An Originator’s Guide to COVID-19 Communications

By Mike Seminari

April 2020

Regardless of where you stand on the current debate about when we should reopen the economy, one thing is clear – there is a great deal of confusion around how the pandemic is affecting the mortgage industry. According to some of STRATMOR’s clients, the recent Fed rate cut caused droves of borrowers to call in and see if they could get the “zero” rate, or to see if they could re-lock their in-progress loans at even lower rates.

Adding to the confusion, with unemployment at an all-time high, many borrowers are now facing anxiety about their ability to make their coming mortgage payments. Thankfully, the CARES program and stimulus checks are providing some relief, but with the continued uncertainty about how long quarantine measures will be in place, “forbearance” has become the latest buzzword as borrowers ask their lenders and servicers about relief options.

Often, in the stress brought on by the quarantines and economic shutdown, a borrower’s first call for answers is to the originator who helped them with their loan. Rather than immediately suggesting the borrower contact their servicer, originators have a unique opportunity to go the extra mile by guiding their clients through questions and potential options in a scary and confusing time. This is how you build loyalty that lasts.

What to Say to Borrowers

Preparing your originations team to have informed, valuable conversations with their borrowers starts with having good short-hand information. Here are a few talking points that will elevate every originators game and provide immediate value to an inquiring borrower:

- If you can pay your mortgage, pay your mortgage. This is advice straight from the CFPB website, whose main reason for existence is to protect the consumer. The options available will not simply erase mortgage payments and in most cases, interest continues to accumulate. If the borrower indicates that if they can’t pay their mortgage or can only pay a portion, suggest that they contact their mortgage servicer right away.

- Expect to wait on hold for a while when calling your servicer. Loan servicers are experiencing extremely high call volumes and may also be impacted by the pandemic. Encourage the borrower to grit their teeth and persevere. Remind them to be ready with:

- Their account number

- Why they are unable to make their payment

- Whether the problem is temporary or permanent

- Details about their income, expenses and other assets, like cash in the bank

- Whether they are a servicemember with permanent change of station (PCS) orders

- You’re not in danger of foreclosure (for now). Borrowers need to understand the particulars of foreclosure. Offer a straightforward explanation of what foreclosure is and explain the Coronavirus Aid, Relief, and Economic Security (CARES) Act (new federal law), which provides two protections for homeowners with federally backed mortgages:

- A foreclosure moratorium

- A right to forbearance for homeowners who are experiencing a financial hardship due to the COVID-19 emergency

- Forbearance doesn’t mean your mortgage payments are forgiven (or paid by the government). This is a big one. Many borrowers think forbearance “forgives” part of the mortgage debt. Be sure to explain that forbearance is when the mortgage servicer or lender allows a borrower to pause or reduce their mortgage payments for a limited time and that they will have to repay any missed or reduced payments in the future.

- Watch out for scammers! The CFPB says these are the red flags to point out to borrowers:

- High up-front fees for their services

- They promise to get you a loan modification

- They request that you sign over your property title

- They ask you to sign papers you don’t understand

- They tell you to make payments to someone other than your servicer

- They tell you to stop making payments altogether

- They promise you payments in connection with providing credit card numbers and other personal information

- If you need extra help, professional resources are available. Share the following links from the CFPB with borrowers that can help them work with their servicer or help them better understand their options:

- HUD-Approved Housing Counselors. The U.S. Department of Housing and Urban Development (HUD)-approved housing counselors can discuss options with borrowers having trouble paying your mortgage.

- Credit Counselors. Reputable credit counseling organizations are generally non-profit organizations that can advise borrowers on money and debts, and help them with a budget. Some may also help them negotiate with creditors.

- Lawyers. If the borrower needs a lawyer, there may be resources to assist them through their local bar association, legal aid, or for servicemembers, their local Legal Assistance Office.

Also, loan officers should consider reaching out to their communities and influencers with offers of educational help. The more real estate agents know more about this process, the better prepared they will be to help consumers, and they will appreciate the information provided when they think of who to refer their next loan too.

Here are three things you can do right now to educate your staff and be prepared to talk with borrowers:

- Have your staff share this 30-second video from the Mortgage Bankers Association with your customers. You’re not a servicer? It doesn’t matter. This is about showing your customers, past and present, that you care about them and that you continue to be a valuable resource for them.

- Share this 3-minute video from the CFPB with your staff. For a little more in-depth information, the CFPB made a great informational video for borrowers on forbearance. It’s the perfect introduction to the topic and will get your staff up to speed quickly.

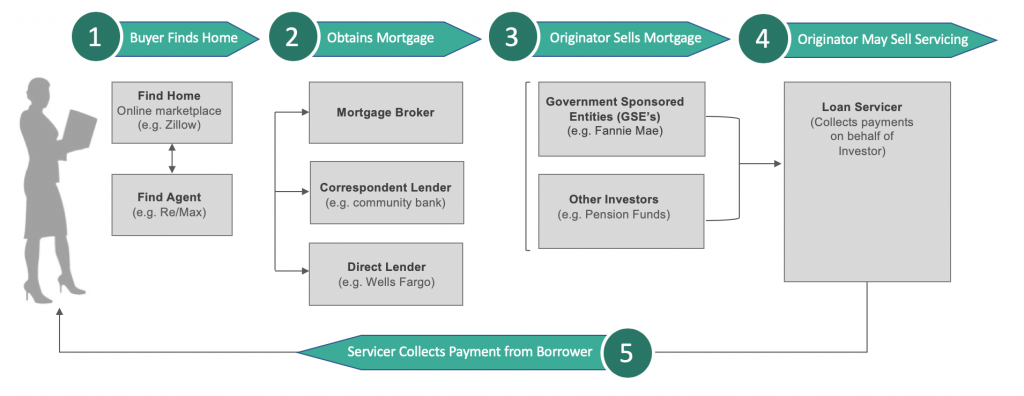

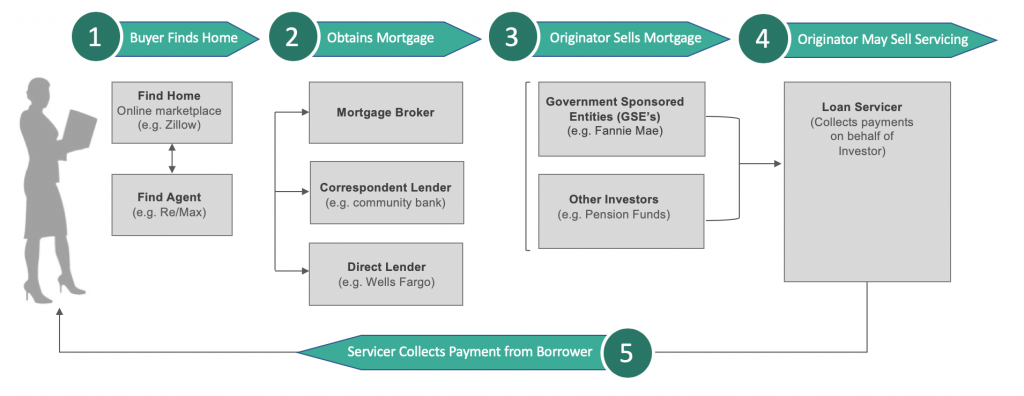

- Create a shareable PDF. Have your marketing team take the above talking points and create a PDF graphic that originators can easily share as an email attachment. This can be shared not only with past and present borrowers, but also with referral partners. Consider including graphics like the one below that shows borrowers where servicers are in the loan process. Everyone likes being in the know!

How Can We Help?

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.