There was a time when the home finance industry was the poster child for slow technology adoption. It was as if the industry was proud to be ten years behind other industries in the implementation of new automation.

Those days are behind us.

While PGR: MBA and STRATMOR Peer Group Roundtables Program data shows that technology only accounts for about 5.5 percent of the total production cost per loan to originate a loan from the point-of-sale through closing/funding, the last few years have seen lenders go back to market en masse in search of new technologies. Many of these recent investments were driven by new Fintech competitors rushing to the mortgage feeding trough and using innovative digital point-of-sale strategies to improve customer experience and streamline the sales-to-fulfillment hand off. Point-of-sale innovation that conveniently automates sourcing borrower data from trusted repositories has spread to the entire loan process, end-to-end (E2E), with incumbent providers trying to expand their value proposition up or downstream based on their initial offering.

Now, lenders are facing new challenges that will likely send them back again to market in search of new and improved technology. Margin compression and lower volumes will drive lenders to seek out new solutions, while at the same time increased M&A activity will have them investing in technologies that will enable them to make necessary pivots to capitalize on new synergies to improve performance.

Meanwhile, there are still many lenders who are progressing on their own paths to digital lending. Every day, we talk to lenders who have realized that their current technologies are simply not capable of supporting their customer-centric growth strategies.

Given this market cycle, and knowing that a new technology design and implementation can take 6 to 18 months to deploy, a misstep now will put some lenders far behind their competitors.

Lenders who choose the right solutions to empower their teams to best serve customers, and who implement these new technologies effectively, can win a significant competitive advantage via a speed to market strategy.

Is there a best way to tackle a new Point-of-Sale (POS) or Loan Origination System (LOS) implementation? STRATMOR recommends a 360-degree voice-of-the-customer approach, starting with defining the critical customer moments of truth and continuing through designing and implementing the enabling process/technology to deliver success from the lender’s perspective.

After 20 years spent supporting mortgage lenders as they implement new technologies, we’ve seen the challenges that can derail a component or an end-to-end digital implementation.

Limited 2-way communication. If lenders don’t verbalize exactly what they hope to accomplish it will be harder for their mortgage technology partners to deliver the right solution. Also, if technology firms sell what has yet to be developed instead of tested functionality, lenders will suffer.

Automating an old process. Modernization isn’t just about new technologies — it’s about enabling a new customer-centric process. The lender and technology provider must jointly agree to a target state process and how the technology provider’s out of box solution best aligns to the target.

A strained lender-vendor relationship. The technology provider’s sales team will build a relationship with a lender that will result in a sale. The technology provider’s implementation team must be brought to discussions early to deliver the new technology agreed to in the sales cycle. One key element here is trust. The technology provider must earn the lender’s trust.

Choosing the wrong technology. Today’s new technologies must be built on modern, open architectures to allow seamless connections via a robust API integrated platform. Not all tools have been developed to this point. Even when the technology has all the latest bells and whistles, if it doesn’t support the lender’s target state model, it will not be effective.

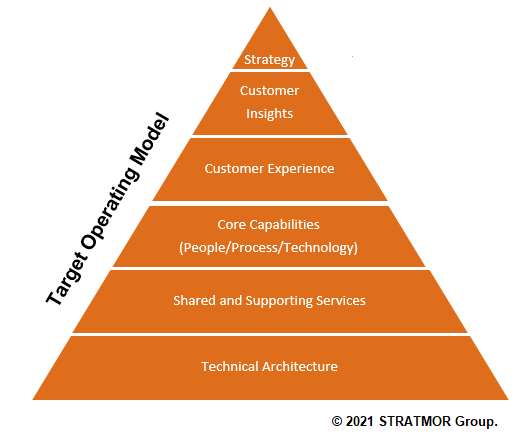

Alignment to Target Operating Model. Far and away the most common challenge we see is a lender with a non-existent or poorly developed operating model for the evolving market, or a technology provider with a poor understanding of the lender’s operating model.

Understanding the lender’s Target Operating Model (TOM) is so important that we consider the solution to this final challenge an absolute requirement for a successful implementation project.

We believe a top-down, customer-driven strategy drives the required digital core platform capabilities, processes and the enabling technology infrastructure. Without this target operating model in place, lenders are literally investing in the dark.

We spend dedicated time working with our lender clients to ensure that their TOM fully addresses and enables their strategic growth objectives. In creating the model, we’re watching that the lender is investing in technology that serves their objectives and does not simply automate outdated processes. A strategic TOM — and insightful people, process and technology gap analysis — will yield an implementation roadmap design, enabling the implementation team to execute effectively and deliver a quality solution within budget and on schedule.

The most significant benefit of beginning the work with the TOM is that it can conceptually align all parties involved and provide the required direction, structure, and discipline for the implementation work that follows. Having worked through this process a great many times now, we call this “Process Led Implementation,” a proven step-by-step approach to new technology implementation that has been very effective for customer-facing technologies such as POS and LOS systems.

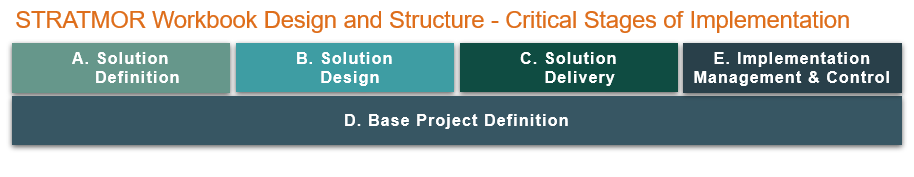

Process Led Implementation is designed to address every critical state of a mortgage lending digital project, including:

Project definition

Together, these elements allow us to create a map from the lender’s starting point through to project completion.

© Copyright STRATMOR Group, 2021.

© Copyright STRATMOR Group, 2021.This model enhances the technology provider’s traditional implementation process and puts the lender back in control of the project. Importantly, it allows the lender, through every step of the process, to ensure that the project is on track to meet the actual needs of the lender and its customers.

And, we create a project implementation workbook that guides the team through the entire process.

The Process Led Implementation approach is a combination of the best tools brought to the table by the lender, the technology provider and the STRATMOR advisory team. It allows lenders to clarify and verify their Target Operating Model assumptions and at the same time it allows us to help technology providers get their tools into production faster. This is important as many modern technology contracts don’t generate revenue for the lender until the technology is used.

Having the right framework for the implementation process is a vital first step but getting the right people, process and technology information into the framework is the key to project success. For some time now, STRATMOR has recommended lenders form their own internal, multi-disciplinary teams to seek out answers and to respond to the problems that naturally arise during the digital design and implementation process and as changes in the industry create new challenges.

We help prepare these internal resources through what we call the STRATMOR Digital Innovation Lab (DI Lab).

The DI Lab is the locus of collaboration for business design, technical implementation, process simulation, testing, and rollout support for all new E2E or component implementation projects. The DI Lab is staffed by the lender’s collaborative team of dedicated operations, process engineering and technology resources all working toward the singular goal of accelerating delivery of a production-ready solution.

A complete discussion of the makeup, organization and operating procedures of the DI Lab is beyond the scope of this article. The creation of such a body has been instrumental in client success, allowing lenders to deal with the changes that are inevitable when implementing technology in a complex, fast-changing environment.

The current shift from ten years of high levels of refinance transactions to a purchase money market is a perfect case in point. There are many differences between refinance lending and purchase money lending. Moving current refinance-trained staff from a refi-centric sales and fulfillment environment to a purchase-centric one is not an effective way to serve the purchase customer. To ensure the borrower has an exceptional customer experience, the customer may need to be nurtured through the loan process for months, not weeks, creating a process redesign opportunity. Establishing a DI Lab capability creates a team that can help the lender retool the people, process, and technology and make the shift to serve the purchase customer.

The DI Lab delivers critical benefits to the implementation effort, namely:

Additionally, the DI Lab allows the lender to overcome the inherent weakness in many large institutions that stems from siloed functions/operations with limited communication between departments. The Lab brings together a team that has a 360-degree view of both the customer and the company capabilities, making it possible to rapidly respond to the voice of the customer.

The DI Lab ensures that solutions designed and implemented by the team will have positive effects across the enterprise and not just for one or two departments within the institution. It ensures that people, processes and technology are all considered when decisions are made.

The DI Lab is a capability that lenders can and should develop to increase their likelihood of success with any future technology implementation.

User Acceptance Testing (UAT) is the final stage of any software development life cycle. This is when actual members of the lender’s staff test the software to see if it can perform the required tasks and automate the process in the real world.

The implementation horror stories we have all heard about in this industry were written during this phase of the project, when lenders learned to their dismay that despite the many planning and kickoff calls with their vendor partners, only a fraction of the lender’s actual requirements were captured and made part of the implementation plan.

Because the truth doesn’t come to light until many months and millions of dollars after the sales contract was signed, these stories strike fear in the hearts of any lending executives tasked with investing in new technologies. And yet, for all the reasons stated above, more lenders will be buying and implementing new technology in 2022 and 2023.

It may seem self-serving to point out that lenders who attempt to work through a design and implementation project on their own are at a much higher risk of living through one of these horror stories. However, that is exactly what the data show us.

We have asked many technology providers for their detailed implementation workplan for the new technology in which a lender is investing — their out-of-box workplan and supporting process maps. We’ve seldom received one.

Most technology providers will tell you that it all depends upon how the lender wants to use their technology and that they will not attempt to tell any lender how to operate their business. This suggest a TOM does not exist or there is a lack of understanding of the lender’s Target Operating Model and the target state process maps.

This is not to suggest that our industry’s technology developers are not experts at what they do. It’s what they don’t do that increases the lender’s risk when investing in new technology. Those risks can be significantly reduced by taking the approach to implementation that is outlined in this article.

There are many important benefits the lender receives from employing Process Led Implementation. They include:

The right technology investments. Putting the wrong technology into production will not serve the lender’s operating model. By making the TOM the first step in the process, this risk is mitigated.

User adoption. One of the most significant challenges lenders have faced over the past two decades is getting their staff to adopt and use new technologies. By including UAT at the end of the process, this risk is mitigated. This is also due to more effective change management, which is possible with a disciplined design and implementation workbook.

Completed projects. Lenders will see is that their implementations get done and the new technology goes into production more quickly. We would bet that every lender reading this has lived through an implementation that was never completed. A process-led approach solves that problem.

Cost savings. While this benefit will likely win a spot higher on this list for most lenders, it is a byproduct of getting the process right and enjoying the above benefits. This savings is realized in hard costs and time savings.

If you’re considering enhanced E2E digital capabilities or a POS/LOS investment in the coming years, we would welcome the opportunity to visit with you and provide more details regarding Process Led Implementation and how STRATMOR can support your growth strategy.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.