provides always interests me: a consumer’s reason for choosing a lender.

Chart 3

Source: © 2023 STRATMOR Group, MortgageCX Borrower Satisfaction Program, 2023.

Source: © 2023 STRATMOR Group, MortgageCX Borrower Satisfaction Program, 2023. At three percent, the best interest rate is near the bottom, which is interesting because I hear many loan officers say they usually lose a deal over rate and fees. Remember, the answers in the chart above are from consumers. When you look at the top reasons for choosing a lender, the words “referral” and “existing relationship” account for 89 percent of the reasons. These are people who come in with high expectations due to a trusted source or past experience, so it’s critical the experience is consistently exceptional.

Lenders should care deeply about the details of the experience because that’s where all the future business is. Black Knight has reported that the US mortgage industry has a dismal retention rate: about 18 percent of past customers return. Take some time to find out how many of your customers return.

It may be difficult to provide great mortgage experiences consistently at scale, but it is possible. Disparate data platforms, the regulatory framework, de-centralized teams, the involvement of multiple third parties in the transaction, roller coaster rates since 2018 which pushed the focus to mass hirings and unfortunately mass firings… where does one find the time to focus on this? It’s my observation that with so much focus put on all the complexities of originating a home loan, the consumer experience gets pushed down the priority list when it should be towards the top.

Prioritizing the customer experience and tracking business results are worth your time. Do you need to immediately hire a Chief Experience Officer? I don’t think so. But I do think every company needs someone who is passionate about both the consumer and employee experience, who is responsible for documenting experiences, and who is actually empowered to make changes that have an impact.

I am curious what you think. Maybe we can discuss it over lunch at Five Guys then decide if the bacon cheeseburger and Cajun fries are worthy of our last meal. Either way, the experience should be great. McCracken

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.