For twenty years, the Mortgage Bankers Association (MBA) and STRATMOR Group have jointly conducted the PGR: MBA and STRATMOR Peer Group Roundtables Program. In addition to capturing the industry’s most comprehensive financial and operations performance data, PGR facilitates peer-to-peer discussions on the mortgage industry’s latest trends and forthcoming challenges. Executives get a lot out of it, because it enables them to clearly see how they are performing in the origination of mortgage loans — are they more efficient, less efficient, making more or less money? That is a valuable part of the story, but equally important is measuring how your process is perceived by the customer — and how satisfied they are when the loan closes.

In the world of borrower satisfaction, there is no such thing as perfection. Even the Best-in-Class have room for improvement in multiple areas. The question lenders must ask themselves is not simply, “Where should we focus our efforts?” but rather, “Where should we focus our efforts FIRST?”

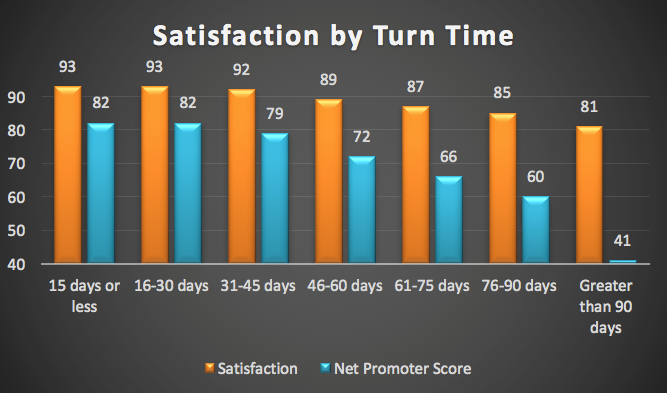

Finding the low-hanging fruit in terms of borrower satisfaction requires monitoring the most sensitive parts of the loan process and knowing how far ahead or behind the curve you happen to be in comparison to your peers. Case-in-point: I recently spoke with a lender who told me they were planning a major project centered around reducing turn times to 15 days or less. When we looked at the National Benchmark data in MortgageSAT to see how they might expect it to affect borrower satisfaction, it turned out there is a low of diminishing returns related to cycle time — getting below 15 is not nearly as valuable as getting below 30, and you definitely don’t want to consistently be above 30 days. The graph below is based on 100,000 plus borrower responses.

MortgageSAT Borrower Satisfaction Program 2019. © Copyright STRATMOR Group 2019.

MortgageSAT Borrower Satisfaction Program 2019. © Copyright STRATMOR Group 2019.© Copyright STRATMOR Group 2019

We sliced the data further to separate Purchases vs. Refinances and found similar results. Then we filter to view only lender s in their same loan volume segment. In the end, this lender decided to rethink the huge project expenditure and consider other places where the money might have a greater impact.

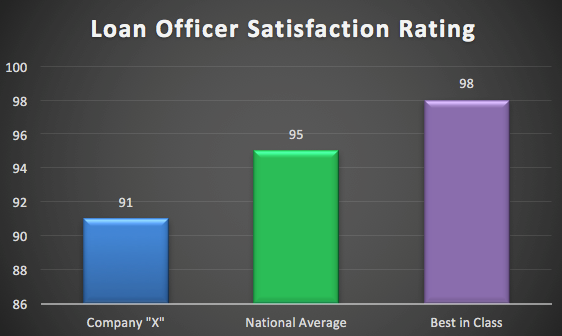

Knowing where you are in comparison to your peers can be a great motivator for your team, too. Another lender I spoke with recently was asking borrowers to rate their experience with their loan officer from 1-10. Converted to a 100-point scale, their scores for the past three quarters were 90, 92 and 91. The lender was quite pleased with these high scores until I informed them that the National Average for this metric is 95, and Best-in-Class is 98.

For this lender, peer comparison quickly changed the conversation and stoked a fire for change. They didn’t want to be average—they wanted to be the best. Recognizing a below average score, however, was only the first step. Since LO satisfaction scores are often influenced by derivative issues unrelated to the LO’s personal performance, we encouraged this lender to dig deeper into the data, including taking a close look at contributing factors like processor interactions, process design and closing experience. These metrics, when viewed side-by-side with peer performance, presented a clear path forward to improving LO scores. This process of peer comparison, therefore, not only spurred greater attention to improving the borrower’s experience, but also resulted in more referrals and better online reviews.

MortgageSAT Borrower Satisfaction Program 2019. © Copyright STRATMOR Group 2019.

MortgageSAT Borrower Satisfaction Program 2019. © Copyright STRATMOR Group 2019.Being able to answer the question, “Are we ahead or behind the curve?” gives you the ability to allocate time and financial resources to fixing the most pressing issues and those that have the greatest potential for immediate financial impact. It’s the difference between throwing darts at a map and having a GPS. It also helps you identify rabbit trails that lead nowhere. For example, it makes no sense to spend large amounts of resources chasing a quarter of a percent in a given category if you’re already Best-in-Class.

Because the voice of the customer is so important, the task of sifting through all of the customer sentiments should be taken seriously. However, deciding which issues need immediate attention, which ones can wait and which ones are simply anomalies can be very difficult. It’s not uncommon for lenders to find themselves buried beneath a huge pile of comments with no way to organize or prioritize them. Overwhelmed, these lenders often take no action at all.

Context is key. The National Benchmark in MortgageSAT shows lenders proximity to the National Average, which clearly shows potential improvement areas with the lowest-hanging fruit. Many of our clients have chosen to focus on one or two problem areas each quarter, with impressive cumulative year-end results. One client gained 40 NPS points using this method.

Here are three things you can do to begin seeing your performance in context:

1. Gain Access to National Benchmark Data. An investment in peer-to-peer comparison data pays great dividends in providing you a compass and a roadmap for your Borrower Satisfaction efforts. There are two options on the market when it comes to getting National Benchmark data: J.D. Power and MortgageSAT. MortgageSAT is 20x larger, provides real-time data, and is a nicer fit with most lender budgets.

2. Identify Low Hanging Fruit. Once you have the Benchmark data, begin to monitor key areas where loans take a wrong turn. Need help identifying potential problem areas? Check out STRATMOR’s Seven Commandments of Borrower Satisfaction. These are the seven most sensitive aspects of the loan process that can make the difference between someone who sings your praises and someone who badmouths you.

3. Measure Yourself Against the National Average and Best-in-Class. As you monitor your performance in these areas of opportunity, you will begin to see places where you are ahead of or behind the National Average. If being ‘above average’ isn’t enough of a challenge, call me and find out the Best-in-Class number for that metric— remember, there’s always room for improvement.

Find out more about STRATMOR Group’s CX services and how transparency into the loan process can help your company. Contact Mike Seminari at mike.seminari@stratmorgroup.com.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.