The current downturn in overall mortgage volume has many lenders searching for ways to boost their bottom line and revive profitability. Firms with extensive referral and customer relationships, which can lead to reasonable levels of purchase money business even in this lower home sales environment, are having a better time navigating these difficult waters. Still, it is very challenging.

A lot of effort has been put into cost cutting, but much of the low-hanging fruit has already been picked. And, the cost of absorbing ongoing, necessary capabilities, such as secondary marketing and compliance, still make the per-loan costs too high to generate profitable business.

On top of that, margin expansion, while a critical area to address, is also difficult because of intense price pressure from all industry segments. Both independent mortgage bankers (IMBs) and banks share these challenges and may feel like they’re being swept under by the strong current of rising interest rates and low volume. There are some tactics, however, that banks can employ right now to improve their business and generate additional mortgage volume that are not available to the IMB. In this article, we’ll dive into the advantages financial institutions have in the mortgage market today, help them uncover the treasure trove of information that can lead to their success and provide recommendations for how to surface new leads.

STRATMOR works with firms operating in all channels of production and using many different business models. We work with both financial institutions (banks and credit unions) and non-bank mortgage companies, and have long believed that financial institutions have several characteristics that are ideal for successful participation in mortgage over the long term:

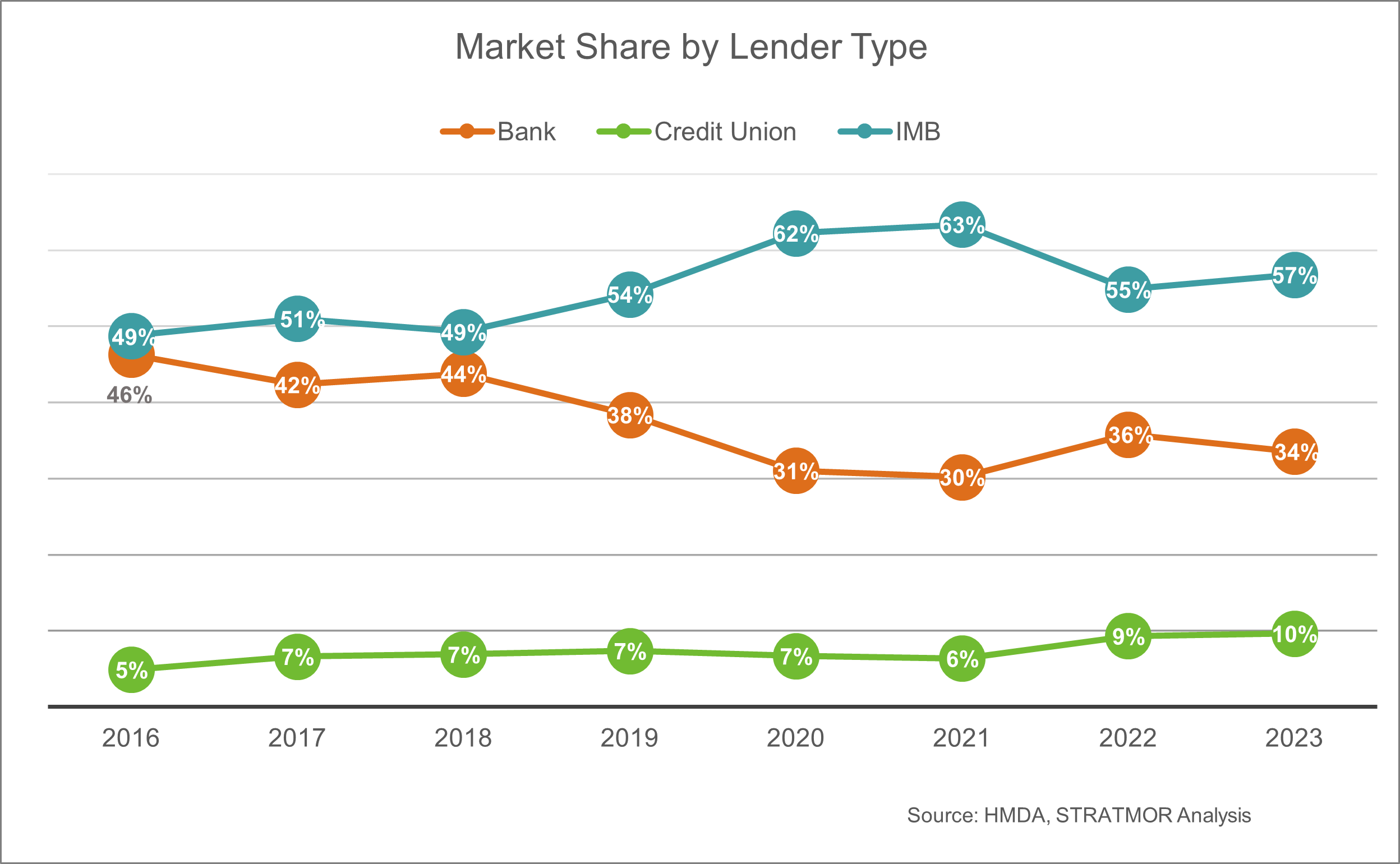

Yet, even with these advantages, the bank market share has declined substantially since 2016, while the market share of both independent mortgage companies and credit unions has steadily increased, as shown in the following chart.

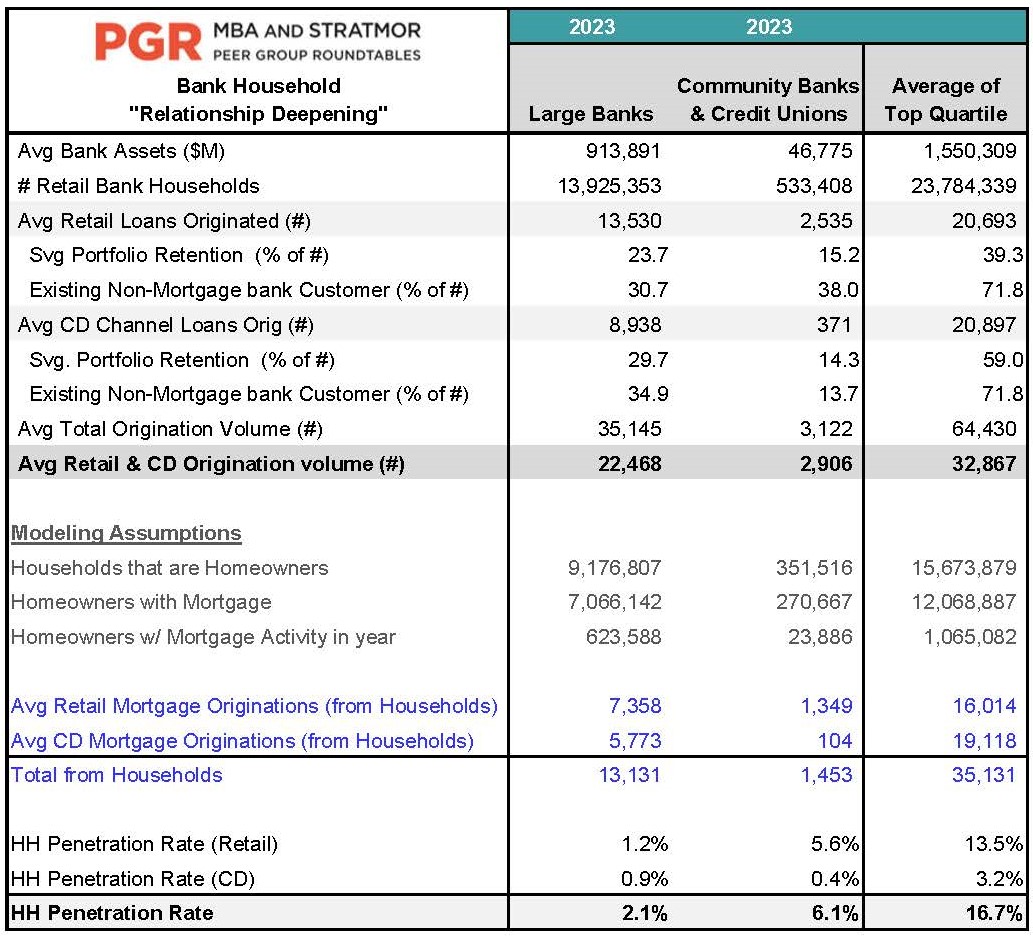

So, what’s causing this shift? Large, dominant mortgage players, such as Wells Fargo, have pulled back, and independents have filled much of the gap. The emergence of several large credit unions as significant mortgage participants and the appetite of some credit unions for portfolio products have also contributed to the change in market share. We believe that the most likely overarching issue is focus. Banks have not effectively promoted their mortgage capabilities to their own customers and natural in-footprint Realtor and builder relationships. The following table shows the very low levels of penetration among banks with respect to being selected as the provider of a mortgage in 2023 to their existing banking customers. Large banks fared much worse than community banks and credit unions. Even the top quartile of banks only captured 16.7% of the opportunity.

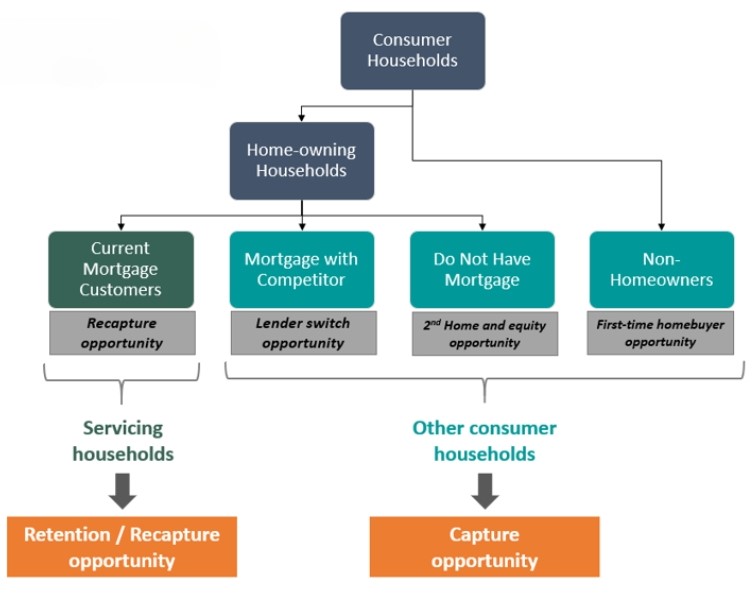

Independent mortgage bankers primarily rely on referrals from Realtors, builders and past clients to find new business. In contrast, banks and credit unions have a wider reach due to their existing customer base. They can tap into potential mortgage borrowers among their deposit account holders, business loan clients, private banking and wealth management customers, as well as those with existing loans like home equity lines of credit and auto loans. From a macro standpoint, the opportunities for mortgage generation can be displayed as follows:

In my own experience as the senior mortgage executive at regional banks, I know that some of the suggestions that follow can be very tough to execute because of the organizational barriers that exist among departments and the tendency for banks to operate in silos. Also, mortgage is likely not the most favored group right now because we are at a low point in terms of the fee income contributions from mortgage production. But, taking on the challenge can be interesting and rewarding.

We believe that it’s time for banks looking to regain more of the mortgage market share to focus on the mortgage delivery model. A plan for mortgage is the starting point. Consider the following questions when developing a plan:

The goals must be clear and understood throughout the bank to develop the right target operating model (TOM).

STRATMOR believes there are several strategies banks can work on right now that don’t directly relate to improved pricing discipline (though very important), cost cutting or operational efficiency, but that can move the dial in terms of gaining market share and improving profitability. These strategies can create an improved operating model that will pay dividends both today and in future, more robust volume periods. Most revolve around improved execution of critical business development activities, rather than on new investments in technology or systems.

In our advisory engagements with banks, no single issue stands out more than the focus—or lack thereof—on marketing the bank’s ability to handle mortgage loans. Unlike monoline mortgage bankers that have a singular focus on generating mortgage leads, banks tend to think of mortgage as just another product that can be supported with institutional or brand advertising and an occasional mention in printed material.

Surprisingly, loan officers working with leads sometimes encounter existing bank customers who are unaware that the bank even offers mortgages!

Now is an opportune time to rethink your marketing structure and approach. Due to the infrequency of mortgage needs, banks must seek out the business by being visible to customers at the right time and by proactively reinforcing and asking about customers’ homeownership plans and situations, or others will. While the necessary customer analytics may exist inside the bank, the information often does not translate into actionable outreach programs.

To revitalize the mortgage business, we recommend integrating marketing resources directly into the mortgage team that reports to the senior mortgage officer. This dedicated mortgage marketing team will be responsible for all mortgage promotion across various channels, including branch offices, the internet, social media, and external loan officer support. The team’s scope will also encompass promotional strategies for the bank’s customer base and its mortgage servicing portfolio and will contribute to loan officer training and the education of bank personnel to identify mortgage opportunities.

Of course, while collaborating with the overall bank marketing strategy, this team will operate with a more mortgage-focused approach, similar to a monoline mortgage banking organization — because that’s the competition!

For banking offices lacking dedicated retail LOs, a centralized mortgage sales team with expertise in working leads can be a valuable part of the referral process. This team can handle referrals at a lower cost compared to the retail LO group, who prioritize building external relationships. If the bank has strong digital capabilities in terms of applications and verifications, the central team is empowered to act as coaches for borrowers. This ensures a great experience for the customer. Nothing will derail an internal referral program faster than negative customer experiences. For many, even the most attractive referral incentives lose their appeal when staff risk damaging their reputation by referring customers to a poor loan process.

Supporting business generation by leveraging bank-wide interactions with customers—a proactive effort to mine the customer database for likely mortgage opportunities — is also critical. Answering the following questions can help you build a database that gold mine:

The marketing team should collaborate with data analytics providers to identify potential mortgage customers. This analysis can consider various factors, including:

Additionally, as the impact of recent Realtor commission lawsuits unfold, banks may have opportunities to offer valuable home-buying advice to customers.

In this digital age, success for any company is highly dependent on its virtual presence. And with 72% of Generation Z on the lookout to become homeowners in the next six years, banks looking for success in the mortgage space must be accessible and easy to work with virtually. Ask these questions of your organization:

These are key questions to address when reassessing how mortgages are marketed at the bank. Making improvements to the bank’s website can serve as a relatively low-cost method to drive business and improve the customer experience. Existing customer information provides banks with a sizable advantage. When an existing customer becomes a prospective mortgage applicant, the bank needs to show that the customer is already an important part of its family of customers and avoid asking interview questions that are clearly things the bank should already know about them

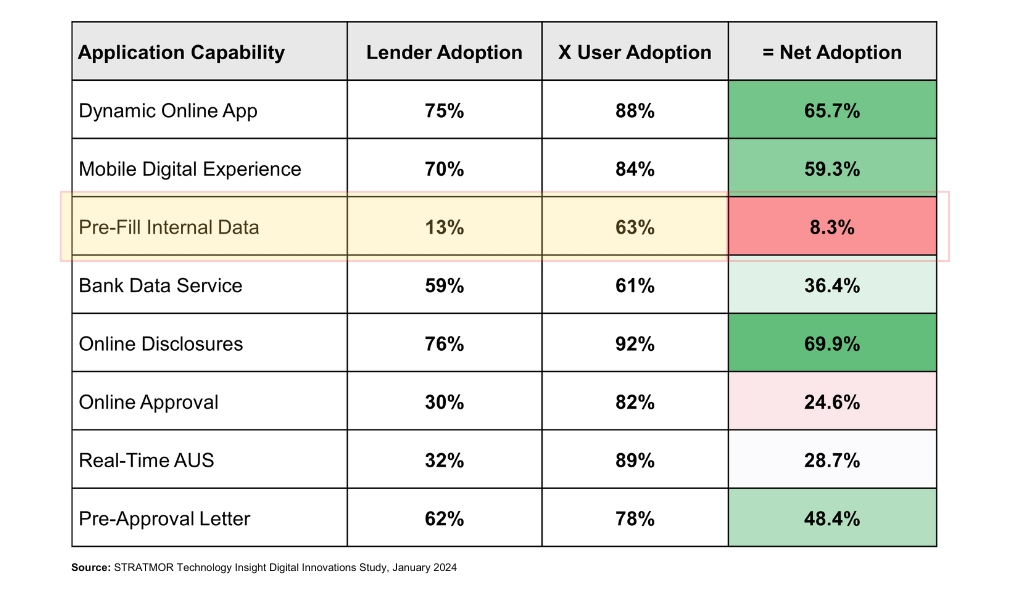

According to STRATMOR’s recent Technology Insight® Digital Innovations Survey results, among those application-related capabilities that have been automated by lenders, prefilling of borrower data has the lowest level of adoption:

Only 13% of respondents have adopted a pre-fill capability, and, of those, only 63% are actively using it. This is a real opportunity for banks to set themselves apart from the competition.

Exploring how this capability might be developed can be a great internal project in today’s lower-volume environment.

Banks have both an obligation (CRA and minority lending) and the means to offer a mortgage product set that enables them to serve their communities effectively. While the ability to portfolio sizeable amounts of first mortgages has been reduced at most banks due to pressure on deposit inflows, this is an area in which banks clearly have an advantage.

Banks should employ a very active product development capability — typically led by the secondary marketing group — that includes representation from sales, marketing, operations, asset/liability management, credit risk, and technology. The product development committee should meet regularly to evaluate market trends, competitor products, low-to-moderate income product needs, and the current product mix in applications. Here are some product offerings banks should evaluate:

This is also a great time to review internal training for loan officers to make sure that basic prospecting skills are being carried out by the sales force. Bank loan officers in particular can have call reluctance when things are tough — but that’s the essence of the job of an externally focused loan officer. Those skills must be reinforced.

While business development is critical, our experience working with bank clients shows a frequent disconnect between leadership’s perception and the actual customer experience for a mortgage. As the bank develops an improved mortgage discovery capability and branch and digital experience, implementing a secret shopping program can be highly beneficial. Having people pose as real customers—walking into a branch, calling the 800 number, applying online — can help banks identify areas where the mortgage experience falls short and address these issues to prevent potential lost business.

STRATMOR has conducted many secret shops for our clients. It’s always an eye-opener for mortgage executives to see how their employees and their competitors handle mortgage inquiry opportunities. And just when we think we’ve seen it all, we still can be surprised. Two of our advisors in different cities walked into a physical branch to inquire about a home loan and both were told to go home, create an appointment online, and then come back to the branch! Both shops were in the middle of the day on a weekday, both bank representatives had an NMLS# on their business card and one of the branches was completely empty — with the exception of our STRATMOR shopper. We find that a significant number of our shoppers are not entered into a CRM or any other bank database by bank employees to flag their interest in a mortgage product. The reality is that many bank executives are unaware of the actual number of daily missed mortgage opportunities.

Senior mortgage leaders should make time to talk directly with both referral sources and borrowers about their experiences. These communications can occur at any time throughout the process. They don’t have to be sophisticated — go into the loan origination system, find a file in process or recently funded, pick up the phone, introduce yourself and ask questions!

Banks should also consider shopping the competition. See how your own capabilities compare with your main competitors and discuss perceived shortfalls internally. For example, some banks are doing great work with real estate agent referral networks and are offering the ability to shop for homes behind the bank’s single sign-on (SSO) which keeps their customers away from lead generation sites like Zillow. The tools being used are often commercially available to banks rather than being proprietary and, when properly deployed, communicate those buying signals back to the CRM for timely follow-up.

Yes, production profits are low or non-existent in today’s market. However, servicing is very profitable at most organizations, with low delinquencies and few payoffs. If the mortgage banking business line does not report on the business inclusively, with both production and servicing, as well as the results of the bank’s investment in portfolio mortgage loans, executive management may be missing the entire picture, and the clear benefits of having both production and servicing for most banks.

STRATMOR continues to recommend to its clients a reporting approach that covers all areas of the business (on an economic as well as GAAP-accounting basis) in order to properly reflect the value of the business. The PGR: MBA and STRATMOR Peer Group Survey and Roundtable Program approach to mortgage business line profitability is a good starting point for evaluating a bank’s reporting methodology. Other value considerations, including placing value on multiple product and service relationships, can also be reported on as the bank deems appropriate. But the mortgage business really benefits from a business line reporting approach, in comparison to other loan products which are primarily driven by portfolio asset generation.

STRATMOR works with banks of all sizes to address the unique challenges of today’s mortgage market. From strategic planning to operational reviews, marketing optimization and technology, STRATMOR offers a comprehensive suite of services to enhance customer experience, streamline processes and ultimately, drive profitability. Tom Finnegan

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.