There’s a famous quotation from Socrates about change that speaks to where business, and the mortgage industry in particular, is today:

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.”

In this brave new world of pandemic impacts, we’re all learning as we go, traveling the ever-evolving path of rapidly changing business needs. Mortgage rate volatility, servicing liquidity issues and bursting refinance pipelines have left a wake of uncertainty and stress — change has become the “new normal” for lenders and servicers. Many who fought the remote work model must now consider the benefits of increased productivity and reduced overhead expenditures. Those who relied heavily on in-person borrower interactions and fought the idea of technology investment must now fully pivot to online closings and to digital tools like Zoom and the video email platform BombBomb.

The constant in the midst of this change? The need to focus on the customer.

It turns out customers are happy with the service they’ve been getting since the pandemic hit. Work from home fulfillment teams have not only increased productivity, they’ve also provided more white-glove service to each borrower. Crisis events have a way of pulling people together. For the mortgage industry, this pandemic has meant ramping up borrower communications, finding creative ways to “virtually” attend closings, and tapping into the emotional needs of borrowers. Even though these practices have in some ways been forced upon the industry out of necessity, lenders should do everything possible to make them permanent habits. They are not only good for the customer — they also build loyalty that will last through any storm, pandemic or otherwise. They are marks of a customer-centric culture.

In STRATMOR’s recent Customer Experience Workshop, the question most asked by attendees was, “How do you create a shift in company culture toward customer-centricity?” When we asked attendees to describe their commitment to the customer experience, the word that came up most often was “evolving.”

Chart 1

Source: © Copyright STRATMOR Group, Customer Experience Workshop, 2020.

Source: © Copyright STRATMOR Group, Customer Experience Workshop, 2020.Part of the evolving nature of a commitment to the customer experience has been the ongoing struggle of how to prioritize it, not conceptually, but with the real investment of time and resources. “Companies often struggle to get customer centricity right,” says STRATMOR Senior Partner Jim Cameron. “They are perpetually either too busy with the effects of volume spikes or too budget restrained when volume is down to prioritize time and resources around improving the consumer’s experience.”

Considering the current economic uncertainty coupled with the recent refinance volume spikes, it’s not surprising many lenders “punt” on decisions regarding new investments to optimize the consumer experience. This reluctance, however, has not been across the board. At STRATMOR, we’ve seen some of the top companies — ones that have an established commitment to service excellence — doubling down on their efforts to understand and improve the borrower experience.

According to a study cited in Forbes magazine, 90 percent of CEOs believe the customer has the greatest impact on their business. And th belief holds water:

Now, ask a group of loan originators how well they’re doing at providing an exceptional customer experience. Spoiler alert: There probably won’t be too many low scores — and with good reason. After all, loan originators are helping their borrowers achieve the American Dream and their parting conversation with the borrower usually includes smiles and congratulations on the completed loan.

Borrower feedback backs up this view. According to STRATMOR’s MortgageSAT Borrower Satisfaction Program that measures the loan experience for more than 133,000 borrowers annually, the average rating for a loan originator is 95 out of 100.

Herein lies the problem. Executive management wants to extoll the customer experience as the highest company value, while originators feel like they’re already achieving this ideal in spades. How do you initiate organizational change when there is no perceived need to change? Or put another way, how do you get someone to care about a leaky pipe behind the wall when the water coming out of the faucet appears to be flowing just fine?

Time to pull a Socrates and stop fighting the old. Instead, start building new customer-centric culture by following these three steps:

Two characteristics create the sizeable gap between the ideals of executive management and the glowing self-perception of originators:

Once the organization acknowledges the gap in the perception of what constitutes an exceptional customer experience, work can begin to close the gap.

The second step in creating change that leads to a customer-centric culture is measuring both the cost of current process miscues and the potential for increased loan revenue. There’s nothing like putting dollar signs to theoretical concepts to get people’s attention. Historically, lenders have been hard pressed to find reliable customer experience models on which to base projected loan revenue. Fortunately, there are emerging models — like those used in STRATMOR’s MortgageSAT Program — that allow lenders to measure customer experience performance in terms of real dollar losses and projected earnings.

Lenders can now calculate the financial impact of process miscues by measuring how they cause shifts in the Net Promoter Score (NPS), a measurement of the borrower’s likelihood to recommend the lender to friends and family. Using STRATMOR data to set certain parameters such as average loan size, net production margin and pull-through rate of promoters to referrals to closed loans, STRATMOR can calculate the number of new loans being lost due to each of a variety of process issues.

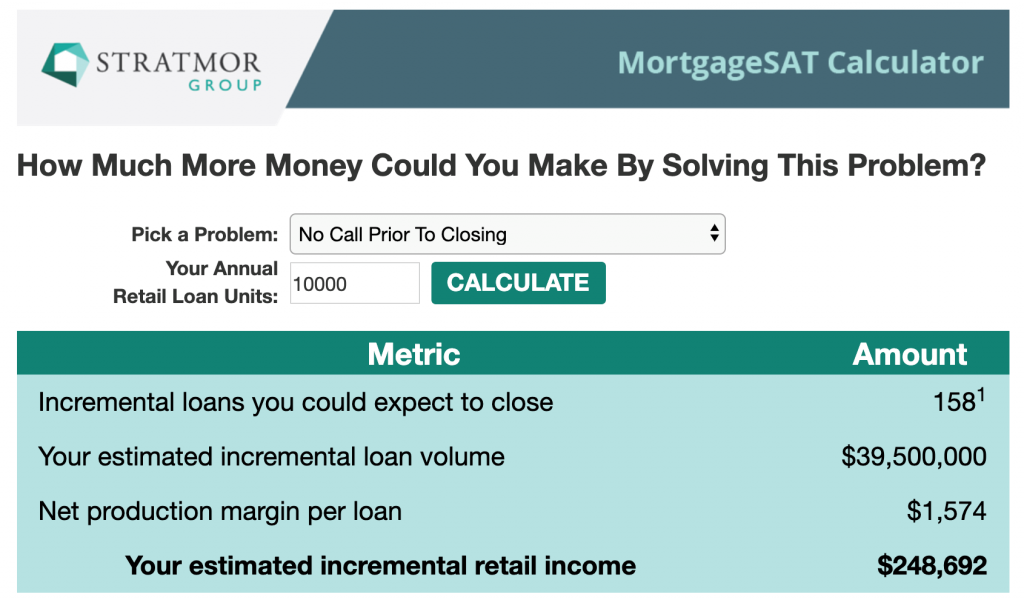

For example, borrowers who do not receive a call prior to closing to discuss closing figures have an NPS score that is approximately 100 points lower than those who do receive a call. If a lender closes 10,000 loans’ annually, and the problem happens on 10 percent of their loans, the lender is missing out on roughly $53.5 million in loan volume and almost a quarter million dollars in additional retail income due to this problem alone.

STRATMOR provides a calculator on the MortgageSAT website for lenders to explore the costs they likely have wrapped up in each of the Seven Commandments for Optimizing the Customer Experience, the seven most sensitive aspects of the loan process when it comes to earning a borrower referral.

Chart 2

Source: MortgageSAT Borrower Satisfaction Program, 2020.

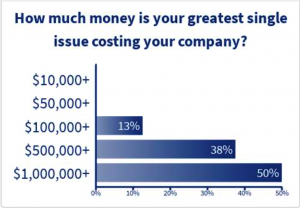

Source: MortgageSAT Borrower Satisfaction Program, 2020.In our most recent Customer Experience Workshop, we gave attendees this tool and they found substantial cost savings and growth potential in multiple areas. Eighty-eight percent of attendees said their greatest single issue was costing their company $500,000+ in revenue.

Chart 3

Source: © Copyright STRATMOR Group, Customer Experience Workshop, 2020.

Source: © Copyright STRATMOR Group, Customer Experience Workshop, 2020.With details on the cost of not providing an exceptional customer experience, justifying an investment in projects to improve the customer experience just got easier.

Operationalizing a customer-centric culture is a top down process, but it takes more than the CEO getting on their soap box at a company meeting. It also takes more than measuring how much the loan process miscues are costing you. What it really takes is a concerted, multi-level approach by leadership to communicate, model and hold team members accountable to new, higher standards around customer centricity.

Helping originators, processors, underwriters and even closers establish new, customer-centric habits will come with some growing pains, but the long-term cultural change will surely pay high dividends.

Here are some strategies you can implement right now to build a customer-centric culture that catches fire in your organization.

One of the biggest mistakes that lenders make in their quests for customer centricity is having a lack of cohesive ownership. This can take several forms. At some companies, executive leadership is the only group that reviews and manages to customer satisfaction metrics. With the rest of the company unaware of goals or progress, there is little impetus for change. At other companies, marketing owns customer satisfaction results, which is great for testimonial sharing, but not great for identifying and instituting process improvements. At still other companies, the originator is the only party that sees feedback, which may be great for their ego, but not necessarily great for their referral potential.

Borrower satisfaction tends to diminish when any single department attempts to lead and execute the customer experience alone. Departments need to partner and collaborate with other departments and bring more employees into the conversation, especially in a way that gives them a vested interest.

STRATMOR’s MortgageSAT Program, for example, provides scoring not just for originators, but for processors, underwriters and closers as well. Even though an underwriter never speaks directly to the borrower and the borrower isn’t asked to assess the underwriter directly, there are certain common denominators that will surface with certain underwriters, whether related to response time, reasonableness of documents requested, or asking for the same document multiple times.

In short, everyone should own the customer experience.

As you bring more employees into the customer experience conversation — and as they begin to receive score ratings for the loans they touch — they may develop a tendency to deflect blame for loans that experienced problems. After all, something like “poor response time” could just as easily be the result of an over-promising originator, a disorganized processor, or a slow-moving underwriter. While not surprising, this tendency to blame-shift is very counterproductive, since the whole purpose of measuring borrower feedback is to deliver a better borrower experience, not to finger-point.

To get away from the blame game and to move towards a culture where everyone is focused on the “team win,” lenders must focus equally — if not more so — on the positive feedback as well as the negative feedback. Gallup research shows that 90 percent of employees who received manager feedback that left them with negative feelings (felt criticized, demotivated, disappointed or depressed) felt disengaged, and four out of five say they’re actively or passively looking for other employment. That’s the opposite of the culture you want! Positive feedback creates an environment where people feel safe making — and taking ownership for — an occasional error because they are consistently being recognized for their good work.

Lenders who are used to viewing positive feedback solely as a marketing tool and promotion vehicle for originators must remember that every employee impacts the customer experience, directly or indirectly so every employee can benefit from hearing positive feedback.

A few tips to create positive feedback channels for your back office:

Expanding on the idea of sharing positive feedback across the organization, lenders also need to realize that the overall employee experience feeds the customer experience. Marriott International founder J.W. Marriott famously said, “Take care of associates and they’ll take care of your customers.” Marriott employees know they are valued, and that makes them want to share that feeling with their guests. Marriott goes out of the way to reward employees for a job well done by celebrating diversity and inclusion, loyalty, and by offering a wide range of training programs.

When employees feel valued, they want to stick around. One of our workshop attendees commented, “I just love working for [my company]. I really hope to retire there.” In a recent study of more than 1,000 people who work for customer-serving companies, there was a strong correlation between attention to customer experience and employee loyalty. Specifically, 83 percent of people who said their company prioritizes customer satisfaction were at least pretty sure that they’d still be working there in two years. In contrast, just 56 percent of employees were willing to stay with companies they said didn’t focus on satisfaction.

The adage “You can’t manage what you don’t measure” applies to customer centricity, too. As noted in the Harvard Business Review, “Managers will be motivated and equipped to cultivate a customer-centric culture if they know if and how it impacts results, so organizations should ensure they establish and track the link between culture and customer impact.”

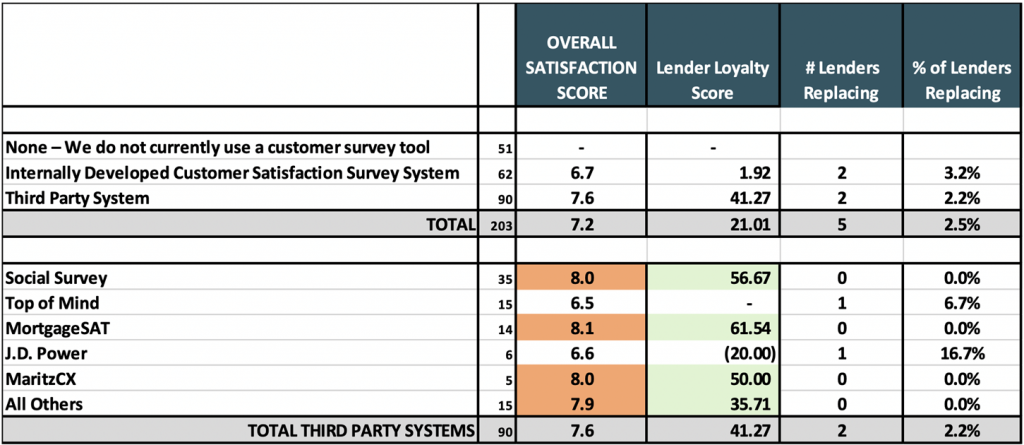

The trouble is, most companies are less than thrilled with their current technology tools for measuring and improving the consumer experience. STRATMOR’s Lender Loyalty Score® analysis, which measures lender’s loyalty to vendors with a scoring method similar to the Net Promoter Score, shows just two borrower satisfaction solutions with loyalty scores greater than 50.00.

Chart 4

Source: © Copyright STRATMOR Group, Technology Insight Study, 2019.

Source: © Copyright STRATMOR Group, Technology Insight Study, 2019.Lenders should ensure that their solution, whether in-house or third-party, addresses each of these aspects and provides the management team the tools they need to lead effectively.

The best way to fast track a shift in company culture is to hire people that already fit the desired cultural values. One of our attendees at the Customer Experience Workshop, representing a company that is award-winning for their excellence in borrower satisfaction, noted that their leadership cares more about a recruit’s ability to express empathy—especially through the written word — than it does about prior work experience or other technical skills.

Consideration of a customer’s emotional needs should be one of the main filters used by hiring managers when interviewing prospective employees, and they should make the priority clear from the initial conversation. This may take collaboration between your human resources, marketing and sales teams to execute properly. The investment will be worth it.

A few tips to get you started:

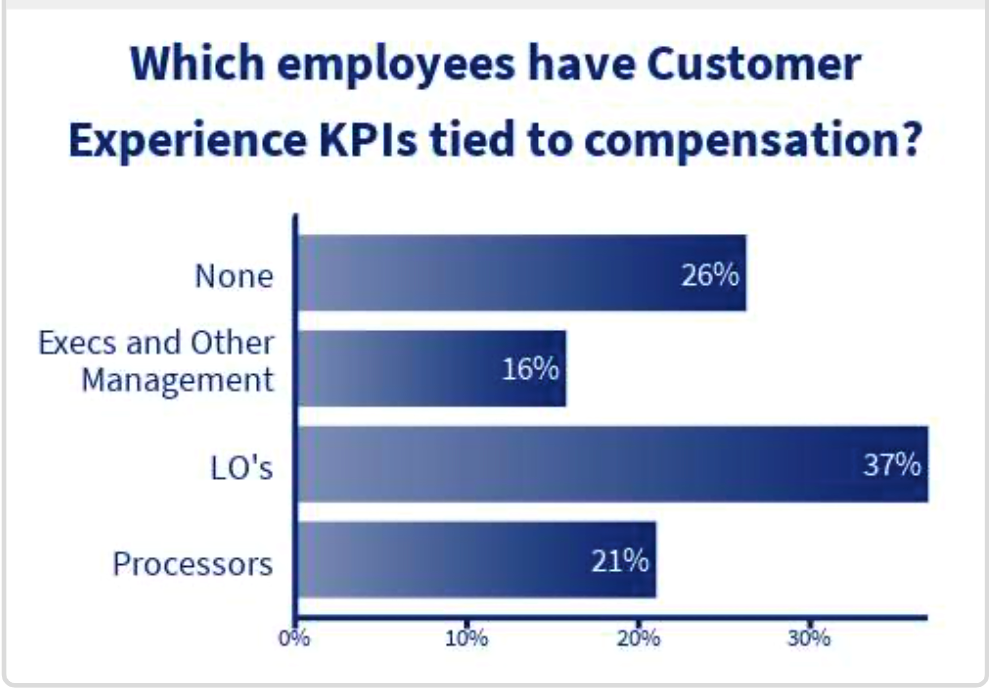

One of the biggest things we learned at our Customer Experience Workshop is that there is a large appetite for tying consumer experience metrics to incentive programs. More than a third of our workshop attendees, as seen in the chart below, already have incentive plans in place for their originators. Very few, 16 percent, have plans that include executives and other management.

Chart 5

Source: © Copyright STRATMOR Group, Customer Experience Workshop, 2020.

Source: © Copyright STRATMOR Group, Customer Experience Workshop, 2020.I saved this one for last because I wanted to go down some of the roads less traveled before we inevitably found ourselves discussing compensation. Keep in mind that for some employees, the prospect of tying financial incentives to the customer experience is very exciting and rewarding, while others see them in a more punitive light, as a potential threat to their paycheck. Either way, money can be highly motivating!

The key to successfully implementing compensation incentives tied to the consumer experience is to measure based upon clear standards. This means that your post-close surveys must go into adequate detail to help you identify not only whether the borrower was happy or dissatisfied, but which person or part(s) of the process cause them to feel that way. Consider the difference between the two questions, “How would you rate your overall experience?” and “How would you rate your originator’s response time when you had a question?” While both are valuable metrics, the second one leaves little room for dispute.

When we eventually arrive in the post-pandemic world, with the job loss and the quarantines and the economic instability all in the rear view mirror, there will be two very different types of lenders that emerge — those who hibernated and those who evolved, those who survived and those who are poised to thrive. Evolving requires lenders to build a new, better, more customer-centric culture in the midst of the pandemic. It certainly may start with CEO vision, but it takes clear, systematic implementation of that vision to see tangible results.

If you need help implementing your customer-centric vision and want to empower your management team, STRATMOR can help. Our MortgageSAT Borrower Satisfaction Program will help you unearth deep insights about your people and processes as well as show you how you compare with peer lenders in each stage of the loan process. Contact Mike Seminari, Director of MortgageSAT for more details.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.