The mortgage industry has been making lemonade out of lemons for quite some time now. The lemons arrived in boat loads with the onset the pandemic last spring — business closures, job losses, and forbearance plans just to name a few. And yet, thanks in part to low rates and high home appreciation, lenders became flush with refinance loans and were making more lemonade than ever before. Then came more lemons in the form of capacity issues and worker burnout, but the mortgage industry rose to the occasion once again with record productivity and profits. And despite the forecasts over the past 18 months predicting a severe refinance drop-off, there always seems to be just a few more drops of juice left in the lemons. However, even the juiciest of lemons eventually go dry if you squeeze them for long enough.

As lucrative as the mortgage business has been of late, it would be foolish to think that the record refinance volume is sustainable long-term. It may be a few weeks, or it may be a few months, but if the latest forecasts are any indication, there are dry days ahead. Now is the time for strategic lenders and originators to shift focus to planting new seeds in new fields — in other words, focus on growing purchase business. How can lenders and originators shift focus to purchase business at the tail end of a refinance market?

I remember when the MBA’s 2020 Forecast came out and all signs pointed towards an inevitable drop in the “unsustainable” refinance volume – a 25 percent decrease to be exact. They were about a full year off! Granted the forecasters couldn’t have known we were on the precipice of a global pandemic, but no matter which direction the story turned last year, a new crop of lemonade-ready lemons seemed to appear. The 2021 forecasts were incidentally almost an exact replica of 2020, with firm expectations that the second half of the year would bring a refinance “cliff.”

As we reach the mid-point of the third quarter, we’re finally starting to see loan volume recede, just not as drastically as anticipated — not yet anyway. But the writing is on the wall and the refinances will dry up. Margin pressures are likely to reappear, and the industry will continue to be challenged by higher costs. All of this leads us back into an environment where lenders will live or die by their focus on purchase volume.

As purchase business once again comes to dominate the lender loan mix, referrals and repeat customers become the most predictive factors of revenue growth. Understanding how to create “raving fans” from the closed loans and the delighted referral sources who will send referral business your way is paramount to surviving and thriving in a flat market.

Providing a delightful experience that customers can’t help but talk about involves more than getting a testimonial statement. It’s about creating “raving fans,” borrowers who will drive actual growth.

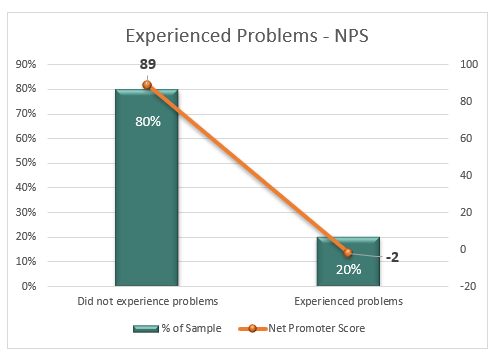

When it comes to creating a “raving fan,” most lenders assume that it takes extraordinary acts of service that go above and beyond expectations. According to data from STRATMOR and CFI Group’s MortgageSAT program that measured the loan experience for more than 260,000 borrowers last year, the Net Promoter Score (NPS) that measures a borrower’s likelihood to recommend falls 91 points when there is a problem with a loan. That’s the difference between a “raving fan” referral and someone who badmouths you.

Chart 1

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. (n=179,980).

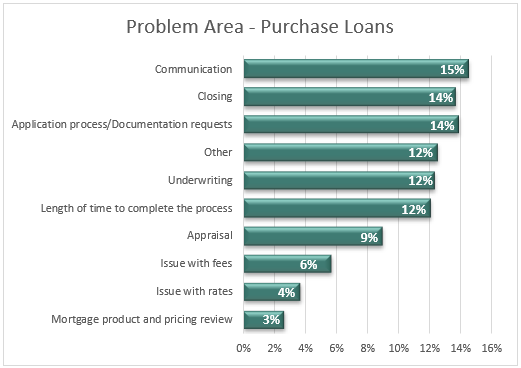

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. (n=179,980). Here are the areas where problems have occurred most often on purchase loans in 2021:

Chart 2

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. (n=54,368).

Source: © MortgageSAT Borrower Satisfaction Program, 2021. MortgageSAT® is a service of STRATMOR Group and CFI Group. (n=54,368). Notably, less than 10 percent of the issues are related to cost. Document collection and underwriting issues comprise roughly a third of the problems, while several others, including issues with rates and fees and communication, could be grouped into another third involving communication breakdowns. To address these issues, a lender needs further transparency into where exactly missteps occurred. Did the loan officer or processor forget to call to go over closing figures? Was the borrower asked for the same document multiple times? Did the closing start late? These are the types of questions that MortgageSAT asks borrowers, so lenders can pinpoint and fix process issues while, at the same time, identify coaching moments for their personnel.

If your intent is to thrive in a flat market in the year ahead, here are three tips for creating a delightful purchasing experience for your borrowers:

Find out more about the MortgageSAT Borrower Satisfaction Program, a service of STRATMOR Group and CFI Group, and how transparency into the loan process can help your company. Contact MortgageSAT Director Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.