A business referral partnership takes years to build. It takes time to establish trust, which is the bedrock of a good relationship. When trust is lost, partnerships crumble. But that’s not the only thing that can kill them.

Sometimes, a massive shift in the way an industry operates can wipe out hundreds, or even thousands, of partnerships overnight. I believe that’s what we’re going to see in the real estate industry over the next six to twelve months.

The ongoing battle between the industry’s largest real estate companies and the Department of Justice (DOJ) over consumer disclosures regarding buyer’s agents is having a massive impact on the real estate business.

Real estate agents are far and away the leading source of new purchase money mortgage business for lenders, but that dynamic is changing quickly.

Experts are predicting that sometime within the next six months to a year, mortgage interest rates will fall, making buying a home more affordable again. The decrease in rates certainly SHOULD inject some new life back into the real estate and home finance business — but what will our business look like when that happens?

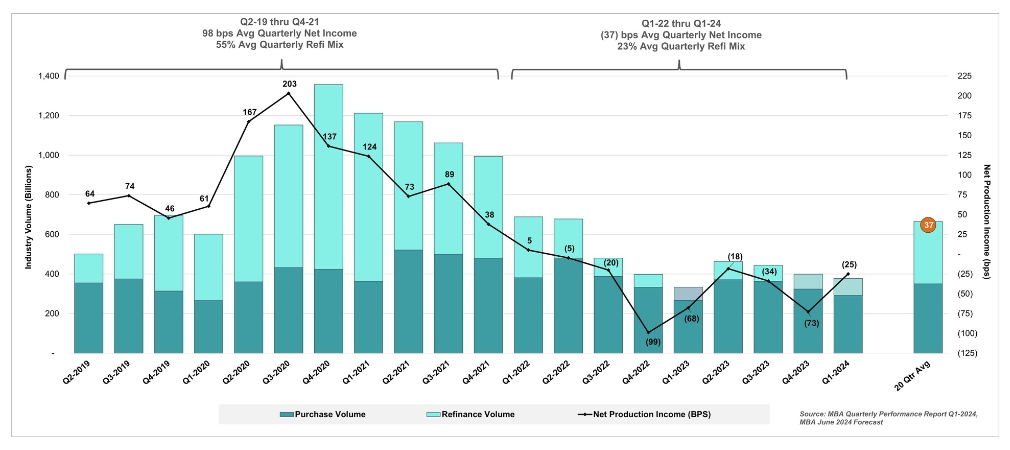

My last article addressed how the refi wave may not help all lenders equally, and I got a lot of feedback from industry participants. So, here’s a hint regarding the rest of THIS article: the upcoming surge in purchase business will not look like it did the last time the industry saw a wave of new business and it won’t benefit all lenders equally.

In this article, I’ll show you why and what lenders can do to prepare for it.

Since the beginning of the Dodd-Frank era, refinance mortgage business has been the primary driver of lender profitability.

Unfortunately, as I pointed out in my recent article on the next refinance boom, it won’t benefit all lenders equally. In fact, only the lenders that are well-prepared stand to capture a significant portion of that new business when it comes.

Yes, purchase money loans are harder to originate. They take longer and cost more. But that’s mainly because lenders are originating them in the same old ways they have for decades. A new approach will be required to increase the profit they earn from each loan. But first, they must win the business.

Lenders have been living in a highly competitive market for the past three years now. Well, let’s be honest, when was it not highly competitive? It’s just that the downturn of the past three years has made it more difficult for many lenders to win new business.

Part of the reason, and we’ve written about this in the past as well, is that most lenders don’t have sales teams made up of enough loan officers to directly generate purchase money business from consumers in a significant way. Most have traditionally waited for their business referral partners to bring them the deal. Meaning, the REALTOR is the one that generated the business, and the LO took the handoff.

But that may not work in the future. First of all, there may not be enough deals to go around, and the Realtors who might have dealt with buyers in the past may not have the opportunity to work with them in the future.

When mortgage interest rates begin to fall, most expect sellers to trust that prospective buyers will have more confidence in the market and make higher offers on their homes. This should increase the number of homes listed, ease the industry’s inventory shortage, and kickstart the mortgage business.

It won’t take much of a drop in rates to kick this off. With inflation finally showing signs of cooling, the Fed may lower rates sooner rather than later.

But what if it doesn’t work out the way most experts think?

If homeowners don’t list their homes in sufficiently high numbers, despite falling rates and improved buyer sentiment, we could see demand quickly outstrip supply, leading to rising home prices. This is a potentially very scary outcome. But it’s possible.

In fact, specific housing markets are almost certain to see this imbalance. There just aren’t enough homes in some areas to match the demand that could hit the market if rates fall and buyers finally jump in.

So again, just as in our exploration of the refinance business, an increase in purchase-money business that comes as a result of falling rates will NOT help all lenders.

A quick look at the market fundamentals indicates that it could help far fewer than we would like.

I often say that nearly every challenge in our industry can be explained by two factors — it’s highly cyclical and it’s highly fragmented. The cyclicality of interest rates is well documented. Now let’s look at the fragmentation issue.

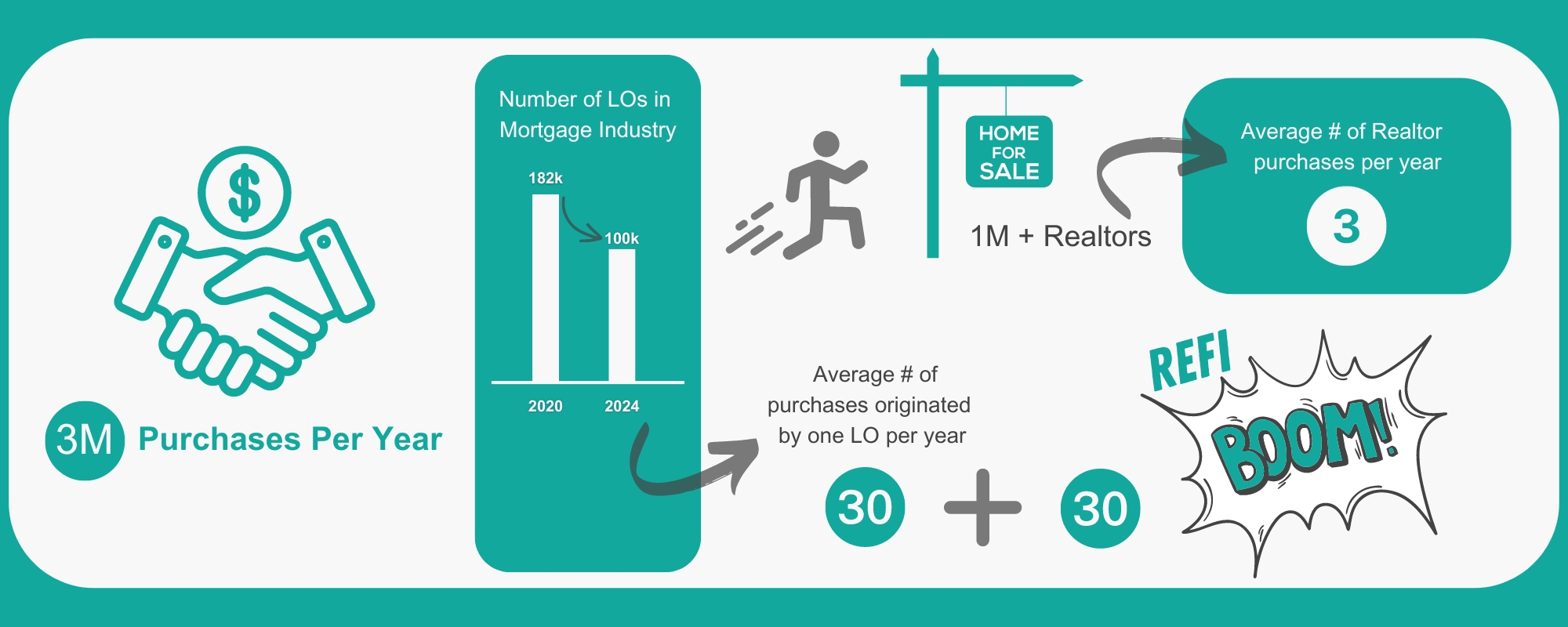

Let’s start with the high number of LOs we have in our industry. The number is roughly 100,000, down from a high of 182,000 during the refinance boom. Those 100,000 loan originators are basically chasing the one million Realtors who are working with consumers. And the typical real estate market has three million purchases per year. So that means the 100,000 LOs are originating an average of 30 purchases a year, which is exactly the number in the most recent MBA and STRATMOR Peer Group Roundtable data analysis. During a refi boom, the average LO picks up another 30 refinances, so can originate 60 deals a year, or five per month. And the average Realtor is doing three purchases a year.

Those numbers have kept our industries operating for at least four decades or more. While the lean years are missing the refinance volume, there is still an opportunity to chase the one million Realtors who are focused on working with the three million buyers every year. But what if the number of Realtors dropped significantly?

Think of it this way: Many originators have relied on deals sent their way by real estate agents that only sold a few homes a year. Real estate is one of those businesses that anyone can do as a second business, a side hustle, or something to keep a non-working spouse from getting too bored. Of course, the rest of a part-time agent’s time is taken up by providing instructions to the LO about how the mortgage business should be run, but those super valuable insights don’t show up in the production statistics. (Note: please read the previous sentence with the sarcasm that was intended.)

But with recent changes that will require a buyer’s agent to negotiate commissions with homebuyers or coordinate directly with the listing agents who control the listings — more on this in a moment — many low-producing real estate agents will leave the business. If the average Realtor closes three buy sides a year, how many is that likely to be when they can’t rely on a built-in commission split with the listing agent?

The new model may be that the typical LO/mortgage lender will be competing for the smaller set of professional listing agents, which will probably amount to less than half of the number we’ve seen selling real estate in the past. After all, we joke that the real estate industry counts every deal twice — once as a buy side and once as a sell side. But what if the industry morphs to just ‘one’ transaction?

If you’re a high-producing real estate agent, you’re not looking for an LO who can reliably produce a loan each month. You want to work with the best.

These numbers don’t look good to me, and I’m not even a mathematician.

There is some speculation here because the real estate industry’s battle with the DOJ isn’t over yet. We don’t know exactly how the industry will change, but you won’t find an expert anywhere who will say it’s NOT going to change.

It is possible that what’s coming next for the real estate industry will completely change how it looks and how agents interact with mortgage lenders. That could make the impact of these changes hard to predict.

For instance, the old model of the real estate business had a sell-side agent and a buy-side agent, each of whom worked for a broker, sometimes the same broker. Through a mechanism that is now coming to light, sell-side agents offered buy-side agents a commission that was published on the multi-listing site that the seller would then pay. Basically, they were splitting a commission set by the broker that the consumer often did not realize was negotiable.

This is now unraveling.

The commission split never made a lot of sense, given that most of the work in the deal — talking consumers into listing, helping them prepare their homes for sale, setting a fair price, negotiating with buyers, and handing off the closing paperwork to the title company — was done on the sell side.

The buy side just brought the buyer, and often not even that when you factor in the huge increase in online home shopping. What they really brought was the code to the lockbox holding the house key and the phone number of an LO.

Consumers have been shopping online, touring virtually and making decisions about their next home online on their own for a long time now.

The future of real estate could look more like Airbnb, where a prospect finds a home on any of the online search engines, texts the listing agent for a code to the front door, and tours the house themselves, under video surveillance, of course.

A virtual assistant could show up on their smartphones and give them a guided tour. And help them fill out their online mortgage application while they toured the home. And offer to show them other homes that might meet their needs, all without requiring another agent on the buy side. In fact, there are already companies available in many states that allow homebuyers to tour homes by scanning a QR code.

Does this mean the buy-side agents will disappear completely?

Some brokers are considering this. It is possible that the real estate industry will just bundle the buyer’s needs into a more tightly integrated offering, helping buyers see the home and get a loan. It doesn’t take a buy-side agent for either of these tasks. A licensed agent could hire an assistant to drive out to a home and let a prospective buyer in to look around.

In fact, STRATMOR does secret shopping on behalf of mortgage lenders, to gauge what the consumer’s true experience is when they are shopping for a home. In the past, we may have seen lenders mention their favorite local real estate professionals, or a Realtor might refer the lender for financing questions. However, we have recently seen that begin to change, where the consumers engagement with real estate professionals has moved to be more of a connection with the online shopping experience.

What does all of this mean to the mortgage lender?

If you’re counting on your business referral relationships to bring you your share of the coming wave of new purchase-money business, stop. Follow the steps below instead.

It’s time now for lenders to prepare for the changes that are coming. Standing still is not a good option and hope is not a strategy.

Here is what we recommend lenders do now.

If you don’t have buyer’s agents out there sending in business every time a consumer likes a home, you’re going to have to get your business from the listing agents. They’ll be dealing with consumers who have found homes online and they are likely to start that relationship online and keep it there (or in the call center) as long as possible. If the lender has a link that takes the consumer to an easy app and pre-qualification tool, the system will move smoothly. If not, the agent will find a lender who does.

This is where lenders who have a servicing operation are going to be the big winners. They can partner with a real estate company (or many of them) to serve up new home options to borrowers in their portfolio. They will also be able to proactively identify when customers in their database are considering refinancing or purchasing a new home and insert themselves into the transaction early. Lenders who don’t have this advantage will need to put their marketing machines into high gear or hire loan officers who can build relationships with listing agents.

Without a buy-side agent counseling homebuyers to just put up with a bad loan origination experience so they can get the money to close (something that is in the agent’s best interest), lenders who put listing agent sales at risk will lose the business (the current deal and any that might follow). Because less of the lender’s business may come from refinances, a better process for purchasing money lending is their only hope of increasing profitability.

The mortgage lending business will change to better match the way the new real estate industry works, which means much more activity in the online channel and call center and far less from traditional business referral partners. In some possible future real estate sales models, the listing agent’s concierge team may include licensed brokers who can handle much of this work, counting on the lender for little more than fulfillment. That means most lenders will be paying too much to their front-line salespeople.

The mortgage business is facing unprecedented changes in response to the significant shifts on the real estate side. While it’s impossible to know the exact impact, one thing is certain: lenders who fail to prepare for some kind of change risk jeopardizing their business.

We’ve already explained why the refinance business will not benefit all lenders in the near future and why the purchase-money business will become increasingly important. This is why STRATMOR Group is having more conversations with lenders who want to not only stay in the lending game when the next wave of new business hits, but also lead the market in their regions.

Through a combination of strategic insights, operational expertise and a hands-on approach, our consultancy can ensure that lenders make the changes now that will guarantee them success in the future.

STRATMOR provides a range of services that can benefit any mortgage lender. To get the help you need, contact us today. Garth Graham

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.