“I think it’s true

That we’ve all been through some nasty weather

Let’s understand that we’re here

To handle things together.”

It may seem like a coincidence that eight-time Grammy award winner Gloria Estefan took the stage at Concert MBA during the 2024 Mortgage Bankers Association (MBA) Annual Convention in Denver this year. But her hit song “Get on Your Feet” resonated deeply, perfectly capturing the mortgage industry’s journey through one of its most challenging periods. After enduring more than two years of “nasty weather” — marked by high rates, low inventory and plummeting sales — the industry stands at a pivotal moment where Estefan’s lyrics strike a powerful chord:

“Get on your feet

Get up and make it happen

Get on your feet

Stand up and take some action.”

Today’s mortgage business is dividing into two camps: those waiting passively for the next refi wave or rate decrease to bail them out and those taking bold, decisive action to reshape their future. The latter group is positioning themselves to thrive in 2025 and beyond.

Throughout 2024, STRATMOR’s experts have witnessed this firsthand while crisscrossing the country to participate, present at, and gain insights from industry events. While last year’s atmosphere was decidedly grim, 2024 brought encouraging signs of cautious optimism and renewed confidence in the industry’s future.

“The lenders who struggled through the painful downturn are now showing signs of resiliency,” observes STRATMOR Senior Advisor Brett McCracken. “The industry events of 2022 and 2023 were dominated by solution providers. Now, we’re seeing lenders not only show up but arrive with clear purpose—actively seeking ways to optimize their platforms with solutions tailored to their business models.”

This month, we share our key takeaways from recent industry gatherings, including the recent MBA Annual Convention and Expo held in Denver, and provide strategic guidance for capitalizing on the opportunities ahead in 2025.

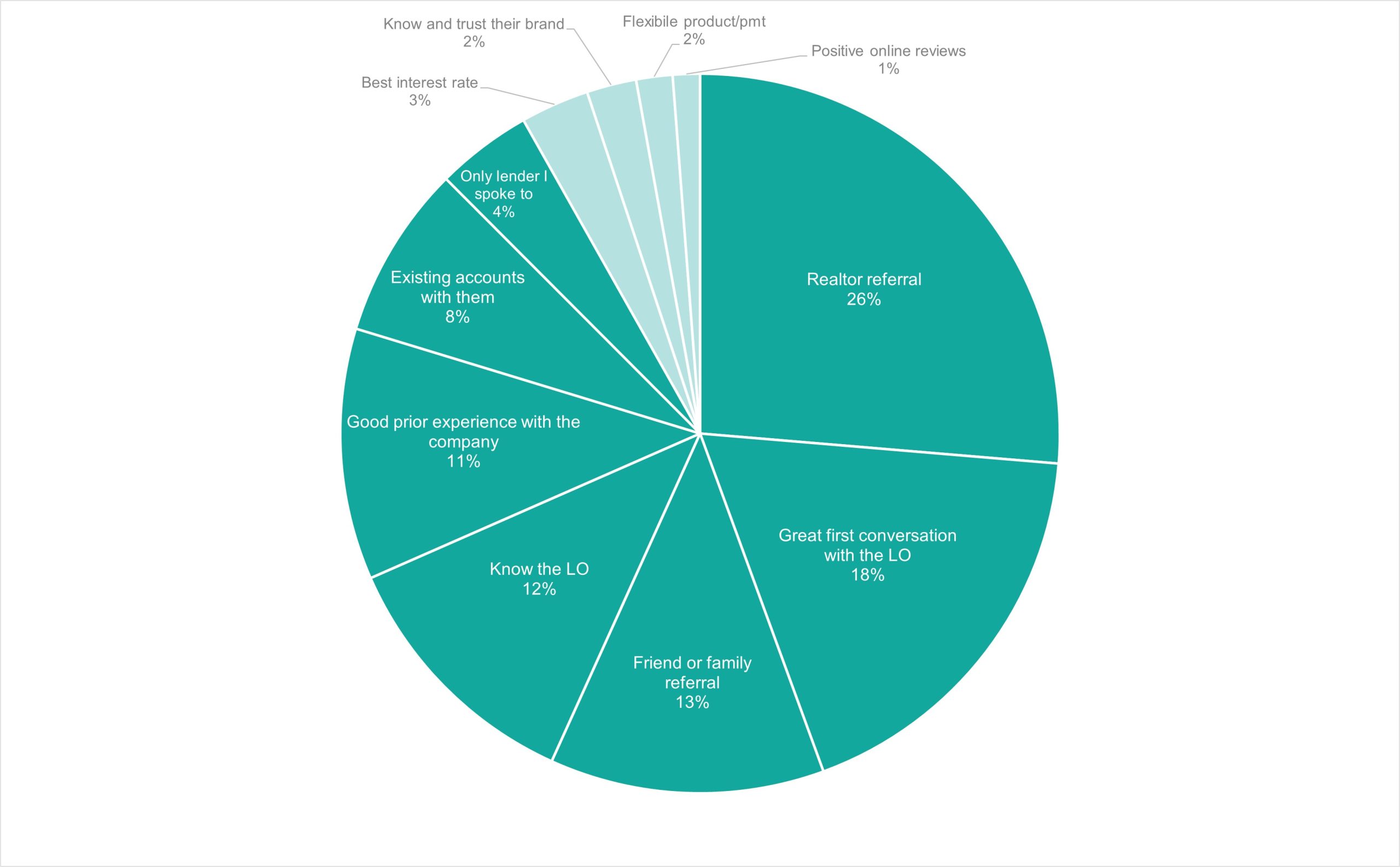

According to STRATMOR data, 90% of borrowers chose their lender based on their own experience with the lender or the experience of someone they know and trust.

STRATMOR Customer Experience (CX) Director Mike Seminari was a featured speaker at several industry events this year and shared the following information in each of his sessions:

First, lenders need to redefine customer experience success by shifting the focus from producing a customer that loves their LO to creating a simple and easy process for the borrower. STRATMOR data shows that the latter is four times more valuable in terms of creating repeat and referral business.

Second, lenders need to consider new ways of supporting their loan officers to deliver exceptional CX, such as giving each one personal coaching that shows them the path to more raving fans. When following STRATMOR’s guidelines and MortgageCX (MCX) program, loan officers are able to achieve a 97 Net Promoter Score (NPS) by simply laser-focusing on and correcting seven aspects of the loan process.

Third, lenders need to integrate customer experience initiatives across their entire organization— from LOs and processors to managers, underwriters, closers, and executives. This transformation starts with visibility, advances through identifying which teams and personnel work best together, and the needle really moves when enhanced with performance rankings, achievement badges, and strategic compensation incentives.

Senior Advisor Brett McCracken, who presented at both ICE Experience 2024 and CoreLogic’s CoreConnect event, also emphasizes the need to evaluate the entire origination process — from initial contact through post funding. “If you set up your CRM, Point-of-Sale system, LOS or servicing platform years ago, have you tested what it’s actually like to be a customer today? Particularly in larger organizations, teams often operate in silos, unaware of how their work directly impacts other departments and the overall customer experience.”

Brett notes that proactive lenders are moving beyond traditional one-on-one meetings with each business partner. Instead, they are organizing collaborative meetings with multiple partners to work through integration challenges, discuss ways to collectively improve their models, reduce production costs, and improve the experience for both employees and borrowers.

Senior Advisor Sue Woodard, who attended and spoke at multiple conferences, including Digital Mortgage, MBA Annual and ICE Experience, observes that lenders and solution providers are engaging in more productive conversations around technology adoption, best practices and ROI. “Both lenders and solutions providers are stepping up to stop finger-pointing and instead find solutions that solve not only the challenges of today but help prepare for the opportunities of tomorrow.”

She further noted that several innovative technologies are coming to market, such as voice AI, that have the potential to disrupt traditional mortgage processes by improving cost efficiencies while providing an enhanced customer experience. “This is definitely a space to watch,” she says. “Smart lenders are thinking outside the box with these new technologies, not with an eye to entirely remove humans from the process but to optimize costs while ensuring their teams can focus on meaningful client connections at crucial moments in the mortgage journey.”

Senior Partner Nicole Yung attended the MBA and STRATMOR Peer Group Roundtable sessions this fall, where technology emerged as a central theme. “Lenders are hoping that the work they put into people, processes and technology during the down markets of 2023 and 2024 will yield positive results as volume increases. They are prepared to terminate or replace any technology that fails to deliver as expected.”

According to Nicole, the first step in achieving technology ROI is selecting the right system, and there’s no universal solution that works for all lenders. The “right” system depends on three factors: the lender’s business model, their strategic goals and their commitment to full implementation.

Technology investments alone won’t deliver meaningful ROI without careful attention to the people and processes they impact. Employee buy-in is crucial for realizing cost and efficiency savings, according to Nicole. Even when a system creates operational efficiencies, if staffing levels aren’t adjusted, the ROI diminishes. The key differentiator between lenders that realize strong ROI and those that don’t often comes down to how effectively they manage the people and processes associated with a given technology implementation.

Senior Partner Garth Graham, a frequent speaker at industry and company events, has logged countless miles traveling to share his expertise and has the frequent flyer miles to prove it. His observation from his time on the road? True connections have a lasting impact.

“We all go to industry events with the best of intentions,” Garth says. “We’ll be fully engaged, take in every session, network with our peers, and bring copious notes back to the office on what we’ll implement next. But all too quickly, our busy lives overtake us and the follow up can be lacking.”

Garth recommends maximizing on industry events and in-person meetings by focusing on three simple guidelines:

The before and the after of a conference are equally as important as the time spent during a conference, emphasizes Sue Woodard. “Set meetings and team goals for the event far ahead of time, and coordinate with your team to ensure you cover the most ground across prospects, clients and partners — including gaining knowledge from key sessions,” she says. “Perhaps most importantly, even before the conference happens, schedule two debrief sessions to take place immediately afterward: a debrief with yourself to organize your notes and send out key follow-ups, and then a debrief to compare notes with the team who also attended as well as company leadership. Seems basic, but these debriefs are often delayed for weeks or skipped over entirely. And nothing drives accountability and effort at an event like a pre-scheduled meeting to review outcomes with a broader team following the event!”

Our STRATMOR experts note that the mood at industry conferences has noticeably shifted towards optimism for 2025 — a sentiment echoed throughout STRATMOR’s client base. To borrow from another legendary MBA Annual performer, Katy Perry: “Already brushing off the dust … Get ready cause I’ve had enough … Cause I am a champion and you’re gonna hear me roar.”

We’re looking forward to seeing how the industry roars back in 2025. The spark of innovation and determination we have seen in each of you promises many exciting developments at next year’s gathering in Vegas. We can’t wait to hear about them!

Let STRATMOR help turn your vision for 2025 into reality. Our team of advisors brings decades of mortgage industry experience to help you navigate challenges, seize opportunities and achieve sustainable growth. Whether you’re seeking to optimize operations, enhance technology integration or refine your market strategy, we’re ready to help chart your path forward. Contact us today to begin building your roadmap to success in 2025 and beyond.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.