Living as I do so close to the Florida shoreline, I’ve seen firsthand what a rising tide does to all boats. The philosophers are right! In all the years I have been enjoying my state’s beaches, I have never seen a rising tide fail to raise all boats on the water.

Not that anyone has ever doubted this bit of wisdom. And that’s a problem because it doesn’t always work. It holds true for buoyant vessels, but not when the adage is applied to things that do not have the ability to stay afloat as the tide goes out.

Over the past year, I’ve talked with many lenders who believe at the core of their beings that as soon as the next wave of refinances hits the business, all of their problems will go away. But that isn’t guaranteed.

In this article, I’ll tell you why and share the strategies that smart lenders are using now to weather the current market and thrive when the market improves.

While lenders hoping for a refi miracle have history on their side — past rate drops triggered a surge in refinancing — this next wave will likely be different.

We like to believe that history always repeats itself because it so often does, at least when it comes to human behavior. You can bet that when interest rates fall, consumers, being human, will jump onboard a lower-rate option. And the latest industry forecasts do predict a rising tide of refinancing — but there are reasons that the coming wave of refinances, when it appears, will be very different from the past.

When that happens, many lenders will find themselves in a much different position than they were the last time around. After over two years of COVID-era profits, lenders have suffered through a multi-year downturn. In fact, the data shows that the typical mortgage banking firm has been taking on water, with the industry showing losses for eight quarters in a row. Many have been selling off servicing rights and stopped retaining servicing on new production because they need the cash. This will put them at risk because, while having the cash is good, it also means they have likely sold off the client relationship and the potential future refinances associated with them when the rate drops in the future. In particular, mid-sized Independent Mortgage Banks (IMBs) who expect the new wave to deliver refis like it was 2021 are going to be gravely disappointed.

We’ll talk about what lenders can do shortly but first let’s look at why I believe the business will come back differently next time.

The tide will eventually come in. When it does, it will bring more refinance business, but it won’t lift all the lenders in the market. Here’s why:

Even with potential restrictions on who can order or purchase a consumer’s credit file, lenders who buy “trigger leads” will likely face competition from those who already service the borrower’s loan and know how to build and maintain a relationship.

Now, servicers have not, as a class, always done a great job of building relationships with the borrowers in their portfolio, but we’re seeing that change. In fact, we survey mortgage customers about their servicing experience, and there is a class of borrowers who are pretty satisfied with their servicing relationship, making them more likely to consider a refinance from their current servicer.

The same goes for strong retail originators who retained servicing: high customer satisfaction throughout both origination AND during the period of servicing gives them a major advantage in retaining those customers for refinancing.

STRATMOR has worked with a number of larger Independents who got into the servicing business specifically because they saw it as a source of future new business leads. Because they went into it expecting to win that business, they priced accordingly. This is especially apparent when viewing the rate sheets of the major correspondent purchasers, who are bidding aggressively for business, often beating agency execution. The mid-size IMBs should ask themselves a question: “Why do the big five correspondent aggregators keep winning the bids?” The answer lies in their higher valuation of the servicing, because they see it as a valuable tool for retaining (recapturing) that customer during the next refi cycle.

So, even if an IMB has done a good job on the origination process but then sells the loan to an aggregator, you can bet that aggregator is going to aggressively solicit for the refinance. And the aggregator has the added advantage of making it easy for the borrower with a streamlined process, an easy escrow transfer, and perhaps lower rates and fees.

Of course, in the LAST refi boom (2020-2022), a lot of refinance opportunities were captured by IMBs and servicing retention at the large servicers was not as high as it could have been. Let’s examine why that was and why it’s not likely to be as much of a factor this time.

During the historic refi boom, homeowners raced to lock in lower interest rates. Lenders’ phones were ringing off the hook, and websites were awash in borrowers clicking for lower payments. Any delay in capturing the consumer — unanswered calls or slow follow-up — often meant they’d lose the deal to another lender. Often, this was the large servicer, who might lose the refinance opportunity to the original retail lender or to someone who might advertise their services directly to the consumer. Turn times extended, as lenders operated at or over-capacity.

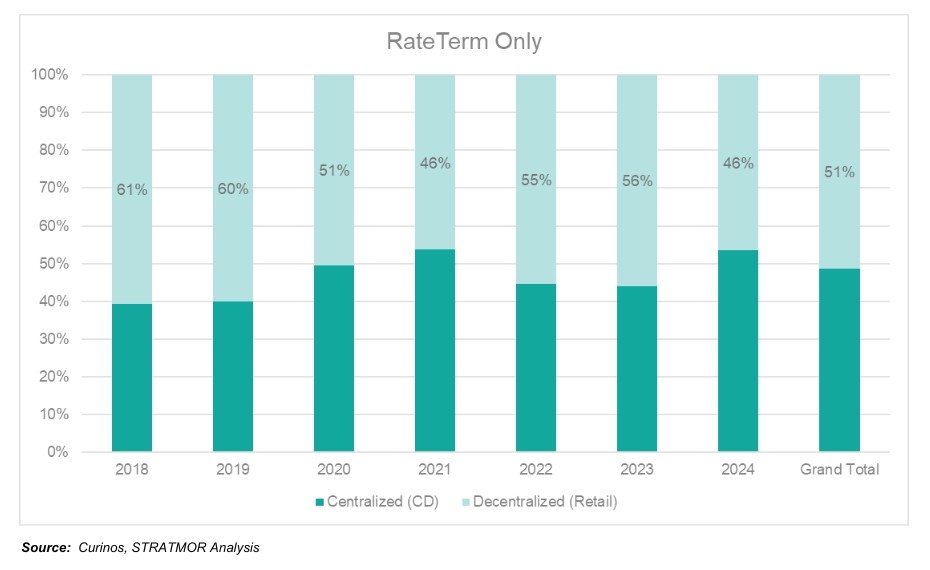

About half of all new refinance loans (units) originated in the last six years have been through Consumer Direct shops. That number was only 40% in 2018 and 2019 (before the last boom) but is up to 54% now. Do we think that will go up or down in the next refinance boom?

Capacity issues may not send prospective borrowers trickling down to smaller lenders this time. I am not sure the mid-size lenders further downstream will even see the business. The big CD lenders (mostly servicers) have the staff, marketing muscle, and have built out major “big data” or AI approaches to identify the most likely refinance candidates.

So, the big servicers paid up for the servicing relationship through their Correspondent channel, and they built big recapture operations that are ready to roll. But that is not their only advantage — they can also originate loans at a lower cost. Let’s examine that factor as well.

We talk about compensation all the time at STRATMOR because we now have enough industry data to clearly show the critical risk in many lenders’ current comp plans. I talk about this in just about every presentation I give because it’s just that important. Traditional comp plans are serious impediments to any lender who wants to be competitive.

On the other hand, lenders who have taken the downturn as an opportunity to tune up their compensation plans have an advantage. Optimized compensation plans typically mean paying less for refinance deals and for in-house deals. It requires a tight technology integration between Retail and CD sales and marketing to streamline refinance opportunities and offer competitive rates to consumers. After all, refinances are MUCH easier to originate and close, so why not pay sales less for them? And in-house refinances are even easier to close, so those should probably be even lower. In the chart above, I showed that over 60% of no-cash-out refinances are being originated through CD, and in this chart I will show how compensation differs.

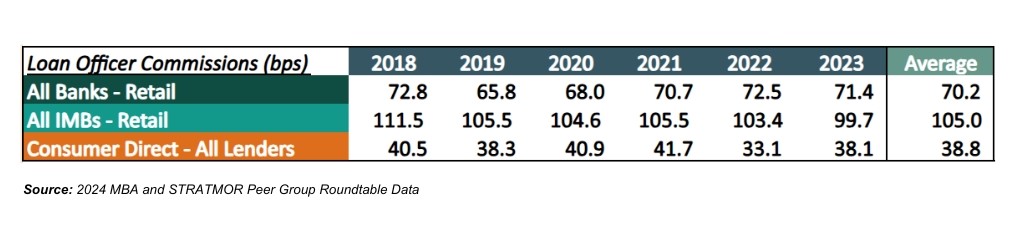

It’s pretty clear from this compensation chart that the average Retail IMB is still paying 100 basis points (bps) in average compensation, though it has dropped since 2018. The average bank Retail averages roughly 70 bps, while the average CD lender is well under 40 bps in compensation. This 30-60 bps disadvantage for Retail lenders typically translates to higher pricing for the consumer.

Lenders who cling to the 100-basis-point model will find it very difficult to compete with the big call centers, which pay dramatically lower compensation per loan. And they may find it hard to compete with banks that also pay less and have some ability to cross sell mortgages to their depository customers. A new comp plan can make a lot of sense, especially when the leads are coming from a business referral partner or the lender’s own servicing portfolio.

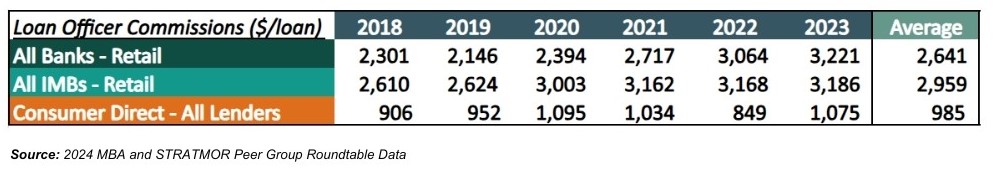

As I wrote about in July 2023, change is hard and it can be painful, but the time to institute new comp plans is not AFTER you need them, but before you need them. There has never been a better time to get your current LOs to accept the change. After all, if you told an LO you were going to pay less on refinances, that would have virtually no impact on their comp today because there are hardly any refinances. I have also written previously about the need to really consider if bps are the right way to pay at all. Let’s take a look at the same chart for compensation per loan, but from a dollar per loan, not a bps per loan, viewpoint.

What this shows is that as dollars per loan, we are paying much more to an LO each year, primarily due to the increase in the average loan amount. In fact, it’s gone up almost $500 – $1,000 per loan since 2018 for Retail, while CD has been very stable. Once again, check out my other article for a more detailed discussion, where I address the big question — are we getting what we are paying for? But in this context, let’s consider the impact on service provided to the consumer and if that truly is driving repeat business (thus the refinance opportunities) in the future.

We have an entire team at STRATMOR — headed up by Customer Experience Director Michael Seminari — that is dedicated to optimizing the borrower experience. Many lenders we work with have streamlined their processes with an informed focus on customer experience throughout the loan process. As a result, these lenders enjoy increased efficiency, reduced costs, and delighted borrowers, which means better deals and a smoother experience for homeowners.

The lenders who consistently do this work are well-positioned to win borrowers’ business when the refis return. And as I discussed above, those that provide a great origination experience AND a great servicing experience have a solid foundation for long-term customer relationships and repeat business. Those who expect to operate the same way they always have will be left out at sea. The experience must be positive and memorable to warrant repeat business and referrals.

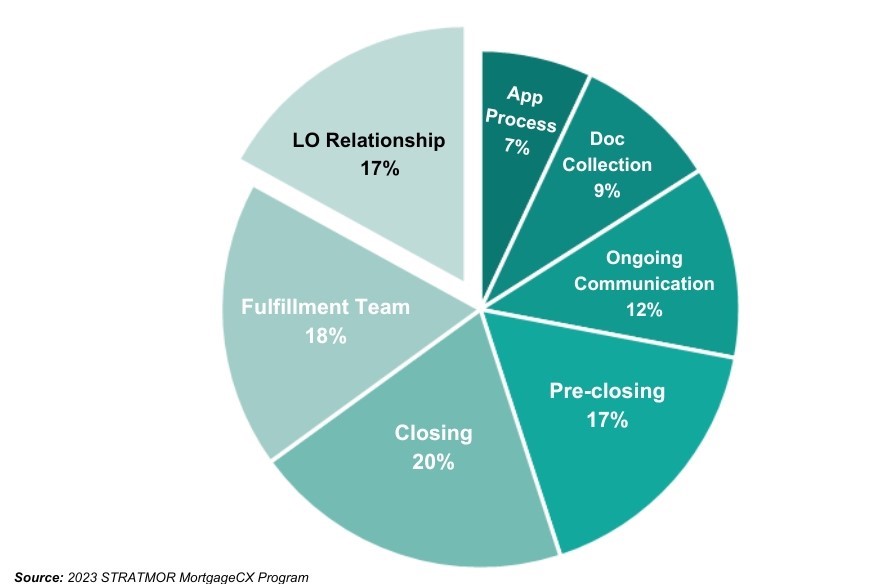

Here is an interesting chart — in 2023, a year with low volume, 55% of borrowers surveyed by STRATMOR had some issue with their loan origination process that prevented them from providing referrals or repeat business. That is OVER half. And it’s not just one thing that creates this disconnect — as the breakdown below illustrates, a number of factors can impact the borrower’s level of satisfaction and willingness to do business with the lender again.

If you are reading this paragraph, please do not assume that the chart above applies to “some other lender.” Remember, these borrowers did not complain, and they may have provided their LO a five-star review, so the organization — especially at the executive level — may not notice the impact on the “next” loan until it’s too late. Customers’ expectations are going up: they expect an excellent and efficient process, great technology and expert advice. And not everyone in the industry is living up to that expectation.

All of this adds up to a much more competitive environment that will put more refinance business into lender shops that are well prepared. Those not prepared or ill-prepared will find it difficult to catch up to their competition.

Lenders who think any refinance wave will lift all boats equally will find that the adage doesn’t hold water in the mortgage industry. But there are things they can do now to keep their businesses afloat.

Given the above, it should be no surprise that some lenders have decided to sell and exit the business. Sometimes that decision is to sell the production franchise to a larger IMB, maybe one with servicing and a strong balance sheet that is better equipped to take advantage of the rising refi tide. It is certainly an option, and STRATMOR is actively helping owners consider that strategy.

However, many more companies will choose to stay in the business, and the purpose of this article is to give these executives some ideas on how best to compete in today’s difficult climate, as well as prepare for the potential changes that are coming. Standing still, or treading water, is not a good option. Here is what we recommend:

There are plenty of indicators suggesting that the next wave of refinance business will skew heavily toward lenders who have strong, tightly integrated Retail or Consumer Direct channels, or both. These channels need to be well managed, properly staffed, and ready to compete aggressively when rates drop. Note, you don’t HAVE to have a big call center to compete but mastering direct marketing, lead generation, effective follow-up, and an integrated sales process is crucial.

Lenders with existing servicing operations have a head start — they can tap into their customer base for new business. Lenders without those relationships will need to step up their marketing to attract refinances. They can’t out-advertise the giant lender shops, so they must find creative ways to raise awareness and show their value proposition to homeowners when rates start to fall.

Today’s consumers won’t wait around for a lender that can’t move a refinance through in a streamlined fashion. We already know that borrowers will apply with multiple lenders for their next loan. The first one to miss a step will be left behind. Our data shows that the originator who ultimately wins the business usually offers a good deal AND a good experience. Now is the time to be sure your experience is top notch — and that comes from carefully measuring the borrower experience through effective use of surveys and secret shopping.

When homeowners come back to the table, they’re going to want the best possible rates. Don’t let your current compensation plan be a barrier to winning the business. Now is the time to fix it. STRATMOR’s data-driven approach can help you get that job done.

There is a famous scene in “Jaws” where the shark hunters realize that they are “going to need a bigger boat” to deal with the dangers in the water. In our industry, this metaphor often translates to selling to a larger company, and those deals are still being made.

However, maybe what is needed is not a bigger boat, but a better approach: navigating through the rising waves with a more strategic course. This article is meant to stimulate some thinking about why and how such a course may be needed.

STRATMOR works with lenders of all sizes to tackle the unique challenges of today’s mortgage market. From strategic planning to operational reviews, marketing optimization, and technology, we offer a comprehensive suite of services to enhance customer experience, streamline processes and, ultimately, drive profitability. Garth Graham

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.