Studies have shown that more than half of smartphone users stare at their screens more than five hours per day, and the average person checks their phone 85 times daily. This means many people are on their phones for better than one-third of their day. All this available screen time offers a world of possibilities for digital interactions with your customers, whether by email, text, website, or mobile app. As technology comfort levels continue to increase, many lenders are wondering if personal calls and face-to-face meetings will soon be obsolete.

In the past year, I secured a home loan, a car loan and a solar roofing loan, and to this day, I still don’t have the slightest idea what any of my loan officers look like. Like many borrowers these days, I went through each loan process without ever setting foot in a lender office. I chose the digital route for the same reasons many do…speed and ease. So, should I be branded a posterchild of the new digital age, where smiles and handshakes have been replaced by computer clicks and text messages? Not exactly.

The value of digital advancements varies, and my personal digital experience was very different for each of these transactions. The car and solar loans were more or less approval-by-credit score and took less than five minutes each from application to approval. I didn’t need to sit across from a loan officer to feel comfortable with the terms. By contrast, a home loan, which often involves extensive document collection, manual underwriting, appraisal work, title work, and inspections — not to mention a price tag 10-20 times that of a car — really deserves to be in its own category. More money and more effort equal more stress, and for that reason, mortgage loans can often be helped by personal touch. In my case, I was very uncomfortable with the impersonal framework of one of the largest lenders in the nation. I had to call for updates, was asked multiple times for the same documents and I even had to correct a few of their paperwork mistakes. Despite a successful closing at the end of the process, I would not go back and I would not recommend them.

To make a long story short, advanced digital tools can make the loan process easier and smoother, but they don’t guarantee it.

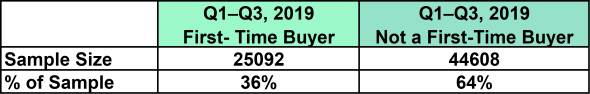

According to data from STRATMOR’s MortgageSAT Program, 36 percent of homebuyers are going through the process for the first time. Not only does that group represent more than one-third of the market, but there is a good chance their friends and colleagues are also at a similar life stage, increasing their potential referral impact even further.

Chart 1

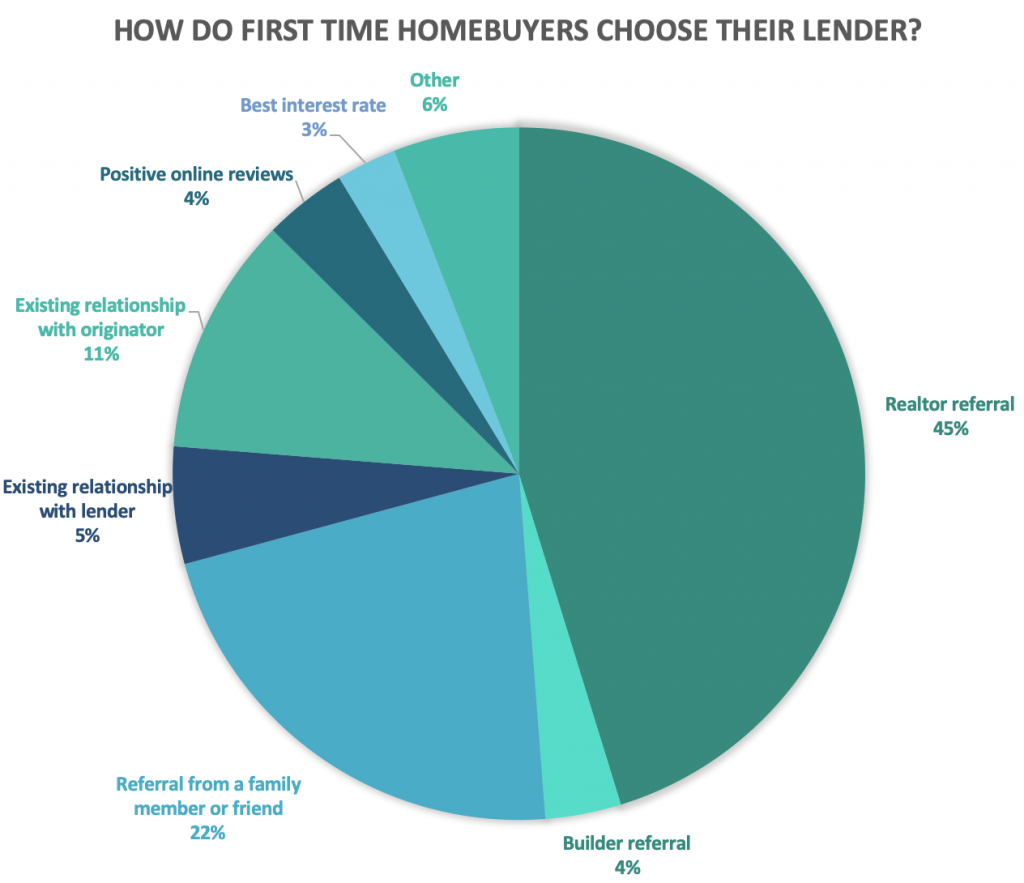

Consider that for most first-time homebuyers, the financing process begins very personally. According to STRATMOR data from the MortgageSAT Borrower Satisfaction Program, which surveys more than 100,000 borrowers annually, 87 percent of first-time homebuyers choose their lender because of a personal referral or an existing relationship. With such a big decision and so much money on the line, new homebuyers naturally gravitate to “trusted advisors” and personal relationships.

Chart 2

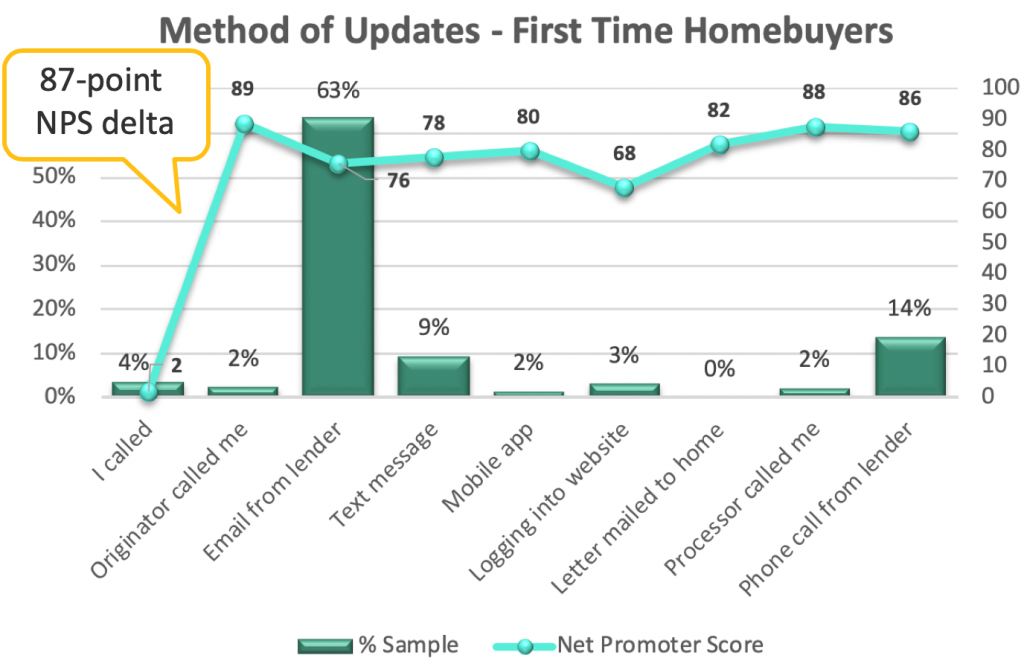

When it comes to providing process updates, most lenders are providing updates via email or text (or a combo), but first-time homebuyers are happiest when they receive a personal phone call from the originator (NPS 89) or the processor (NPS 88). Customers receiving email and text updates score the process much lower, with NPS of 76 and 78. If you look at that like ten missed referral opportunities for each 100 borrowers, those numbers add up quickly. The most impersonal way to provide updates, making the customer call you, unsurprisingly has the worst NPS of all (2).

Chart 3

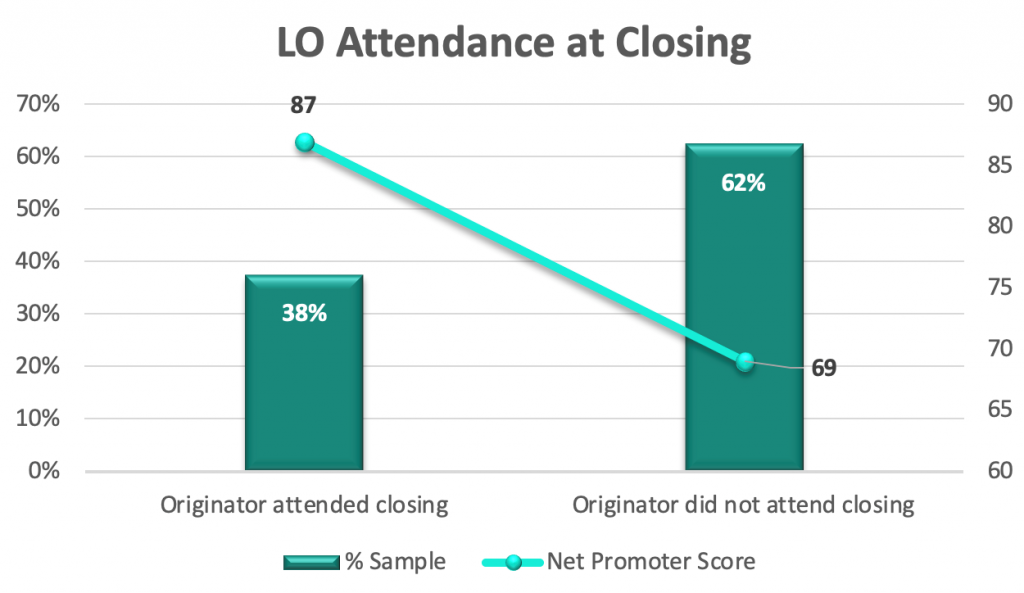

Finally, when the closing doesn’t go smoothly, a personal touch can go a long way. Whether the closing starts late, there is an error on the closing docs, or there is an unexpected fee, the originator’s physical presence can often be the deciding factor on whether that borrower walks out of the room a Promoter (9-10) or a Detractor (1-6) on the NPS scale. Just 38 percent of originators have attended their first-time homebuyer closings in 2019 YTD, which has cost them 18 NPS points. In rough terms, 18 less borrowers per 100 were delighted enough to refer their friends and family.

Chart 4

The mortgage loan transaction will always be one of the biggest financial investments in a customer’s life, which means there will always be a stress factor to ease, worry to allay, and comfort to give. No matter how digital our world becomes, the human element of the mortgage world is alive and well — and needed.

Here are three ways you can make sure your first-time homebuyers are feeling the personal touch:

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.